Asmodee's debutante ball

And news and results on Kadokawa, Furyu and Mandarake

I am still working on the Square Enix deep dive, but that doesn't mean the flow of news stops! Today, the main piece of the action will be talking about Asmodee's capital markets day in advance of its spin-off from Embracer in the coming months, but there will be time to visit other companies.

Asmodee: the tabletop market leader

I find the IPO by spin-off of Asmodee really interesting, because it has long been a company I would like to know better, but the disclosure was typically not that great. The information available through Eurazeo back in the day was barely anything, and in between then and the sale to Embracer, even less. Embracer has since been preoccupied with the failures in the videogame business, and their disclosures focused on that (even if, arguably, Asmodee's purchase was what tipped the company over due to the leverage involved). So let's see what the CPM has revealed1.

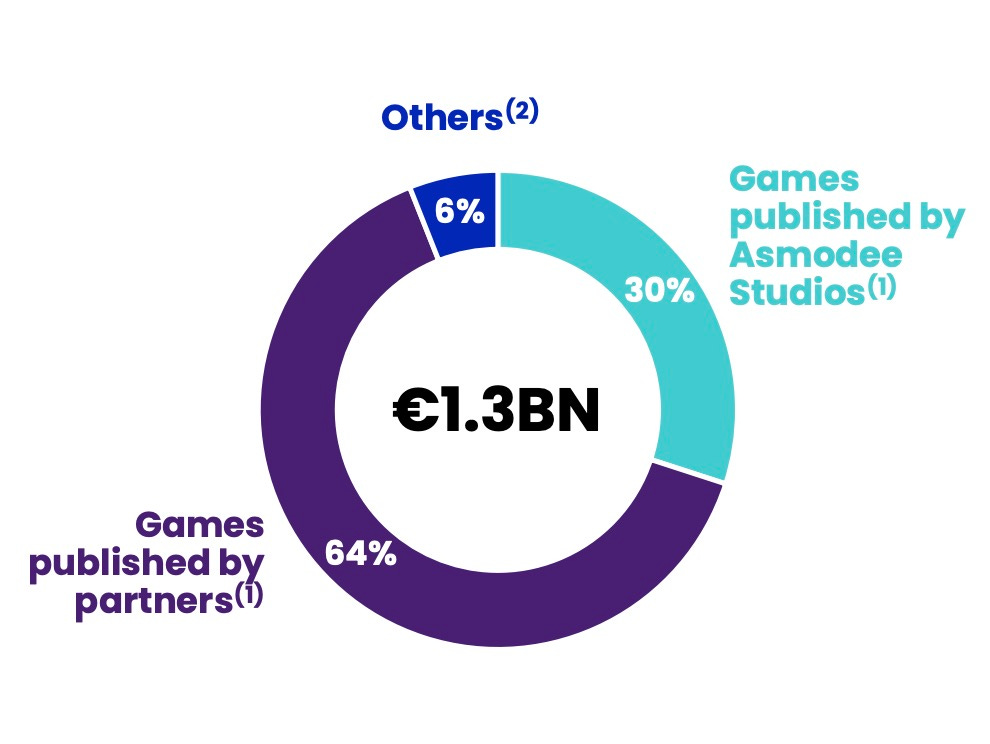

You can think of Asmodee as a mini-Embracer, in that they dedicated themselves to acquire many companies and then kept operating their brands separately. But mostly, Asmodee is a distribution network for both their own games and third party ones. In fact, the split favours the latter!

Asmodee has always been a mixed player, and it is in many ways more of a toy company than a hobby one. Their first success, Jungle Speed, is decidedly in the mass-market party game category, subject to the ebbs and flows of fashion, rather than a niche hobby with a dedicated player base. But they also started distributing other games, like the Pokemon TCG2, which they levered into better distribution relationships.

Then they took private equity money and went into a huge acquisition spree, taking advantage of both cheap debt and decent growth in the boardgame market. They acquired both distributors and game design studies, reinforcing the effect of each other, and they are now probably the second-biggest company in the world of tabletop games in terms of sales3. But in that race, they didn't make much of a distinction between different games and now they classify what they own in three different segments

Social games, or what we know as party games. Cheap, short, fast paced, easy to learn and play. Economically, they are profitable, but not recurring. Subject to fades.

Boardgames, that compete with the likes of Monopoly. In this sub-segment, I think Asmodee is the worldwide leader, with brands as Ticket to ride or 7 Wonders. Longer, rules can be a bit more complicated4. Here, there is the possibility of having a brand, expansions… and hence more recurring sales. But it is mixed, as most of the sales are really stand-alone.

Hobby games5, like TTRPGs, TCGs, and miniature games6. They tend to consume a big chunk of the player's leisure and are more complex, either because of the meta or because of the rules. Really profitable, and really recurring if it sticks (see Games Workshop, or what Magic has been to Wizards/Hasbro)

Let's look at their sales breakdown

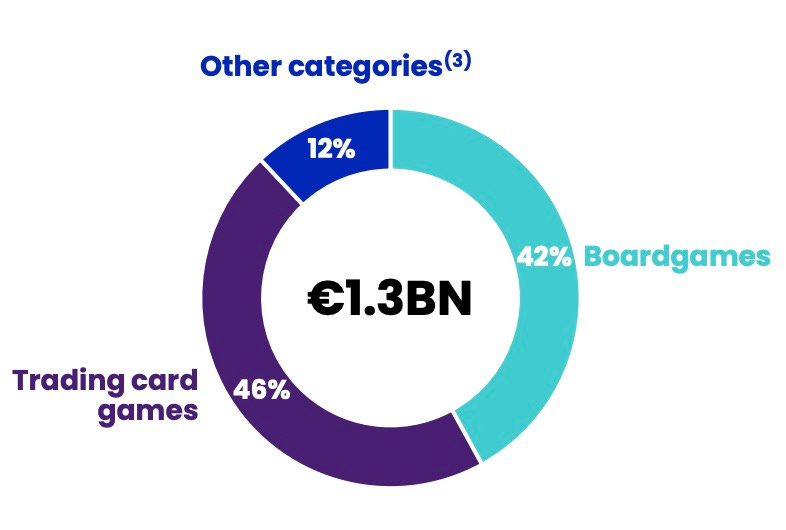

Boardgames includes miniatures. So basically, TCGs make up 46% of Asmodee's revenue. That helps explain as well why the third party segment is 64% in the prior graph. Pokemon and Magic. They also further disclose the breakdown of Asmodee's board game sales in terms of categories:

The idea is that inside boardgames, the games that grow the most are strategy (or euro-games, really, meaning more elaborate games for enthusiasts in this context) and party games, and that is the majority of Asmodee's portfolio, with a smaller share of family games (and almost none to kids games). I don't know exactly how they classify it brand by brand, but it adds up with what I know of their portfolio. But keep in mind this does not include TCGs, the market for which has also been increasing slightly faster than the board game market.

So Asmodee is well positioned in the market for the categories that have more growth. Now… what I am not that sure about is about boardgames being a growth category anymore.

As you can see, and this is according to Asmodee's information, tabletop games peaked in 2020, and have been decreasing since despite inflation. The estimated growth in 2024 would not compensate for it, but in Asmodee they assume a return to growth. I am not so sure.

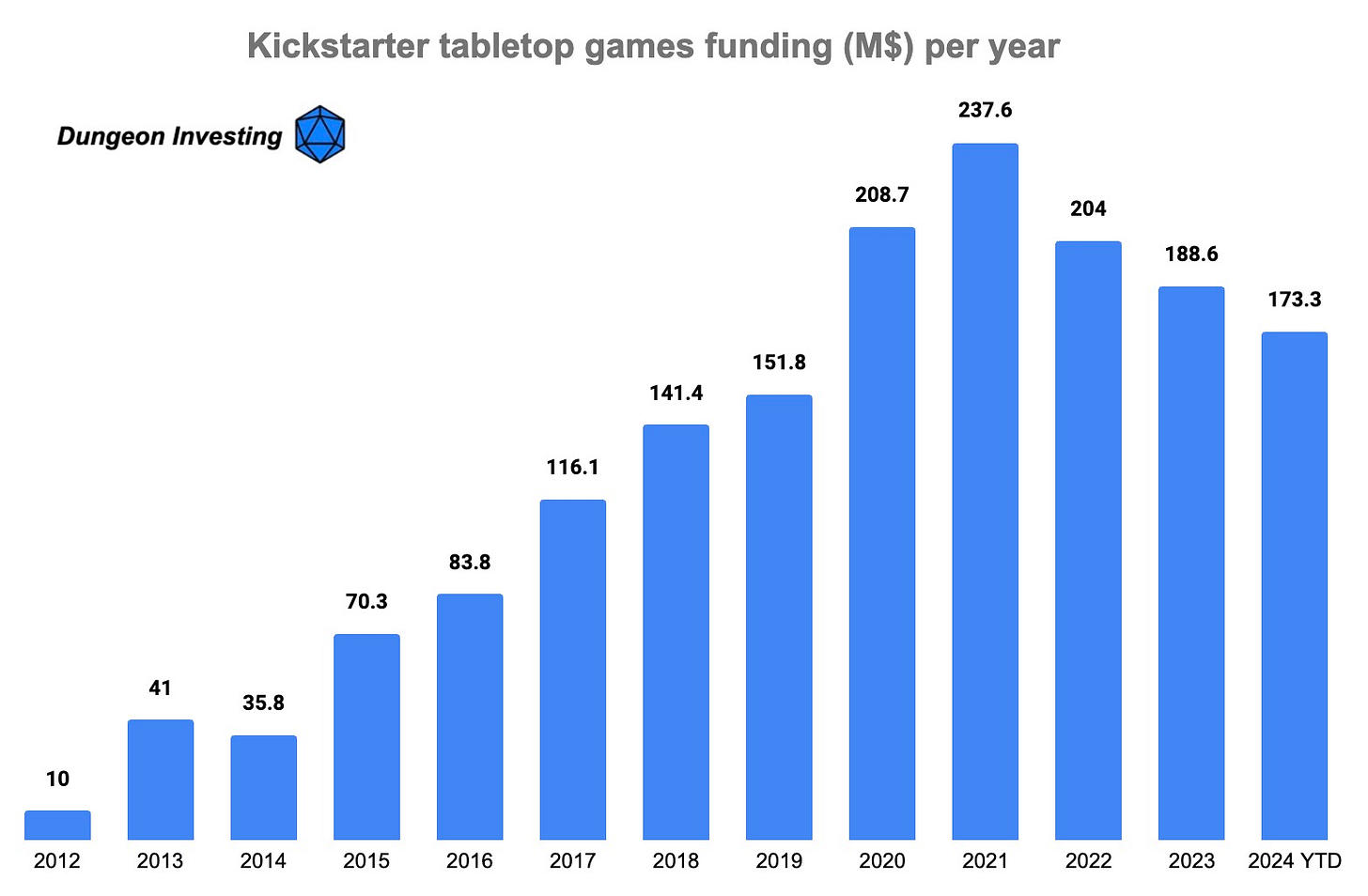

As was very well explained in the CMD, the growth categories are party games (with lower barriers to entry and competition from other toy makers) and strategy (more specialised, more dependent on hobby stores and showcases). Problem is the strategy segment is clearly slowing down, at least in the US, far more than is shown here (at least according to ICv2 reports, as I wrote back in April). So I have some doubts about Asmodee's growth in the boardgame segment not because of Asmodee, but because the trend seems to have stopped. Here, the cleanest data I have is the Kickstarter funding in the boardgame category. Kickstarter-funded games tend to be in the heavy hobby segment, basically what Asmodee deems strategic, although there are some TCGs as well (Altered being the main one). I have been able to gather the following, based on the 5400 most-funded tabletop gaming projects in Kickstarter's history (so not complete, but directionally correct7).

Part of the decline is driven by the rise of Gamefound8, an alternative site for games, but not all, and it seems clear to me, taking into account hobby channel data (centered in strategy games) and Kickstarter (also predominantly in that segment) that the perspectives there are not as rosy as Asmodee is saying.

TCG & miniatures

Half of Asmodee's sales are TCGs, and a decent chunk of the others are miniature sales, so I would like to talk about their position there, because these are growing and very profitable markets, as Hasbro and Games Workshop prove time and again, and this is probably where Asmodee will make or break.

In miniatures, I think there is a reason they barely talk about Atomic Mass Games and the miniatures it has. The reason being they have been steadily losing share since the heyday of X-wing, when Fantasy Flight Games9 challenged WHFB/Warhammer Age of Sigmar as the second biggest miniature game worldwide10. From what I know, Marvel Crisis Protocol is doing fine, while Shatterpoint and Legion, the Star Wars licensed games are far slower. Given that they were not able to sustain the X-Wing push and ended up retiring the game a few months ago11, I expect the same thing will happen with these ones. Once Disney's new films died down, so did X-wing. So will the other Star Wars games and Crisis Protocol in time.

The point I am trying to make here is that Asmodee doesn't have a self-sustaining own-IP game. They rely on the marketing push from their IP partners, and they pay a hefty royalty for it. So I don't expect their miniature games to be a big driver in the long run. They require a dedication FFG used to have, but Asmodee hasn't. Plus, miniature games have higher costs than TCGs, and Asmodee seems to be very focused on having a capital light model. Granted, you can achieve that on scale (look at Games Workshop) in minis, but you have to push for scale first.

In TCGs, the situation is different. Most of their TCG sales come from partners (Pokemon, Magic). Asmodee here provides the local logistics and gets precious little margin, being between the IP owners and retail. The good part is that they can use those massive TCG sales to get sales relationships with every retailer, and then can push their own TCGs and events on those. For the most part, and except for Arkham Horror, Asmodee's TCGs are licenses from other companies on the back of already existing IP. Star Wars Unlimited is currently the biggest one they have, and they are pushing for its use and helping organise competitive events. TCGs have very high gross margins, and the only real cost is marketing (including event organization).

In TCGs there is another dynamic that helps Asmodee's position too. It is a highly fadish area, other than the biggest games12. You see lots of annual releases from anime, games or even vtubers13. They are well positioned to either do that with their own IP or licenses, or to get part of the pie from the smaller competitors, or firms that simply do not wish to have a complicated set of retail accounts only for one game (which is why Asmodee distributes One Piece, Pokemon or Dragon Ball TCGs in many countries). While I think it is almost impossible they get a game in the top 3 in a stable manner, I think they are well positioned to take advantage of this other side, and I think it will be a growing and profitable business.

An IP factory?

There was a lot of emphasis on the IP side of things, on how Asmodee can create valuable IPs and make them cross-media. The evidence is pretty thin so far. The games they touched on have so far been light on sales14, and the film evidence (two adaptations of the Werewolves game increasing sales up to 150% on the week of release of one of them) is, in my view, not convincing. I would change my mind if they have significant royalties that show up in the next couple of periods, but I suspect that won't be the case.

Of the two IPs they set as candidates for further growth I think Legend of the Five Rings is an interesting and well fleshed out IP, but sadly not particularly popular. Arkham Horror can face a lot of competition without much protection, being another Lovecraft pastiche.

Overall, I just think the board-game to transmedia IP trip is long and dangerous, and only achievable in RPGs and similar stuff, where the backstory is part of the game. The latest examples I can think of are Numenera (2013) and World of Darkness (1991), and only somewhat. The others (Warhammer, D&D) date back to the 80s or earlier, and took a long time to become transmedia success stories. And all had a relevant player base before making the jump, except maybe Numenera, which probably no one reading this has heard about15. If someone wants to bring-up Monopoly, I would like to remind you it was first released in 1935 and it was already top of mind when Monopoly Go! came out. Sure, the potential is there, but it is very uncertain and no brand has made the jump successfully in a while, at least that I know of.

All in all, a bit skeptical of this. So let's look at the finances.

Asmodee financial situation

Asmodee and Coffee Stain have been the only parts of Embracer's empire that have reliably made money. That said, Asmodee came with a leverage problem, and the EBIT produced was enough to pay down the interest, but not much more.

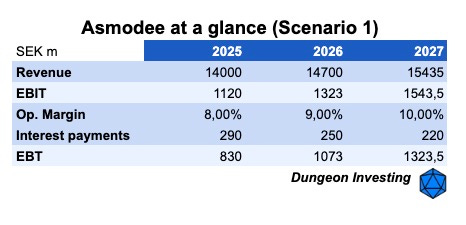

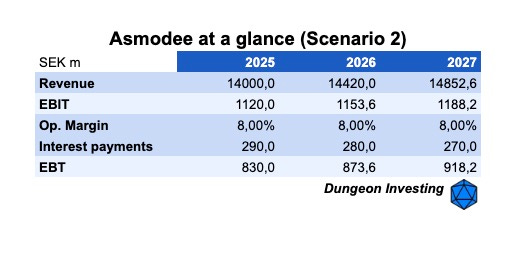

This year, the numbers are better so far thanks to the Star Wars TCG and an improved margin (7% EBIT margin), leading to an almost 50% increase in EBIT in H116. Even if that holds, and I think it will, it seems like their long-term target margins can't be too high17. Let's suppose they are able to improve the margin. They are also going to retain about 6B SEK in debt18, as Embracer is going to contribute part of the Easybrain sale to reduce the financial load. Let's assume they are going to be able to pay about 5% interest on this debt (current SEK base rate being 2.75%, and this being relatively highly levered). That leads me to this back of the envelope scenarios, none of them particularly pessimistic, as both assume growth and a reduction of interest paid

Say what you will, but I think 5 times EBIT is plenty of debt for a company that is not growing that much. Granted, I don't think Asmodee is super-sensitive to economic shocks, but it does have a high fixed cost base (their distribution network). A serious downturn can really hurt.

They are also planning to resume their M&A, now that they have a more manageable debt load. They have done well in the past, but that was, again, with cheap debt, away from public markets and in an environment of relevant growth both on their own and in their industry, and with higher margins than now. Personally, it doesn't seem prudent to me to do that if they don't manage to improve margins first.

Afterword

So far, the reaction to the CMD has been fairly muted and it is, I think, understandable. Asmodee is only one part of the conglomerate, and the results overall were not great, although I think that Eazybrain's sale was at a fantastic price and I am less queasy about the value of the whole group after it.

That said, I have my reservations about the path Asmodee seems to be taking. They have fantastic assets, but I am not convinced about how they are run. They had a really good opportunity to try to compete with Games Workshop in wargames from Fantasy Flight / Atomic Mass, and seem to have thrown the towel and go back to their acquisition strategy. But that only works in the long run if your current operations are a cash cow, and it feels like they need to improve quite a bit before they can be considered that. I have to admit that I mistrust the management and that colors my view, under a different management focused on the hobby games side rather than the M&A strategy or selling trans-media IP potential, I would probably be enthusiastic.

I just don't think it is the best approach.

Results and other news

That was all about Embracer and Asmodee! But it is not all, not yet!

Sony wants to acquire Kadokawa

Talks have been confirmed by Kadokawa, but no firm offer is on the table yet. In my view, the acquisition makes sense, and not because of what I think you are thinking. Sure, From Software and Acquired are interesting assets in the videogame world. But Kadokawa is valued at almost $4B, don't think Sony wants to pay a premium on that for those studios!

The manga and anime IP though? A different matter. Kadokawa is one of the largest publishers in Japan19, and has a deep, deep treasure trove of manga properties, some anime production capabilities and established relationships in the industry. Does that make sense for the company that owns Crunchyroll, Aniplex, A1 and CloverWorks? Yes, even at a relatively large premium.

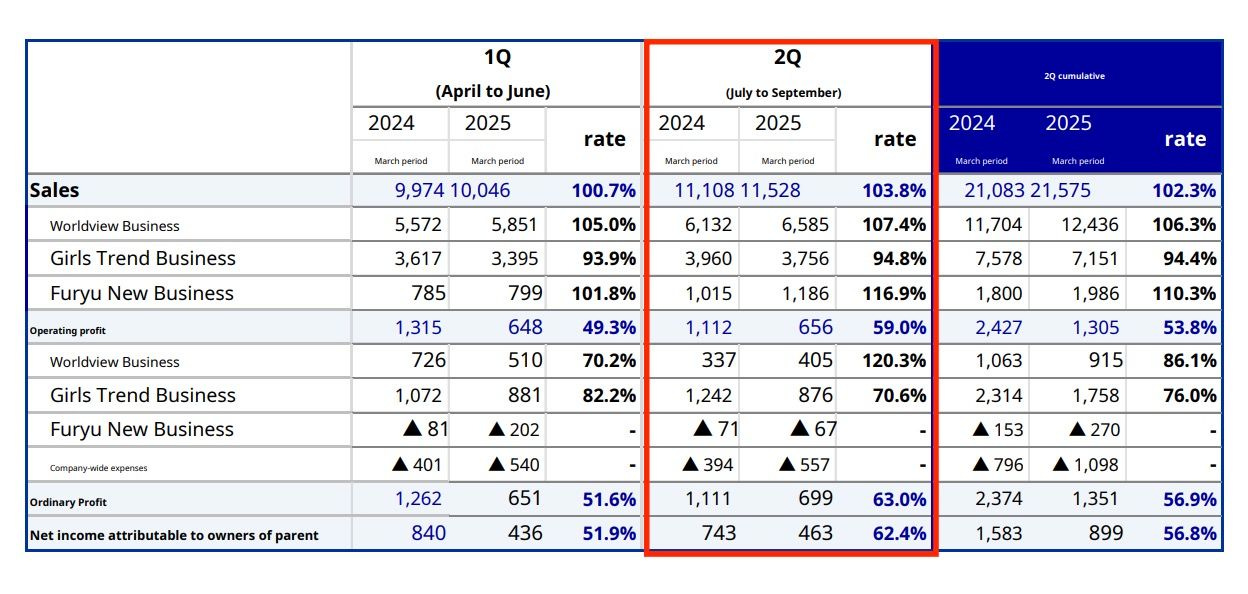

Furyu: Purikura worse than expected, figures go well

Furyu has seen marked declines in profitability due to the decline of the Purikura business being more acute than expected. It should not worsen over the year, and guidance has not been modified because:

It was already quite gloomy

The figures business is doing decently, growing at 6% even after last year's crazy figures, as is the “new business", where Laid back camp season 3 has done fantastically, compensating for the bad performance of the videogame segment.

Overall, the faster decline of the purikura business damages the thesis, but I don't think it outright kills it (given the already existing load of cash and the growth in the figures sector), but we'll see.

Mandarake: bad trend continues, but management outlook is decent

It seems like I sold Mandarake at the bottom, but it also seems like the deterioration was not a matter of a single quarter.

They only managed to deliver 10% earnings growth on 12.5% growth on sales, which points at both margin deterioration in the last Q and sales stalling. Not good. But then the forecast points to 15B yen in sales and a 1.5B in earnings, so they expect some growth and also margin improvement. Mandarake doesn't typically guide optimistically. This was the guidance for last year (first row being the first half)

First half was a handsome beat, the second a bit worse than expected, overall the year was a bit better than expected, even after an unexpected downturn in the second half. Let's see how they deliver.

Other news

Games Workshop released their first half trading update, with full results to be known in January. Bit of a monster beat, thanks to Space Marine 2 and very solid core sales. 24.9% up in operating profit against very tough comparables, especially when part of it comes from core sales going up 10%, is a fantastic result.

Dan Da Dan is the new anime sensation. Not only its opening (which, as you can see, is beating all the records in YouTube for CrunchyRoll, only being surpassed by videos that have been more than three years in the platform). It also has high popularity in MyAnimeList and the mangas have been top 1 or 2 for weeks now (only a new One Piece volume was able to take the spot from the series). Looks like Aniplex (Sony) and Shueisha have caught lightning in a bottle. Sony is too big for this to move the needle, though!

Crime Scene Cleaner keeps outperforming expectations and keeps selling over time. This is really important for PlayWay, as it could net about 7-10 million PLN in operating profit in Q4 thanks to that game alone, if the trend keeps up. Their operating profit in Q4 last year? 13.4 (although there were 20 million of impairments).

Paradox Interactive proved that the Hearts of Iron IV brand is stronger than ever, with good sales and a new CCU peak for HoI IV after the new DLC was published. Probably the best Paradox release in a while, likely to make for a decent quarter.

AltayCap published another great writeup on Mansei Corporation, yet another Japanese net-net

I watched those 4 hours so you didn't have to, including the weird eurobeat-like music between sections.

The deck says that it has an older relationship with WotC (Magic) than it has with the Pokemon Company, but that is through one of the subsidiaries it acquired.

Hasbro is mixed, but even without knowing the exact percentage tabletop gaming, including TTRPGs and TCGs, represents, it is almost certainly bigger than Asmodee. Asmodee is third in the US, behind Hasbro and, I think, Mattel, and 1st in Europe (although it looks like they still lose to Ravensburger in Germany)

Or a lot more. Euro-games are included here too.

They call them lifestyle games, but I think this reflects better what we are talking about.

Inexplicably, Asmodee includes Zombicide as a Tabletop game. Which makes me think management doesn't know what they are selling.

That's why pre-2022 numbers are correlated but below the ones in this piece, roughly 20% below (although it is not exact across years). Same correlation should apply in 2022 and after, so the drop is bigger than it looks in the graph in absolute amounts, should be about right in percentage terms.

This is a theme I might explore in more detail in a future issue, in terms of exploring tabletop gaming trends. Both Kickstarter and Gamefound are really interesting sources of info!

Another subsidiary.

Warhammer 40k's position was always unassailable.

With the final goodbye in Adepticon, an event heavily dedicated to all things Games Workshop even if it is for all wargames in theory.

Magic, Pokemon, Yu-gi-oh. Lorcana is probably the most popular of all the others, and it was released in 2023, it has yet to prove its longevity.

One of the main reasons for Cover Corp's latest earnings beat, actually!

Exploding Kittens VR has a whooping 98 reviews in Meta's store, Exploding Kittens 2 (PC) has sold less than 5k copies by all indications and the Snapshot Games agreement for 12 games is… well, it is an Embracer subsidiary that used to be part of Saber and has published nothing since 2021, make of that what you will.

Torment: Tides of Numenera did OK, but that's about it. It is debatable it is a transmedia success.

I will hold to my usual practice of ignoring Embracer's group adjusted numbers, as historically they have been unreliable.

Asmodee's margins have seasonality. They are usually bad in Q1 (starting in April), good in Q2 and Q3 and terrible in Q4, so my guess for this year is a blended number of around 7-8% EBIT margin.

Not net debt, full financial debt

Considering Shogakukan and Shueisha as part of one group, then it would be Kodansha, then Kadokawa, Square Enix and a bunch of others are sort of tied.

Amazing job

Thx!

thanks for the write up, mate.