PlayWay: One year later

PlayWay just published its H1 results. Its share price is down more than 30% in the last year, what about its business?

I have learned a lot about investing in video game companies in the last year. Two lessons stand above all: usually, holding a company immediately past a big release does not pan out. Two, don't invest in Polish video game companies. In PlayWay, sadly, I made both mistakes!

Jokes aside, '22 & '23 weren't PlayWay's best years in terms of financial results, and the stock multiple has contracted a lot as a result. I initially expected '23 to be better, but that is happening in '24 instead, with profits up 36.5% on the first half1 (and I also expect a good second half!). So far the stock is not reacting. Let's talk about their business performance and what we can expect from them.

Mixed reviews

Back in December, I outlined what I thought were the most promising titles PlayWay had to offer in the coming months. Some of them have come out since, let's have a look at them.

The first and most important is House Flipper 2… and contrary to other investors in PlayWay, I have mixed feelings about how this title has performed so far. It has been very profitable (costs were around PLN 10m, sales seem around 5 times that, which leaves a healthy profit even after the platform taxes, actual taxes and all that). At the same time, it has failed (so far) to generate a community as vibrant as the original game. At this point, both have basically the same number of players. Granted, with HF1 the number of players actually grew over time, and the first year was not far from these numbers, so if content additions go well, we might see the same phenomenon. Still, mixed feelings, I would have liked it to do slightly better numbers than the original in terms of CCU, not slightly worse. Still, I think it has more than enough room to generate revenue with DLCs and new content. So HF2, not a failure, but also not a home-run.

Then we have the two successes of the year! One expected (Infection Free Zone - around $8m in sales), one not so much (Crime Scene Cleaner - around $6m in sales). In both cases, a clear financial success. A bit less so for IFZ, which was relatively expensive to develop for PlayWay's standards (PNL 3.4 m2, CSC was less than half that).

And then, out of the ones listed, Robin Hood and Builders of Greece were released and did fairly poorly, very likely losing money, and there were a host of other games. Only Beer Factory, Trans-Siberian Railway and Car Manufacture Simulator had meaningful revenues, but budgets seemed to be really small for all of them3.

What also did well was additional content. CMS21 keeps selling well, although a bit less, Contraband Police sold almost as much in H1 2024 as in H1 2023, which saw its debut, and after H1 ended we saw the full release of UBOAT, which has been selling well too.

The future pipeline also looks decent, with 30 days on Ship appearing there plus Builders of Egypt, Holstin, or Honeycomb. That said, there are no longer extremely clear bets like House Flipper 2 or Infection Free Zone that are already in Steam wishlists, although I think when Car Mechanic Simulator 2025 is revealed (as is expected) it is likely to take that place.

One more thing: they seem to have been able to generate some money out of mobile with an interesting strategy. One of the subsidiaries (Digital Melody) has been releasing fast followers of PC simulation games that are successful, regardless of them coming from PlayWay or not. Examples include Supermarket Manager Simulator. According to Sensor Tower, they are generating about $100k in revenue a month between Apple and iOS now, with bigger peaks in previous months. Nothing revolutionary, but considering the cost of making these games, probably a decent contribution.

Overall, PlayWay has been doing what they do best. Produce cheap games, and have a relatively outsized success from time to time, while being extremely profitable. What they have not been able to do with either Thief Simulator 2 or House Flipper 2 is really build a property up with a sequel, the way they did with Car Mechanic Simulator4. It is a pity, because moving one franchise into relative big numbers territory would be enough to put the company in a different valuation realm. It would, however, require concentrated investments in a single title and that is not how PlayWay has operated so far. They did try with Hose Flipper 2, and it has largely been a success in financial terms, even with the qualifications made above. Would it have been a bigger success with a larger investment in creating content pre-release? I think so, but who knows.

The numbers

Now that we have gone over their releases, I want to have a look at the numbers of H1, although they don't cover things like the CSC release.

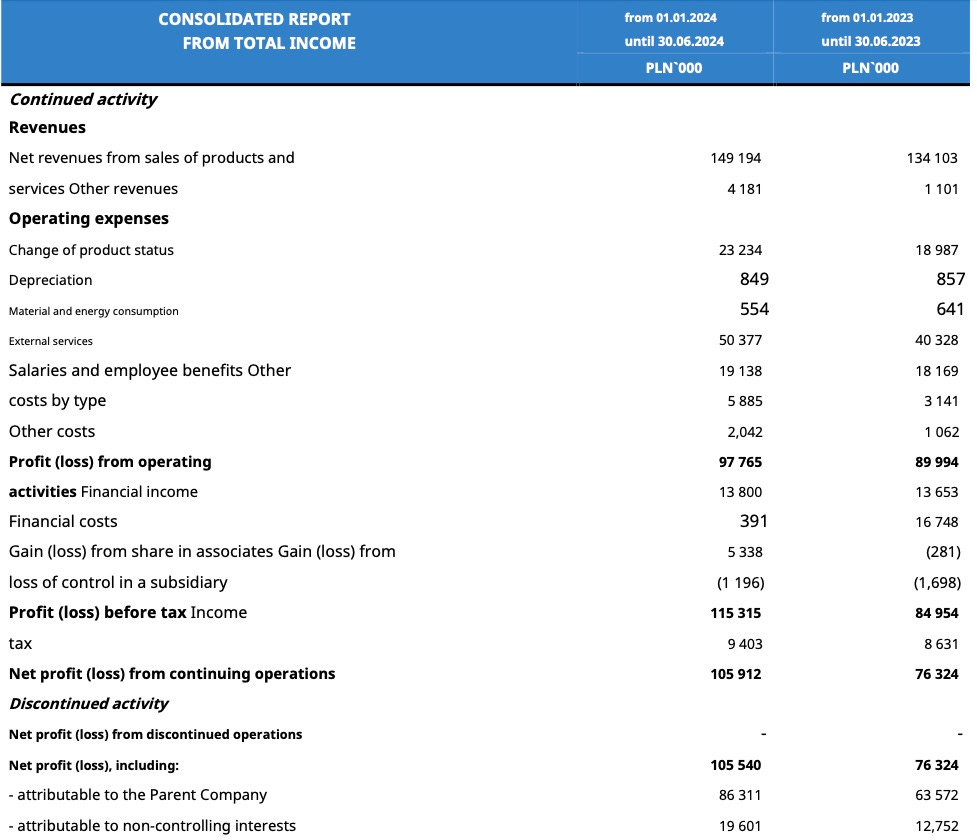

The long and short of it is that revenue has gone up 11%, operating profits 8.6% and total profit about 35% (both total and attributable to parent company shareholders). In terms of operating results, things are going well, especially considering that H1 only had one big success (Infection Free Zone, and then House Flipper 2, but the initial sales were made and accounted for in December).

Operationally speaking, we can expect H2 to have a bigger differential with last year's H2 even. PlayWay's Q3 2023 was their worst quarter in terms of profit since 2021 and driven by a lack of relevant releases and the publisher sale being moved to later in the year. This year we had the sale and also Crime Scene Cleaner's release5, so we should see the opposite picture. Q4 will be more difficult to beat in terms of revenues, but I think it will be there in terms of profitability, as the profitability was hurt by the full recognition of House Flipper 2's cost. If things go the way I expect, PlayWay should be close to 200 million PLN in operating profit (versus a current market cap of 1850, although a part of that belongs to minority shareholders in other entities).

But then, both the financial income and the income from associates have increased substantially. Financial income is not detailed in the report, and we will have to wait until the annual one for confirmation, but I guess a part of it might be due to the sale of stock in affiliates6, although I don't expect it is most of it. I might be wrong, but money received from those shares seems even slightly below the book value ascribed to the affiliates in December 2023, unless there is some receivable pending7. Given the relevant cash pile PlayWay had until the dividend was paid in July, I suspect a big part of this is interest on deposits8. Earnings from associates are a different matter. 2023 and 2022 were complicated for the gaming industry, and PlayWay associates reported losses. Now, they are back in the black, led by Games Operators after the IFZ launch9. Surprisingly, MeanAstronauts10 and Ritual Interactive11 is also reporting profits. Overall, that is something I expect to continue. In PlayWay's associates there were, and still are, many companies yet to start publishing. Some probably never will, others might not be successful, but so far the good has far outweighed the bad.

All in all, I think of the PLN 86 million of profit attributed to the shareholders of the company we can consider 75 to 80 as normal profits, pending seeing the full year disclosures. Cash conversion is ridiculously good, as usual, as are the dividends flowing to the main entity of the group from subsidiaries and associates.

Corporate changes

PlayWay has gotten rid of a few companies in the group this half, continuing with their streamlining of the group. Most of them were relatively small (3R, Polyslash12, Manydev, Forestlight), but after H1 closing there was one that was relatively big news: Big Cheese Studios, the developers of Cooking Simulator, one of the most successful franchises for PlayWay until recently.

Big Cheese had been a thorn in the side of PlayWay for a while. Huge delays in content for CS, CS2 still without clear progress and no other developments and internal drama that included a change in CEO, so I think it is a good sale. The buyer of Big Cheese is Silk Road, which has also bought from PlayWay the 25% stake they had in Silk Road itself (price is undisclosed, but carrying value is PLN 7.8 million)

Now, in financial terms this is likely to result in profits (they are selling 53% of Big Cheese for about PLN 30 million, and it was fully consolidated with about 20 million in net assets, with about half of it registered as attributed to minority interests, and I doubt the stake in Silk Road was sold for less than its carrying value, but we'll see), but also means losing some profits and revenue. In 2023, they had 10.9 million revenue and 1.9 million profit, albeit with Cooking Simulator in clear decline. Not all the CS-related revenue and profit will go away, as PlayWay co-publishes the title13, but part of it will.

But those are not the only news, the dispute with Titan Gamez has also been settled. The result is that PlayWay gets the rights to Viking City Builder outright in exchange for cancelling the outstanding debt Titan Gamez had with PlayWay (about 4 million PLN).

All in all, 4 companies that didn't quite work were sold without much of a loss, and two long-standing problems (Titan and Big Cheese) have been sorted out as well. This reduces the number of subsidiaries and associates of PlayWay further, leaving it in 41 subsidiaries and 27 associates. When I first wrote about PlayWay, it had 55 subsidiaries and 39 associates. After the explosion of new companies until 2022, the last couple of years have been two years of maturing and culling the parts of the group that didn't work, leaving a slightly cleaner (though still convoluted) structure.

Strategy and results going forward

So let's put all of this together and see what it means. PlayWay keeps executing along its general strategy. In the last few months, we are seeing that the writedowns in associates are probably at an end as a rule, given they are back to profitability as a whole. We are also seeing the main companies in the group execute relatively well, with decent growth and even a more decent foray into mobile (that represented less than 3% of revenue last year), along with a widening of the portfolio, with CMS + HF representing 43% of revenues this half despite the launch of HF2, while last year it was 52% in H1 and 49% for the full year, and 52% for the full of 2022. The share of revenues brought by franchises amounting to less than 5% revenue is now up to almost 40%.

I would say they have navigated well this period of stress for the gaming industry, and have actually managed to increase both revenue and profits. Last year revenue grew, but margins were compressed (due, partly, to HF2's release timing). This year operating margin is back to its typical 60%+ track, at least this half, and nothing makes me think H2 will be worse.

While they did that, they have been simplifying their group structure, which had become unwieldy, and solving some of the inevitable conflicts that pop up in a group composed of so many nearly autonomous units (even if each of them is tiny), which should allow better focus.

In terms of portfolio, the biggest opportunities that are coming up are the new edition of CMS, Holstin, Honeycomb, 30 days on ship and the city builders (Viking City Builder and Builders of Egypt). Due to their history, I think both city builders will most likely not be particularly big, but I am pretty hopeful with the other four, although I only expect major numbers for CMS. That aside, there is always a stream of lower-budget titles that are profitable, Recycling Center Simulator being the last example. The cost was covered at around 4k units sold, and it surpassed 15k in the first 72 hours.

Equally important, though, is the stream of content for the existing portfolio of games. Upcoming DLCs for HF 1 & 2 are relevant, but also the full release of IFZ (currently in Early Access), DLCs for Uboat (with new types of submarines) and maybe for Crime Scene Cleaner (free updates are on the way, let's see if DLCs join the fray at some point). All seem to be marching well.

Progress in mobile is also nice to see, especially seeing the capability to iterate and launch fast to see if something hits.

Governance and capital allocation

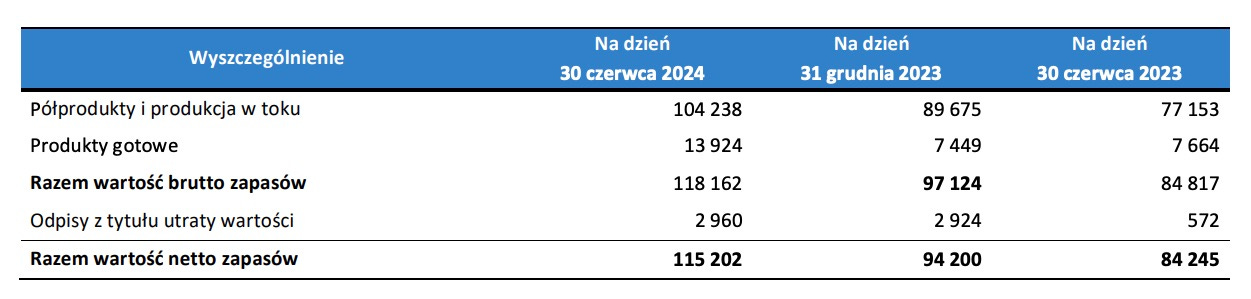

PlayWay's capital allocation is simple and has always been. Invest as much as you need to increase your capacity to publish cheap games and not a dollar more, all extra cash generated is distributed as dividends. The best way to keep track of how much their investment levels are going up is the inventory account in the balance sheet, and currently, it is at its historical maximum, at 115 million PLN, compared to 69 at the end of 2022 or 94 at the end of 2023. Contrary to most videogame developers, PlayWay capitalizes their development as WIP inventory and then subtracts it in full against revenue as soon as a game is released. Only 14 million PLN are of finished products, and that is before impairments, which have remained stable.

It is not the only metric in terms of investment (investments in new associates and loans to them are also relevant) but it is by far the most important. And despite the large dividends, they have been able to increase it at a good pace, probably difficult to increase it more without hurting returns. In my opinion, the policy is optimal.

But what about buybacks, some of you will say… well, buybacks don't make sense for PlayWay, in my opinion, given that PlayWay only has about 18% free float. 40.91% belongs to Krzysztof Kostowski, the CEO and founder. An additional 40.91% belongs to ACRX Investments, which as far as I can tell is a tiny Cyprus-based investment company with no other known public holdings and that supposedly works in the sports media rights space.

Now, those percentages could have changed earlier this year, although not in a huge way, as Krzysztof was set to receive an additional 1% of the company (as newly issued shares) as a performance bonus… but that didn't happen in the end. See, in 2023 the company established a performance bonus based on the consolidated operating profit… but that didn't go well, with operating profit in 2023 being slightly worse than in 2022. So in June of this year, that was changed to target the net profit as calculated in the individual statements, not the consolidated ones, which were actually better. That way, Krzysztof was retroactively granted the performance bonus. That was not a good look and generated quite a few protests online, so eventually the CEO renounced the bonus.

In my view, all that was a bit weird. Krzysztof would have been entitled to the bonus in 2024, as it was valid until FY 2025, with almost complete certainty, without changing the conditions. Now the company has a worse image governance-wise, and the CEO will get the bonus at the same time as he would have with the original wording. That is, unless individually calculated net profit goes down in 2024, which incidentally is what happened in H1 and can happen if a bigger portion of the profits falls in subsidiaries. It would be sad because I honestly believe he deserves the award, even if the way they have tried to accelerate it (with no votes against it in the shareholder meeting, I must add) was less than ideal.

Wrap-up

All in all, I think we currently have a moderate grower with net cash at a very compelling valuation.

Market cap: 1850 million PLN

Net cash: Around 10% of the market cap after July's dividend, taking into account the company sales mentioned before

Growing at high single-digits/low double-digits

P/E for this year around 12-14x, if expectations for H2 are not too far off

Cash conversion of pretty much 100%, as seen in the dividends they are able to pay while still accumulating cash and investing in a healthy way.

The only doubt is if they can continue to grow and what is the maximum size a company doing this type of game can reach. Since they seem to be trying their hand with some slightly higher budget games (HF2 is, I think, proof of that, as CMS25 will be) and they are still able to increase revenue from the smaller ones, they don't seem to be the slightest bit market-constrained.

So I am still long PlayWay, and intend to remain so, despite the loss14 so far, let's see how it goes!

Profits attributed to parent company shareholders. Operational profits are up way less (about 9%), but this year they are not weighed down by financial losses. I think there might be some in H2.

Still below $ 1 million, and one of the most expensive games the PlayWay group has developed

For Beer Factory it was $75k, for example.

Just to clarify… House Flipper is a bigger franchise than CMS. But House Flipper 2 has failed to increment the sales and player base as successive CMS iterations have.

And Uboat came out of early access, and a ton of other stuff.

There were several corporate operations, I will discuss them a bit later!

Total value in the balance sheet of the associates sold was PLN 8.6 million, and PlayWay has received 5.6 for sale of shares in associates

Interest rates in Poland are at 5.75 at the moment. PlayWay started the period with more than 240 million PLN in cash and short-term deposits and closed with more than 300, and part of those deposits where signed in 2023, when rates were at 6.75% for the best part of the year.

Games Operators share price evolution after the publishing of IFZ is pretty sad, but also understandable. Sure, they are going to earn 25%+ of their current market cap with that game, but no other title seems to be picking up, at least in anything close to similar to that scale.

Robin Hood: Sherwood Builders’ developers. It could be one of those cases where the publisher (in this case PlayWay) paid for milestones and it is taking the losses, though.

Developers and co-publishers of SWAT, still to be released. From what I have seen in intra-group payments, they played some role in Contraband Police, which has enabled them fo finally earn some money. They do owe quite a bit of money to PlayWay as well.

After Tribe's flop, it was that or injecting resources. A similar tale as Atomic Jelly, although there PlayWay has injected some money through a couple small loans.

Titles, including Cooking simulator VR, where BigCheese is a publisher along with PlayWay, but the developer is Gameboom VR, another PlayWay group company.

The loss is a bit less than the headline number, as they have paid 41 PLN per share since the initial article was published, limiting the actual loss to around 24%.