Dungeon Investing: Annual Report 2024

With the year coming to an end, is time to review what has worked, what hasn't and what is coming!

I started this blog back in August 2023, but it didn't see much activity for the rest of the year, and so I didn't think a retrospective made sense a year ago. 2024 is different. There has been enough time to reflect on some of the ideas pitched and their performance. I also find it curious to check about what has been more popular here, content-wise. Also, it is a good place to just look back on the year.

The year in general

In general, it has been a fairly eventful year. Things at work were interesting, and they might get even more so. I think I mentioned it at some point, but my day job is being an engineering manager at a European tech company. Not the best job market I've seen. Also not the worst1. Might get worse with all the AI stuff2, we'll see! Family-wise, I became a dad, and I'm still over the moon about it. It has been a bit challenging at times (things can get a bit rough if there are problems with food and weight, as many of you probably know), but all is good now, and we are extremely happy to have her here!

Investment-wise, it has also been a good year3. My best so far, actually4. And writing here has been a big part of that, because I have connected or reconnected5 with a bunch of other investment junkies and that means we exchange ideas fairly often. Not that I always go for the correct ones (someone pitched Build-a-Bear back in May and I didn't listen, for example), but it helps to have people bringing ideas, especially in other areas, be it Argentinian equities, Polish renewables companies or UK industrials (seriously, you know how to make the value investor in me happy6). Thank you all, you know who you are (and feel free to identify yourselves, don't want to out anyone).

Process-wise, I've made some unforced errors, mostly related to playing with options and a couple episodes of FOMO. Thankfully, while it seems I have not learned those lessons as well as I had thought, I have learned to do it with smaller amounts and they haven't affected returns that much… but it should have not been a factor. I have also started to short more often. Not the best year to do it, but the contribution result was positive, even without taking into account the additional return of the long side of those bets7. We are talking about funding shorts, tiny positions each, no heroics. Still, have been burnt a couple of times (RGTI takes the cake, although I closed early… should have flipped long, but never had the stomach for the meme stuff).

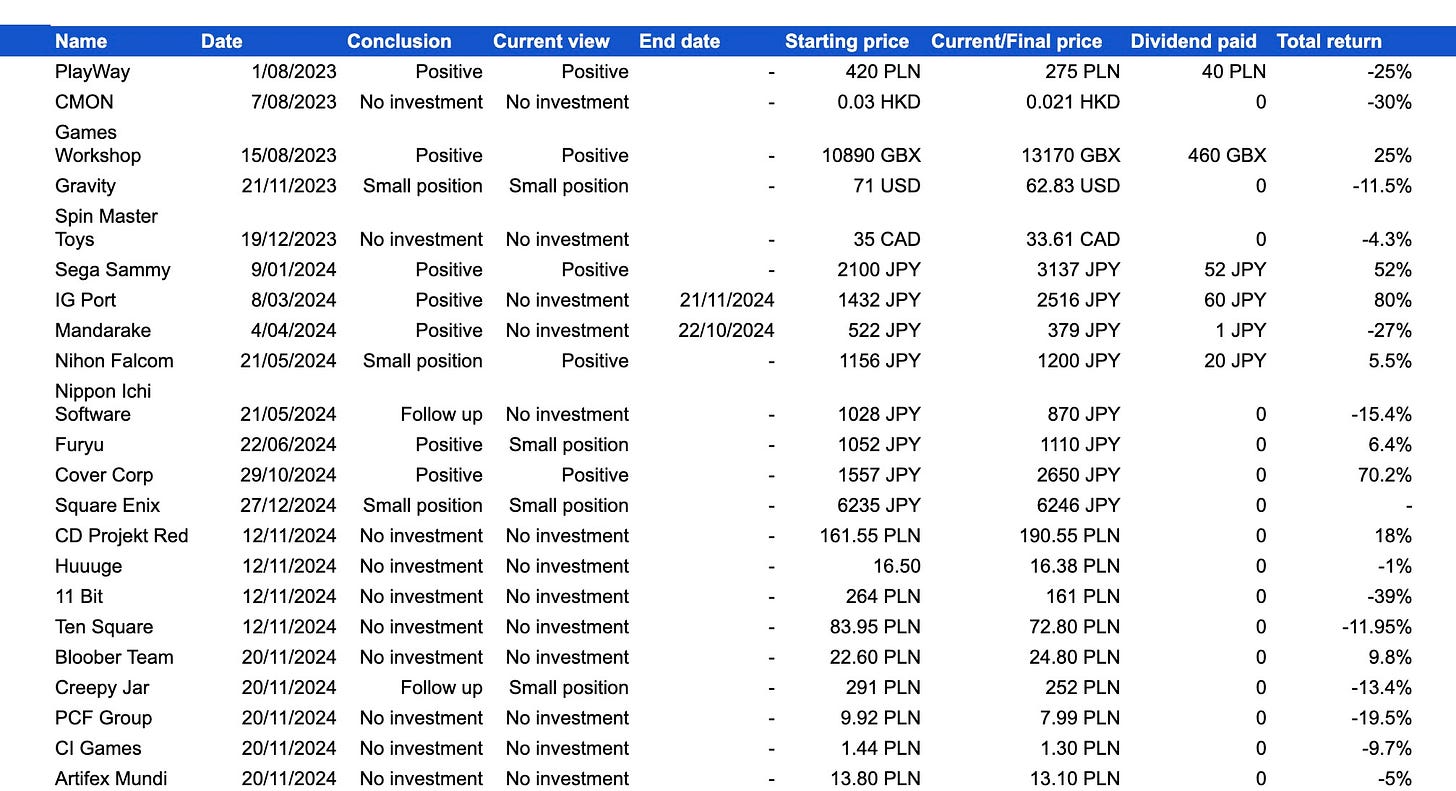

The investments

Over time, I have talked about 22 stocks in relative depth and with a clear conclusion, and then we have a couple of weird situations. In the table, you have the ones that I could classify more clearly and you can see the returns timed from the time I added the info in the blog to now or the time when I communicated I had closed the position (in one case I communicated it in X/BlueSky though). The returns are in local currency8. I won't go through the ones where I took a no-investment decision and that is still the case… but it is worth noting that out of 10 no investment decisions, only 2 had a positive return. And one of them (CD Projekt) is a company where the only thing I don't like is the price.

Odds & ends

We have Embracer, which I have left out because I have discussed it several times, first with a no-investment perspective (May 7th) then with a more positive one due to Eazybrain's sale (much as I don't like Asmodee's strategy that much) on November 26th, and truth be told I had (and still have) a small position since. But despite having a position the most positive thing I said was “I think that Eazybrain's sale was at a fantastic price and I am less queasy about the value of the whole group after it". I dislike how management has manipulated communication over time, and I let that get in the way of my communication, and for that, I apologize. Just so everyone knows, I have a small position now, and I think that is the first sale that is actually beneficial for the company. I still don't trust the management much. Between May 7th and November 26th the stock was roughly flat, and since then it has moved up about 4%, so nothing meaningful one way or another.

There was also another case that I didn't know how to classify. Back in January 25th I pitched shorting Toei Animation and going long Toei Company, a trade that I could not implement as the brokers I have don't allow shorting Toei Animation (but they do allow shorting Toei Company!). As I mentioned on November 5th that valuation gap disappeared, so if you were able to implement that trade, congratulations! Toei Co had a total return of 23% between those dates, while Toei Animation had a roughly 0% return. The thing is, since then, Toei Animation has remained at the same level, while Toei Co has gone up a further 20%, with Toei Co now valued at about 50% of Toei Animation's market cap (remember they have 40%), despite Toei Co's main business not going great. If it keeps extending, maybe we can go the opposite way!

Ok, into the regular stuff.

Full positions

PlayWay

This one is a curious situation. The fundamentals have improved, and yet I have lost money. 2023 was a record year in terms of revenue and but not in terms of profit (due largely to the late release of House Flipper 2 and the particularly conservative accounting they use for development costs). 2024 is a record year (as of Q3) in revenue (+15% vs 2023), operating profit (+20% vs 2023) and profit attributable to shareholders (+45%, although this is in part thanks to the sale of Big Cheese), and I think Q4 will confirm it as a record year in all magnitudes. However, the multiple has contracted to about 12x PE and about 8% dividend yield for a growing company with net cash and 25%+ ROE. I, of course, remain long. I wrote an update after H1

PlayWay: One year later

I have learned a lot about investing in video game companies in the last year. Two lessons stand above all: usually, holding a company immediately past a big release does not pan out. Two, don't invest in Polish video game companies. In PlayWay, sadly, I made both mistakes!

Games Workshop

Games Workshop has inflected in growth and royalties are becoming more significant, thanks to Space Marine 2. With that out and the Amazon deal in the bag, probably more deals (and more royalties) will follow. And there is some cross-over from games and series to the main hobby. +25% return since the main article, more since this update. I remain long as well!

Games Workshop: Going mainstream

This blog is a year old already, and there are a few things that I have been wanting to revisit in light of the latest developments, and Games Workshop is one of them. Their report came out in July revealing some interesting tidbits about their improved economics. After that, some other interesting developments, including worldwide success for Space Mar…

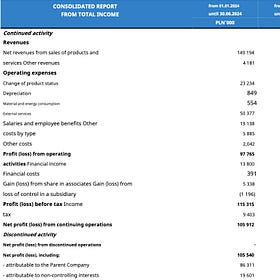

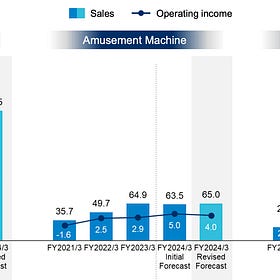

Sega Sammy

I am particularly proud of the initial Sega Sammy article. I mentioned the potential divestment in the resorts, the focus they were putting in slot machines to complement pachinko/pachislot, the potential recovery for CA and the good growth of Sports Interactive and the bad fit of Relic and Amplitude in the group, how the Japanese studios were in a good track and how important 2024 was for the Sonic IP.

One year later, they have divested Paradise, the segments in Sammy have been re-expressed to highlight slot machines (gaming sub segment), CA has recovered through 2 good DLCs for TW:W3 and a huge update to TW:Pharaoh, Relic and Amplitude are no longer in the group, RGG9 and Atlus just had their best year yet (with Metaphor winning 3 awards at The Game Awards and nominated for GotY) and Sonic 3 seems on track for a franchise-record box office. I missed on Sports Interactive (FM25 was delayed until March), guess you can't get everything right!

Sega Sammy has returned 52% in JPY (below 40% in USD though), and I think it is still fairly cheap, given the more than decent results in Q2 and given that games sales in Q3 are looking really decent. Will write an update after Q3 is out, but I remain long.

SEGA: The year of the blue hedgehog

SEGA was one of the mainstay sources of entertainment for many kids growing up in the 90s, but it quickly fell out of favor after a few mistakes. That story is well narrated both in Acquired's episode on the death of SEGA and in Sam Pettus’ Service Games: The Rise and fall of SEGA

IG Port

I closed my position in IG Port about a month ago, which might sound strange given that my last update here, in October, was fairly positive. What happened was… well, that the stock went up 53% in a month!

I still think in the long term IG Port will be a good investment, but the price has run a bit more than the fundamentals, and there is execution risk (the profitability of the animation segment is a bit too negative for my liking), so right now I prefer to have that money elsewhere. That said, IG Port has been pretty volatile the last few years, and I will give it another go if it goes below 2000 yen or so.

In any case, not going to complain after a +80% in a year10.

The not-so-new anime king?

IG Port probably doesn’t say much to you, even if you watched (or watch) anime, unless you are really deep in the weeds. But if you grew up in the 90s you had to hide under a rock to avoid Ghost in the Shell, one of the biggest works in the cyberpunk genre.

Mandarake

I closed my position in Mandarake in October, after validating that the slight slump in sales was not a matter of a rogue month and had come with a reduction in operating leverage as well. This one was a full blown mistake, not a case of the multiple contracting more than could be expected. I continue monitoring it, especially as I see some things that can be interesting (the mercari store, for example). But they haven't been able to capitalize on the tourism boom and the merchandise craze to the extent that I expected, so I closed at a 27% loss.

Mandarake (2652.T): Profiting from the manga collectibles explosion

Half pawn-shop, half geek emporium, Mandarake is not a very typical business. In the last couple of years, its market cap has exploded (multiplying by more than 4), but it is still tiny, at about ¥20B ($130M, give or take). That explosion comes from its profits exploding 3.5x, and a modest increase in multiple.

Nihon Falcom

What is Falcom doing here, if I pitched it as a small position back in the day? Well, recent developments make me think it is a far better proposition than it was, and I have increased my personal position, despite the results being just OK.

Will publish an update as soon as I can, but I have a bigger position here now. Not close to the biggest ones I have (Cover, Games Workshop, PlayWay) because it is fairly illiquid, but this is no longer a tracker or a 1% position for me. The short version is that the release schedule and the change in publishers is exciting, with simultaneous global releases in the works for autumn 2025, something Falcom has never had before.

Cheap J-RPG Makers: Nihon Falcom (3723) & NIS (3851)

JRPGs were an inseparable companion of many of us. Wether it was playing Legend of Zelda or Golden Sun in the Nintendo portable consoles, or the Final Fantasy or Tales series when we were at home, we spent countless hours on it. Hell, even Pokemon is one of this games. With all those examples in mind, is easy to understand the attractive of this genre, …

Furyu Corporation

Furyu is still a good investment, but their photobooth business decline has accelerated. While their collectibles business is still going well (although profitability was slightly lower in H1), and Laid back camp is the gift that keeps on giving, the decline of that business at a higher pace than expected damages the thesis, as it is still the biggest profit pool (and was supposed to be for a while), and now I only have a small position and would not make it a core one. The return so far has been positive, but only 6%.

I think this should still work, especially if they use the cash they have (about 40% of the market cap) for something.

Cover Corp

Cover Corp started to run immediately after I published this write-up, as they published a positive update the same day, with profits soaring, as well as revenue. Despite the 70% run, I don't think this is over, despite the rich multiple. After all, they have just turned-on the merchandising machine, and the last quarter saw an impressive 80% YoY profit increase (although the prior one had been disappointing, now that the merchandise distribution is ongoing, it should support better numbers overall).

Plug-in idols

Fictional icons are nothing new, but at the same time we have very real celebrities attracting the interest of the general public. They inhabit the talk shows and gossip columns, set or expand trends, and many people are obsessed with them.

Summary

Out of the 7 stocks I pitched as full positions (not counting Falcom, which I originally pitched as a small one), 5 had positive returns. Of the two with negative returns, I closed one at a 27% loss, and the other remains, I think, an attractive investment. Of the positive ones, I only closed IG Port so far, at an 80% gain. A naive average between all the main position pitches gives us a 27% return (and much higher CAGR, as most of them have not been on for a full year yet).

It is alright, but given how the indexes have behaved, it is also not unbelievably good.

Small positions

These are positions that are added either as trackers or expecting a right tail outcome, but with more uncertainty.

Gravity

Not much has changed here. Still has a giant pile of cash that won't be used until GungHo says so. Still gaining relevance in earnings vs. GungHo core business. But GungHo now has activists running a campaign as shareholders, and using and/or fully appropriating Gravity's hoard should be part of any optimization program, and something should go to minorities (probably as a take under), so I think a small position is still warranted. Still, -11.5% since first publishing.

Gravity, or a black hole?

The early 00s had a lot of weird stuff going on. Now that we all have broadband at home, cybercafes don’t seem very practical, but back in the day, it was the best way of playing video games with people. And there are companies still making some money out of them, now as in 2002. Of course, I am talking about Gravity, the maker of Ragnarok Online. MMORP…

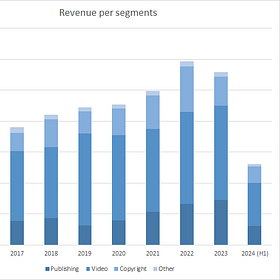

Square Enix

Just too soon to tell! I just published the last entry of this trilogy a couple of days ago. Regardless, why did I spend so much time investigating and writing about a business that doesn't qualify for a full-blown position?

Well, because Square Enix reminds me a bit of Sega, with underearning IP, they just went through a change in leadership and the new strategic plan says many of the correct things. If things are alright, it can graduate to one of the biggest positions in the portfolio. But I am still watching the initial steps of the implementation.

Square Enix: Beyond games

I don't know who you are, but if you are between 30 and 50, it is very likely you have heard about Final Fantasy. If you are a videogame enthusiast (or have friends that are), Final Fantasy is the king of JRPGs… and arguably of RPGs, at least for a brief period in the late 90s and early 00s

Square Enix II: The JRPG masters

In the first part of this analysis, we went through Square Enix's smaller segments (arcades, merchandising and manga).

Square Enix III: Strategy, allocation, valuation

In the first two parts of this Square Enix deep dive I went through its less well-known segments (manga, merchandising and arcades) , that are doing really well, and its biggest segment, videogames, which is chugging along, with some good things, but with excessive spending in the HD segment, SD declining steeply and MMO relatively stable.

Creepy Jar

Creepy Jar has graduated to a small position, as it has a decent potential game and still earns decently thanks to Green Hell. Still, further delays in StarRupture would greatly damage the thesis here (and I would probably close if I don't see a good stream of material pointing to a release).

A random walk through the Polish videogame sector (part 2)

Today we are going to continue our exploration of the Polish gaming sector that started last week. Just as a reminder, you have it here!

Small position summary

Out of the three small positions I have talked about here, it is too early for Square Enix, Falcom moved 5.5% up and Gravity 11% down. Creepy Jar also moved down after mentioning it, but was only here as a follow up. . The big ones did better for sure!

I have not talked about some other related positions here (Pullup, although I mentioned it in Twitter/X), but if we try to measure the value this blog brings, well, it is what it is!

Follow-up

NIS

The argument for NIS (same article as Falcom) was that better releases of the Trails franchise should improve their results… and they seem to have lost their relationship with Falcom for the most part. Not surprising, their work in the releases was lackluster. Their results have also taken a nosedive, as their release schedule has been fairly weak, other than Falcom games. Complete pass for me nowadays.

The blog

When I started Dungeon Investing11, I had been inactive in the investment community for about two years, so I didn't start with much of a platform and I was mostly writing for myself. It took 5 months to reach 100 subscribers here, now we are 808!

Granted, the reason it took so long (partly) was that I had two relatively long periods of not publishing anything (from September to November 2023, and this summer). Those periods also show pretty clearly in views!

As you can see, the best month so far was November, with slightly more than 6k total views, with December a close second (will finish between 5 and 6k). Still not widely read, but a decent increase! Thank you all for reading (and especially for the discussions on different stocks!).

The open rate oscillates between 40 and 50% depending on the edition (30-day open rate sits at 45%), which is not particularly high. I suspect that is because I have been catering to different audiences:

Investors interested in videogame companies, coming here for the posts on Sega, Embracer or PlayWay.

Investors interested in Japanese companies, coming here for the post on Mandarake, IG Port, Cover Corp, Toei or Square Enix12, or the article on how to research Japanese companies.

Games Workshop's shareholders. Been writing about the company since 2018 and I have talked about it in other places (like this podcast with Graham Rhodes, or my former blog). GAW has a relevant following, as noticeable when I publish something about it - the 2nd article I published, which was about the company, is the 11th most read in the substack despite the subscriber count back then being about 20 people

People (not necessarily investors) interested in videogame companies, rather than in investing as such and landing here thanks to a couple of mentions inThe GameDiscoverCo newsletter or through GameDev Reports’ recommendation (thank you both!).

There is, of course, overlap between all groups, but since I focus a lot in the state of a company rather than in stock pitches (after all, I write articles at times with a negative conclusion), this substack is both a lot narrower in focus (sector) and a lot wider in potential audience than other investment ones. This might need some rethinking going forward. I like exploring companies in the nich entertainment, even if they are not necessarily a top-notch investment when explored… but I am also a huge fan of more to-the-point pitches (like the ones AltayCap makes, for example).

Where do you come from?

How do people find Dungeon Investing? Well, the main sources are readers sharing, of course. So please, keep doing it! It really encourages me to keep writing, because the way to get more information both on the stocks I pitch and others is to have other interested stock pickers reading it!

In terms of sharing the content, I have to thank Michael Fritzell, Simon Carless (especially in this case, because his content is a bir removed from stock analysis, although really recommended for anyone looking at videogame stocks) and Memyselfandi007 for relevant boosts. Mentions in stock analysis aggregation newsletters, mainly Stock Analysis Compilation and Giles Capital have also helped quite a bit!

The recommendations from GameDev Reports (again, not related with stocks, so I appreciate it even more!), KonichiValue Japan, Valuation Matters, East Asia Stock Insights, AltayCap, Made in Japan and Continuous Compounding - Alan have brought more than a third of you here. Thank you all! It is a very useful mechanism to help new publications here to grow.

The podcast I did with Graham on Games Workshop has also proven to drive a bunch of you here, but other collaborations (in Spanish in Hablemos de Inversiones, and the collaboration with Continuous Compounding on Furyu) failed to have a similar effect. My conclusion is that this kind of stuff is pretty hit and miss, unless it is an extremely popular podcast/blog. Still, it is really fun to do, so if anyone is interested in discussing any gaming/anime stock, hit me up!

Another source is, of course, Twitter/X. And I say that and not social networks because in terms of generating traffic and subscriptions, is the only one that has worked up to a point. Granted, it is the only one where I have some following and a real network. I like BlueSky more, but most of the interesting people I follow has not migrated there, and the conversation remains more lively in X in stock analysis, at least for me. If you are in BlueSky though and want to discuss things there, happy to talk! But social networks are much tougher ways to get your content out there nowadays unless you enter in the engagement bait game which is not something I am particualrly good at.

Substack notes and engine recommendations also seem to drive some people, but it is difficult to judge. Also, the only notes that seem to have reach are the ones referencing how many subscribers you have.

The most popular articles

Out of the 36 posts I have published so far, the 5 best-performing articles since inception have been:

Revisiting Games Workshop is always interesting, and not only for me, it seems. In this case, it was revisiting the company after the release of Space Marine 2, seeing the consequences it had. Progress since has been really good, with the Amazon deal signed already and miniatures sales going up significantly.

Japanese stocks have been popular this year, and having some tools on hand for them has also become popular!

The first part of my latest deep-dive has benefited from a larger subscriber base, and I think there is also a fair amount of interest in the company

Reviewing what is known about the future spin-off from Embracer. I am a fan of what was built before joining Embracer, but I also think the market is not as interesting for M&A as it was before, so the plans of resuming M&A management has have left me a bit cold

This article on Sega Sammy is still one of the most popular ones, and also the one that drove more people to subscribe to the blog. I think it is a good article, but to be fair, also benefitted from being featured in the now paused Monday Morning Links and I Thanks Michael Fritzell and Ian Bezek, that helped a lot!

Not sure I see a pattern here, as there we have tooling, deep dives and updates. One interesting thing is that the two best performing pitches I have made (on IG Port and Cover Corp) were not particularly popular. That said, tooling and single-stock articles are far more popular than result update medleys or similar stuff. I think when there are things like that it makes more sense to add them as a coda (as I did in the Asmodee post) rather than a post with only short excerpts, and will probably try to keep to that approach.

Going into 2025

I still have a few things! An anime investing primer and Paradox Interactive are still pending, and even before that I have another two of posts pending for the next couple of weeks (let those be a surprise!), and an update on Nihon Falcom.

My goal this year is to have something up weekly, so almost twice the 29 posts I published in 2024 (counting this one!), between new stocks and continued coverage of the ones we have already mentioned… and anything else that pops-up, really.

Don't miss it ;)

You wouldn't believe it to hear the people in the area complain about it. US guys going crazy about H1B, lots of people complaining also about the market in Europe… and look, might be tough for entry-level positions, but right now for someone experienced it just takes a bit longer and a bit more effort to find something versus a couple years ago, when it was extremely easy to do and get a significant bump out of it. And salaries are significantly above average pretty much everywhere If you think this is a bad job market, you have never seen one! I have also never seen one in this sector, but I originally majored in Biotechnology.

Personally, I think it will. It is part of the reason I moved to get a better job back in 2020 (basically get something while the market is still good!). That said, back then I thought we still had a bit more time before it became this evident. It has its positives too, and I think it can enable a lot of good work and many small business starts, so we'll see where it lands.

Not posting numbers because I haven't been posting trades or positions, so there is no way to verify them. But I am happy. It was way below triple digits, in case you are wondering, so don't worry, no otherworldly results here!

Two trading days left, let's jinx it!

I started investing back in 2017, had another blog in Spanish (Trampas al Póker) back in the day, and connected with a bunch of people smarter and more dedicated to the craft than myself. Then from late 2021 to late 2023 I didn't do much in the area because I was too busy with other stuff (namely getting nice pay bumps before the robots made us obsolete).

Which, at times, means losing money.

I've used shorts as a way to finance longs, rather than looking for performance on its own.

About 20% of my readers invest in USD. About the same in EUR. And there is a significant percentage that invests in GBP, JPY and AUD, in that order.

The studio behind Yakuza.

And it was pretty close to +80% for me. First, I have been borrowing in JPY for part of my investments in Japan (which at the rates offered, still seems like a good idea to me). Second, I'm a europoor, and while they JPY/EUR change has been pretty volatile, between the date of publishing and the date of closing there is about 1% in difference in the exchange rate (although with wild movements in between).

Well, re-started. Dungeon Investing existed in Revue for a short time in early 2021, but i didn’t migrate the (admittedly very small) list of subscribers or the 3 or 4 articles I had there before Musk killed the platform.

Yes, Sega is also Japanese, but Square Enix is a lot more Japan-focused, and the type of games they make overlap quite a bit with the anime crowd. Not so much for Sega, Atlus aside.

Thanks for the mention and I wish you a happy 2025 !