SEGA: The year of the blue hedgehog

SegaSammy is not the SEGA of old. But it has very interesting assets and the price is very attractive.

SEGA was one of the mainstay sources of entertainment for many kids growing up in the 90s, but it quickly fell out of favor after a few mistakes. That story is well narrated both in Acquired's episode on the death of SEGA and in Sam Pettus’ Service Games: The Rise and fall of SEGA1. But SEGA didn't completely die. It was absorbed by Sammy (a Pachinko company) and now it is the biggest part of the conglomerate again, as Pachinko and Pachislot are on a slow decline while videogames are still going up.

This conglomerate is valued at around $3B, and it doesn't have the customary Japanese pile of cash, as they decided to spend most of it on acquiring Rovio (around $300M in revenue, and around $25M in EBIT). It did make around $350M in net profit and $2.9B in revenue last fiscal year. While in fiscal year 2024 it is expected to make less (a bit below $300M), it will be with bigger revenues ($3.3B expected) and cash flows (most of the losses coming from Creative Assembly write-downs).

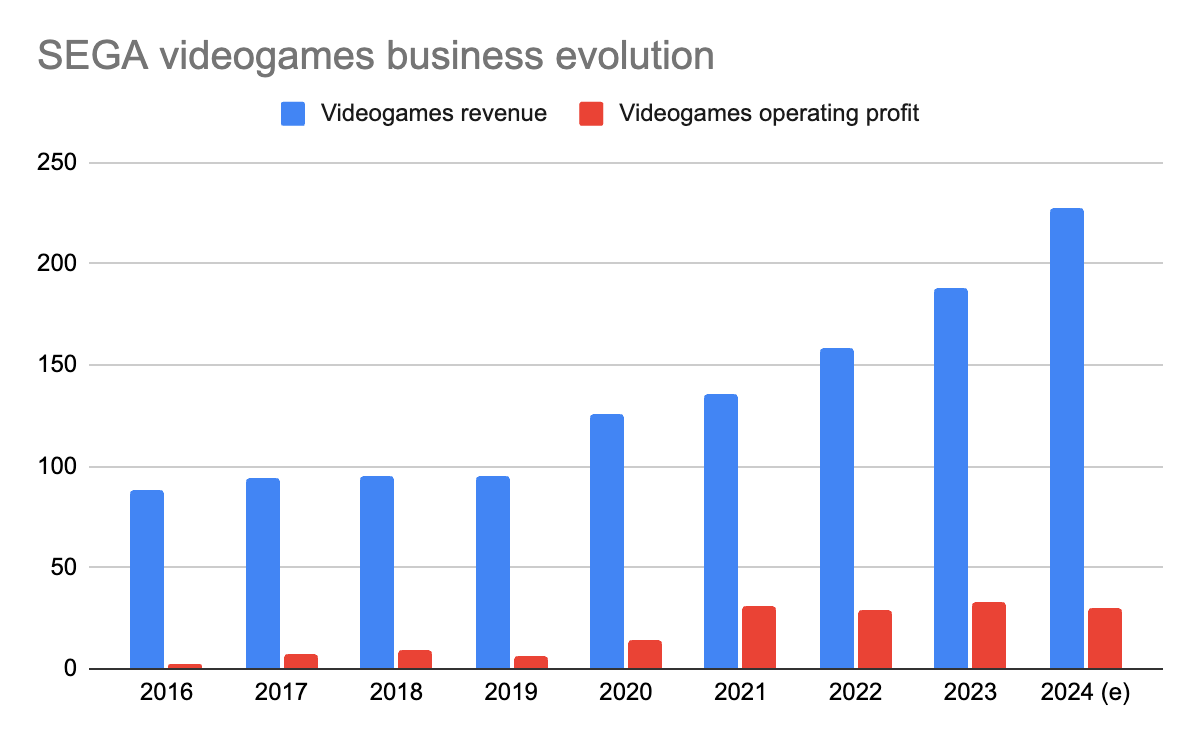

Evolution of revenue and operating income in the entertainment segment. Consumer essentially means video games and licensing.

In the last few years, they have managed to grow their videogames area, and they have been improving their overall margins along the way, especially since the change in CEO a few years ago (although given it was really a family succession, that could be a coincidence). At the same time, their capital allocation has been sensible, if not exceptional. They have kept a dividend, but they have also been repurchasing stock until the price went up, and then they recently went at it again. They have also bought Rovio, which is a risky bet, but also a very complementary acquisition for SEGA's strengths. I am a bit more skeptical of the acquisition of GAN, but it is a much smaller bet.

So overall we have an improving business with a long list of underutilized IPs, decent capital allocation, and new-ish leadership offered on the cheap. Let's look under the hood!

Sammy: Pachinko, resorts… and online gambling?

SEGA was absorbed by Sammy, a Pachinko company, and the family that controlled it still runs the show. Between the personal holdings of the former CEO (Hajime Satomi), the current one (Haruki Satomi) and the percentage they control through FSC Co and HS company they hold more than 25% of the conglomerate. And that is the first of SegaSammy's many businesses I want to look into. It has a lot less potential, but also it is the business that brought the ruling family to prominence, and it still generates a fairly relevant amount of money. Still, because Pachinko and Pachislot are a declining business:

That is not preventing Sammy from getting a bit of money out of it, but let's not be confused. Even if it seems the business is recovering (even exceeding in the last quarterly reports) the pre-COVID heights, it is still far, far from its heights. This year is predicted to be extraordinary, with ¥40B in operating profits thanks to the unexpected success of one series of machines, but that amount was commonly exceeded pre-2015, and there are many years were profits recorded were more than double that. But still, unless something goes very very wrong in H2 (¥38B in operating profits were recorded in H1), this will be the best year in a long time in terms of profit.

The business was already in decline when SEGA was bought and has steadily sunk even further. The good thing here is that SegaSammy's leadership doesn't seem bent on investing in the business to avoid that decline. Profit from it while it lasts sure, but no more. The capital invested in it has decreased, and the plan seems to be to keep it stable.

The same has been true for the number of employees, from close to 1,600 back in 2019 to 1,150 today (slightly above COVID minimums), and there seems to be a strong focus on keeping expenses under control. Proof of this is the increased profit, achieving better numbers than in 2016-17 with lower revenue. Overall, it is a slowly dying business that is being run to extract the remaining value, not trying to fight some rearguard action. Sammy has lost some share as a result but it still seems the smart choice, and I hope that continues.

But wait… why is it the plan to increase the asset base, even if it is slightly, in a dying business?

Online gambling & overseas development

Sammy is involved in the US slot machine and casino equipment business as well. And the same goes for SEA. Although it is not a major player, it does have some hold. But really, SegaSammy's gambling business has been focused on the domestic side… until now. It looks like part of the strategy to offset the domestic pachinko decline is to go global.

The references to this ambition are not completely new, but they started only in 2022, with the presentation of the growth strategy for the next 5 years. The company does not break down the sales of any segment per country2, so we don't know exactly how this progresses. We do know they have been making some efforts to scale the international team, or at least look the part, and they have been going to G2E for the last couple of years. We also know they were talking about more than 1,000 units installed of the Genesis cabinet only a few months ago which, to be honest, is not much.

A few months ago, the acquisition of GAN Limited was announced. That was puzzling to me and I am still not fully on board with it. But I think I understand what they are trying to do. GAN has essentially two businesses. The European and LatAm B2C part of the business is largely irrelevant to Sammy, and I suspect they will eventually divest it. But the B2B part in the US, the UK, and Canada targets the same customers Sammy is trying to target with its Casino machines. GAN offers a different product (essentially, software to manage betting operations online, plus content for those and the Player Account Management system). that is complementary to the one Sammy is offering (physical machines), and they already have a foothold in markets that are interesting to Sammy. So this means essentially buying the client list plus some options to bundle things together.

Granted, this is a client list burning a bit more than $10M a year and has lost share in the US in the last year. ¥16.15B (about $115M) seems a bit steep, especially if it comes with a bit of net debt3 and negative tangible book value. Not the first time Dermond Smurfit managed to convince someone GAN is worth a lot more than it probably is4, but those numbers are far from a big problem for SegaSammy.

The value of a dying business

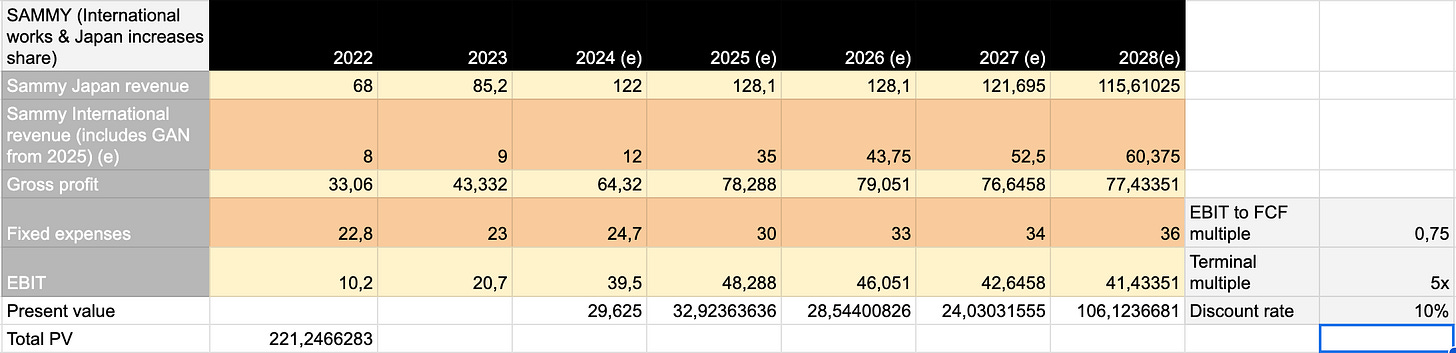

So let's try to model this in 3 types of situations. In the first one, the international expansion effort simply goes nowhere, while the gain in market share seen in the last year in Japan fades away, and the local business

Now, there are a ton of assumptions buried in there (the distribution between fixed costs and variable costs, investment being sort of stable and thus matching with DA, how management would react to lack of success, the multiple, and the transformation to FCF from EBIT among others). The transformation from EBIT to FCF is actually quite conservative if we look at the results in the last couple of years, the discount rate is above the risk-free rate really, and the terminal multiple chosen is I think adequate for a dying business. But still, we would get about 25% of the current market cap.

Now, if they are able to regain some market share in the Japanese market (which I think is likely, to be honest), but the overseas expansion still flops, we are in a slightly better scenario. Multiple is only slightly better, because it is still a dying business, only more slowly, and we would get more than a third of the current market cap.

Just for fun, let's consider what would happen if the international expansion succeeds. Which, in all honesty, I think is difficult, but there has been some progress in the last couple of years without GAN there. In that case, more than half the market cap would be justified by this business alone.

The least interesting part of the business. But if things work out, it can be really important. If it doesn't… it is still a decent cash cow, assuming management does not decide to throw good money after bad. Which I think they won't do, because of what is happening with resorts.

Resorts

I would also put the resort area under Sammy, nowadays. SegaSammy owns a couple of integrated resorts (that is, casinos). They used to own some SEGA-themed parks as well, but those were sold in 20165. One in Japan, fully owned, and one in South Korea, together with Paradise. And their results have not been particularly great. The Japan resort was on break-even right before COVID, and they are aiming for breakeven this year in the whole business.

So why did I jump into the valuation of Sammy before talking about resorts? Well, because to me it looks like they are looking for a buyer. In the latest presentations, management has made it clear that they are no longer considering investing in more integrated resorts after plans for a new IR in Yokohama fell through in 2021 and the bad results from both existing results forced them to re-evaluate.

Not sure when that will happen, or if they will find good buyers. But that means two things:

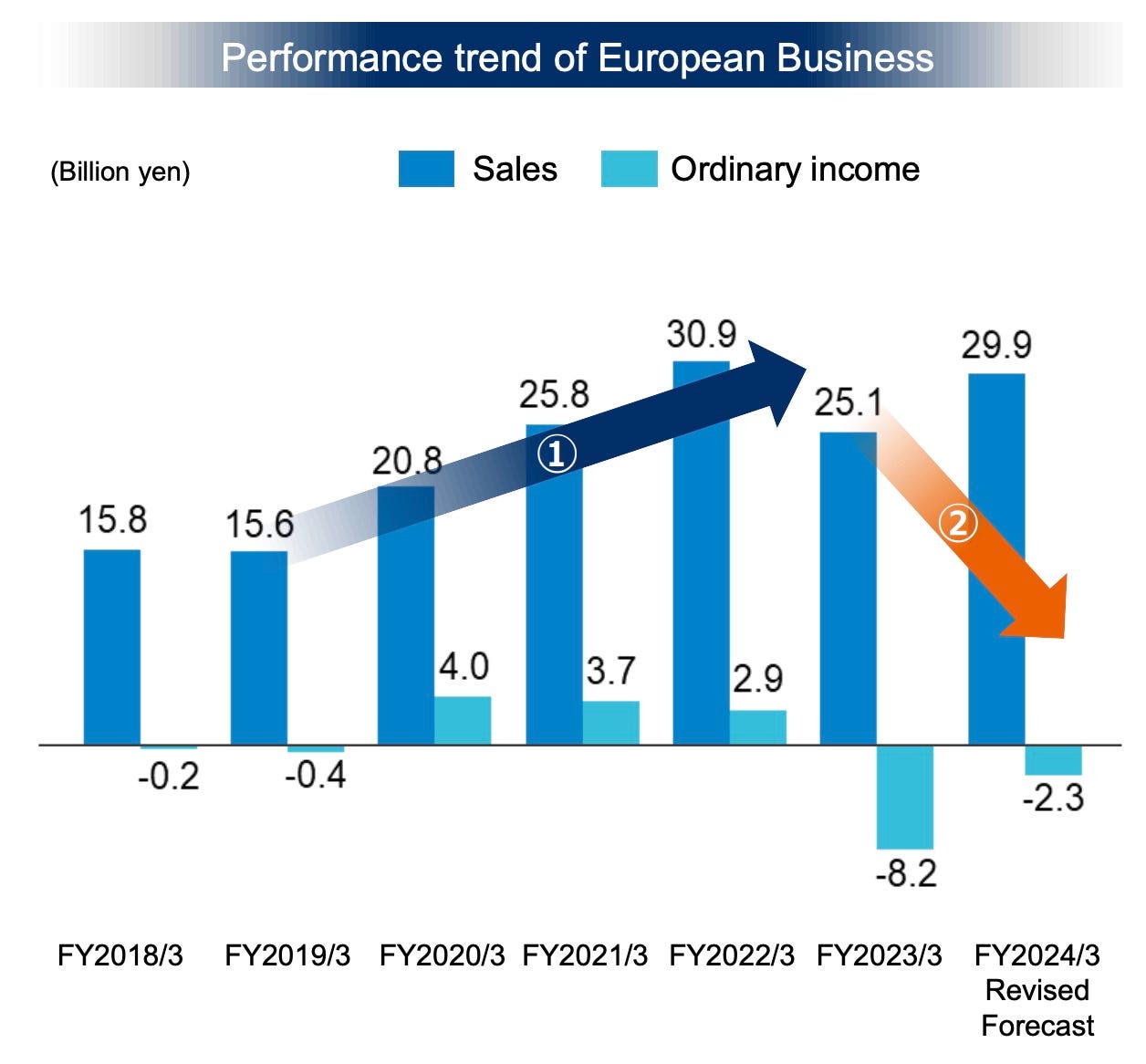

Management is able and willing to cut projects that don't work out. I am seeing the same in the video games area, and in particular in the European side (will get into that situation in more detail later).

Less resort focus means better margins and visibility, and that should mean a better multiple for the group.

I don't think it will be a 0. Both Paradise and Phoenix have improved markedly, and I think they will generate cash this year6. But the loss of focus and the capital commitment still don't make that much sense, so I hope they sell. I don't think ¥15B is an incorrect price tag to slap there. It would still be a massive value loss versus book value7 but it reflects observed profitability in the last few quarters.

SEGA: the least profitable videogame company?

With that headline, many of you will already be running the other way. But well, it is more or less true, and I have already talked about it. SegaSammy has the worst or close to the worst margins in the industry, at least when you take it as a whole company. But that is partly because the margin is bundled with so many other things. Sammy, of course. But also, within SEGA, we have TMS (animation), toys, and the amusement machine area. Videogames as such had a 17% operating margin last year. This year it will be worse, but that comes mostly from a massive writedown in HYENAS.

The evolution of SEGA's video games business has been good in the last few years, improving both revenue and businesses organically (the only relevant acquisition was Rovio this year, and eliminating its estimated contribution, 20248 would still be ahead of 2023 according to company estimations). Due to the revenue decline in Sammy (not so much profit, excluding COVID impact), and the sale of the arcade operations9, this has not really registered as growth for the market.

Let's analyze how that has happened, and see if it can continue. For that, we will have to go segment by segment. We will start with the currently troubled SEGA Europe. Then, we will jump into SEGA Japan, including potentially underutilized old IPs from the past, and finally the Rovio acquisition.

SEGA Europe

SEGA Europe was the reason I started looking into SEGA in the first place, mostly because it has properties that I love. The Total War saga and Football Manager are long-time favorites of mine, and Creative Assembly handled Total War: Warhammer I & II magnificently. This year… has not gone that well.

According to SEGA's management, what happened there was that from 2020 onwards, they started to reinforce the European studios to take on bigger challenges and new games. In some cases that panned out, but then Creative Assembly missed with TW:W3 content and HYENAS, Relic missed with CoH3, and Amplitude missed with Endless Dungeon. Only Two Point and SI seem to have not blown something up in a short amount of time. Now, some of those studios came from developing some hits (TW:W1-2 and TW:3K for CA, Humankind10 for Amplitude).

So what I suspect happened was a ton of money was put to work very quickly across all of SEGA Europe in new projects without much sense. And by the end of 2023, you have ¥33B in costs, more than double the 2020 numbers. And the HYENAS debacle, and all that has gone on in Creative Assembly, seem to match that. But still, let's review the business to check it is a really interesting one!

Creative Assembly

Creative Assembly is a success story, no matter how big of a problem they are having now. This is the videogame revenue reported by CA in their Companies house reports11. They also report operating profits pretty much every year, and honestly, that's not surprising! Thanks to the Warhammer franchise, they have quadrupled their annual revenue.

Of course, 2024 is going to be a lot worse. They have released two DLCs for TW:W3 (one a success, one a huge flop) and TW: Pharaoh which has been the worst-performing Total War game to date, generating about 3% of the revenue generated by TW:W3 according to Gamalytic12.

And then, there was the HYENAS debacle. Building on the success of Alien: Isolation, this was going to be SEGA's first attempt at getting into the massive F2P shooters, it did cost a lot, and it was not up to sniff, so it was canceled after the private beta. The story is a full-on drama, and while the cost is unknown, the cancelation of the title (among some other unknown ones) implied a ¥14B write-down.

For an independent studio, canceling a title that has eaten up all your surplus from prior years at the same time that your main cash cow falters (TW:W3 DLCs) and your new release (Pharaoh) goes badly would have meant closing almost certainly. For CA, it has meant only downsizing and focusing only on Total War. They released an apology, and a plan for TW:W3 content, plus a change in price to Pharaoh (essentially admitting it is not a full Total War game in its current state). It seems to have gone well with the fan base, and despite the problems this year, they have built massive goodwill, and have no real competitors in the space. Now refocused on strategy games, they can really thrive.

Or so I hope.

Sports Interactive

Not the biggest one here, but probably the most special one. Sports Interactive has only ever made 2 games, and one of them is long discontinued. So basically they only release a new version of Football Manager each year. And they have the most faithful player base imaginable, with an average playing time of over 200 hours for each edition, selling more than a million copies (plus the people playing thanks to Apple Arcade and Xbox Game Pass, which also generates revenue).

And the sales have gone decently well. FM23 was the best release (before FM24, which is doing much, much better, tracking it here) in terms of revenue.13

SI is currently working on FM25, which will be the first of the series in Unity, instead of their current custom ball of mud. If the success over the last games goes on (a few fewer copies sold, sure, but exposure to many more players through Xbox GamePass and Apple Arcade and higher total revenue), maybe we will finally see SI try their hand at other sports.14 Personally, I hope so.

The rest of the pack

To add to that, we also have Relic, Amplitude and Two Point. Amplitude is finding it hard to replicate the successes of Humankind or Endless Space, and Relic failed terribly with CoH3. Two Point, meanwhile, is doing decently well in switch games… but it is tiny in comparison. These three brands have also much less durable and recognized properties and, considering only the revenue numbers I gave, SI and CA would amount to about 80% of SEGA Europe in FY 2023.

SEGA Europe, in a nutshell

SI and CA were the reason I started looking into SEGA…. and I still think they are incredibly valuable assets. They are niche game developers that, in the last financial year, generated more than ¥20B in revenue. And while profits have not been as big, their margins are incredibly depressed because of two things: HYENAS for CA, and the Unity migration for SI. Both projects have been going on for several years (since 2017 for Hyenas, since 2020 for Unity).

I guess my point is that both SI and CA create niche games with a multi-decade history of good returns, and I think them generating ¥7B in operating profits (together and per year) from now on is not far-fetched, and the only public comparable with niche as good as them is probably Paradox. And I would gladly pay ¥100B for a spin-off of those two only. Two Point is a nice addition that I think needs no major changes.

Relic and Amplitude can be too, but right now I think they are a negative15. Amplitude needs, I think, to get back to trying to challenge Paradox and Firaxis in the 4x space. I don't think they can really get to first place. I just think they can win even if they lose. Relic… I honestly don't know what I would do with that studio. They are sort of specialized in RTS, but they are very hit-and-miss within the genre. Dawn of War III was terrible, AoE IV was good, CoH III was terrible. I don't see how they can make money with that hit/miss rate on pretty expensive games (especially given that the only relatively recent success was a contract job). I hope things change, but right now, I would be glad if it was sold.

SEGA Japan: The crown jewel

Sure, SEGA Europe's videogames have brought in ¥15B in additional annual revenue since 2019. And that is great. But also a very, very small part of SEGA. Back in 2019, SEGA's videogame revenue was only ¥95B. This year's updated forecast (given in November) is ¥203B, once you take out Rovio's contribution. That additional ¥90B came mostly from SEGA's Japanese studios16.

Now, some of you might expect me to start talking about the Sonic revival, with Frontiers and the Persona and Yakuza series. And I will! But what surprised me the most looking into it was how much of the revenue came from F2P games that I had no idea existed.

F?2P

¥60B in revenue in 2023 came from F2P games. The biggest ones are Project Sekai, Phantasy Star Online 2, and… Sega Net Mahjong. The first one is a rhythm game with vocaloids which is monetized through an in-game currency (gems), Phantasy Star Online 2 is monetized through cosmetic updates. Sega Net Mahjong is a strange world17. SEGA Japan has found a fantastic cash cow, although the latest releases (PSO2 New Genesis 2, plus 404 GAME RE:SET) have not worked out as expected18. But really, it has shown a lot of resiliency. The profit margin for other operators of similarly in-game monetized games is usually very high (see Gravity), which should mean SEGA has plenty of margin to squeeze here if they ever want to.

For me, it is difficult to predict if they will keep growing here or if they have hit a ceiling (there are only so many people that can play Hatsune Miku rhythm games, right? right?), plus they have only achieved success with them in Japan. But the margin aspect… well, let's just say it is embarrassing SEGA isn't making twice as much money as they do. Their progress on F2P has been notable since it was first disclosed and, while it is going down this year, there are plans for future developments. But it is also fragmented. PSO2 is essentially a console/PC MMORPG, while Sekai or One Piece: Bounty Rush are mobile F2P19, an entirely different beast with less faithful players and a higher CAC usually.

Part of those plans are the Rovio games (Angry Birds related, mostly). But also using the Persona IP (Persona 5: The Phantom X) to help grow the business.

SEGA Japan's IP

For many years, SEGA20 didn't do very well in its IP management. They have always had some video game series doing well. Even in in the late 00's, they had the Yakuza21 and Bayonetta series taking off, and several installments of Persona doing well. But the Sonic property mostly languished22. Colors and Unleashed did ok, but still. The last few years seem different for the blue hedgehog. Sonic Frontiers (2022) was the best-selling mainline Sonic game since 1994, and we have had 2 successful films and a Netflix show.

Yakuza and Persona also seem to be well taken care of. Persona 5 (2016), Royal (2019) its remaster (2022) and Persona 5 Strikers (2020) selling well over a million copies each. Yakuza: Like a Dragon (2020) was probably the most influential title in the series, and it has sold close to 2 million copies23 (and there is a sequel coming up in a few weeks). All in all, their three main IPs have done well, and the plans for them make sense.

All three of the IPs did their best sales in recent history in 2023 (or close, in the case of Yakuza), and the prediction is that all will do them again in FY 2024. And given this prediction was made public with only 3 months of FY 2024 to go, I hope it is not off by much (although Persona 3 Reload and Like a Dragon: Infinite Wealth are launching in that period, so a flop would affect predictions).

And then Sonic… well, for 2024 there are BIG plans

The third movie is coming up in December

A new season of Sonic Prime airs on Netflix. Given that season 1 was on position 139, I think that is pretty relevant.

Knuckles is getting his own show, as a spin-off from the movies

At least one mobile game out, maybe several. There was one already in the works, and the December management presentation implies that Rovio will develop more mobile games for the IP.

While this is unconfirmed, there are pretty intense rumors of a new mainline game coming up in late 2024

SEGA has found out the blue hedgehog still has it, and they are not letting it fizzle out. Maybe it won't work, but it won't be for lack of trying.

As a bonus, this year should also see the resurrection of some old IPs that have die-hard fans, like Crazy Taxi and Jet Set Radio. Initial reception of the joint trailer was pretty decent, but it is too early.

All in all, SEGA Japan owns several franchises that have gone past $1B in sales (Persona and Sonic at a minimum, probably Phantasy Star as well), and they have only recently woken up and started to really exploit them. And I want to be there while it happens

Sega videogames abridged

Look, SEGA sells ¥200B of videogames each year. Most video game companies are valued at 4 to 10 times their revenue. For the most part, the reason is high margins and/or the perception their revenues are easy to defend. SEGA is currently valued, in terms of sales, at about the same level as Gravity, a company with the worst capital allocation you can find, and where everybody half-suspects the majority shareholder will try to screw everyone else up. And that is because historically they have deserved it.

They don't anymore. They have been able to grow well, but instead of expanding margins they have chosen to reinvest mostly via PNL24. And I think starting in FY25, we will see margin expansion. Partly because of cost control in Europe, and partly because the results of the investment in the last few years on the Japanese side will become apparent.

And then you have the Rovio acquisition. It will add around ¥40-50B once fully consolidated, depending on how it declines, but the main thing it brings is a fully formed mobile studio that can bring SEGA's IP to mobile. SEGA already has successful mobile games (Sekai) and others in development, but Rovio is better at mobile and might be able to bring Sonic and other IPs into casual monetizable games.

It might not work. And it was not cheap25. But I don't think it was a bad idea.

So if any of this plays out, we are going to see both growth and multiple expansion (on margin improvement). ¥1T for the videogame division alone wouldn't be that surprising (base sales being around ¥250B once Rovio consolidates). And I think there is very little downside.

Capital allocation

In FY22 and FY23 (inclusive), SegaSammy generated more than ¥60B in FCF, and they also had about ¥150B in their pockets to spend around or do whatever. They decided to purchase GAN and Rovio (¥120B). But they have also reduced the share count by almost 10% (from 235 million shares to 215). For that, they have used ¥35B, the last 10 of them this year. Actually, they didn't deploy them as soon as they could, but only when the share price went down, towards the end of the year, in November and December. Close to ¥25B have gone to dividends (including FY24). This means that they still have ¥30B, plus whatever has been generated in FY24, which should be above ¥30B.

Essentially they have made a small acquisition with a very high probability of failure (GAN), a big one, where they might not get full value, but that makes sense for the strategy and is difficult that it fails completely (Rovio) with the cash pile, and then used the FCF generated each year to reward shareholders, mostly through share repurchases at prices that I think were attractive.

A fairly aggressive allocation policy for a Japanese conglomerate. And I'm all for it, I even think at current prices it could use a bit of leverage to increase repurchases. But hey, this works.

To summarize, we have an improving company valued like a stagnant one, and fairly decent allocation. Personally, I'm long and I think this is worth 2 or 3 times its current price if things work out, with very little downside. But happy to listen to other opinions, so please do your own research and find holes in mine!

Outro

While I have not talked about them, SEGA has three other businesses. Arcade machines (but mechanical prize ones, it got out of the other business) they sell but not operate, a toy company and an animation studio. The machines sell well, but it is a very low-margin business that I hope they get rid of someday (although it is generating ¥4B in operating profits a year). The toy business is, I think, too small nowadays to be very profitable, and they would probably be better off working with other toy companies instead.

But the animation business studio and its IP? Detective Conan and Anpanman are both very established properties, that still generate decent revenue today, and they have some other decent properties (Fruits Basket, Lupin the Third, Dr. Stone, Hanma Baki…). The animation and the toy segment make another ¥4B in profit a year, although I suspect it is very lopsided. And I think the animation business has some room to grow. But it is far from core for the thesis.

Really interesting book, but be warned, it is lengthy and repetitive at times

They do provide the breakdown on local/overseas for video games, but that's about it.

$10-20M, depending on how you choose to consider the different types of liabilities.

I actually used to own GAN plc back in the day, back when it was in the LSE. That was a fun ride. But it also became clear, quickly, that the rollout in the US was not all that smooth. I was already out when they bought the B2C business, but my view of that move was pretty much “Oh, so they are trying to hide the lack of B2B growth". What happened later with B2B revenue will probably not surprise you!

They sold the subsidiary managing parks for about $5M, which should tell you something about its performance. SEGA retained a small minority stake. Haven't seen it sold, but I don't think it is very relevant

Paradise SegaSammy has had a positive net profit for the last 4 quarters, amounting to about KRW22B (although that barely covers the 2023Q2 losses). Participation in those profits for SegaSammy would be about ¥0.7B, and it is growing. Phoenix Seagaia is toying with either breakeven this year or very slight profitability (¥0.2B in the first half)

About ¥30B, more at the end of the year, according to the invested capital forecast presented before.

Remember 2024 only really includes the first 3 months of that year, this prediction is the one released when the 2024 H1 results were released.

They sold most of it back in 2020, then the remaining 15% in early 2022. The amount was not disclosed, but the carrying amount of amusement machines & facilities went down by almost ¥40B while ¥18B were recorded as an accounting loss, make of that what you will :).

Despite mixed reviews

That is not the full revenue reported, I have subtracted the revenue of The Creative Assembly VGDC. As with the case of Sports Interactive, those companies are likely set up to take advantage of the video games tax relief scheme in the UK. Unless I am mistaken, CA pays VGDC to develop videogames, and then VGDC pays CA because CA's employees are doing the work, therefore inflating the revenue reported in CA's case because it is not a consolidated report and therefore no eliminations happen. The video games tax relief scheme gives companies quite a lot of money, and if someone understands how this works exactly, I would love to know about it!

Well, it outsells Shogun and Medieval in Steam. But both were released before Steam was a thing, so for a 2023 game, that's not much of a stretch, is it?

Also profitable in theory. Also, a VGDC involved. Also removed the VGDC-derived revenue.

Other than their brief ice hockey adventure.

If we look at the profits reported in UK filings, Two Point, CA, and SI were profitable (close to ¥2B after tax between the three of them, without counting the VGDCs reported profits), and intangible assets capitalization doesn't seem to be part of it.

Not entirely. Licensing revenue is also accounted for in the consumer area, and I couldn't find a reliable way to separate it. It is somewhere in that “Other" epigraph, but the extent is not very clear. Since the licensing comes from videogame IPs, I've kept it there. But the Sonic movies and series had a hand here.

But I'm not kidding, I would say that generates a cool ¥1-2B per quarter.

Setting back revenue forecasts by ¥10B. But remember, all the problems are in SEGA Europe. Looking at this company, you can't help but remember SEGA Japan vs SEGA of America stuff sometimes.

The mahjong game is for computers and Android, but I'm not going to pretend to understand its allure.

I am not going to talk about the studios separately here, mostly because they are more teams within SEGA rather than separate companies. With the exception of Atlus, of course. The company was relocated to be close to everyone else, so not even sure about them. But the Sonic team and the Like a Dragon studio are just teams dedicated to a series.

Yes, originally it was Like a Dragon in Japan and Yakuza in the West. And I would have used the original except… Yakuza: Like a Dragon is also the 7th game. Or Like a Dragon 7: Whereabouts of Light and Darkness as it was known in Japan. I'll never complain about Spanish translators again.

Well, Sonic and Mario at the Olympic Games sold well.

Like a Dragon Gaiden: The man who erased his name was released in November and seems to have done really well for a title outside the main line, with about 120,000 physical copies (around 25% below Y7) sold in Japan, and Steam sales comparable to Y7 at the same time after release, according to Gamalytics estimations

SEGA capitalizes development costs as intangible assets, but doesn’t seem particularly aggressive in allocating costs there. They have been aggressive at the devaluation of residual value of videogames in the balance sheet. That's why their intangible assets are pretty much non-existent. And also they are not particularly aggressive in allocating costs to particular developments so that they can capitalize while on development. That means their profitability is understated, but the conversion to cash is fantastic. Net profit to FCF has converted at around 0.8 in the last couple of years.

A bit more than 2x revenue is a steep price to pay for a business that is failing due to CAC being too high. The thesis here is that Rovio's team is misallocated working on their hypercasual games, and IP-backed content will have much lower CAC and increase profitability a lot. We'll see.

I took the opposite route from you; I got interested in this stock thanks to the Japanese studios (especially Atlus.)

I learned a lot from reading your perspective on the European studios, and I agree with everything you wrote about the power of the IPs and the current undervaluation.

By the way, this article aged really well—you nailed the sale of the Phoenix Resort.

Thanks for the detailed write-up!

I want to like the stock, but I really struggle with the GAN purchase. But as you wrote: they don't seem to be afraid to shut something down instead of throwing good money after bad.