Games Workshop's ever expanding catalog

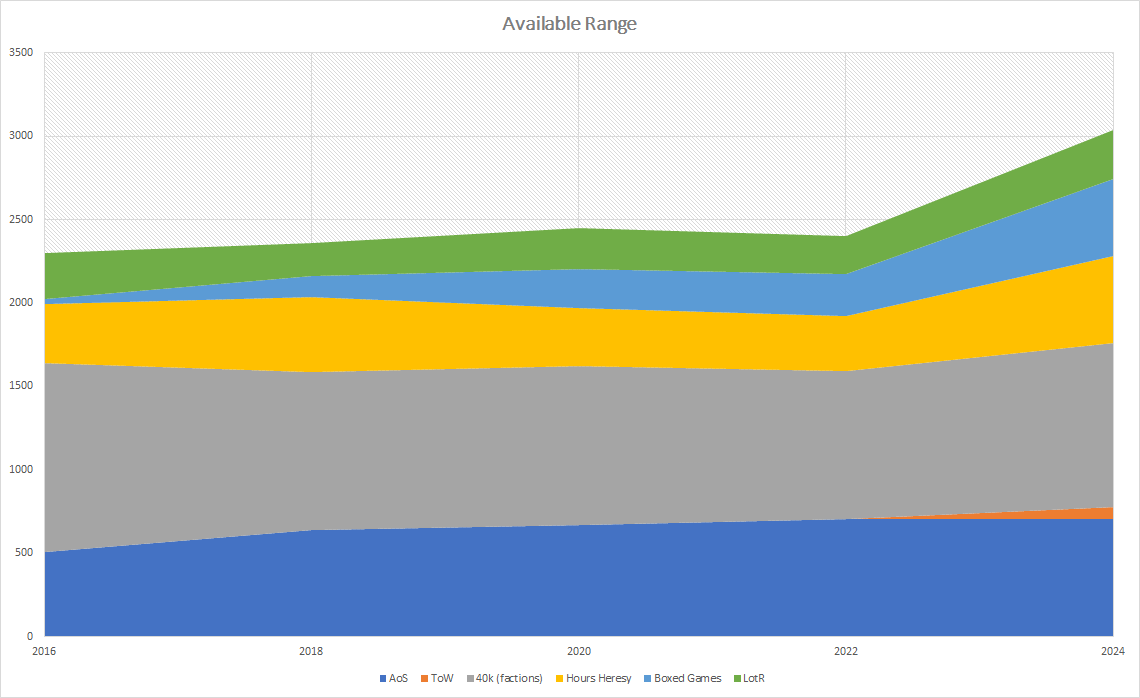

Let's have a look at how Games Workshop's catalog has evolved over the years, and the implications that might have.

One of the things that popped up in the conversation I had with Graham at Longriver about Games Workshop was the increasing complexity of Games Workshop's catalog. Later someone1 in a chat asked if there was any hard data on that and… well, here we are.

The results have been… well, surprising!

But first, I’ll share what I have done, so you understand it has gaps. Or rather, gaping holes. But it was still the best method I could find. I basically used the Internet Archive’s wayback machine to access GW’s store at different points in time, and then checked the number of references in the menu.

This seems straightforward, but is anything but2. The categorization of items has changed a lot, especially after the website redesign, and the archived versions don't actually have all the catalog, only the summaries with the number of items per category. That means de-duplications are off-the-table, and the choice of how to sum is… well, mine to do.

To try to keep some uniformity, I have kept it to 5 games (AoS, 40k, LotR, ToW, Horus Heresy) and tried to keep the same categories (basically adding up by faction inside of each of those).

Why is catalog complexity relevant?

Since its high watermark in 2021, Games Workshop has not been able to increase profits as fast as it used to because operating leverage has its limits. Not only that, but it has lost some margin, and its core gross margin (that is, without counting licenses royalties) dropped to 67% in 2023 (from 73% in 2021).

Fixed expenses have been growing in line with the size of the business, or even slightly less (revenue increased 27% from 2021 to 2023 while operating expenses increased 24%3). That by itself is remarkable, because it means GAW still retains some capacity to increase margins despite the change in scale. But the change in gross margin has eaten that up, and then some. At least until the last half-yearly results where, with a 69% margin, we see a recovery to historical numbers4. What we need to figure out now is if that was an accident (or something caused mostly by Leviathan) or something we can rely on a bit.

Leviathan definitely played a part, or at least that's what happened in 2021 with the previous 40k release. H1 gross margin was significantly higher (75%) than the rest of the year, because scale does that at times, if it is scale in the same production run.

And that's where I wanted to go. A bigger active catalog means each production run is a smaller percentage of sales, and that also increases overhead:

Changes in moulds

Different moulds and masters to be maintained and archived

Downtime to change between types of production

More difficulty on scheduling the runs (which increases exponentially, not linearly)

More complex logistics

And so forth and so on. That's why one of my core ideas is that an increased range of miniatures has reduced margin for Games Workshop. But enough rambling, let's check what has actually happened over the last few years

Games Workshop catalog evolution

Well… that's awkward, and not exactly what I expected. Yes, the range increases, but mostly thanks to other games (Necromunda, KT, Underworlds, Warcry, Blood Bowl…). The core range actually has some reduction from its peak (although AoS is mostly there). There are some explanations for it though, and that are compatible with the increased pace of releases of Games Workshop.

Models that used to be part of the line-up permanently are now only there from time to time, rotating. That used to be the case in Middle Earth miniatures only, but it now has been extended to AoS and 40k as well, starting only in 2022. This effectively means that a similar number now actually means a bigger catalog in terms of different types of runs.

In any case, whether it comes from specialist games or the core range, it seems clear that the catalog has been increasing. I don’t trust my method to be precise (not at all!), although I will try to keep a record going forward but it seems like the AoS range has been expanding (as expected) along with specialist games (again, as expected).

The reduction in 40k range surprises me, in all honesty. But I suspect it is in great measure due to rotation. The biggest drop is in 2022, when that was introduced, and then it goes up again. If it wasn’t because of that, I suspect it would be the biggest point in the series.

Add to that the made-to-order runs. They have always existed! But from 5 sets in 2019 we have moved to once or twice a month (2023 saw 12 different sets… some as big as the Battle for Macragge box)

Inventory situation

With all those new references, maintaining everything in stock is a challenge. Specially if, as I suspect, there is a bit more breadth than it used to. The reason I think that is the case is that before basically Space Marines sold, and the rest selled little by little, and was in a big part release-driven. While that is, I think, still the case, the sheer number of releases has to drive breadth between production runs.

But anyway, that is just a theory! Let’s go to the interesting stuff.

Games Workshop is having some troubles to keep things in stock.

Coda

Games Workshop has released the new The Old World Orcs & Goblins line-up. Funnily enough, most of it is in metal, while it seems the company can only keep in supply plastic models.

That aside, I was in another podcast! Hablemos de Inversiones, in Spanish, where we talked about Games Workshop, but also about Sega Sammy and PlayWay. If any of you wants to hear me ramble about stocks in my mother tongue, this is your chance!

Hi Pat!

Even after you get past that pesky language prompt

In the last half part of that was reverted, but let's see the whole year.

Games Workshop's margin has oscillated between 69-72% for most years in the last two decades. Record core margin was reached in 2011, with 77%.