A random walk through the Polish videogame sector (part 2)

Let's continue our walk and visit Bloober Team, PCF Group, CI Games, Creepy Jar and Artifex Mundi)

Today we are going to continue our exploration of the Polish gaming sector that started last week. Just as a reminder, you have it here!

After going through our five guest companies, I will also talk about another thing: This blog! I sent a survey last week (thank you for taking the time!), so let's discuss results and the next articles that you will see here!

Before that, I want to ask you one favor: Share this article (and others) if you like the blog! Whether it is on socials or through e-mail, it is hard to make some noise these days. Thanks for the help!

And now, without further ado, let's start with…

Bloober Team

The horror specialists!

Valuation

Market cap of 449m PLN with 66% free float (approx). Tencent owns 20%.

32.3 TTM PE. In this case, talking about earnings CAGR is not very useful, as the earnings are extremely volatile. Their record year was 2021, and I think they will surpass that slightly this year, depending on the Silent Hill 2 remake terms.

4.3 P/S with 49% 5-year revenue CAGR and 9.8% 2-year revenue CAGR

Has not produced any FCF in the last 2 years or LTM1

There was a 2.5 million PLN net share repurchase in 2021, but nothing in dividends or repurchases since.

Net cash of about 15 million PLN

Strategy and present

First thing that comes to mind when you see this numbers should be… why on Earth do they trade this high? Second will probably be… wait, those margins are too low. And they are very related.

Most other companies we have been talking about earn most of their revenue from selling their games, but not Bloober, at least not for now. In 2023 they obtained about 80% of their revenues from publisher payments, with the other 20% coming from their catalog sales. Not only that, but a big portion of that revenue is redirected to third parties with which they subcontract.

Publishers typically pay by milestones, and there is not much profit margin until the game goes out (if it is a success, publishers typically recoup their costs before they start sharing revenue). Bloober has been able to milk some more profitability out of those revenues, at least according to their PNL2, but they have used pretty much all the money (and then some) to grow.

Now, will those margins change? Bloober just released the Silent Hill 2 remake, developed by them for Konami. In the last few years, about half their revenue has come from Asia, and it is very likely that the vast majority of it belonged to this contract3. Based on the revenue received from Asia in 2022, 2023 and H1 2024, I think likely that Bloober has already received more than 20 million $ in payments for Silent Hill 24. Although the game has been a success and has surpassed 1 million copies5, Horror is a niche segment and if they have already received that much, revenue share is probably not going to be huge. Much smaller than the current payments, for sure.

So what will happen with Bloober's revenue? Most likely it will go down, unless some of the other projects they have with editors picks up quickly. Since the most advanced one they had fell through and now they are self-publishing6, they won't see revenue until release, and actually will have to do a lump sum payment to Take Two on release to reimburse them for expenses already incurred in the game. The game is set to release at some point in 2025.

So results in 2025 (and H2 2024, although that depends a bit on the final milestones from Silent Hill) will probably see revenue down quite strongly (fewer milestones from Konami and none from Take Two partially compensated by revenue share from SH2, and maybe milestones from other projects), unless Cronos is a decent success. At the same time, Bloober needs to continue paying the third party studios with which they have publishing agreements of their own, and their own team. My impression is that the next 18 months of results are not going to look particularly well.

Where is Bloober going?

What will happen afterwards is the question. Because Bloober is not generating cash, but is generating a reputation, and they have several games ongoing internally (Cronos being the next one) and externally (not yet revealed, except under codenames). I am sure that the good reviews and sales from Silent Hill 2 will help them sell their future projects (and maybe even secure new agreements with publishers).

But at the same time, they have a lot of things to fund, only one release planned for 2025 without a lot of hype as of now and more limited sources of revenue, which means they will most likely have to take on debt.

Bloober is a very small company as of now. But they have used the revenue under the publishing agreements to grow aggressively. And with Layers of Fear (2023, not the original ones) underperforming, their best hope to compensate for their overextension was SH2 massively outperforming. And it has, but not as much as I think they need.

Is it investable?

In my view, no. Bloober is a good studio, and they have improved their reputation massively. But the breakdown of the deal with Take-Two for Cronos introduces enough funding risk for an already over-extended company7 that I wouldn't like to put my money here. Maybe I'm wrong and the SH2 revenue share is bigger than I expect because part of those payments that I think come from SH2 milestones are actually from other projects. But I am not going to risk it now!

That said, I don't think this is a company in immediate existential risk. Others can't say the same.

PCF Group

People Can Fly is a nice name for a gaming company. The company has not been flying as much as dropping like a stone.

Valuation

Market cap of 342m PLN with 31% free float (approx).

Loss-making last year, and TTM. In 2023 they lost 75 million PLN (mostly due to writedowns). In H1, 33.

2 P/S with 16% 5-year revenue CAGR and -8% 2-year revenue CAGR

Has not produced any FCF in the last 2 years or LTM and burned through 74 million last half

They have needed to raise 360 million PLN in the last 3 years. The reason why they paid 15 million PLN in dividends in the period eludes me.

Net cash of about 60 million PLN

Strategy and present

PCF is a very typical tale in the industry, although it doesn't typically happen as a public company. The company has a few successes, they think they are on top of the world and go into more projects than they can manage (or finance). Then some fall through (like the agreement for Take-Two to publish one of their projects fell through in 2022, only to be fully discontinued a few months ago), some underperform (2021's Outriders, were the recoup for the publisher, Square Enix, was never fully covered) after exceeding what the publisher covered and the studio is left holding the bag.

Right now PCF is dealing with the aftermath of one of these periods, and there is not that much to say about their present. More than 90% of their revenue comes from publisher deals, but contrary to the approach in Bloober, they spend a lot more than that on the games.

Where is PCF going?

PCF burns 70+ million a half, and they have on hand about 83, of which about 60 are net cash. Which means they probably don't have a lot of runway despite the recent cancellation. They would need some release relatively fast, but their aim (high quality games with AAA publishers) does not match that well with that need. They have invested heavily (200 million PLN in intangibles in the balance sheet) in games in development, but they only have one project (codenamed Bison) slated for release in 2025, while the rest will have to wait until 2026+. And Bison seems to be one of the relatively smaller self-published projects, being a VR project. Prior VR projects include the VR version of Green Hell and Bulletstorm, not exactly best-sellers.

So it seems clear PCF is going toward another capital raise. Afterward… who knows. They seem to have the ability to produce decent games, but not in a budget adequate to their potential. Will be keeping an eye on future announcements in case something with potential shows up… but after they get money to get some more runway.

Is it investable?

No, in my view. They need to raise more and cut expenses to be able to get out their exiting projects, and I am not confident they will offer a return, given the lack of IP in the studio to exploit.

CI Games

Once the pre-release hype for Lords of the Fallen (2023) went past, CI Games has suffered in the markets. Let's see how they have fared business-wise.

Valuation

Market cap of 273m PLN with 51% free float (approx)8.

14.7 TTM PE. Again, talking about earnings CAGR is not very useful, as the earnings are extremely volatile. Their record year was 2021, and 2023 was also good, matching the releases of Sniper Ghost and LotF games, while other years have been much lighter. But they don't make a loss since 2019

0.97 P/S with 61.9% 5-year revenue CAGR and 52.7% 2-year revenue CAGR, greatly affected by the last year coinciding with LotF release, H2 2024 should be softer.

Has not produced any FCF in the last 2 years or LTM. They report profits because they capitalize a lot (80+ million a year)

They haven't issued stock since 2020. It's something, I guess!

Net debt of about 33 million PLN

Strategy and present

CI Games has managed to grow their sales very well, but has invested heavily in growth. It is a somewhat similar story to the two ones before, where the company had successes and launched into a big expansion that is now having a bit of trouble funding. In appearance, it is a bit more similar to Bloober in that they probably don't face existential risks, as they burned about 10 million PLN last year, and they were able to produce FCF pre-2022. But the cover of a book can deceive you.

They have been investing heavily in games and they have 160 million PLN in the balance sheet, of which 75 belong to already developed games (which is a bit aggressive for my liking, but still, they generated almost 60 million in sales last half from them.

Still, these are their plans for future launches

Nothing for 20259, except small published games. The last iteration of LotF probably damaged their reputation, as it got bad ratings (63.6% positive in Steam) and sold less than the prior iteration. Are more iterations by the same studio going to fix it? I don't know.

And they don't seem to have much else in reserve until 2027, and are already loaded with debt and burning cash.

Where is CI Games going?

Seems likely that they are going to raise capital again. They have an agreement with Epic to publish the new LotF, which has been touted as a major investment, but the terms are not known. Might be enough to keep a raise at bay, but I find it unlikely. Plus, if it becomes an epic exclusive, this comes from sales they will lose from not being in Steam.

Then again, toward 2026 it might be interesting if LotF picks up hype and they have already raised, or toward 2027, with the new Sniper Ghost release. But they are going to have an acute decline in revenues in H2 and in 2025, and still have to support the development costs of the projects they have.

Is it investable?

Go read what I said of PCF. Pretty much the same. So no.

Creepy Jar

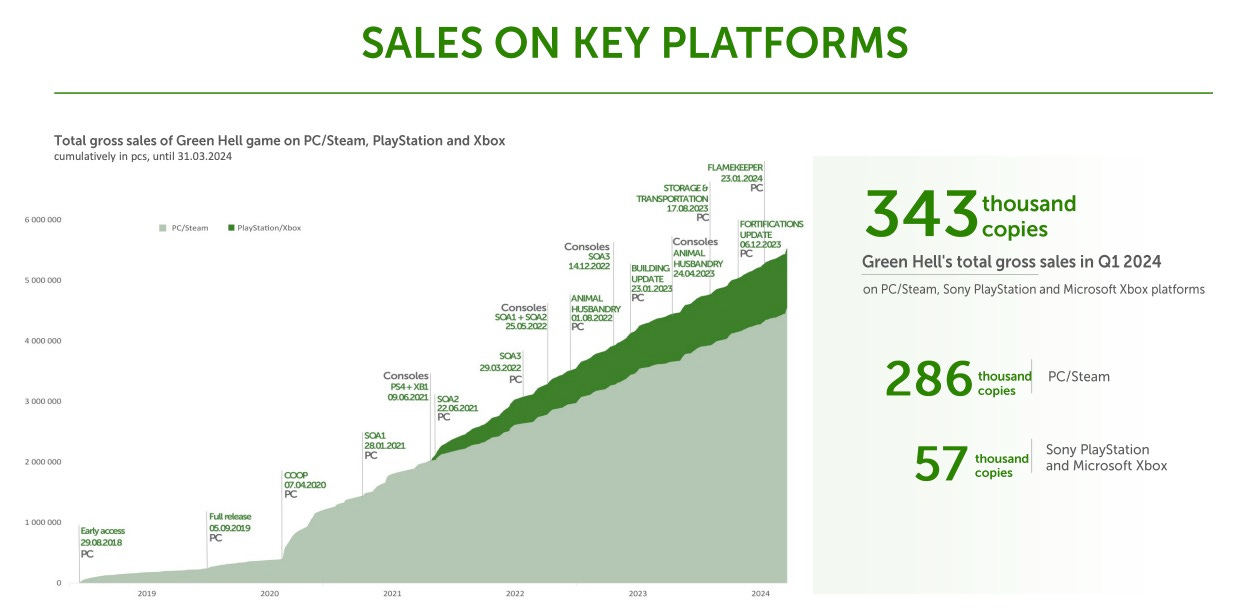

Green Hell creators Creepy Jar are a rare company. They self-publish as indies. They focus on a project at a time. They don't have a subpar publishing brand. They have used the Green Hell money to focus on StarRupture while milking it with good patches, content, and a related VR game. Let's look under the hood.

Valuation

Market cap of 205 PLN with either 68% free float or 47% free float, depending on if you count two funds that have big chunks of the capital… but for them it is a relatively small part of the portfolio.

18.8 TTM PE with 47.9% 5-year earnings CAGR and -20.6% 2-year earnings CAGR

6.3 P/S with 51.7% 5-year revenue CAGR and -9.8% 2-year revenue CAGR

20 x TTM FCF or whereabouts with 111 million PLN generated cumulatively in the last 5 full FY (vs 106 million in earnings)

They have distributed 42.5 million in dividends in that same period (and a bit extra in the current FY)

Net cash of about 75 million PLN

Strategy and present

Creepy Jar is very atypical among the companies we are seeing in the sector. No mad dash for expansion. Nothing of the sort. They had a successful launch back in 2020 (well, early access in 2019) with Green Hell, and have been able, through content expansions and well managed promotions, to keep decent revenues for 4 years. And since they have not done a mad expansion, they have kept profiting handsomely, keeping margins almost as good as PlayWay's.

They have been able to do this following a strategy of periodical free content updates for Green Hell (20 as of Q1) and doing great in terms of promoting it. Seriously, this sales curve is extremely uncommon in games, perhaps similar only to the most popular Paradox games as they get content.

So obviously, I admire them. Their next game will be StarRupture, of which we know it will be a futuristic base building game, but not much else. Not even a release date.

Where is Creepy Jar going?

Creepy Jar has managed to stay profitable every single year since the early access of their first and only game, and they have managed to keep a small size and build a really decent image.

Even if StarRupture was to be a failure (and there is not a lot of hype around it given the lack of info and a release date, so it is possible) they can probably still get some more FCF out of Green Hell, and they have enough of a reserve to last 2-3 years at their current clip of expenses, although their glacial speed of release would mean problems anyway (StarRupture is in development since 2019, reportedly).

Is it investable?

I think so. There is no guarantee of success for StarRupture and no date yet. That said, they recently revealed a gameplay trailer, so I would be surprised if we don't have a date soon (ish). And they have proven to be pretty careful stewards of capital and the studio, and have almost half the market cap in cash (and still generating).

If StarRupture fails absolutely terribly, it will drop, but it has the backstop of Green Hell cash generation and the cash on hand. If it does ok, they will be just fine, and if it blows up, this will multiply.

For me, the clear surprise of this set (I have to confess I had not looked at it before the article!). I don't have a position at the time of writing this, but I might build one.

Artifex Mundi

Valuation

Market cap of 164 PLN with 59% free float.

6.7 TTM PE with 38% 2-year earnings CAGR (5 years ago they were losing money)

1.61 P/S with 32.6% 5-year revenue CAGR and 45.28% 2-year revenue CAGR

20.5 x TTM FCF with 20.45 million PLN generated cumulatively in the last 5 full FY (vs 44 million in earnings)

Not much history of capital allocation, but they are repurchasing shares currently. There has been recent activity from insiders, with some purchasing shares, and others selling, with the overall result being an increase of insider ownership.

Net cash of about 20 million PLN

Strategy and present

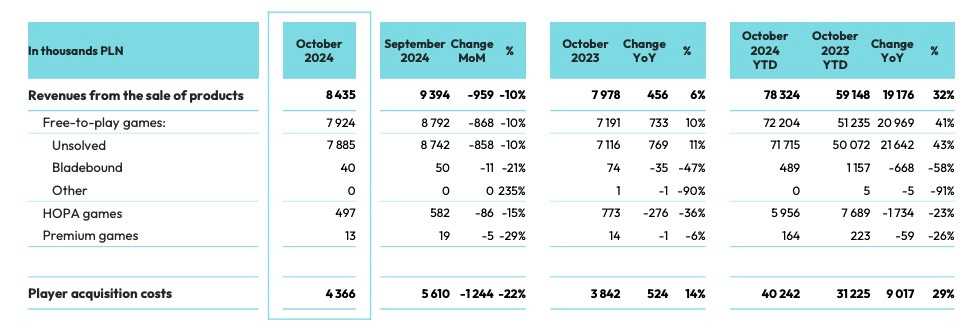

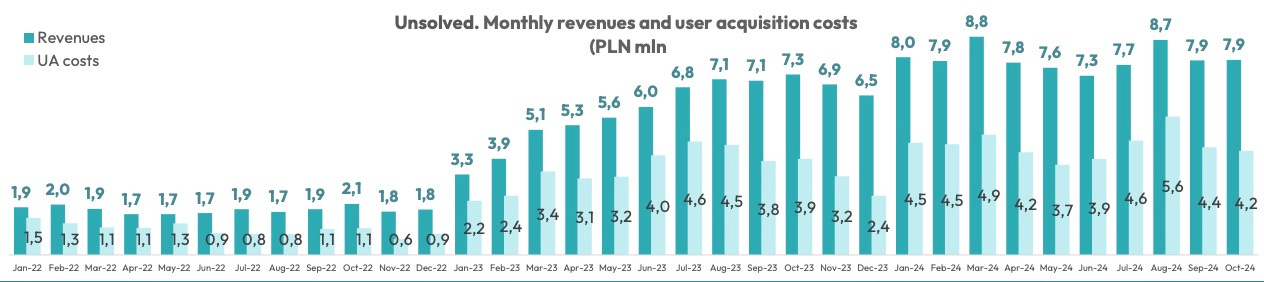

Artifex Mundi is a developer of small games. Don't expect great releases or anything like that. They do puzzle games (well, hidden object games) and small RPGs, mainly for mobile (but also for Switch and some make it to PC). Their main source of revenue is Unsolved, and they have been updating and promoting that game since 2019, with good results.

What happened in 2023 for the game to gain so much traction? Well, one obvious answer is increased investment. But the more full answer is that they started a big push of content to the mobile version10 then, and took the opportunity to increase marketing spend… and it worked. 2024 has been really good, but growth seems to be stalling.

All their other games are losing revenue though. They have a new RPG in development with relatively high budget for them (22 million capitalized as of Q1) and several other projects ongoing (which they capitalise, so the poor cash conversion is probably just accounting profit being overstated)

Where is Artifex Mundi going?

To release and pray, when the big RPG project is ready. Unsolved has clearly stalled, and the other games are not working out excessively well (they do earn money, just not much), and are in decline. So to improve their current level of profitability (overstated, I would go with FCF in this case) they need new releases not far into the future. Since they haven't disclosed much about the new RPG, I don't have any idea how it will go. But if we have to go by Bladebound's performance, I don't expect much.

It seems like the plan continues to be exploiting Unsolved to death (understandable) while they develop new property, with the RPG as their big bet.

Is it investable?

Maybe, but it looks relatively fully valued to me. If the RPG does well it is fantastic, but they have a good franchise with stalled growth and undisclosed projects in development… the biggest of which is a “big" RPG, an area where they haven't found success before. Not for me, but it is also nothing where I can say it is an absolutely clear pass, thanks to the monetization of Unsolvable (and the HOPA web games, to a smaller extent)

And well, that is all on Polish gaming company on my end. I hope you liked it, and please subscribe if you did!

From here onwards, it is just housekeeping!

What is going on in Dungeon Investing?

Let's talk about the survey (thanks again for answering!), the results that came out and what you can expect form this substack in the coming weeks. First, don't worry, I am not paywalling this for now (and in the event it comes, I will mention it with time to spare). Just wanted to understand what you wanted. So let's go over the questions

As you can see, the options were almost tied… so I will start with Square Enix, and probably will follow with the Anime sector guide. These things take a lot of time, so there will be other, lighter things in between. I also had some suggestions (deep dive of Nintendo, the board games industry, articles on how to value a company11). One suggestion (SEGA) surprised me a bit given we have this (which is maybe the best one I have written in my opinion, along with Cover Corp's). Maybe it was about an update but friend, if you had missed this one… I really hope you enjoy it!

I sort of knew no one wanted to read me waxing poetic about Hornby PLC (not saying it is a good investment!), but it surprised me to see the proportion interested in tabletop. I might have to think about Asmodee and how the Kickstarter market has evolved. But there are not that many companies12.

Unless you want me to write about Hasbro. Which may happen eventually, but I want to get out of the way the ones I mentioned above first!

I will probably write more about anime and manga (and adjacent areas) than most respondents seem to want. I just think there is quite a bit of value in there (and Sony seems to think that too, I don't think they want Kadokawa because of From Software). Apologies in advance, and I will try not to have other topics in between, but fair warning in case you don't like the topic!

There were a few “Games Workshop" in the suggestion box. I have noticed there is a spike in visits whenever I cover it, I love the company and it is a relevant part of my portfolio. I probably will only do updates like I do now, and not another in-depth piece (already did one back in 2018, and a very good one came out in Edge recently). That said, I will continue to cover the company and the changes it happens to go through!

Here almost everyone is in agreement. You want more company deep dives. They are fun to write, so nothing against it! But they do take a lot of time, so expect them to have other things in between (shorter articles with news and result updates, mostly). I will probably not invest that much time in market guides though, seeing the preferences (as they are equally time consuming). Thank for the insight!

And last but not least, thank you all for all the positive comments! It was really, really nice to read both the positive comments and the suggestions. If you want to chat about an idea (of the ones that you sent there or others), you can reach out:

Through DMs in Substack

Through DMs in X/Twitter

Through DMs in Bluesky

Through e-mail at trampasalpokerblog@gmail.com (legacy of my olden days as a blogger in Spanish)

Thanks a lot for the responses, and thanks for reading!

Some would argue a lot of the investment in new games is growth CAPEX so it shouldn't be counted… I disagree. It is not exactly paired with generation of revenue, but most of the time you need this "investment” to keep the company running.

The intangibles balance is substantial nowadays. How much did they book for games that editors funded and that are subject to recoup? How much will they recover? We'll see.

No more projects in Asia disclosed, 80% sales to publishers and the games in their back catalog sell more in Europe/USA.

97 million PLN received from Asia in the period (24 million $), with an allowance for back catalog sales.

Well… shipments. It is a bit of a trick most publishers use to claim reaching 1 million copies well ahead of when they actually do reach it. Pretty confident Silent Hill 2 has surpassed it though.

And thankfully they didn't open the LA and Warsaw offices they were projecting.

I am counting Active Ownership Capital as an active partner despite it being a financial investor, since they have 20%… but it is 2% of their portfolio, so not entirely sure.

Yes, they did release Beyond Galaxyland, which sold nothing. And Tails of Iron II doesn't look like it will move the needle either.

It is a compilation of already existing games that was then expanded.

Might do one for videogame companies, since there are many different ways to capitalise development and amortise it, and I usually don't want to explain how I normalise or the characteristics of the company I am checking on in the article, to avoid breaking the flow.

CMON these days is not worth writing about. The negative perspective I had back in the day was fulfilled, and then some.