Quick updates: Games Workshop, Cover Corp, Toei Animation, Sega Sammy and more

A collection of updates on several companies that have appeared here before!

Before starting to talk about the investment side of things… as many of you are aware, I am Spanish. While I live in an area that has not been affected by the floods (Barcelona1, if anyone wants to grab a coffee some time), I used to live in Valencia. While my friends there are, thankfully, alive and well, it is still a huge disaster, with more than 200 dead and some still missing, and areas without access to water and electricity. Volunteers, both spontaneous and through NGOs, are doing a lot of work on this to try to help estabilise the situation and rebuild as quickly as possible. If you have the money to spare, please consider donating to any of the organizations that are helping. Here you can find some:

FESBAL (Spanish Federation of Food Banks) is gathering resources to support the food banks in the regions affected by the floods. It is the option I have gone for, personally.

Cáritas (an NGO linked to the Catholic Church) is also actively participating in the relief effort and receiving donations as well

There are several more options gathered in this notion, in case you prefer to look more.

Thank you.

Cover Corp

Last week I published an analysis on Cover Corp, a vtuber talent agency. Since then, it has gone up about 40%, so I thought it was worth revisiting what has happened to make it pop this much (other than you all bidding on it, of course!). To be clear, I still think it is cheap and has multibagger potential, despite the jump in price. You can also read (or re-read) the original article if you want!

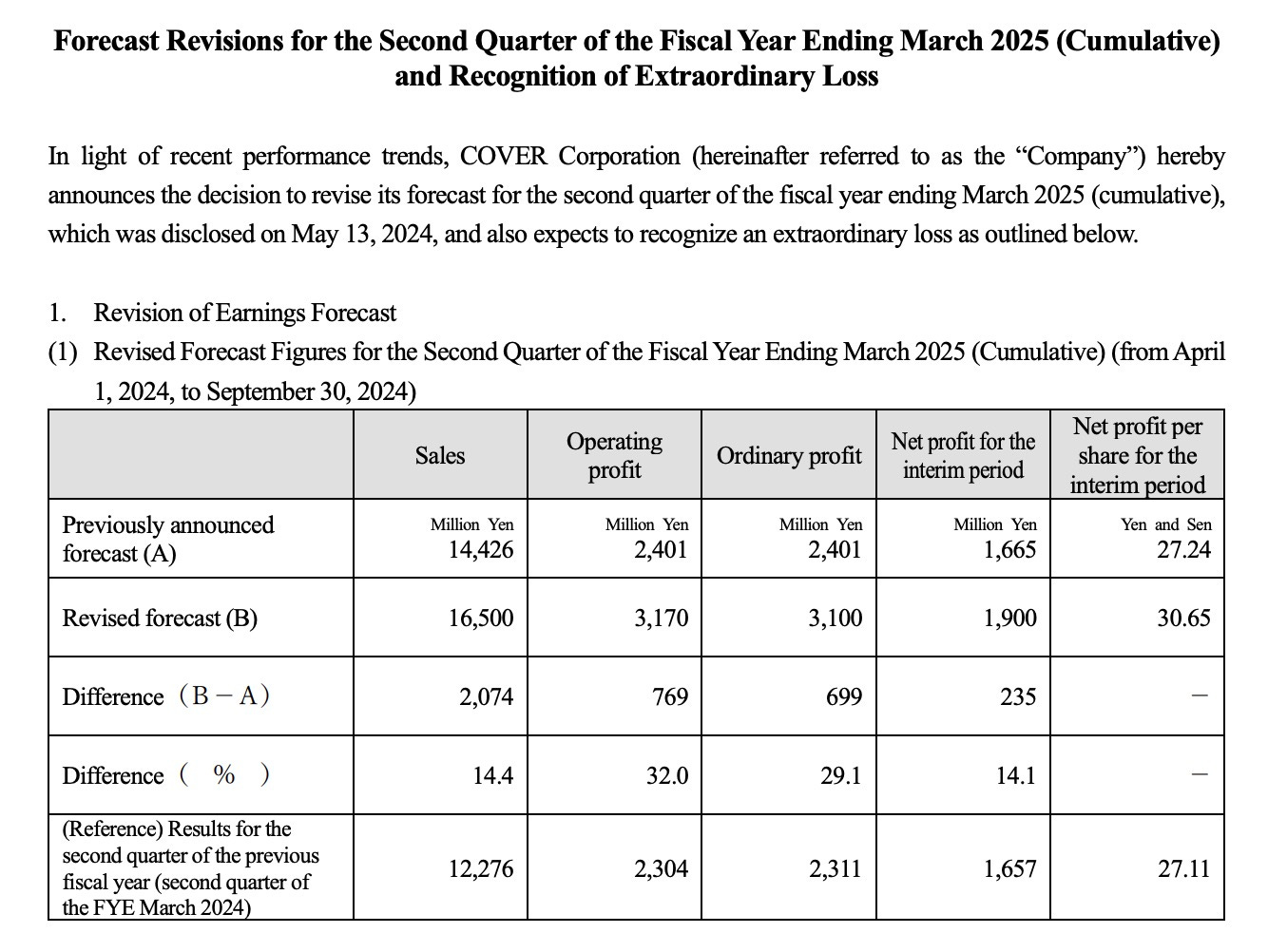

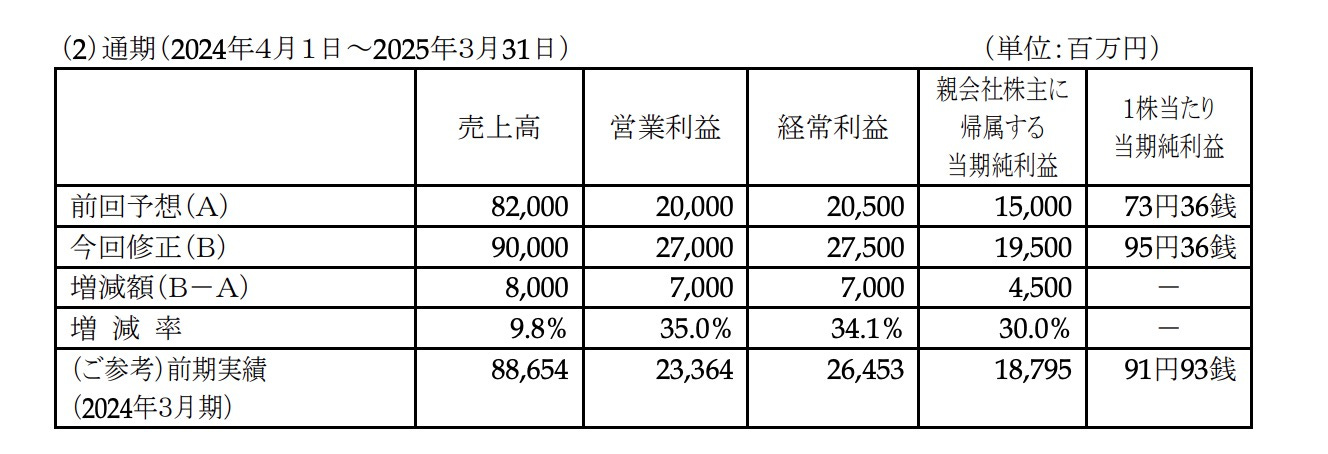

A few hours after releasing the post Cover released an updated H1 guidance (H1 finished a month ago, so we can talk really about a results release ahead of time). 14% up in revenue, 30% in operating profit, and 14% in net profit. What we see here is first a nice bit of operating leverage and then… why is the net profit so low?

The guidance includes an extraordinary provision of 450 million yen (about $3 million) because they didn’t charge sales tax in some transactions in the US and now they have to cover it. This is an 8-year-old company that has started operating more seriously outside of the country fairly recently. It is a bad look, but in a young company that has multiplied by 5 is revenues in the last 3 years… well, let’s just say if you ever worked in one you probably have seen similar stuff. Of course, most companies go through this while they are private.

Anyway, this means they did 2.2B yen in operating profit in Q2, on about 10B yen in revenue. Close to the numbers in their last Q4 (which ends in March). Since Cover has pretty strong seasonality and beating Q4 of prior year is pretty hard (last year only Q4 of last year did it) those are incredible news

One day later, Morgan Stanley initiated coverage of the company with a price target that is basically double of the current one (3900 yen). And that made the stock pop a bit more. This one I heard from Thomas over at Thomas's Innovation Wrap!

And then, on Friday, Cover announced a few new collaborations (aka brand advertisements) in Indonesia and Japan and a project to improve their… live virtual performances? I am intrigued by the project, but the collaborations are what really shows the strenght their vtubers have as influencers.

Toei Animation (and Bandai Namco!)

Toei reported earnings properly, not in some measly advance… and I am going to quote myself, as tacky as that is. Back in May I said this:

The guidance asumes a further 20% drop in earnings. Still well above pre-23 earnings, but disappointing. Now, is that true? Well, Toei famously lowballs their forecasts. The forecast for 2024 was a drop of 40% in earnings (-10% actual). For 23, 4% growth (60% actual). For 22, 30% decrease (15% increase actual). It is almost comical honestly. Considering that, this guidance seems pretty optimistic. And with Daima coming up, I see why, plus The One Piece12 (actually made by Wit, but they get a piece of the action) keeping interest high and bringing new fans to the table. Between this and the 40% drop in price YTD, I am starting to consider it an option!

Their results so far? 20% up. And an updated forecast for the year that is 4% up rather than the 20% down in the guidance… but I think going to be surpassed. The new forecast assumes that H2 is going to be 6% better (in profits) than originally forecasted. For that, profits would have to be 40% lower than in H1, and 14% lower than last year.

And this still doesn’t take into account Dragon Ball Daima, which premiered recently, and Dragon Ball Sparking! Zero, which will probably leave a decent chunk of cash in royalties given the Bandai Namco game sold 3 million units in its first day (counting presales, of course, which given it had advanced access is kinda cheating… but I don’t mind). So if those releases are not driving the earnings, what is? Mostly overseas royalties for both animation and other products from both One Piece and Dragon Ball selling like hot cakes (well, or streaming, I guess?)

Domestic licensing for Dragon Ball is also doing record numbers. Toei is doing just fine. It has gotten a bit more pricey though, going up about 50% from the June lows, at about 34x LTM earnings. Top notch assets with a good history and good plans to keep up the printing machine going with Dragon Ball and One Piece. They have really struggled to find decent new IP, with Pretty Cure being the last relevant one, and that only domestically. It launched in 2004. Toei Company no longer trades at a discount, but at a slight premium of its stake, but not enough for a pair trade (reverse of the one discussed here int he past)

As an aside, the real protagonist here is Bandai Namco. Who sells all those toys that pay royalties to Toei? Who did recently announce a pretty impressive forecast update? And last but not least, who released a Dragon Ball hit game? Bandai Namco revised upwards their annual estimates by 36%, citing mostly Elden Ring and the toy segment sales in Q2 (up until September). Granted, the original forecast was pretty gloomy, and the 10% YoY in earnings the revised forecast promises is not that fantastic. Still, a decent change from last year, and might warrant a deeper look (the stock has been flat for the last 4 years)

Games Workshop

As you know, I have a bit of an unhealthy obsession with Games Workshop’s levels of inventory and SKUs. So let’s see what has been happening with their SKUs during the year…

A 5% drop in available SKUs in the online store, and more or less consistent over time. That despite the new AoS edition launch and The Old World increase in range. At the same time, stocks keep improving, especially in the US, but also in Europe outside of Horus Heresy and Middle Earth, which are pretty niche.

The inventory improvement comes in part from the removal of SKUs, but not exclusively. In general, I think a smaller rotating range and good stock coverage will help Games Workshop sell more, so I hope they are going in that direction!

The truly interesting stuff is, however, in mobile gaming. I have also been tracking how well Tacticus does, being the main Warhammer 40k mobile game, and to say the Space Marine 2 release has been a boon is very conservative.

Granted, it was already going decently well before. It was not the only side-effect of the success of the game. The first edition of the game has had a bit of a revival, Darktide is still above the pre-SM2 CCUs thanks to a good use of a discount campaign taking advantage of the tailwinds of the other game’s release. Rogue Trader also timed their DLC release pretty well to take advantage of the increased 40k buzz, and is also doing fairly well. In general, Space Marine 2’s success is lifting all other 40k games.

Sega Sammy: Turds and raisins

Sega Sammy's last few months have been a bit extreme. We have had a fantastic launch with Metaphor: ReFantazio. It sold really well for a JRPG and a seems a firm GOTY candidate2). The response in Steam (a platform where Atlus games don't sell that much) was stellar, almost doubling Atlus' previous record of CCU with P3R.

Sonic x Shadow Generations also launched fairly decently for a relatively minor title (it is a remaster of a 2011 game with an adventure for Shadow), with good reviews and sales, passing 1 million copies with ease. There was also the relative success of Yakuza Kiwami's switch port, which I think nobody expected, internally or externally.

But then… Football Manager 25 has been delayed until March, which means this year we won't have the typical 1 million copies coming from this series. The migration to Unity is going a bit slower than expected3, and the way it was handled (opening preorders for a release date 1 month in the future, then moving the release date back 5 months a week later) has damaged the credibility of the studio quite a bit. If they had not opened preorders and had set the initial date in March, it would have been bad, but not this much. Oh well, the franchise survived the CM4 transition, it will survive this.

On balance, I think it is net positive, especially since in the pachinko business the latest Fist of the North Star machine seems to have captured significant market share in Pachinko, rather than Pachislot. That said, Q2 is likely to be soft on the consumer side (expected since there were not many launches). Q3 should be the strong one this year!

Oh, and the Yakuza Amazon series? Let's just pretend it didn't happen. Everyone else is already doing it, anyway.

Other brief news

Nihon-Falcom (3723.T) found another reason (celebrating the 20 years of the Trails games series) to issue a commemorative dividend for the second year in a row, doubling the ordinary dividend and bringing the yield to a whopping 2%. Given they have more than 80% of their market cap in cash, I consider that pretty stingy. That said, the 2025 remake of the most beloved entry in the series (Trails in the Sky) for Switch looks promising.

Mandarake (2652.T) continues the trend of lackluster sales updates in the second half of the year that I discussed in the last quick update with only 9% growth in September. Seems like there is no quick recovery, sadly. We'll see in terms of profitability.

Furyu (6238.T)'s last Q was not particularly great, with a drop in profits despite a very slight increment in revenue. Q2 seems similar. The merch/figures business (highlighted in the image) is growing, but only about 6% while purikura (the most profitable business) keeps shrinking slowly. Still think they can do much, much better on the figures business, but it might take time.

Well, not very affected at least. There have been a few problems with trains, and some roads to the south were flooded a few hours ago, but very, very far from what happened in Valencia.

To be clear, I don't expect them to win (Astro Bot or Black Myth: Wukong would be my bets). Not sure if they will even get nominated, with Rebirth there. But it is fun to see their name thrown around.

Not entirely surprised, but I had expected them to just cut features until it was enough to release.

Thoughts on Toho vs Toei in the animation battle?

Toho has other businesses as well but anime IP and monsterverse IP seems to be growing much faster and account for most of their profit.