Square Enix III: Strategy, allocation, valuation

In the final part of the deep dive on Square Enix, governance strategy

In the first two parts of this Square Enix deep dive I went through its less well-known segments (manga, merchandising and arcades) , that are doing really well, and its biggest segment, videogames, which is chugging along, with some good things, but with excessive spending in the HD segment, SD declining steeply and MMO relatively stable.

Here, we will look at their strategy, and especially at their newest strategic plan announced a few months ago, their capital allocation, and finally their valuation. But first let's get to know the current captain of the ship.

Kiryu's new reign

After Wada's lackluster reign (with a total return of -40% over 10 years after the merger even after considering dividends), Yosuke Matsuda took over in 2013. Matsuda focused the company mostly on RPGs, gave the needed space and resources to refocus FFXIV1 after a terrible release and divested the western portfolio (mostly to Embracer2), and also saw the publishing, merch, and arcade divisions grow in the last few years (leaving almost a 6x total return to shareholders). He also started the much-debated investments in blockchain games. But all those returns were achieved before 2021, and we have already seen the pain in that period in the games division. In June 2023, he stepped aside and left his position to Takashi Kiryu3 in what has been explained as a planned succession... but it also came after a run of bad results.

So who is Kiryu and what does he bring? As for who he is, he has been at Square Enix for only a few years (since 2020, to be precise), and he started as the Chief Strategy Officer. Before that, he had been working for 7 years (including an MBA leave for one) at Dentsu, the publicity giant. In the last year, he was running the Dentsu Innovation Initiative4. Before that… I haven't found much, and he was born in 1975, so I guess he did something before 2013. I just haven't found that information! He is, reportedly, an avid gamer and long-time fan of Dragon Quest and Final Fantasy, but as far as I know that only came out after he became the CEO5.

His public comms so far, aside from the ones in conference calls, have been trying to emphasize his love for the games, and he has not talked much about Web3 or blockchain, which has led gamers to have a relatively positive view on him6. He does, however, talk a lot about the internal use of generative AI for efficiency, so we might be just seeing him using the buzzword of the day.

All this to say that I don't have a particularly strong view of Kiryu himself. I am primed to have a relatively negative opinion here, because he joined the company in 2020 as CSO, and the strategic decisions since have been lackluster (in the gaming sector, at least!), including:

Releasing two main FF almost back to back and with little marketing for the second.

Not moving or canceling some releases to avoid cannibalization.

All the crypto/blockchain things (which I have not discussed much because they didn't seem to be a significant part of the use of funds or, of course, revenue, but were very prominent in earnings calls and similar)

Then again, they have also doubled down on Taito, the publishing segment, and the merchandising segment, so not all is bad. Let's check on the plans he has in mind!

2025-27 Strategic plan

The new strategic plan is focused on games, as is normal for Square Enix, and does not set a lot of hard objectives. It focuses on operating margin, targeting 15% consolidated operating margin, without targeting revenue or profit or cash volumes. The objective itself is a bit underwhelming, as Square Enix has hit it 4 out of the 5 last years, with 2024 being the only one which didn't, at 10% and with significant sandbagging (the content account write-downs mentioned in part 2). Aside from that, they target a 10% ROE which, you guessed it, was complied with 4 out of the 5 last years, with 2024 being the only exception. So no absolute numerical targets, only ratios that have been hit regularly. Not a great start, but let's look at the actions they want to take.

Shift toward multiplatform: They were already doing this slowly, but I really want to see FF main releases going to PC/Xbox/Nintendo at the same time as to PS. Nintendo is the one that I'm doubtful about for the most graphically intense games (FF), as it will depend on the capabilities of the new console. Dragon Quest III remake was already released this way and is selling really well despite being a HD-2D remake.

Less games, better quality: My personal opinion is that in this market 2 types of companies can go well. Hyper cost-conscious (PlayWay, Falcom) or really focused companies with not many releases. The era of flooding the market with AA games has passed, I think. So it is good to see them focusing and avoiding cannibalization.

Focus on in-house development: Square Enix's biggest hits have been internally developed games, and their published games’ game has been lackluster to say the least with even relative successes (Outriders) being eventually failures because of the cost.

Look for cross-media opportunities / better IP monetization: At this point, I think you can make a drinking game out of this. No particular plans were mentioned, though (although there is a NieR animation airing). What it means in this case is, I suspect, to increase licenses of DQ/NieR/FF and monetise merch better. Again, something they were already doing well.

Overall, all are good ideas but nothing surprising. They address most of the issues that I mentioned in the prior entry, and that should at least avoid the money loss. There is more in the plan, about reviewing organizational structures (that is, optimizing costs, and in development's case, not making the different areas silos anymore) and bringing the London mobile studio closer to Japan's development, but more housekeeping than anything else. And then one element that would worry me in other circumstances.

If this reads to you like “We are going to buy a new office", you are not alone. But the thing is this move was already announced in March 2023, almost at the same time as Kiryu taking the reins. Guess we can add “new expensive offices" to the list of sins since 2020, but the thing is that the investment was already well in progress when the strategic plan was announced.

Overall my impression of the 2025-27 plan is… positive, actually. There is nothing too outlandish, or incredibly brilliant. No crypto, no we will become an AI powerhouse. It is hey, let's focus on core competencies and spend a bit less cutting on everything else, and move all our games to pure multiplatform, it is working well for everyone else! There are also no outlandish promises for MMO and SD, where they know they are in decline for now, other than keeping at it7.

What do I miss here then? Any sign of ambition whatsoever. All targets are below some of the recent years, to the extent there is any. There is some mention about cost-cutting, but not about the areas or how much. It is true that it is framed as three years to reposition the company and grow from there, as a transition period. If I had to use a word to describe it, it would be mid.

I also miss plans to bring DQ to the West in earnest. But well, guess that is difficult to put there!

Capital allocation: track record and plans

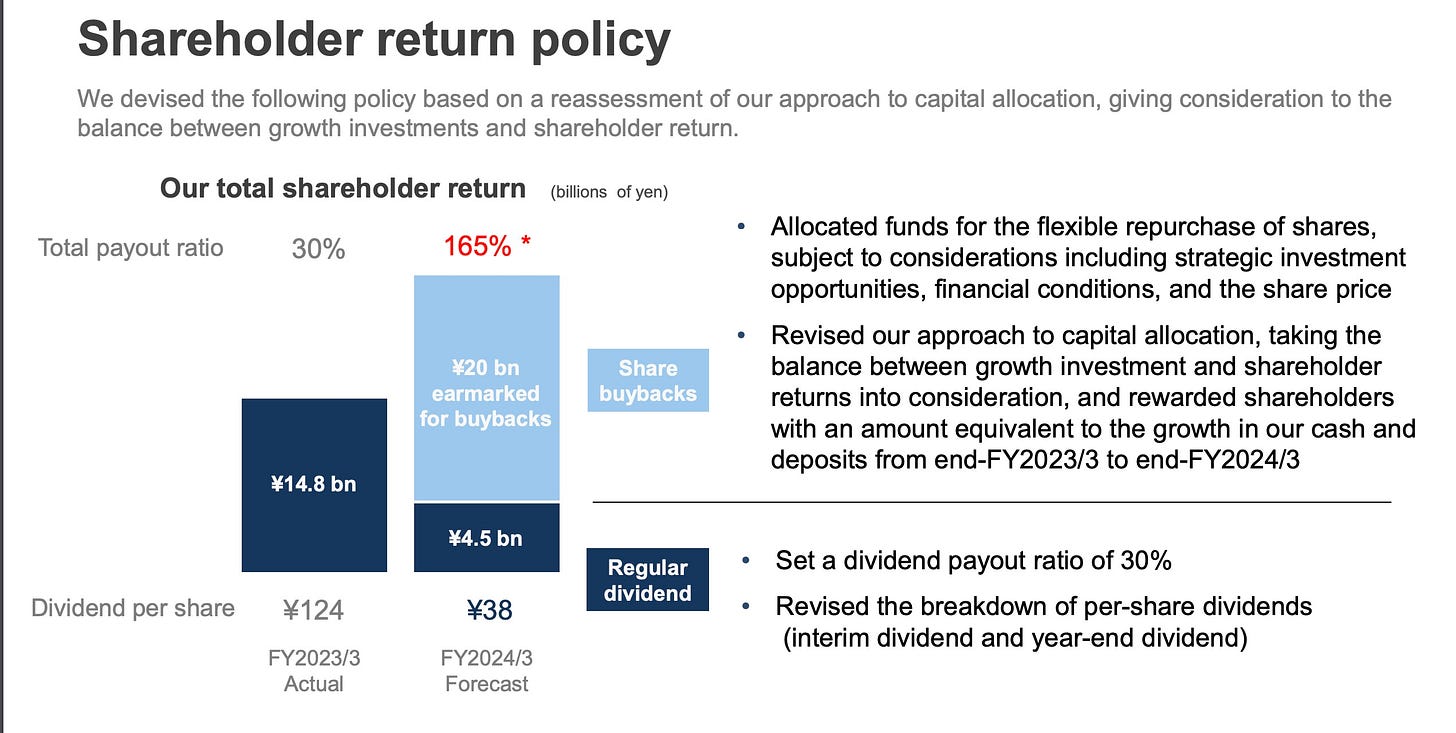

Capital allocation is also mentioned in the strategic plan, but let's discuss first their prior track record and how what is discussed in the plan changes things. Their past track record is not great, but also not particularly terrible. No relevant M&A in the last few years. Instead, they have returned 50B yen as dividends over the last 5 years, have accumulated a further 105B yen in cash and investments, and have invested a few billion more in the business. Their plans going forward seem a bit different.

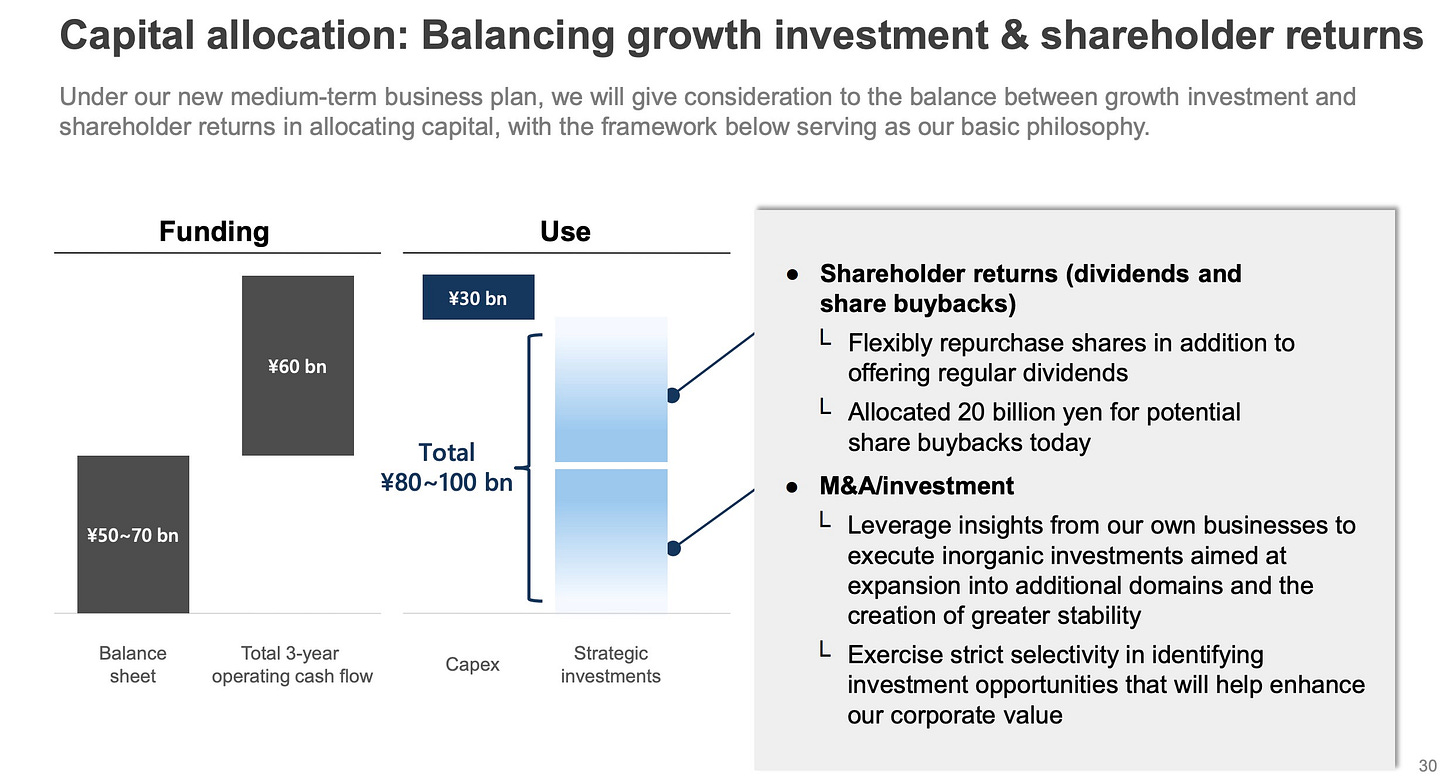

They have an ongoing share repurchase program for 20B that they have to use before May and that is, as of November, untouched. Also, they are planning to use part of the current balance sheet cash for both return to shareholders and M&A if some good target appears. With 220B in net cash and another 20B or so in investments and deposits, reducing that haul by 70B yen over three years is not that impressive, but it is a start. The three-year OpCF prediction of 60B is probably lowballed (they did 92B in the last three years and have surpassed the target in every rolling three-year period since 2016-2018 at the very least), so if they hold themselves to the policy and not to the total number given, they should be returning more or executing more M&A.

As with the strategic plan, better than what was already in place, although nothing truly spectacular. I would love to see them using a bigger part of the cash pile, at the very least.

Valuation

After discussing so much about the business, I guess it is time to put a number on it. And in this case, it is hard.

The other business area is very easy, as they are consistent growers with relatively easy-to-understand drivers. I think publishing might stall a bit, but I think the merchandise (which includes both anime and videogame licensing!) and arcade areas will continue growing at least in the next few years, and I think the 300B tag makes sense (sure, it is for about 20B in operating profit8, which might sound a bit rich, but it is growing fast. 2x from FY21 to FY24, and the operating profit is growing 22% YoY in H1.

Then there is the cash, at around 240B (counting investments).

And then the videogame segment… it is really difficult to value. Using a blended approach based on operating profit makes less sense, as the cash conversion of this segment is worse when investment is ramping up, and also a lot lumpier thanks to the HD segment. SD and MMO are easier and should convert fairly well, but even then they have very different dynamics. SD is seeing a steep decline, as Dragon Quest Walk faltered quite a bit in the last few months. MMO should see a less steep decline and recovery in three-year cycles. HD is anyone's guess, as it depends a lot on the year's releases… but one or two decent multiplatform releases and back-catalog should be enough to make the numbers work. The central scenario I use looks like this.

Now, there are two strong assumptions here:

MMO and SD don't recover from their current downward trend, which I think is most likely (although MMO should see a bump in 2028 in this scenario with a new expansion released). MMO profitability is lower than before, in line with what we have seen in H1, but that should be content expense amortization for the expansion packs (hence why the margin goes up in subsequent years, although not to current levels)

HD does recover profitability and keeps a similar level of sales, once you account for inflation. I think with fewer titles the return to profitability is not in question (back-catalog does a lot here!). Seeing a similar level of sales in 2027 to the one in 2024 is a bit more iffy, with fewer titles. But multiplatform and good promo can do wonders (after all, we are seeing Dragon Quest III's remake sell close to FFVII: Rebirth, if not more).

But I think the first assumption can be challenged. First, Square Enix will probably try to go back to 2-year release schedules for MMO expansions. Second, there are many mobile titles in development and one of them is a FFXIV adaptation (although reportedly without compatibility with the current FFXIV). So I think the scenario above can be taken as a base case with little downside and potential upside.

Would I pay 200B for that base case? Sure. And there is great optionality. Say MMO goes back to a 2-year release cycle making FFXIV/DQX go back to growth, and SD recovers thanks to the FFXIV adaptation, and the next FF goes back to 10+ million copies (which is easier with full multiplatform). Suddenly you are looking at 40B+ operating profit in the segment. Would I pay a lot for that option? Well, I try not to pay that much for optionality, but at the current price (740B yen market cap) you are getting a fairly valued business (if you add up cash, other business and games) plus the optionality of the games segment doing well. Not only that, but I think HD profitability will improve beyond a 10% operating margin, as it is still a fairly depressed one.

Conclusion

Square Enix has a problematic gaming segment with tons of good IP, and fantastic segments elsewhere. I think currently it is slightly undervalued (I have assigned no value to the optionality in the analysis above), but not a super clear bargain. I own a small position, build during the summer (when the valuation was more compelling). If they show signs to walk the walk and actually improve the videogame business, it will be a fantastic investment over time, otherwise it will be only middling.

In many ways this situation reminds me of Sega Sammy, with other business units that support the valuation and a videogames unit that is less than ideal… but Sega was already working on fixing the segment problems in 2023 and with Atlus and RGG doing really good work, as well as doing well in cross-media. It was also cheaper and more profitable, thanks to Sammy. Square Enix seems to be starting down that path, and arguably has better IP to build upon and its other business are of higher quality. But a cheaper valuation or more signs of improvement are needed to make it more compelling at this point.

There is an additional point that also applies to Sega, and it is the value of their existing IP. This might sound silly, but I think AI is going to make content creation a lot cheaper, and that is going to make existing well-known IP far more valuable. After all, content being too abundant makes discoverability worse. Which, for me, is an additional reason to keep track of Square Enix, and even have a small allocation there.

By putting Yoshi-P at the helm!

At what was widely considered, at the time (May 2022), a bargain price of $300 million for a deal including Tomb Raider or Deus Ex. In retrospect, I think Matsuda correctly understood that from 2022 onwards we were going to see a glut of content and it was a good time to exit.

The process was announced in March 2023.

Which seems part of Dentsu Ventures and specialised in forming partnerships with other venture firms and some companies. To be honest, it is not clear to me what they do or did, beyond the buzzword peddling..

What do you expect him to say? That he is a Tales/Trails fan?

He joined the company in 2020 as CSO from a company that already dabbled in Crypto. So personally I think this is all just comms and he probably was pushing for this, but who knows.

Although if I were them I would try to get another FFXIV expansion in less time, given the harsh reception of Dawntrail

25B in FY24, but remember we allocated 5B of the unallocated corporate expenses to these segments.

Insightful conclusion to an insightful series. Thanks! :-)

Square Enix has risen quite a bit, off the back of 3D Investment partners buying 10%+ stake. I can't see the logic in them bidding this up so much. Their cash cow FFXIV's latest expansion Dawntrail hasn't done well. Playerbase is still sticky so it'll continue to be their main cash cow, but these multiples seem nutty. Considering shorting them for the first time in forever.