A random walk through the Polish videogame sector (part 1)

The Polish stock market boasts dozens of videogame companies. While they have not done well as a group in the last couple of years, is there anything salvageable there?

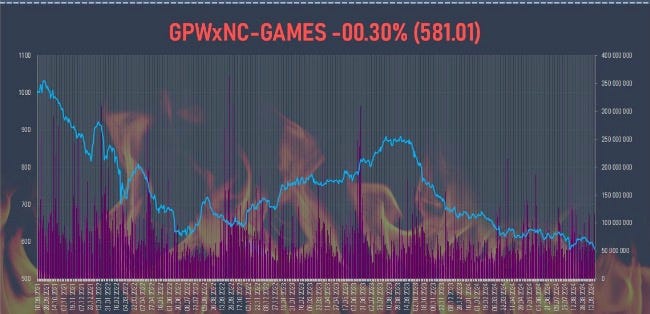

I recently joked that one of my mistakes in the PlayWay analysis was buying a polish video game company. It was only a half joke really. WIG-gry is a sectorial index made up of all the gaming companies that trade in the GPW. Since its heyday in August 2020, it has declined by more than 60%.

The fact that it is essentially a CD Projekt Red tracker (80% of the index currently) is pretty obvious in those numbers. But it is not the only component of the basket, and not the only component that has gone down. Zofia Gambetti has been tracking the sector performance for a while with less lopsided basket and well… results are also pretty terrible. So much so that she ended tracking back in September.

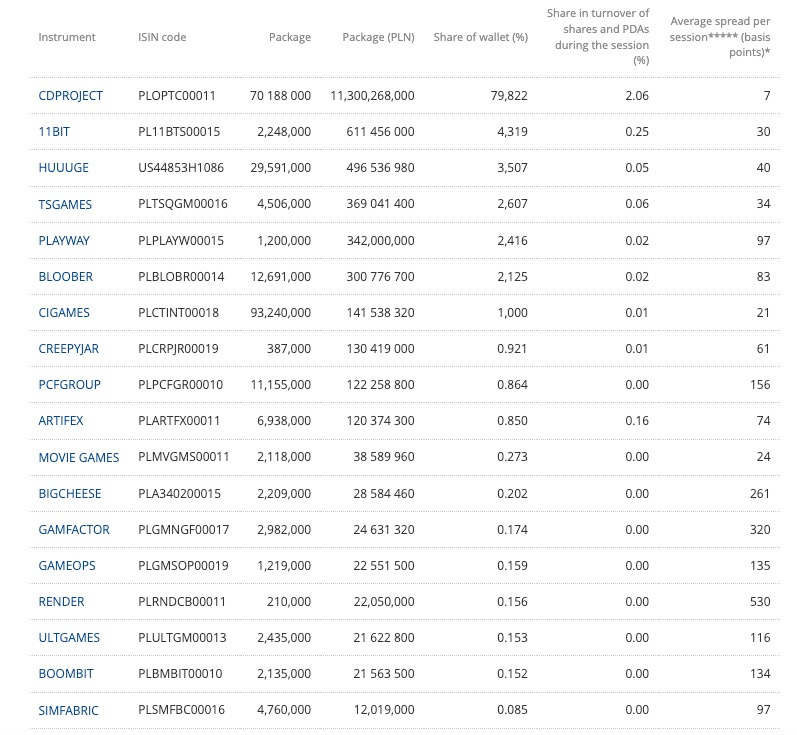

As any value investor would tell you, this is the right time to get involved and buy everything there! Or at least, have a look to see if anyone can recover. Let's start with the WIG-gry composition, to see if it can act as a guide. These are the biggest holdings

If you know anything about the sector, you might wonder why on Earth 11Bit, Huuuge and Ten Square are ahead of PlayWay in weight, while its market cap is way bigger. Well, PlayWay has owners, and only 18% of the shares are free float. Not the case for almost everyone else on this list! Let's have a look one by one to see if it is interesting. But, what questions will we be asking each of these companies?

First, basic numbers, looking at the recent past. What is the valuation, are they growing?

Second, the present, how do they work? Maybe they create major IPs, maybe they create AA games, maybe they do very cheap games and just see what sticks to the wall… Just so you know, I think SuperJoost is right with his content-distribution pendulum (go read it!), and what that means right now is that only content that is either of incredible quality, caters to a very specific and well defined audience or has production cost advantages is well positioned, and that is the framework I will be using.

Third, the future. Any major known changes or releases coming up?

Let's get to it and go through 10 of these companies. Today I’ll go through the first five (CD Projekt, PlayWay, Huuuge, 11 Bit, Ten Square) and we will look at the other five (Bloober Team, PCF Group, CI Games, Creepy Jar and Artifex Mundi) in a second.

CD Projekt Red

Of The Witcher and Cyberpunk fame, it is arguably one of the most written-about Polish companies, up there with Dino Polska, Allegro, InPost… although there used to be far more written about it when it was doing new ATHs non-stop in 2018-2020, before Cyberpunk 2077's release. That said, there are long form analysis out there, like this one by @ValueInvesting1 that go much deeper than I will here.

Valuation

Market cap of 16B PLN with 70% free float (approx)

28.5 TTM PE with 34.5% 5-year earnings CAGR and 52% 2-year earnings CAGR

12.1 P/S with 18.7% 5-year revenue CAGR and 17.7% 2-year revenue CAGR

48 P/FCF with 1.7B PLN generated cumulatively in the last 5 full FY (vs 2.4B in earnings)

0.8B PLN paid as dividends in the last 5 years, 0.3B PLN dedicated to buybacks in the last 5 years

Net cash of about 1.2B PLN (considering all bond investments, including the ones classified as non-current assets)

What this tells is first that the firm has shown significant operating leverage and has fantastic margins (look at that P/S vs PE). Their LTM 42% net income margin is incredible. But part of the story is lost here. Their best year was 2020, where they did about double the money than in the last twelve months (their second best year). Not only that, but 2015 and 2016 were much better than the following ones, and indeed better than 2021. So this is as lumpy as it gets, and 5 years ago it was a particularly low time for the company. Always profitable though!

Another thing that we can see is that cash conversion is not terrible, with 70% of earnings going to FCF (including all investments needed for growth). But still, in the last 5 years it has generated only 10% of the market cap in cash (most of it returned through buybacks and dividends, no M&A spree here). Cash conversion has been a bit less good in the last few years as the investment in new projects surpassed amortization. Someone could argue that's growth CAPEX but I am not that person.

The long and short of it is this: As an investor, I need CD Projekt to grow meaningfully while demonstrating continued operating leverage (or at least not lose margin). So far, it has operated in a sort of step function. The Witcher 3 was a relevant step, then revenue/profits declined steadily until Cyberpunk 2077 was released 5 years later. The release was bumpy, but the release of the Phantom Liberty DLC in Q3 2023 solved most of the problems. It also means from Q3 2024 onwards we will stop seeing growth for a bit. Will it be there in the future?

Strategy and present

As I mentioned, their present is mostly selling Cyberpunk 2077 and its DLC. And they are doing well, it is a fantastic IP that has spawned anime and tabletop games already. The same could be said for The Witcher's games2, which spawned the Netflix series. What I'm trying to say is that they are mostly in the business of creating AAA IP that they can hold and lever into further games and other products. That has earned them a considerable fanbase, and they have managed to create two of the most successful franchises in videogames. Definitely a good strategy, if they can keep up the good work with relatively limited increase in expenses, as they have done so far. Because I would say that what sets them apart from many other in the industry is that they haven't gone off the rails with growth. They are still focused in getting a few, very few, games right.

Aside from that, they also have GOG.com, sort of a Steam competitor in gaming distribution3. It is not all that relevant to the business (last year it provided about 2% of the operating profits) nowadays, but provides a small stable cushion if things don't go as well in the gaming release side of things. They have also managed to grow steadily4, but all in all, something that we can ignore.

So we have a company focused on offering very few games of very high quality with solid franchises and a fanbase. Success in this area is a huge prize (see Rockstar!) but more often than not studios falter before reaching anything close to that (Bethesda, the old Blizzard… the list is really too long to count).

Where is CD Projekt going?

They seem to be trying to increase the number of projects ongoing, and they are opening a new studio. In Boston, no less! That will help them realize an ambitious roadmap that includes:

Cyberpunk 25, developed mostly in the Boston studio.

A new Witcher trilogy, developed internally in the original studios, and that is aimed to be released with 2 years between each game. We don't know when the first will be released though!

The Witcher remake, developed externally by Fool's Theory6.

Another game in the Witcher universe focused on survival developed by The Molasses Flood (acquired in 2021 and also based in Boston) that has, rumor has it, been rebooted once already, and it is supposed to offer multiplayer (maybe an service game experience)

A new unveiled IP in the works, internally, since 2021.

That is, CD Projekt is diverging from their classical strategy of focusing on very, very few projects7 at an extremely high level of quality. They are now developing 7 games across 5 lines of work, 4 of them internally. At the same time they have expanded their footprint both through M&A and studios.

Aside from that, they are also migrating to Unreal Engine from their own internal tools. That will effectively make it easier to find and onboard new developers, and also maybe reduce support work. While some people see this move as potentially saving costs and improving margin… I see it more as table stakes, and not worsening. But still, necessary.

This is clearly an investment cycle that has not yielded its intended results yet, so it can clearly produce the growth that we need for this story to work. Will it? That is a bit more uncertain. Studios expanding have a difficult story, and the new studios in another location examples that come to mind (CA Sofia, Paradox Tinto) haven't worked out that well or needed time to work out the kinks in the system. And if they don't work out well, this will result in both expenses inflation and brand dilution. The good thing is that CD Projekt direction has Cyberpunk 2077's release in recent memory, so they know the price to pay if what they get out is less than perfect.

Is it investable?

Success depends on them coming out of this investment cycle well. In my view, the equity already reflects some changes, but not unbridled optimism as it did prior to Cyberpunk 2077 release. Partly because there are no release dates for anything I just mentioned, as far as I know (although rumour has it that 2025 should see at least the Witcher survival game out, then in 2026 the first game of the new Witcher trilogy). Partly because of what happened with Cyberpunk itself.

Let's suppose things work out and they are able to deliver 2020 level of results on a normalized basis, with decent growth too coming from the accumulation of back-catalog and that leaves us at… well, it is 7% of their current market cap in earnings yield. Say it is growing at double digit and consider that a 5% earnings yield is fair. For me, it doesn't cut it. But if they manage to get a service game going really well, or if the multiple gets high enough, it can work well. And in this case, the multiple can get high because it is perceived as a quality company and is also well-known as a product among investors. There is also the chance they get to GTA's levels of greatness. But overall, it is priced for relevant growth and it happening rests on them executing well. Certainly a good company, and one I would invest in if growth was not priced in. But I missed the boat a few months ago. Oh well!

PlayWay

Yes, it is the 5th in size in the index, but really the second in size in the market. Let's get it out of the way, it will be quick!

Valuation

Market cap of 1.9B PLN with 18% free float (approx)

14.5 TTM PE with 17.6% 5-year earnings CAGR and -8.6% 2-year earnings CAGR

11.3 TTM Market cap / Operating profit with 26.22% 5-year Operating profit CAGR and 1.8% 2-year operating profit CAGR (included because I think it explains better how the business is going in this place)

6.4 P/S with 30.6% 5-year revenue CAGR and 8% 2-year revenue CAGR

12.1 P/FCF with 0.46B PLN generated cumulatively in the last 5 full FY (vs 0.63B in earnings)

0.53B PLN paid as dividends in the last 5 full financial years (0.65 if we take into account the current financial year and remove 2019)

Net cash of about 0.2B PLN

So wait, they have grown sales a lot more than earnings? There had to be a reason why this was so optically cheap, right? Well, as everything with this group, it is complicated. Earnings numbers are muddled with the sale of subsidiaries, both at a profit and at a loss. In operating terms, 22 was their best year so far, but 24 is probably going to close better (H1 was 11% higher than H1 22). Still, growth has not been impressive in the last couple of years, hence the multiple. Capital allocation in the form of dividends is essentially a must given the low free float. The high amount of dividends vs FCF might look worrying, but that is because in the FCF calculation I am not including either purchases or sales of subsidiaries. PlayWay's cash balance has also increased along the way.

So this is a very profitable company, with higher margins than CR Projekt even (or pretty much any other competitor), but that seems to face growth challenges in the last few years.

Strategy and present

I have discussed PlayWay's strategy other times, but the TL;DR is: produce games as cheaply as possible as long as they garner some interest, get them out, see what sticks, be ruthless about costs. They do that both through internal development and by financing tiny studios, many times by getting a sizable stake in them. Many of them fail, but enough go well to make the business exceptionally profitable.

They have had 2 really relevant franchises (House Flipper, Car Mechanic Simulator) and some other relatively successful titles (Thief Simulator, Contraband Police, Infection Free Zone, Crime Scene Cleaner…). As successes go, they are relatively modest (House Flipper, the biggest so far, has sold around 3-4 million copies and at far from AAA price, averaging maybe 15$), but given the cost base, it is extremely asimetric.

They rely on the one or two successes they get pretty much every year, plus the host of other profitable games they put out (Ship Graveyard, Gunsmith Simulator…) and the relatively stable sales from their two main series. Their catalog has been increasingly contributing to that, as titles like Contraband Police go in there.

Where is PlayWay going?

They are mostly doing the same, but at a bigger scale. They are also bringing international developers into the fold, collaborating now with Turkish and Indonesian developers, while the majority are still Polish. And also making forays in mobile. The summary is lots and lots of bets with a good balance without betting the house anywhere, even in the main franchises.

Is it investable?

In my view, yes, and as I have disclosed in the past it is one of my positions. It is cheap enough that the downside is limited, and I don't see their discipline with costs eroding as long as the current CEO is there. And despite the hiccups in 23, content for House Flipper 2 plus the new iteration of Car Mechanic Simulator plus a bunch of other bets maturing should should yield enough growth. Don't expect high multiple though. It might happen (has in the past), but it is much harder to get high quality ratings in a publisher that does a lot of cheap games, rather than a couple of AA/AAA, despite the business being better. But it is priced for no growth, which is I think wrong. More details here:

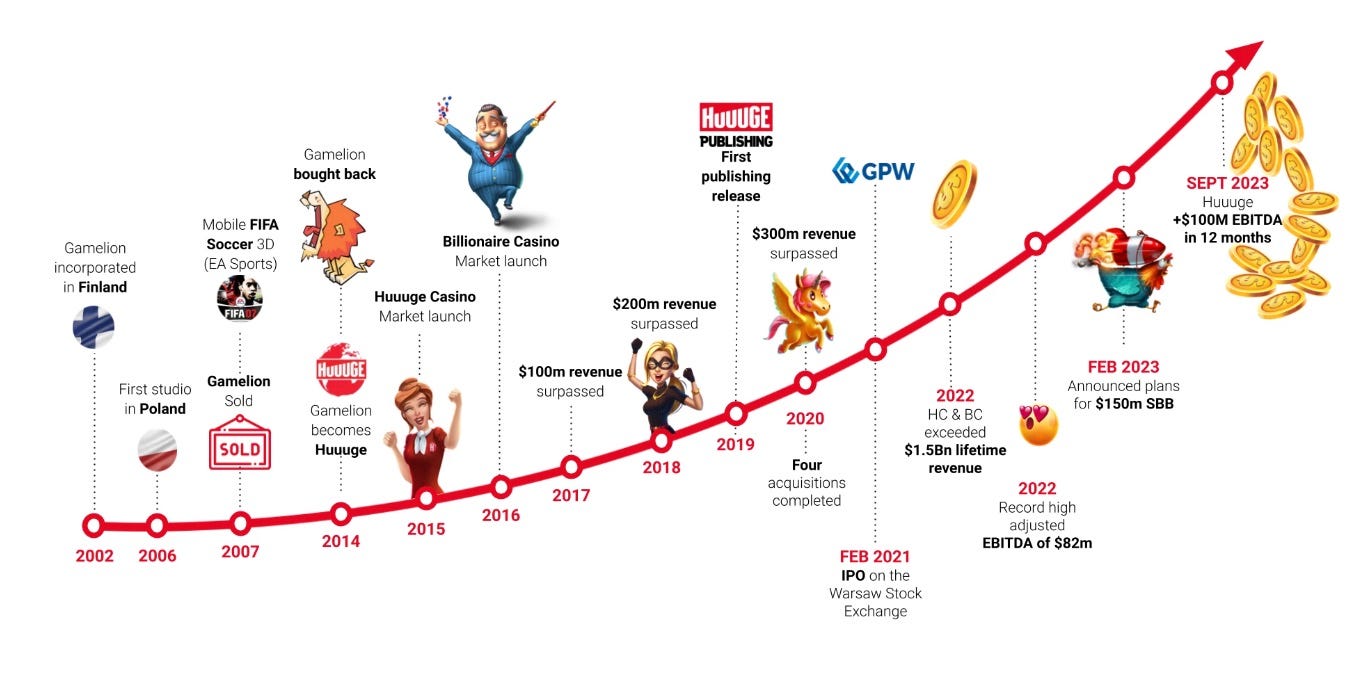

Huuuge Inc

Mobile F2P galore, with the customary in-game charges and publicity. Currently the third in market cap after 11 bit's recent debacle

Valuation

Market cap of 0.94B PLN with 61% free float (approx).

3.7 TTM PE. CAGR here does not apply, as they were losing money 2 years ago and the profits 5 years ago were ridiculous

0.87 P/S with 3.7% 5-year revenue CAGR and -12.9% 2-year revenue CAGR

3.17 P/FCF with 0.21B $ generated cumulatively in the last 5 full FY (vs 29 million in earnings)

0.24B $ used to repurchase stock in the last 5 full financial years - but they did issue 0.17B in stock meanwhile. To be fair, they have repurchased at a lower price… but mostly with the issuance money.

Net cash of about 0.1B $ or 0.4B PLN

Oh boy. A melting ice cube.

Strategy and present

Huuuge Inc found success years ago with two F2P games, Huuuge Casino and Billionaire Casino, that you can use both from web and facebook and on mobile. These are casual games, mostly slot machine emulators, and you get prizes in the virtual currency of the game, and you need them to play more rounds. Classic time and money wasters. They have been up since 2015, and the company has not managed to get any new properties going, with these games representing 97% of the revenue in H1. The company benefited from the COVID high, as everyone else in the industry, and did peak revenues in 2021. Since then, they have been losing revenue at a good pace, but huuuge8 efficiency efforts, slashing SG&A in half, saw them turn a profit.

Where is Huuuge going?

Down the drain, most likely. They have not been able to find new properties in a decade and they have probably hit bone in the cuts to expenses they can make, and competition is though in their space. They can be profitable for a couple of years more, or they can keep revenues stable for a couple of years more, but most likely not both due to customer acquisition costs. They have been using their earnings and cash from the 2021 raise to fund repurchases to sustain the share price… which has taken a huuuge9 nosedive since they ended back in April. Their most recent data puts bookings going down 19% YoY in Q3, which shows the decline is accelerating (probably as CAC is more limited to try to squeeze a bit more profit).

Is it investable?

See, they did generate 13% of the current market cap in cash last half, and have more than 40% of it in cash as well. But with 19% YoY revenue declines and no replacement in sight, I wouldn't buy this if it is not in net-net territory. I would actually consider it for shorting if it was available for that in any of my brokers (not the case, sadly). Not going to go for a declining company that promotes itself like this.

Of course, where they to find another property that worked out as well as those games (which, again, they have been trying for almost a decade now), this would become a homerun.

11 Bit Studios

Frostpunk creators. They have had a rough patch of late with Frostpunk 2 and The Thaumaturge, let's see how it is going.

Valuation

Market cap of 650 million PLN with 83% free float (approx).

They had loses in the last twelve months, so no PE.

11.3 P/S with -8.7% 5-year revenue CAGR and -13% 2-year revenue CAGR

Negative free cash flow in the last 2 years, with 22.6 million PLN of negative FCF in the last 12 months

Net cash of about 20 million PLN

In other words, you have to believe in them as a turnaround play, given they are losing money. Let's understand why looking at their recent past.

Strategy and present

11 Bit released (as in developed and published) a successful game, This War of Mine, in 2014. Then they followed up with the fantastically well received game Frostpunk back in 2018. The funny thing is that being well received is about the only thing they have in common, being in completely different genres (survival vs. RTS). 11 bit has also acted as a publisher of relatively minor games, but has found only moderate success there so far (with Children of Morta and Moonlighter being their best performers, I think).

After those initial successes, 11 Bit has struggled to find follow-ups. They managed to keep their revenue at decent numbers while they invested in three main areas:

New games of other studios to publish, especially in the AA space. The most relevant (The Invincible, The Thaumaturge, Indika) came out in the last 12 months

Frostpunk 2, a direct continuation of the first one

The Alters, continuing the studio survival games tradition

As you can see, the studio doesn't have a particular focus in one type of public, publishing and developing several types of games (adventure, survival, horror, RTS). They also fall in the middle ground, with decent budgets but not quite at AAA level.

Not a good space to be right now. All the published titles they have released from other studios have had decent reviews, but have failed to sell much. Both The Invincible and The Thaumaturge have resulted in losses so far, not recovering their cost. Indika did, because it had lower budget, but was not a particularly well sold game (hovering around 100k copies).

All this failures after investing for years left the survival of the company in the hand of the two internal projects, Frostpunk 2 and The Alters. Frostpunk 2 covered its costs10, but it is far from the level of success of the first one and probably can't sustain the company through another investment period. And The Alters is not charting particularly well in terms of hype.

Where is 11 Bit going?

Difficult to tell. Frostpunk 2 will add to their formerly cash reserves. Maybe 40-50 million PLN. They did burn about 10 million in H1 despite the releases, and they will need to keep investing in new games. They have The Alters and another unrevealed project still ongoing, both to be released in 2025 (after The Alters was delayed, it was supposed to be Q4 2024).

It is tough. The combined lifetime revenues coming from Frostpunk 1 and This War of Mine until June 2024 were 370 million PLN. They have spent already all of that, and the results have been mediocre, and they would have to surpass their biggest successes to return the investment. They have The Alters, another project, and other 60-70 million to get a second lease on life (and a big chunk of that will get spent in the others). It is hard to see how they can avoid downsizing at this point, unless both projects do well.

Well, that, and The Witcher remake. See, as part of the investment in The Thaumaturge, they did get 40% of Fool's Theory on the cheap, as that is the studio that developed it. As luck had it, the remake deal was not closed (or at least disclosed) until months after the investment. At this point, maybe that, and their participation in the remake of The Witcher, is worth as much as the rest of the company (although the conditions are probably heavily slanted toward CD Projekt… as they should). Still, it is a minority investment, and I don't know if they will be able to funnel cash to dividends, that they might need.

Is it investable?

At this point, not for me. The market cap is a bit high for the level of catalogue sales and the performance of Frostpunk 2, and the conditions on the remake are certain to be favourable to CD Projekt. But I would keep The Alters under close watch. If interest picks up or if it fails and the stock goes down enough, this can get really interesting (thanks to the Witcher remake optionality).

Ten Square Games

Casual mobile games with social features for retention purposes. They have suffered in the last couple of years, as many other actors in the sector. Will they find a comeback?

Valuation

Market cap of 520 million PLN with 70% free float (approx).

8.6 PE with -16% 5-year EPS CAGR and -67% 2-year EPS CAGR

1.26 P/S with 30.5% 5-year revenue CAGR and -17% 2-year revenue CAGR

4.6 P/FCF with 638 million PLN generated cumulatively in the last 5 full FY (vs 435 million in earnings)

In the last 5 years, 251 million in dividends. Plus, they ran a 114 share repurchase this year (although it was ran as a tender, and management sold part of their stake there, at a price 50% higher than the current one)

Net cash of about 80 million PLN

This is a strange combination of metrics, but it has its explanation. As a COVID winner, they grew a lot, and earned a lot more too, expanding the business as a consequence. Then, post-covid hit and earnings fell. A lot. But in the last half they have changed size a bit and are already getting better numbers. As for their outlandish cash conversion, well, customers finance them by paying for their in-game currencies well in advance of when they use them. Unearned revenue is the bulk of their liabilities.

Strategy and present

Ten Square is a developer of mobile games, and earns most of its money form Fishing Clash (2017) and Hunting Clash (2020), with a new game, Wings of Heroes, slowly gaining relevance in the mix. The Clash games are losing ground, with Fishing losing about 10% of revenues YoY according to Q3 provisional booking numbers, and Hunting about 15% (ouch). But Wings of Heroes did a 3x in a year, and is 60% up from last quarter. It is only 5.5% of revenues so far, sadly, so it has to grow a lot more to make up for the others. All of them invest heavily on marketing, with more than 30% of revenues for both hunting and wings going there (with very different results!). Fishing only dedicates 18% of revenues for that, and still churns more slowly than hunting (and is much bigger already)

The dynamic of the games is very close to gacha games, in that you are using currency to get opportunities and better probabilities to fish or hunt animals to add to your collection. They do have some social element to try to avoid churn, but that's the essence of it.

Aside form Wings of Heroes, they are also developing other 2 games that hopefully can contribute in the future. But Ten Square doesn't spend extremely heavily on development. Their main cost centers are CAC to compensate for churn and live operations.

Where is Ten Square going?

Ten Square has managed to cut costs and is fairly profitable for the revenue it has. Given their prior scale, they might be able to operate even with a bit less expense. But long term, they need to stop the revenue bleed. The good news is that they have already have a game with momentum (Wings) and two prototypes. Plus, the combined revenue decline (around 10% YoY) is much less terrible than in Huuuge. This has far better chances of surviving, either through new games or good operations in the current ones.

Is it investable?

It generated a fifth of their current market cap in the last twelve months, but for something with declining revenue, I need to see even more. If the revenue gets stable or close to, this is one to watch, though!

A bit of housekeeping

As some of you are aware, I have been running a survey to try to gauge what types of articles can be more useful for you. It is only 4 questions, and it would be super useful for me if you can answer them. Thank you in advance!

Mostly behind a paywall. Comprehensive though!

The books are fine! I like the books better than the games! But let's not kid ourselves, what made the IP popular was The Witcher 3.

Not really, in that they don't compete in terms of having a launcher, and they are more focused on distributing older and/or heavily discounted games. But still.

Well, they did use Cyberpunk 2077 as a crutch in 2020, and that came back to bite them in 2021. But other than that, it is generating profits.

Codenamed it Orion. All the other projects have codenames too. Sigh.

Of The Thaumaturge lack of fame. We will talk about 11 bit later

Not sure Gwent counts.

Can't help it

Sorry, sorry

Well… they announced it had covered the costs, but that included future game pass payments. It has since sold a bit more (maybe 50-100k more copies), so I think it has actually covered the cost but it was not a homerun.