Games Workshop: Going mainstream

Games Workshop's latest results show good progress in the Nottingham brand, and there is progress in licensing. Yet, share price remains at the same levels!

This blog is a year old already, and there are a few things that I have been wanting to revisit in light of the latest developments, and Games Workshop is one of them. Their report came out in July revealing some interesting tidbits about their improved economics. After that, some other interesting developments, including worldwide success for Space Marine 2, import data, and a surprising roadmap (or lack thereof). A collection of signals that make me think Games Workshop is about to take off in a major way. But first…

A personal announcement…

I have been absent for a bit, and many, many things have happened in the markets (the yen carry trade flash crash, SegaSammy with above expectations results, PlayWay’s Crime Scene Cleaner, Mandarake’s and Cover’s not-so-good results, just to mention a few!). But the most important one for me happened outside. I am a father now!

Not that it changes much investment-wise, but like (almost) every new dad I just feel the need to shout the good news to the world. Don’t worry, will try to avoid the cringe-worthy investment parallelisms, and I don’t know more about this because I have a few-weeks-old. If anything, I might be a bit more risk-averse. Not necessarily a good thing! Anyway, back to Games Workshop!

Return to operating leverage and profit growth?

Games Workshop presented their annual report in July, and there are… interesting signs. Revenue growth was not great (11%), but the margin improved for the first time in 3 years, driving an almost 20% EBIT increase1. But it is important to understand how that growth happened. It is easy to attribute it to the new 40k edition released in June 2023, and then worry about FY25 comparables… but that doesn't match reality.

If we go by periods. Q1 was fantastic with the launch of the new 40k edition, but Q2 was slugish. H2 seems to have reaccelerated, and core sales grew 11% YoY (versus 7.5% in Q2). And H2 had interesting releases (Several 40k factions and The Old World probably being the biggest, since AoS was saving the big stuff until last June), but nothing on a new edition scale.

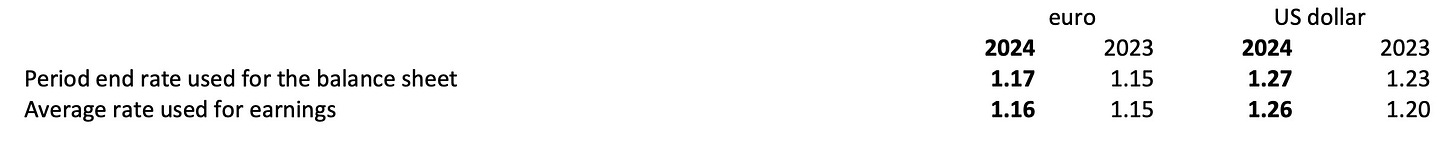

And then we have a headwind that I don't usually take into account, but was relevant this time (and at the moment seems like it will continue into FY25). The pound has strengthened notably in the last few months, and as Games Workshop has about 80% of its revenue coming from other countries (44% from North America), that has affected growth a bit.

So we have decent growth. A bit more sluggish than I would like but accelerating in H2 and against relevant headwinds2. Good! Let's talk margins.

H2 delivered the best margins for a whole half since 2021, with a 39% PBT margin, leaving the whole year with a blended PBT margin of about 38.5%. While this is far from the record in 2021 (almost 41% for the full year, almost 47% in H1), it is an improvement over 22 (37.8%, and that with really good royalties) and 2023 (36.2%)3.

But the most interesting part is where does that margin improvement comes from. If we consider core margins as the margin made from selling their products, PBT is always going to be very correlated, but royalties on videogames and similar projects are lumpy. That helped soften the blow to margins in 2022, but it might also be a confounder factor here. So let’s review the evolution of 2 metrics I like to track: Core operating profit margin, and core operating profit margin before profit share.

As you can see, they are the best in a few years, and also not quite parallel, as the margin before profit share improves more than the final margin, and that is because the profit share has gone from 8.8% in 2021 to 9.5% of the core profit, while in 2022 & 2023 it was a bit below 2021. The profit share is limited to 10% of core profit, so it probably won’t detract much from margins going forward. But we have to keep in mind that the improvement in core margins versus last year is actually of 3 points instead of 2, once we exclude the variable payment.

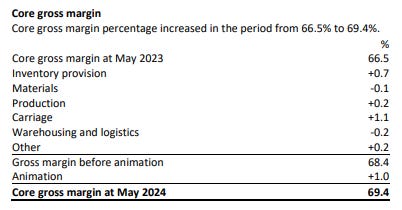

So where does that improvement come from? Mostly from gross margins!

Transportation costs eased, and there were less inventory provisions (we can imagine it is because of better demand prediction and transport), and also way less costs recognised from animations in Warhammer+4. Operating expenses have increased as a percentage of revenue, but it responds to the profit share percentage increase, otherwise they would actually have decreased as a percentage of revenue and the increase in margins would be more visible.

An important part of the increase in costs is staff costs aside from the profit share scheme… and those increases are mostly in production and warehousing (where staff numbers increased 10%, versus less than 1% last year). Another sign in the same direction is the planning of a fourth factory, mentioned in the annual report5

Talking about gross margins, as you all know I think their ever-increasing range is a bit of a threat to keeping them, and at the same time I think I prefer to sacrifice that than sales at this point. But in Games Workshop they seem to be trying to balance both for in the last few months. While they have kept a break-neck pace of releases, they have also been removing SKUs from their available range aggressively. SKU count has gone down for both AoS and 40k, although ToW and other games have taken part of that space so the result is mostly flat. Let’s see if things continue in that direction, but I think that is positive for margins. If done correctly, probably also won’t affect sales negatively (which would have a mix of short-run exclusive sales and long-term SKUs, or at least see some return only periodically in limited runs). I suspect the attempt to keep balance here is part of the reason why the new release roadmap is so sparse until early 2025 for 40k and The Old World.

Another very interesting point is where the margin improvement does not come from. Some investors have been pushing for increased online sales to increase margins (as GAW gets full price and doesn’t use the stores), which is fairly understandable. I am not on that camp, as I think community building is important and some trade partners6 play an important role there. Seems like GAW is not moving in that direction, with online product sales representing 14.6% of product sales, versus about 17% a year ago. When looking at these results, we have to take into account this is yet another headwind to margins. And, since retail sales percentage is also down slightly (24.9% to 24.4%), we have to take into account that product sold has grown more than the headline 11%, as the channel that is increasing its weight is the one were only about 50% of the price is reflected on revenue!

Before we move on, I have to say I was counting on some more information for FY25 to be mentioned in Games Workshop September trading update. Well, here is the trading update:

Given that the board has not disclosed their expectations, that tells us nothing. The absence of a dividend this time is a bit surprising, but also no explanation. I suspect it might be in preparation for major investments (some participation in the Amazon show? Factory 4? ANZ logistics require more money?), but it is just an educated guess.

Sales by region and exports

For the first time in many years, North America is not the main engine of growth for Games Workshop. And I think that is a lie. Or rather, an artifact.

North America grew below 10%, that is, below core sales growth. A big part of it is because USD lost value relative to GBP, so there are some currency headwinds. But those headwinds are also present in Europe, and growth actually accelerated there.

Also, growth in North America improved in H2, from only 6% in H1 to almost 10% in the full year (and, I estimate, around 13% in H27). So, what is happening there? First, I suspect that the supply situation has been improving for some months8. When I started tracking it, pretty much all games (40k aside, that has hovered around 20% for the entire period) were in a worse situation than they are now. That was already in H2, and extends into H1'25.

Out of stock is almost always lower in Europe, with the notable exception of the Horus Heresy game, that apparently can’t be kept in stock. There were some instances of 40k being in worse stock condition for short periods of time in May and June, but that is no longer the case.

My impression is that better supply and logistics in the US are enabling reacceleration (and the same should happen in ANZ9). Exports to the US also seem in a good trayectory so far this year, with Q3 already surpassing last year… without the September numbers in. On aggregate, exports to the US are 18% higher than they were in 2023 for the first 8 months.

I suspect that improving the supply situation in the US/ANZ, is yet another reason that drove the decision to pause releases mentioned earlier. Given the export numbers to the US, I still expect some relatively big releases that didn’t make it to the roadmap for some reason and are not army books (other than Kill Team, already announced), but we’ll see!

IP Progress!

Probably the most important bit, which is why I have left it for last. And yes, I am going to talk about Space Marine 2, but not only that. Space Marine 2 was the top seller in Steam for 13 days straight, losing the spot in the 14th. Only Palworld, Helldivers 2, Black Myth: Wukong and Elden Ring10 have managed to get Counter Strike out of the top position for more than a week in a row this year11. Other than Space Marine 2, that is. I estimate that they have already passed 3 million copies12 and I think they will pass 5 million before a year passes, given the success we are seeing. Clearly the best-selling Games Workshop related game so far13.

But that is not the only thing happening in the IP area. If we go back to the annual report, this year was a record in royalty revenue, with 31 million pound. Now, that is so-so, really. The increase came from recognition of guarantees of signed deals for the future (17.6 vs 8.1, for a total royalty revenue increase of 5.6 million). More deals for the future are good, of course, but the licensees making more money would be even better. But I think that is what will happen in the coming years, given the source of that small drop in current revenue form licenses (excluding guarantees).

The Warhammer: Total War series has been the main engine of royalty revenue for Games Workshop in the last few years, and it hit a big slump in FY24, as the DLC content didn't meet expectations. That was partially resolved by the end of April with the Thrones of Decay DLC release, and the game and DLCs have been selling better since, with only part of the improvement reflected in FY24. If the next DLCs keep doing well (and Creative Assembly, the studio behind it14, certainly is doing better with communication), revenue from this series should be higher in FY25 as well.

This is accompanied by a bunch of other relatively successful releases and DLCs (Rogue Trader, Boltgun). Revenue recognition for those is a bit wacky, as they probably don't contribute that much above the minimum guarantee, and so most of their revenue was already recognized years ago. But they do reveal the strength of the brand. A fun factoid comes form Simon Carless at GameDiscoveryCo. They do a classification of game hype, and Warhammer 40k is one of the tags with a higher median. There has been no outstanding success until SM215, but every game attracts a dedicated fanbase that pretty much guarantees surpassing 100k copies, even if it is a chess reskin (Regicide), a niche combat racing (Speed Freeks) or an updated Metal Slug (Shootas, Blood and Teef16), and a good shot at 500k copies if it is a decent, well-targetted game (Gladius or Boltgun were close to that number, even if they were far form outstanding successes). Warhammer Fantasy has also proven to be a good license, although it has not been as regular (Vermintide and Total War have done great, Man O'War: Corsairs not that much). Age of Sigmar is still to prove its mettle, sadly17.

Mobile has been the weak spot of Warhammer-related apps, but that also seems to be improving, with Tacticus gaining quite a bit of popularity of late. It is sadly the only one working out so far, with a smattering of other apps contributing essentially nothing. There are other mobile games in operation and in development, hopefully some of them can break through.

SM2's success comes at a very relevant point for Games Workshop though. As we all know by this point, the company and Amazon are in discussions about Warhammer 40k shows in the giant's streaming platform, with no known outcomes after almost 2 years and December as a deadline. A global success like this can be a decent incentive to sign the IP. Or not, you know, depends on many other things18.

In terms of royalties, I do expect FY25 to be the best one yet. TW:W3 has recovered in sales and players, SM2 seems to be the best 40k game yet, Rogue Trader has a promising DLC… and more things will come.

The future of the company

As much as I love listing Games Workshop-related minutiae, we can't go on forever! But in my view, what I have been mentioning paints a fantastic set-up for this company in the next couple of years, and I am more optimistic than I have been in a while regarding results and also stock potential, and I think this set-up is at least as good as September or October 2022. Back then it was simply because the stock was extremely cheap. Now it is for different reasons.

This year seems to confirm 22 & 23 were bad years for margins, not the norm, partly due to shipping costs and logistical issues, and also adjusting to the new scale of the business. But as I explained in a bit more detail in the podcast in Longriver, I think ‘21 was a year were they were overearning relative to their scale, and I don’t expect margins to be significantly higher than then. There are still some points until there though, and I think at the current scale we can see Games Workshop going there! If that happens, I suspect a re-rating will be in order, if it goes along with revenue growth. Games Workshop currently trades at about 24x PE, not very demanding for a business growing double digit and with close to 100% cash conversion (which means more than 3% dividend yield)

I think growth will accelerate, and the company seems to agree. They have hired far more people for production and logistics, mostly in H2, and unveiled plans for a new factory, so all points to them expecting increased demand. Whenever Games Workshop has been able to give unrestricted access to their products, sales have gone up, so I think some growth will come out of that alone. But I also think that we have new factors stimulating demand…

Warhammer 40,000 is be going mainstream. Space Marine 2 is selling better than I expected, and shaping up to be a large scale success. I think the Amazon deal will come through as well in the coming months. Even though conversion is very low, there should be some new collectors coming out of this which should help core growth… but I think the main effect of this is more interest by potential game and show developers, and also more sales of other licensed items (JoyToy action figures, plushes and, of course, other games19).

Now, not all is good. In the last couple of years, I am a bit worried by what seems lack of a strategy to grow both the business and the IP imprint. I have talked many times about how disappointed I am with how The Old World has been managed (coming out 2 years after the last Total War: Warhammer, with barely any new miniatures, and with a different set of characters that are not available in miniatures in many cases) so I am not going to have another go at it today.

Warhammer+ also doesn't seem to make any sense. It is not a cash grab, since it seems to be running at cost. It is not marketing, since the content is closed. I hope they don't aspire to make it a truly global service, because they don't have the IP for it, and also they are barely spending anything in content. The best attempts at explaining it I have heard so far is as part of a fidelization effort, as having more content the fans engage with drives more sales… but having that content in the open would fulfill that better, or at least that is how it looks to me. I truly don't understand the initiative at this point.

The strategy regarding boxed sets for smaller games also seems… erratic. Warhammer Quest had fairly decent success with Blackstone Fortress and Cursed City…. and then crickets.

And yet, they are growing at double digit and accelerating. If they ever figure out those areas, I don't know where they will go.

Net profit increase was only 12%, courtesy of a corporate tax increase in the UK from 19 to 25%. Ouch.

According to Games Workshop, at constant currency growth would have been almost 15%, and EBIT growth above 25%.

It is also better in terms of margin than any pre-2021

0.9 million pounds versus 2.9 last year in impairing of intangibles, haven't seen a full disclosure of costs. Seems like GAW is less intent on building a proprietary content library than on having a showcase of what can be achieved, or maybe that is wishful thinking! Also, Warhammer+ growth has slowed down a lot with only a 4% increase in the half.

Although British fintwit had already brought it to light before!

Local Friendly Games Stores, or LFGSs in the jargon.

It is impossible to estimate apples to apples, as in the half-year results GAW does not provide a full geographical revenue breakdown. It does provide a breakdown of retail, trade and online miniature sales, but not of online services. Trade sales grew 13.8% YoY in NA in H2 and that is the biggest segment, retail was softer, and online decreased, as everywhere else

As some of you know, I have been tracking out-of-stock percentage for a while. I have kept at it, even if I don't publish it on Twitter/X so often!

Although the new warehousing facility is not ready yet. There are also some IT issues in the US one which will be hopefully solved soon.

DLC release

PUBG managed to do it twice, but not in contiguous weeks.

And I think I am being fairly conservative, given that they passed 2 million a while ago and Gamalytics estimates the copies sold in Steam only at 1.9 million. Granted, that is almost all (say 90%) the copies sold for PC, but we still have consoles and other platforms.

Probably not yet, but it will be soon. I think at least Vermintide 2 and Warhammer: Total War 3 are still ahead in number of copies, as probably is the first Dawn of War. Not for long though! In terms of revenue generated, Warhammer: Total War 3 is probably still the king, thanks to DLC revenue. Especially if we take into account all the Total War 1 and 2 DLCs it sells.

Part of SEGA Europe. One of those weird situations in which I am interested as a Games Workshop shareholder, a Sega Sammy shareholder, a long-term Total War fan and a player with waaay too many hours in TW:W3.

Dawn of War was an outstanding success in my view but it was a different time, with much more piracy going around, lower prices, lower royalties… Regardless, that was 20 years ago.

Incidentally, it seems like it is always the Orks getting these tongue-in-cheek low-cost games.

To Frontier Developments’ chagrin

I don't think Amazon wanting to push DEI and Games Workshop or Cavil not liking it is the deal killer some people are pushing. The sources of the rumours are pretty hit and miss, and Games Workshop has been pretty inclined to add DEI stuff, as long as it doesn't break much

Space Marine, Dawn of War, Rogue Trader… all of them have been selling better since Space Marine 2 came out.

Congratulations on being a father!

Exciting times. All the best for the new family.

How probable do you think is it that the Amazon deal still falls apart as they cannot agree on IP?