The not-so-new anime king?

Toei Animation is not the only company producing anime content. Most of the public ones are buried inside conglomerates. IG Port is as close as you can get to a pure play!

IG Port probably doesn’t say much to you, even if you watched (or watch) anime, unless you are really deep in the weeds. But if you grew up in the 90s you had to hide under a rock to avoid Ghost in the Shell1, one of the biggest works in the cyberpunk genre. Video Girl Ai and the not so well known (but with a cult-like following) coming of age story FLCL are other examples of the work of Production IG in its relatively early years. In recent years, it has become almost impossible not to hear about Psycho-Pass, The Ancient Magus Bride, SPY x FAMILY, or, of course Attack on Titan mostly under the Wit Studios brand. And some of them even coming from MAG Garden. Because, of course, this is yet another japanese conglomerate, even if it is a very focused one.

IG Port as such started out as a merger between a manga publisher (MAG Garden, very small one really) and Production I.G. in 2007, as they were both at risk of going down. Publishing manga in traditional format was less and less profitable, and the animation business used to have razor-thin margins. Even the all-powerful Toei didn’t manage to get to double-digit net income margins until 2016, and no one else has Dragon Ball and One Piece (well, more on that later!). Together, both companies managed to navigate the turbulence of their industries, and were well positioned for the anime & manga boom we are living. They operate mostly those 2 businesses, although in the anime one they operate both as Production I.G. and Wit Studios.

IG Port at a glance

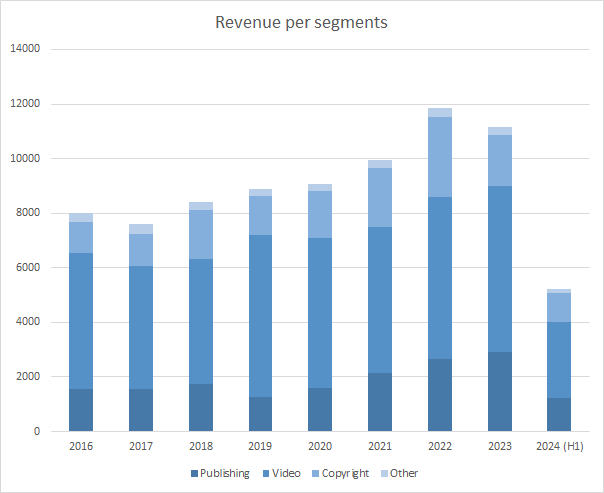

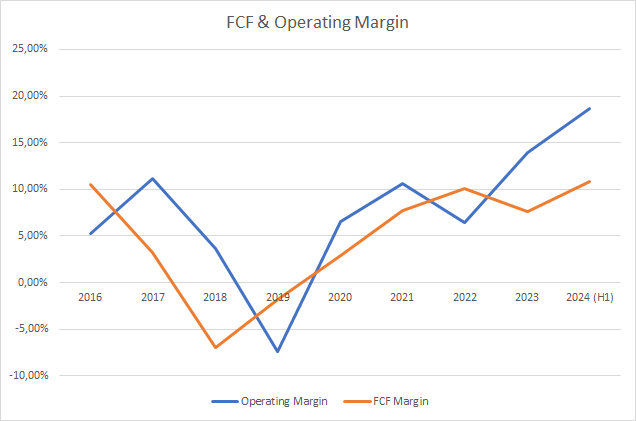

IG Port is a growing anime producer. But so far it has not been a super-fast grower in the sector, and its profit margins have also been lackluster. Some things make me think that is changing. The first one is, obviously, revenue growth.

2024 H1 aside (and I’m pretty sure that will change in H2 due to their release schedule), IG Port has been growing nicely in the last few years. Toei has more than doubled their revenue in the period though, so maybe that is not that important. The margin expansion definitely is, as is the fairly good cash conversion profile2.

From 4% in 2016 to 11% in the last half, their growth has increased their profitability. Which, in turn, can supercharge their growth in a virtuous circle. You see… one of the reasons IG Port has not become absurdly rich is that it wasn’t moderately rich. Toei is rich because it owns a big chunk of many of its productions, including the incredibly successful ones. Most anime studios haven’t had that luxury, or at least not at that scale. IG Port sort of did… but always in much smaller slices, and never had a property with the level of success that would allow them to become that. In the last few years, thanks to the hits mentioned before, that has started to change. Spoiler alert! Attack on Titan is not the impressive money maker for IG Port one would think, a sure sign they have a smaller slice than they would like. It has been more important for their backlog, though.

The video production backlog of IG port has moved from ¥4B to ¥18B since 2016, and I think a huge part of that is because of Attack on Titan’s success (although one can’t discount the effect the other recent successes have had!).

This effectively means that IG Port has a better investment pipeline for their relatively small investment power, better distribution partners, and also profits to take advantage of both opportunities, increasing the revenues they receive from licensing and repeated broadcasting. And that, in a nutshell, is why I think IG Port can work out fairly well!

But let’s get manga publishing out of the way first, as anime is… a bit more complicated.

Publishing

MAG Garden is not one of the manga publishing powerhouses, well behind Shūeisha, Kadokawa, and Kodansha3, and that’s why they had to look for a merger. In the last few years, the Publishing business has been a steady earner for the conglomerate, at times competing with the copyright segment for the first position in most profitable division.

The problem with publishing is they lost their best series (The Ancient Magus’ Bride), so this year they will probably go down in sales and profit. The last half saw sales decreasing 15% (and operating profit almost 6%), which is not that bad taking into account the hit. The company is getting ¥200 million in compensation for the loss of the series to Bushiroad, but probably far from enough to really compensate (and they also lose some of the advantages that having the manga in-house gives). It might also affect IG Port’s participation in season 3 of the anime (but I don’t think so).

That series aside, the publishing branch has done well in large part thanks to their webtoons, and boast better margins than their competitors (pretty much doubling the operating margins of Kadokawa’s publishing segment4), and they seem to be able to keep gaining share. From a company that survived almost only on The Ancient Magus’ Bride, they seem to have been able to build a diversified base, mostly based on webtoons and online sales as opposed to paper publishing.

It is a nice growing business, and my impression is it will continue to grow. The growth in the last few years didn’t come from the lost series, as its sales were starting to wane (as it is normal for a 2016 series), but from good management and direction.

That said, while a profitable & growing publishing business is both a rarity and something nice, it is not the main dish. I would pay somewhere in the ¥4-6B range for this business, maybe, and IG Port is currently valued at ¥30B, so I don’t think the market makes much of them either. So let’s talk about the anime business.

Anime & Copyright

When you look at IGPort’s presentations or statements, you will see it is divided in three segments: Publishing, Copyright, and Video5. Copyright is, however, very tied to video, and I think they have to be analyzed together. But it is very useful to understand why they are divided this way!

Anime studios don’t necessarily own what they make. Usually, the anime is owned by a production committee… which effectively is a joint venture between several companies. The studio can be part of it or not, but the production committee pays the studio for their work. Usually, the main distributor for the work is also in the production committee and is one of the main, if not the main, financer of the work. This role was usually fulfilled by Japanese TV companies, but it is not uncommon to see Netflix or Crunchyroll in the credits now. They get first dibs, and then the work can also be licensed to other countries or formats (think streaming vs. TV). Other typical members of production committees are toy makers and, of course, manga publishers (as anime is rarely an original IP)6.

That effectively means the production committee pays the studio to do the animation work. Then the production committee receives money for every use of the anime. As in playing it in national TV, or international, or streaming, or toys, or videogames7 and then the production committee distributes the profits amongst everyone according to their share.

What does copyright revenue mean for IG Port?

Well, a very different thing than licensing for Toei, and that is partly why they have very different margin profiles. You see… Toei mostly owns the animations outright. That is why you don't see minority interests in their statements, and also why their segments are structured the way they are. Film includes all national, international and streaming revenue. Royalties are all the other stuff.

For IG Port, the situation is very different. All their stuff is owned by production committees (where they have a share), so they recognize as video revenue only what is paid to the anime studio, and then as copyright anything they receive from the production committees. This explains why IG Port's video margin is so much lower than Toei's. It also explains why the copyright vertical in IG Port has higher margin than Toei's royalties. When that money gets to IG Port, Shūeisha8 has already taken their cut!9

Now that I have gone over what those numbers mean, it is time to look at the actual numbers of IG Port.

As you can see, video profitability is pitiful, when it is there at all, although higher volumes are helping. But I don't think IG Port will ever make a lot of money there. What I expect to see is higher and higher volumes in the copyright segment, as they get more back-catalog and successes where they have a share in the proceeds. The higher backlog in video might make them a bit more money from the studio… but should increase markedly the copyright business. Its profits should also improve markedly, as the share of the already-amortized back catalog also grow. Video basically generates revenue for the copyright segment, that grows little by little (especially in terms of profits).

Before we continue, 2022 looks weird in that series, with all that copyright revenue, but being much less profitable. The reason is simple: IG Port made two shows, one for Netflix and one for Crunchyroll10, that were self-produced. So they recorded the production expenses as copyright investment, and then amortized it almost in one go, recording the revenue as copyright11.

Now, IG Port had record results in 2023 thanks to their latest successes, but they are still very, very far from the big names in Anime. What they need for that is more success stories, and a stable base of copyright profits that allows them to keep investing in them an increasing their portfolio. What I want to evaluate now is if they have that base using the evolution of the revenue share of different IPs in the last few years.

This is how it looked in 2019, 2020, 2023 and H1'24:

Basically, the share of the IPs that are not in the top 10 keeps growing. And more importantly, so does the absolute amount, which is key. Top 10 properties are usually the ones that are currently more active, or relatively potent IPs that still generate income for a long time after they finish. It looks like IG Port has some interesting stuff going on! Let's jump into looking into their most important IPs. First, I will look into the ones that show up on several year’s top 10, and then into the main one’s currently airing.

IG Port's main legacy IPs

I am not sure legacy is the correct word, but I am using it for IPs that either have had a long run

Attack on titan (Shingeki no Kyojin)

Attack on Titan has to make the list. It is one of the most popular animes of all time. As you can see, it does make up for a decent chunk of IG Port's copyright revenue… but far below what one would expect out of the box. The ¥0.2B generated in 2023 is a far cry from the more than ¥23B generated by Dragon Ball in the same year. Now, Dragon Ball is a different level of phenomenon, but Pretty Cure generated ¥0.6B in domestic licensing alone for Toei (that is, not including streaming or any other form of broadcast). And Pretty Cure is a far less popular franchise. The explanation is simple… IG Port owns a very small part of Attack on Titan's rights. Kodansha and MBS take the lion's share of that. That means that no matter how big it gets, IG Port's participation on it is always going to be residual (but hey, nice profits that can be reinvested!)

Ghost in the Shell

Much less well-known than Attack on Titan, Ghost in the Shell has retained stable popularity for the last 29 years. The revenue share here is, I think, bigger, but the reason we are seeing it riding high is the new productions. IG Port has been working hard to keep the IP alive with the Stand Alone Complex 2045 material, in collaboration with Sola Digital Arts. There is a video game license given according to the latest results presentation, and it seems to be trending well.

The Ancient Magus Bride

Probably the most important property for IG Port in the last few years, with AoT's permission, mainly because the manga was published by MAG Garden. This means IG Port has a much sweeter deal here, and actually didn't even create most of the anime. They make almost as much from it as from AoT, even if this is a fairly minor anime12. The next season is in the works, but I don't know how that will go exactly. I suspect IG Port will still be part of the production committee, but since they lost the manga, not sure what the conditions will be. My guess is that pretty similar to the current ones, as the ¥0.2B compensation paid for the manga contract wouldn't even begin to cover the lost royalties potential. But let's see.

Psycho-Pass

While it is not economically that important, I would like to mention it because it didn't follow the typical path. Psycho-Pass was never a manga, but an anime created with the intention to emulate Ghost in the Shell's success and it was… well, successful! While it originated in IG Port, it was a smaller company then, and wouldn't have been able to finance it alone if it had wanted to. It has been a steady earner ever since, and like with Ghost in the Shell, it is easy to generate sequels.

Haikyuu!!

A sports anime, volley of all things, and pretty popular at that. It has been a decent earner, regaining popularity of late. Currently a film is making the rounds, and its debut was fantastic. Currently it has racked more than ¥4B in revenue. How much of it will go to IG Port is, as always, fairly unclear, but it should definitely contribute.

IG Port's most recent success (and future prospects)

IG Port has been striking if not gold at least silver pretty regularly in the last decade. AoT aside, Psycho-Pass, Haikyuu!! and The Ancient Magus Bride are all relatively recent and successful13. That is not as common as it might seem. Toei hasn't been able to find a new successful franchise since Pretty Cure, back in 200414. Not that it matters much to them, they are busy counting the money Goku brings in. But IG Port seems to be able to keep doing it. And that gives them a stronger financial and negotiating position in future deals.

The latest example of this is SPY x FAMILY, released in 2022. With a film recently in theaters that grossed more than ¥4B15 and its second season released only months ago, it is one of the hottest properties right now16, and only a small part of the manga material has been adapted (about half of the currently published material, and it is still being released regularly).

There is also a lot of hype around Kaiju no. 8, which I think might be even more important, as it has the potential to be a long-running shonen manga (and hence anime), which are the ones that can truly make a company rich, and will be released in April.

But that's not the only interesting project IG Port has coming up:

The One Piece is a remake of One Piece, with the participation of Toei in the production committee, as well as IG Port. It will be released on Netflix. I think Toei will still take the lion's share of the rights (because toys and games can still be based on the original, there are different levels of royalties… ), but it is still a nice project to have.

Suicide Squad anime adaptation. Who knows, it might even work.

Grimm, because we didn't have enough with the American TV show. But it is in collaboration with CLAMP, and direct to a Netflix release.

And many other projects17, some of them looking well.

Why should anyone like an anime studio as a company?

Tough question, and a very fair one. If we pay heed to leaked numbers, MAPPA (Jujutsu Kaisen, Attack on Titan S4, Vinland Saga S2), probably the hottest studio right now, makes no money. And that makes sense!

Anime is not extremely capital-intensive, in theory. An episode takes anywhere between $50-200k to make (and that includes high end stuff like Jujutsu Kaisen). But since the barriers to entry are low, there are tons of studios and of anime produced (with MyAnimeList listing more than 300 as airing right now). That means the power in the relationship (and hence the margins) lie in the original IP owners and the distributors, not in the studios themselves. IG Port's animation business margins are a testament to that.

So yeah, no one should be investing in an anime studio, it is a terrible business. Unless they have a solid base of IP and enough leverage, both in terms of financial muscle and fanbase, to try to get a slice of the pie. And that once they are in that position, they hit gold once or twice (One Piece, Dragon Ball, Naruto, Bleach, Detective Conan…) or silver enough times (Attack on Titan, Death Note, Code Geass, Ghost in the Shell, Fairy Tail, Sailor Moon18…) that you become a powerhouse19.

And that is where I think IG Port is at the moment. They have financial stability, with about ¥6B of net cash, a good pipeline of work, and have been recent fan favorites. If some of their series make it big and they have a decent slice on them, their copyright revenue can double, and that means the profit trebles.

Now, IG Port is not extremely cheap. It has danced around ¥1B of FCF in the last few years20, so it is at about 21xFCF ex-cash. But this year, with 2 successful films already in, and good engagement with several of their shows, probably FCF will be higher. What you are paying for here is the possibility it becomes a powerhouse, and it seems on the cusp of being able to. They have an additional advantage, MAG Garden, which has already provided The Ancient Magus’ Bride and a few other less successful attempts. But as that title proves, when you own the rights a moderate success is very, very profitable. If it is able to effect the transformation they are trying, then a 4-5x run over the next few years is on the cards.

If not, well, I don't see a lot of downside, as they already have an established set of properties that they can keep exploiting as they do right now. The multiple can compress, of course, but it is not completely insane as of now.

I could try to pepper this with models, but that is what it boils down to. They have good properties, financial muscle, a good line-up and a favourable set-up. But it is not a done deal. Personally, I own a position, but below 10%. As for you, well, do your own research and come to your own conclusions… and if you find any landmine I have missed, don't forget to write in the comments!

Which became the favourite film of high-school philosophy teachers everywhere for a few short years, until The Matrix came out.

I calculate FCF as OpCF - Investments, including tangible and intangible ones plus M&A, but not including some asset sales or anything related to financial investments, that's why the numbers will differ from some you will find elsewhere. Mine are a bit more conservative!

And Shōgakukan. And Square Enix. And Akita Shoten. And Overlap… you get the picture. It is still a fairly fragmented market, and MAG Garden is not one of the tiniest ones thanks to its online business. But very, very far from the real big ones.

Well, Kadokawa’s publishing operating profit is still bigger than IG Port’s publishing revenue, so I don’t think they are too bothered by this.

Or rather 出版, 版権 & 映像制作, since they don’t tend to make it easy for foreign investors.

There can be others. Sammy is doing anime investments of late, for starters. So are ISPs like NTT Plala. But most of them have anime-related companies in their group as well.

Well, that depends on the agreements between the original copyright holders and the production committee, but usually if the game or toy is based on the animation, the production committee (well, whoever owns the anime, it could be the studio alone) gets money. And then a portion of that goes to the original copyright holder (Shūeisha, more often than not) on top of their participation on the production committee.

Or Kodansha or Kadokawa….

This simplifies things slightly. The copyright business also includes money that comes from royalties on MAG Garden stuff (small part, about 10% of the total), and video-related income that doesn’t go through production committees. Shueisha can get a cut of revenue, and the studio can get it as well, even without the production committee's share. But it gives a rough idea on how that works.

Kaizoku Oju & Vampire in the Garden. Neither was an outsized success.

Incidentally, that also made investments in tangible assets spike while investments in intangible assets diminished. Basically rights over anime are classified as one or the other depending on who has the video masters, apparently. Fairly puzzling to me.

Its first and most popular season ranks 20th amongst Production I.G. - related animes in MyAnimeList.

And there are others, like Vinland saga or Kuroko no Basket.

Well, World Trigger could qualify as well, being kind.

These two films being released so close together also give us an interesting window into IG Port's take rate. I really want to read the next set of results.

Its first season ranks 70th in fans in MyAnimeList, above irrelevant works like Elfen Lied. Now, MyAnimeList is not necessarily a faithful reflection of revenue, but it does reflect the opinions of the community around it.

New seasons for DNT, Great Pretender, The Ancient Magus’ Bride S3 (as investors)… they have taken on the new season of Ascendancy of a Bookworm (probably without investment)… If anything, too many projects.

Ok, look. I understand that list can be divisive. Attack on Titan was extremely popular, as was Death Note. They still are! But they were short. And there simply is no substitution for the streaming/tv airing revenue for all that material, that also keeps the old one relevant. It is like that old thing about American shows with 10 seasons hitting syndication. They sell more toys, more games, and get more fans simply by being on air for longer.

Pierrot, Toei, Ghibli & maybe, maybe Madhouse & TMS. And in the last 3, conglomerates have a majority stake now. And that's it, don't look, there are no more. I would add that good anime doesn't necessarily make a company rich. FLCL or Evangelion appear routinely in best anime lists all over, and Gainax is still not around. Monster is fantastic, and also irrelevant to Madhouse success. And don't look at Manglobe after Samurai Champloo and Ergo Proxy. Long-running shonen with a sizable royalty stake make a company a powerhouse. That, or Miyazaki being around.

By my calculation of FCF, see note 2.

Enjoyed the read, learned a lot, I had no idea the makers of JJK were not making money, that blows my mine. Each episode in season 2 was so well made, it's S tier animation with F tier profitability. It's sad cuz I can only imagine how much hard work (slave labour) the animators put in.