Embracer & friends

On April 22nd, Embracer announced its division in three companies as a way to surface value. Will they succeed?

The Embracer saga has been interesting for me for a long time. Partly because I'm Spanish, and somehow it became a fairly popular holding here (when the stock price was way, way higher). Partly because they bought Asmodee, a company I have been following since 2017, back when Eurazeo owned them. And they also bought the rights to LoTR games. And the rights to Tomb Raider. And Deus Ex. And Borderlands. And Dark Horse comics. And…

…and that was the problem. While there were already symptoms before that the acquiring spree might have gone a bit too far, in late 2022, as rate hikes started to be felt, Embracer's stock kept going down. Some game launches worked, some didn't, but on balance costs were too high to be supported by the successes (like Remnant II or Deep Rock Galactic: Survivor, to mention a few recent ones), and mobile was not working as expected. Even Asmodee had some problems in FY231 to generate as much cash flow as in other years.

Had that happened before the latest set of purchases (Asmodee included), it would have probably been only a bump in the road. But Embracer was hit with the combination of the business slumping after being freshly levered and rates going up. Asmodee had been acquired with a significant debt load, and the refinancing was not too far in the future, and Embracer was under pressure2.

In the last few months, and as a response to that pressure, they have conducted three different actions.

Sale of Saber in a bit of an odd deal. Odd because the guarantee of the deal are Embracer shares that were owed to Saber’s founder as part of Embracer’s acquisition of Saber. So there is the chance that Saber’s next releases don’t work out, the deal is reneged upon, and Embracer has to eat Saber up again.

Sale of Gearbox to Take-Two in a more normal one (as in payment being Take Two shares).

Announced division of Embracer in three entities:

Asmodee

Coffee Stain & Friends: The modest (indie to AA) gaming segment, plus mobile. Coffee Stain, Ghost Ship, THQ Nordic and all the mobile side.

Middle-Earth Enterprises & Friends: The AAA segment, with Tomb Raider and LoTR as flagship IPs. It includes Dark Horse, Plaion, Eidos Montreal3, Crystal Dynamics and 4A Games, among others.

Essentially, Embracer has changed completely in the last month and a half. I will go over the effects of the 2 as of now not closed sales (considering that they will close), and what I think of the resulting structure (considering as well that the split will happen) with what little we know.

Embracer: pre-split

So Embracer was under quite a lot of pressure to reduce debt and control cash outflows. And they did. My impression, however, is that they were not able to do it in a way that optimized for value, but for short-term cash flows (and maybe how they would look like in the financials).

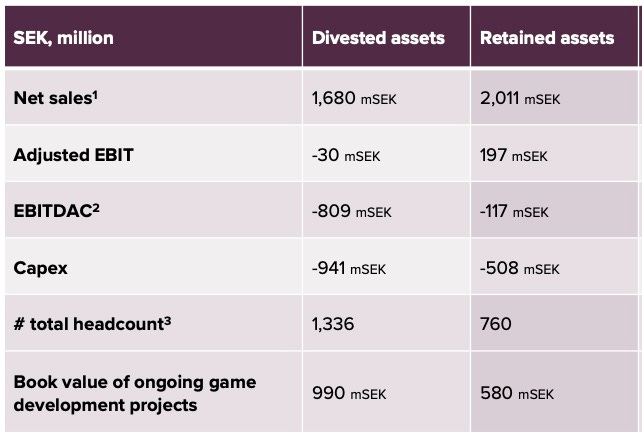

Let me explain… when you look at the sales of Gearbox and Saber, we are looking at relatively complex operations where Embracer didn’t sell the whole studios, but pieces of them. And both seem to slant a particular way. This is the breakdown of the assets of Saber that were sold and the ones that were kept, according to Embracer:

And these are the ones from the Gearbox sale (same source!)

As you see, the retained assets are more profitable, have less headcount and less Capex, and more book value too in Gearbox’s case (Saber’s wasn’t disclosed, but the loss on sale disclosed points to the same). What that means is, essentially, they are keeping studios with recent releases that are cash-flowing right now and they are selling in-progress projects that would cash-flow in the future. Even in the relatively near term one (Homeworld 3 and Space Marine 2 are included in the sales).

Granted, those are potential cash flows and not realities. But I still think those deals materially decreased the value of Embracer. Not arguing they were not necessary though. Embracer will get $200 million for Saber by the end of the year, and around $300-330 for Gearbox4.

While that does not cover their net debt (around $1.5B in the last report, a bit more than $2B including contingent considerations) it helps, and it helps especially with interest (more than $100 million a year at the latest run-rate). Essentially gave them enough breathing room to negotiate refinancing. What remained was a company with:

Asmodee, always profitable and cash flowing, on track to generate more than $100 million in EBIT.

The mobile segment doing decently, and generating about $90 million in EBIT (were the FY to continue as it has been). But with some warning signs. CAC was down a lot, and that can happen in the wind-down phase of some games, when you stop investing in acquisition but you still have sales. The mobile segment changed strategy recently, so I suspect the profitability might be in part due to this.

The media segment (Middle-Earth Enterprises, Dark Horse…) on track to generate $35-45 million in EBIT thanks to Middle Earth royalties from the Magic the Gathering crossover (not something that should happen every year). It also includes Plaion, so there is game publishing mixed in here.

And the segment that was affected by all these operations, the PC/Console one. According to the disclosures, the sales should not affect EBIT because the divested assets give a total sum of 0 in adjusted EBIT. But let’s take into consideration several things

EBIT to Adjusted EBIT bridge for the segment was… well, for the prior 9 month period, EBIT was about $-175 million, and adjusted EBIT was about $179 million. And yes, the symbols are correct. I haven’t seen a disclosure detailing what goes in the adjustments but I suspect that it includes restructuring costs (fair) and write-downs of unsuccessful projects (not so much)

As mentioned before, for Gearbox and Saber they sold the parts most likely to generate cash in the mid-term while they retained the ones generating cash in the very short term. That should impact earnings going forward.

Taking the above into consideration, for me the PC/Console segment of Embracer right now probably has negative to zero value. But that does not mean everything within it is worthless. Far from it. And that is very relevant in the division, because I think it aims to reduce the blast radius of both debt and business underperformance in the AAA segment.

Asmodee

Asmodee is one of the biggest hobby companies in the world. Certainly bigger than Games Workshop in terms of sales, and about half of the size (again, in sales) of Bandai Namco’s toys and collectibles segment. And it is closer to that second company in its client mix and margins as well.

When you start looking into Asmodee, you quickly see it caters to 2 really different markets5:

Mass market games: Ticket to Ride, Catan, Azul, 7 Wonders… they are popular both as family games and amongst board game enthusiasts.

Hobby Games: Anything under Fantasy Flight or Atomic Mass Games, really. Star Wars Shatterpoint, Marvel: Crisis Protocol or Star Wars Unlimited are some of those. As those names indicate, they heavily rely on external IP licensing (but they use it really well!)

The mass market games are not a huge margin business. Hobby games would if they didn’t have to pay big royalties, but they have to. It is still, typically, a higher margin business than mass market games.

Why are board games lower margin than most hobby games (like miniatures or TCGs)? Well, the amount of stuff you have to include to sell a 50$ game is a lot more material and a lot more weight than what you need for TCGs. And sure, you have deck-building games (Dominion comes to mind6), but the price per card works out to a much lower amount than that of TCGs like Magic. Most of these games are sold through retailers, so a big chunk of that ASP stays with the retailer. In the hobby market, you get higher gross margins by default as you have rock-solid fans and can charge way more7. I also suspect DTC proportion is larger.

Getting into the history of Asmodee, it is really a very simple one. A PE fund invested in them and turned them into a rollup, levering them quite a bit. Then they sold to a second PE that levered them even more. The rollup worked great, because Asmodee was growing organically at the same time, as were all their subsidiaries, and interest rates were still going down or stable, so ROE went through the roof, and Asmodee kept growing. In fact, sales of the group multiplied by 10, give or take, since 2014 to 2021, when Embracer acquired them.

Embracer acquired them when two premises were still holding up:

Money was cheap

Tabletop market was still growing really fast

Sadly, both changed in about a year. At least partially. The hobby market is still growing quite a bit. The mass market table top games, not so much. According to ICv2, it actually went down in the US in both 2022 and 20238. In Asmodee’s case, sales remained roughly flat in FY23 and have increase in FY24. At 6%, operating margins were slimmer than expected in FY23, and FY24 was slightly worse in the first 9 months9.

Not all is bad though. ICv2 tipically tracks hobby channel sales, so some online board game sales scape their purview, and Asmodee has been adept at increasing share both in hobby (competing with Games Workshop at times with their X-wing and Shatterpoint ranges10) and mass-market.

The problem is the debt load. Under the proposed structure, Asmodee will take on most of the debt load of the Embracer group, with about $1B (reported value is €900 million), which is close to the total debt of the group after the transactions11. At around 6% interest12 and with 18 months maturity, you can see why that is a significant load for a group that has generated less than $100 million in EBIT in each of the last couple of years.

How much is the Asmodee spin-off worth?

Asmodee is selling somewhere close to $1.3B this FY13. Their margins are not trending well compared to last year, but assuming they repeat their 6% EBIT margin, we would be talking about almost $80 million, to a $60 million interest bill, plus paying down some principal. That effectively means that either they get refinancing on more lenient terms or the equity, if that margin profile remains, is not worth much.

Asmodee needs cash to finance their working capital needs (wind-down of inventory in Q3, build up in other Qs, relevant inventory needs for growth, financing the paying terms of major retail chains…), so they don’t have the luxury of using that as a source of leverage, or of paying down a lot of debt by restricting their needs if they want to keep growing.

So is this Asmodee’s normal margin profile, or these couple of years have been particularly bad? Personally, I think Asmodee should be at 10-12% operating margins14, and with potential to maybe do a bit more. They have in the past, if the PE reports are to be believed. I also think that, given the hobby market component, they can still grow (although I would expect single digit growth from now on, and it can be lumpy with successful products as Shatterpoint pushing it one year, and then down again).

Considering they can make those margins, maybe Asmodee can be reasonably priced at about $2B EV, so the equity might be worth $1B15. But I would not pay even half of that until I see their individual financials, because the very low margins since the group was acquired by Embracer are extremely worrying, and I don’t understand how with a relevant component of hobby market they have a worse margin profile than Spin Master, Hasbro or Mattel. So I would like to know a bit more before jumping in, and if those margins can be recovered.

Middle Earth Enterprises & Friends

Now, the other two blocks are very, very difficult to value, because they both include not fully disclosed parts of the current PC/Console segment. They also include other segments though. In the case of Middle Earth enterprises & friends16, that would be the Entertainment & Services segment that includes Middle Earth licensing, Dark Horse and Plaion17. And then the part of the PC/Console segment that is more focused on AAA games (Tomb Raider, Kingdom Come, Metro…).

Being honest here… I am not sure how much this is worth. With the history of Embracer in AAA, I am tempted to say nothing and write it off. That wouldn’t be fair, as there is some back-catalogue, and now almost all the debt of the company will rest in Asmodee, and they truly have interesting properties. The problem is they will most likely have to lever up a bit more unless Kingdom Come: Deliverance 2 does incredibly well, and by that I mean more than 2 million copies at AAA price.

The reason I think that is Embracer sold almost all the pipeline of AAA that were close to publishing in the latest set of transactions. Which means this segment will cash-flow only on a back-catalogue & royalty basis until KC:D2, and there is not much announced beyond that. These are games that require a lot of time and budget to develop, and they have several almost dorman properties that need good games to revitalize. There are some deals in progress (like Amazon developing an MMORPG for Middle Earth), but as far as I know, no expected releases beyond KC:D2. Dark Horse is also something that I don’t expect provides a lot of cash-flow, although it made sense for Embracer’s transmedia ambitions.

How much cash can we expect back-catalogue and royalties to provide after expenses? Difficult to tell, because it is very lumpy, and the disclosures of back-catalogue sales from Embracer are weird18, but considering only the parts that go to Middle Earth I would expect current back-catalog to yield $40-50 million in cash after expenses19, which will go down every year significantly if there are no new good releases. And then there are Royalties, film and the like. This year, they are on track to generate about $30 million in EBIT, but a big chunk of that comes from the LOTR-Magic crossover, which won’t happen every year. Last year the segment did actually lose money. Let’s be benevolent and say $15 million.

So we have cash streams between $50-70 million. Is that enough to maintain development for 8-9 AAA properties at the same time with, say, 2 full releases a year? Well, no. According to their LTM CAPEX numbers ex-divestments, it might be. But remember they sold primarily areas that were in ramp-up, so investment should go up. And that means failures on release are an existential risk for this segment of the company. They can diminish that through partnerships (like the Amazon-LOTR one) or selling part of those properties, but I don’t see myself trusting the management to do well in a complex situation like this.

I might change my mind after seeing the financials after separation. But right now I would rather not invest on this segment at almost any price. That does not mean it is worthless, I’m sure someone would pay for each of those properties with relatively large haircuts to their original prices. Maybe we could value this in a $500 million floor based on that, but I won’t hide that, out of the three, it is the one I like the least. With the caveat that one or two successes can make its value skyrocket and get to $2B easily. Middle-Earth & Friends is the heir of the original Embracer problem: huge theoretical value, huge barriers to its realization, specially without Coffee Stain to help finance development. Very few AAA companies survive long without long-term cash generators with less cost that help finance the more bigger and lumpier launches.

There is also the potential for more complications here than in other cases. Embracer does not consider contingent considerations as part of the net debt, so there is no mention to them in the report. There are relevant contingent considerations for several of the IPs here, and there were around $600 million pending, including only the cash-related ones, and not all of them recognized fully in the balance sheet (although they are in the reports, the conditions are probably not close enough to triggering for them to be recognized at this point). The sales of Gearbox and Saber will take some of that away, but not all of it… and Middle Earth & friends will carry the blunt of this liability.

For completeness sake, Embracer says this is generating more than $180 million of adjusted EBIT in a LTM basis, on $1.3B of revenue. But that includes the extra margin from Magic royalties, and I suspect part of the adjustments to EBIT are a bit aggressive, though difficult to tell without a detailed bridge. Obviously, if those numbers are both correct and sustainable, this is worth much, much more. I just don’t believe that’s the case.

Coffee Stain & Friends

Or maybe we can call it Embracer Original Taste. Because this would be Coffee Stain, Ghost Ship, THQ Nordic and the mobile segment, that is, a smaller group with an indie to AA focus (with mobile F2P added). Essentially highly profitable, not really expensive to make games, plus solid cash generation from the mobile side.

What can I say, I really like this part of the division. Coffee Stain is a fantastic business, as are most of the other parts. I have my doubts about mobile having overstated profitability as of now, but historically it has been profitable. And most importantly, if you wind it down you don’t loose brand image. This is not like the AAA brands, where you have a really powerful asset that you can lose. Embracer’s F2P mobile games are purely a CAC vs LTV operation, and if the numbers stop adding up, they can stop burning money.

A few words on Coffee Stain though: I don’t think it will reach the multiples that are being touted as comparables, because I don’t think it is close to Paradox’s stability, and I think that is based on thinking about Paradox’s multiple as a result of their margins. I might be wrong, but my impression is that Paradox is that expensive20 because it is extremely defensive. I will probably detail it more in a later post, but basically they have 5 games with an extremely stable player base and they can live off making DLCs for those games for a long, long time. Coffee Stain’s model is different, and is based on making more relatively low cost games that can make incredible ROIs when they are successful, and not a lot of harm when they fail. That means that their revenue stream is a lot more dependant on execution than that of Paradox, in theory.

Now, I don’t agree completely with the theory. Very tight gaming communities can turn on the studios too (see the Creative Assembly saga in the last 2 years, although they are recovering some favour now), so I think Paradox has more execution risk than is usually considered. But Coffee Stain has much more, and I think that’s why the difference in multiple will stay.

How much is Coffee Stain worth as of now? Embracer says that on a LTM basis, this generated about $280M adjusted EBIT on $1B of sales. Even considering that mobile might be a bit overstated right now, I roughly believe the margins in this segment and now that it doesn’t have to pay for the AAA pipedreams, it is more valuable. Say mobile is truly overstated and the sustainable amount that can be generated is about $200M EBIT and that 10x is a fair multiple. I would probably sign on that… after seeing a detailed bridge of adjustments, of course.

I wouldn’t put a higher multiple because the AA segment is having trouble growing globally (in a problem that is not unique to Embracer), and mobile has seen its margins greatly eroded (which Embracer seems to have escaped, which is why I think profitability is overstated right now). But that still leaves us with about $2B. Maybe a bit less, as I assume the remaining financial debt will go here (as Middle Earth would be in a worse position to assume debt).

Conclusion

Embracer is currently valued at $3.3B and change, and summing what I have mentioned would give us between 3 and 3.5B in value, depending on how generous you want to be with Asmodee. Not terrible. But I wouldn’t put my money in there as I see no upside. I might put it in Coffee Stain independently at a low valuation, or in Asmodee if I see good perspective on margin recovery, but with things as they stand, total valuation seems too close to fair value even after unleashing Coffee Stain & Friends from the AAA burden.

Part of it comes, admittedly, from lack of trust in management. I have relatively low tolerance for some shenanigans, and Embracer has certainly done fairly aggressive accounting and adjustments in the past, plus things like announcing the disposal of Saber as the group leaving Russia, when that is not the cause of the sale and most of the divested assets were not even there. Or announcing Eidos Montreal as part of Middle Earth & Friends, when they basically dissolved the studio months ago21. To mention only the ones in the last few months.

Now, I am aware a lot of people puts a lot more value both in Middle Earth & Friends and in Coffee Stain & Friends, and for a more bullish perspective you can go read Valuation Matters on Embracer’s division (in Spanish). So far, the market rewarded the transactions and this announcement sending Embracer to a valuation similar to the one in August’23, but still very far from its heights in prior years (or even a year ago). Let’s see how it continues!

Embracer's financial year ends in March.

Some investors argue Embracer was not over-levered and that it was only a matter of Swedish banks being too conservative on refinancing. I disagree. Given their lack of cash generation and the relative uncertainty of their business model (Asmodee excluded), rising interests were severely affecting them. The thesis about Embracer not being over-levered relied on their assets. Essentially, if you can sell assets to pay down the debt at any moment, that debt is irrelevant to you. As we have seen in the last few months, it wasn’t that easy, and both Gearbox and Saber deals have required a decent haircut to get done.

Well, the press release says Eidos Montreal is part of the deal. What is part of the deal is the brand and IPs related to it. Eidos Montreal is no more. One more of the not-quite-lies Embracer’s management has been so fond of.

Headline numbers are much higher, but that includes contingent considerations that disappear from the balance sheet and other adjustments. The numbers here are purely the cash that Embracer will get according to their press releases.

I know in the acquisition deck they divided this in 3 and along different lines but I think this division is far more accurate. Given the channels of distribution and the focus on different offerings, I think Asmodee thinks that too :D.

One of the few massive successes in the board game community that Asmodee hasn’t scooped up.

There are a lot of things that are in between both things though. Especially on Kickstarter/Gamefound. CMON games are definitely in the hobbyist side, but they can’t make great margins out of them, apparently, and they do include a ton of stuff for the price of a couple of Nagashes.

Adjusted operating margins are more than double, of course.

With Age of Sigmar and Fantasy/Old World. Nobody can touch 40k. But according to the latest ICv2 info, at least in the hobby channel both Atomic Mass games sold more than Age of Sigmar.

In the presentation of the transaction, Embracer says that the group ex-Asmodee will still have net debt, 0.6 times their Adjusted EBIT, which would leave it at a bit more than $100 million if I have done the math right.

It was 6.15% last quarter

With only the last Q missing, and prior nine months reporting significant growth in sales from last year’s $1.2B, I think it is a reasonable number.

Judging by the margins toy makers have, and the ones Bandai Namco has on a mixed line like the toys and hobby one.

Embracer paid about $3B including debt. With organic growth slowed down and profitability hit, I think I might be being a tad too generous here. But hell, I like Asmodee.

I am not making it up, that’s the name they gave in the announcement. I hope it is a provisional one.

Most of their revenue comes from games. In theory they only include the partner publishing business here.

They consider back-catalogue anything not released in the same quarter. Personally, I prefer to think about things not released in the current year as back-catalogue, as the first year typically still sees significant sales during months. That’s why Embracer’s back catalog sales typically amount to more than half of their revenue, versus a bit more than a third in SEGA, that has a far stronger back-catalog.

I have made some numbers to get here. But it is so wildly hypothetical that I might have just as well guessed, so this can vary a lot. I think I’ve been fairly generous.

Well, less so than in the past. Paradox is, that said, one of the companies I really want to write about in the future.

Ahem. Little note here: Eidos Montreal is not closed, although there were cancellations and layoffs. It is still functional, although reduced. I mixed it up with Square Enix Montreal initially. Thanks to Valuation Matters for the heads up!