Results medley: Embracer, Paradox, Mandarake, Toei, Gravity, Hasbro, Square Enix

Quick overview of the latest results by... well, many companies!

In the last month or so, many companies in the geekery area have presented results, and it is about time to give them some attention. Let's start with one of the most recent… which turns out to be one of the most followed and controversial ones as well!

Embracer: record EBIT… adjustments

It is difficult to know what to make of Embracer's results this time. If they typically present adjustments, this time they have gone to town on that. It does make sense, partly at least, but if we review the cumulative adjustments in the last 3 financial years (since they started publishing adjusted EBIT) we arrive at 33B SEK, which is within 10% of their current market cap. That doesn't help instill confidence

Now, most of the record EBIT adjustments presented this time make sense. They are mostly goodwill impairments, related in good measure to the pending sales of Gearbox and Saber, and also to Asmodee. That doesn't mean, however, that removing those adjustments will give us a good idea of Embracer's capacity to generate money going forward. There are too many operations pending.

Overall, and section by section… mobile keeps reducing users but increasing profitability (I still think profitability is overstated due to the reduced investment / aggressive monetization phase), E&S did not do particularly well due to tough comparables, although the announcement of the new LoTR films does something to make up for it (the first will be released in 2026 though1). PC/Console was not great, but we already knew the releases on that Q were a mixed bag (Deep Rock Galactic: Survivor was the main good surprise, Alone in the Dark the main bad one). Asmodee did decently, with some margin improvement driven by the new Star Wars TCG, but not much sales growth.

The most important part of the results looking back is the cash generation (or lack thereof). While Embracer says they have generated Free Cash Flow this quarter (we already know the situation for past ones), I don't agree. If we look at the cash flow statements, they generated SEK 1.8 B from operations, of which about 450m came from WC changes. Then they have spent SEK 1.6 B on tangible and intangible investments, and 168M on leases. So essentially 0 before adjusting for working capital. While it should not be taken into account for a FCF calculation, they also have cash outflows related to prior acquisitions (143 m this quarter, 2.2B in the year)

The reason this was so important before, though, is not so important anymore, though. With the sales of Saber and Gearbox, Embracer is deleveraging significantly, and most of the debt will be put into Asmodee. The other reason this would be important is to understand how valuable Embracer is going forward, but with 2 sales and the break-up of the company in three, that is close to impossible. They did also offer a look at the resulting structure after the transactions:

So if you believe this makes sense going forward, and it will be more or less stable, Embracer trades at about 6.5 EV/EBIT. Not incredible, but not unbelievably cheap either. If you happen to believe CAPEX is understated because of the situation of the assets divested2 and that mobile is overearning right now, it looks worse. They still have good IPs and releases scheduled (Kingdom Come: Deliverance 2 being the most important one), and Coffee Stain is, I think, an interesting company.

But I don't trust the management, and the fact that the scapegoat of the companies’ troubles has been the CFO when the root cause of the issue was clearly (in my view) the CEO's strategy doesn't help. I don't know, might change my mind, but I still think this is uninvestable for me. Valuation Matters has a bit more sympathy for them3 and did a more detailed piece on the results4. Despite all that, I wouldn't be surprised if it goes up in the short term, despite the initial negative reaction. A relatively large percentage of the capital is short, there have been divestments that relieve the debt pressure, and the spin-offs have their public.

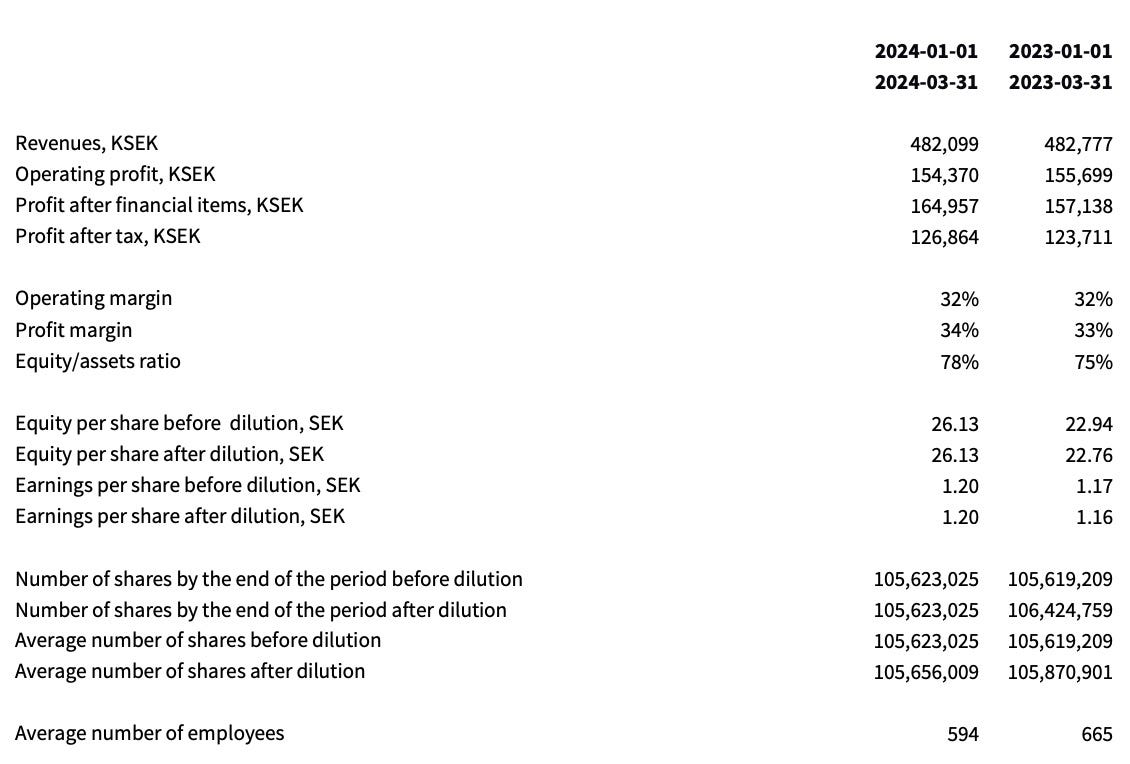

Paradox Interactive

The Swedish giant keeps dropping in the stock market, and has already lost half its value since last August, when things seemed bright with Cities: Skylines 2 and The Lamplighters League in the horizon, along with decent sales and profits on their current catalog and DLCs.

Then The Lamplighters League flopped badly, and Cities: Skylines 2 did not do as well as expected5. The rest of the releases (Foundry, Milennia, Star Trek: Infinite) have also failed to stir a lot of interest6. Not to mention the constant delays of Life by You7.

Meanwhile, the core engine of Paradox keeps chugging along. EUIV and Stellaris are stable, while CK3 and HoI4 keep winning players over… along with Victoria 3 (far from the other 4, but still with a nice install base)8. Cities: Skylines 2 is still not getting there… but I think it will. Despite all the flops, the financials of the quarter are almost exactly the same as a year ago

Look, no growth means you can't command the multiple Paradox was commanding. But keeping stable earnings after so many launch problems? At Frontier Developments they would kill for that! Cash generation looks a bit worse, but once corrected for WC, it is still about the same. This puts Paradox Interactive amazing set-up in perspective. They have such a stable profit base that they can experiment and, as a company, be ok if something fails.

Their experiments don't pay off in a big manner often, though. I think Victoria 3 (2022) probably is in the successful bucket now. Prior to that, they had two major successes with Stellaris (2016) and Cities: Skylines (2015), and a lot of problems in between, trying to expand to other genres.

In the meantime, aside from DLCs to keep the properties updated, they have to manage the occasional generation change. CK2 and V39 are the latest examples here, both pretty successful. The next one seems to be EUV. They will also release a new Prison Architect (sequel, but of a relatively minor property for them) and there is Life by You and Bloodlines 2 there in the horizon, plus maybe optimising the costs to a base more similar to the Paradox of old10.

A very interesting company, and it is slowly getting there on price. Not there yet for me, though. The optionality doesn't make up for the reality of the price tag, and at this multiple I think there is space for losing money still.

Mandarake: no news is good news

Let's take a break from games for a bit and talk about Mandarake.

Fairly simple really. They keep increasing revenue and profits at a steady pace, and showing operating leverage, basically following the path laid out in the original thesis. It is actually slightly below the price it had back then, and I think it is a good opportunity. A cheap yen and a touristic wave are net positives for Mandarake, being an attraction for some tourists and with a solid customer base overseas. Cash conversion is still strong, and I haven't seen plans for new stores. In terms of capital allocation, they keep paying down debt and have done a small share repurchase. Given their debt load,

Not much else to comment, thankfully!

Toei Animation: typically weak guidance

Worse results than last year… but that was expected. Growing 60% is not something that happens every year. The fact that the drop was only 10% is quite impressive. However, the stock was pricey, and still is at a PE of 2611 after the customary drop, probably due to the guidance

The guidance asumes a further 20% drop n earnings. Still well above pre-23 earnings, but disappointing. Now, is that true? Well, Toei famously lowballs their forecasts. The forecast for 2024 was a drop of 40% in earnings (-10% actual). For 23, 4% growth (60% actual). For 22, 30% decrease (15% increase actual). It is almost comical honestly. Considering that, this guidance seems pretty optimistic. And with Daima coming up, I see why, plus The One Piece12 (actually made by Wit, but they get a piece of the action) keeping interest high and bringing new fans to the table. Between this and the 40% drop in price YTD, I am starting to consider it an option!

The parent company, as usual, did worse. The only thing of note is in one of the other documents published: they are talking about reducing cross-shareholdings. So far, the only step taken was Bandai selling their Toei Animation stake (which has not helped the share price action!). Let's see if something else comes out of it!

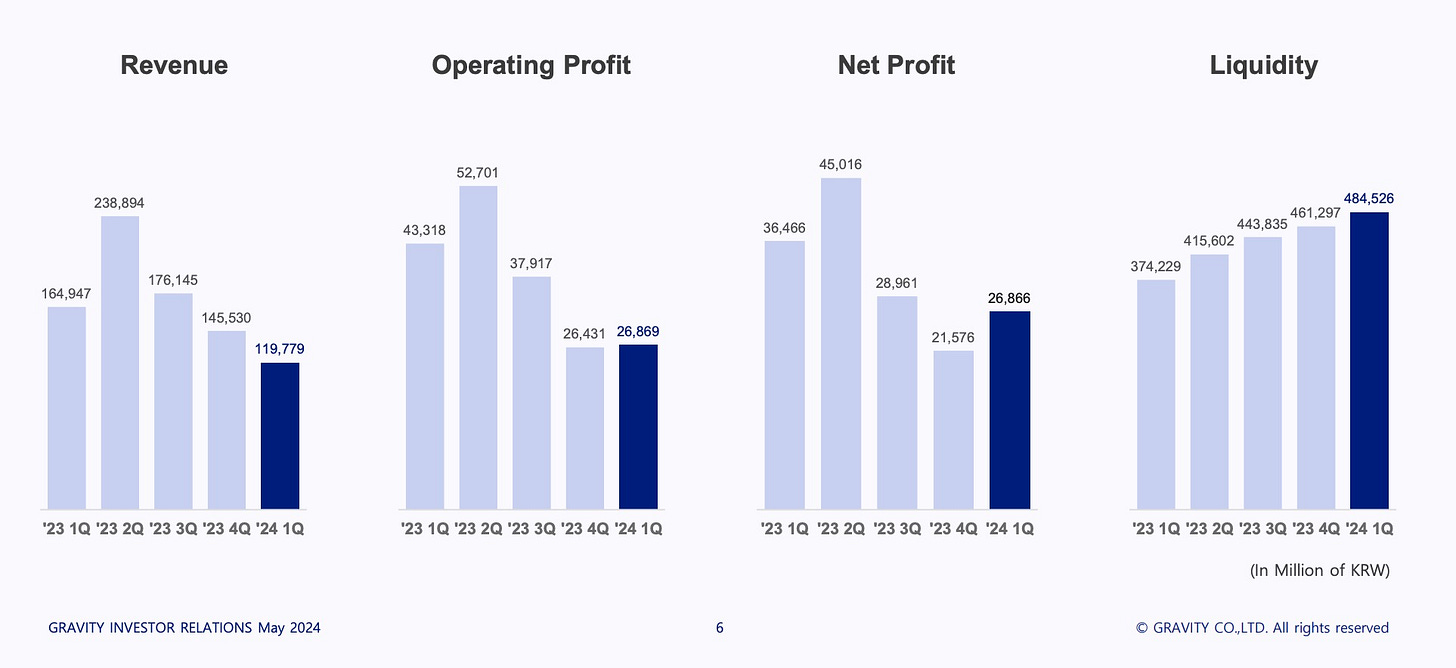

Gravity: GungHo burns cash

Gravity's results were not great. We can see a drop in revenue, and the launch in America (north and south) and China (only a few days) didn't compensate the SEA. Revenue is the lowest since Q3'22. I think a bit more (getting closer to Q4 revenue or even starting the bounce) was expected from the releases. The release pipeline looks decent, and comparables are not so tough anymore, so I expect Q2 to be better.

Anyway, none of that matters for where Gravity trades. Gravity's trading depends on the relative confidence on GungHo doing something with it, wether it is selling, merging, or doing something with the cash. Personally, I think this is getting more likely. The reason? GungHo barely generates cash anymore, and all shareholder returns we see come from their cash pile. They have more than enough, but unless their operations improve a lot, clock is already ticking.

GungHo is increasing buybacks (they already announced 5B more in repurchases for Q2), make of that what you will!

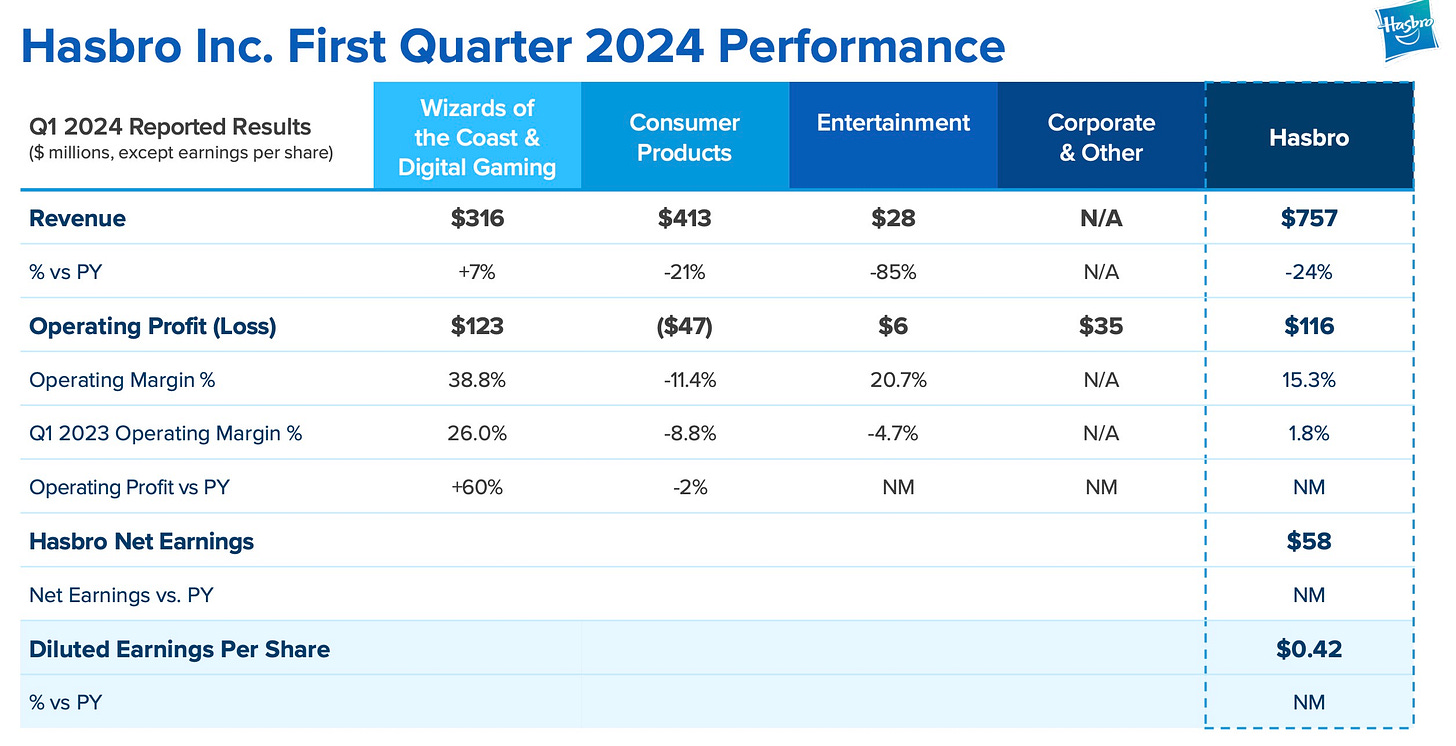

Hasbro: Decent, but pricey

Hasbro keeps shrinking their toy/consumer products and entertainment footprint, while Wizards and licensed games (mainly Monopoly Go! and Baldur's Gate 3) keep doing well, so sales are down big time (24%) but EBIT is up (15%). If I have my numbers right, that means revenue from licensed games is already $82 m this quarter13. This revenue is very high margin and explains why the segment amalgamating this and WotC does a 38% operating margin.

That is expected to come down later in the year (BG3 keeps selling fantastically well and Monopoly Go! is still going strong and likely to do it for long, but they should slowly decline14) and it is sequentially lower than previous quarter. Hasbro is guiding that as well, and a continued drop in consumer (although less acute than in Q1).

Overall, they guide up to $1B of Adj EBITDA, and they are now profitable enough, not like in the past. Given Q1 is typically weaker, it is not a bad result. But then again, $11.5B seems a bit steep, unless you really believe WotC is going to earn a lot more going forward or there is going to be a huge turnaround in toys. I can get behind WotC & Digital slowly going up over time, and Consumer being profitable again, but not at high volumes. I don't know, currently it feels steep and priced for a recovery that I don't see as a certainty.

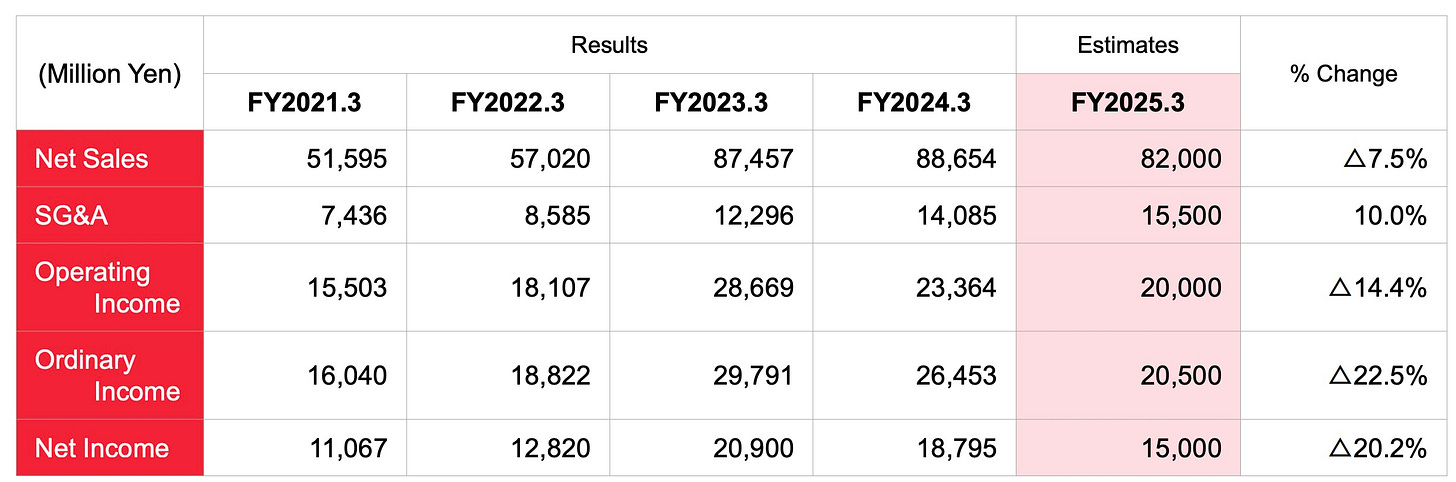

Square Enix

The stock price of Square Enix wasn't this low since early 2020, and back then you would get 107 yen for 1$, not 150. And that's how bad the results were, bringing about a drop of almost 30% in a few weeks. There might be light at the end of the tunnel though.

Let me explain… this year, with FFXVI and FFVII:Rebirth, should have been a banner year for Square Enix. Not to mention Foamstars, which was trying to be a big multiplayer hit. Foamstars didn't do very well, and both Final Fantasy major releases were far form the top sellers in the series15. Their MMO titles (Dragon Quest X and FFXIV) also declined, although the release of new expansion packs in FY2516 should help with that. That combines to get sales only slightly up in the digital area, and margin way down as the costs of those titles are taken into account as they are sold.

In terms of the results of the last few years, Digital has been underwhelming. At the same time, Square Enix has grown decently as a manga publisher (which over time generates a bunch of new IP to exploit in anime and games as well). It is now typical to see 1 or 2 of their volumes in the weekly top 10, and one of their series in the aggregated top 10 as well, wether it is Black Butler, The Apothecary Diaries or Daemons of the Shadow Realm. Profits have been flat over the last few years, but sales and relevance were not, I think.

The Amusement area is also going well, both in sales and profit margin, and merchandising sales (that is, figures based on their IPs) have doubled in 4 years.

These areas put together brought ¥12.3B in operating profit in 2021, and ¥25B this year. It doesn't cover the drop in digital, but helps to moderate it… and it seems like those areas are well managed.

So… why do I think there might be light at the end of the tunnel? Because the problem Square Enix has is they are not commercializing games well, mostly their main games. I have to admit, I've had my doubts in the past, because I was under the impression that the entire valuation of the company rested on FF. A big chunk of the valuation still rests on it but:

FFXIV has been going through a rough couple of years, but without any major expansions since 2021 that is to be expected… and the player base has not shrunk much. If anything, it seems to have slightly picked up, and it is doing good numbers in Steam of late (and I assume it correlates with general interest for the game). Dawntrail (to be released in July) should go well.

While I don't agree cannibalization has been a big part of their problems17, I think focusing on less games is the right strategy for the type of games and experience Square Enix delivers. I hope they keep publishing some other stuff though.

Multiplatform, finally! Guess they got out of the exclusive agreement :). I think Switch and its successor can be a gold mine for them.

Seems like they are focusing on having some buybacks in place. Since there is no signal of them using their cash pile for it, it is not such a big factor. They mentioned potential M&A, and that makes me nervous though!

Well, these are all my musings about the latest round of results. I know, I know, many of these are not even particularly recent, but I think it made sense to cover them. Hope you got some useful information or ideas! And if you are curious about my opinion on some other company, you know where to reach out!

Personally, I think it is a cash-grab and I find it difficult to believe it will be a big success, but who knows. LoTR with Peter Jackson has a lot of pull.

I explained that in the piece about Embracer's breakup.

Although even him pokes a bit of fun

As an aside, I keep recommending his pieces despite my disagreement with the vision there because they have some interesting analytical insights… and also because he is probably the most honest Embracer bull out there, at least publishing. I appreciate the fact that he openly admits the original thesis didn't play out as expected. That doesn't mean I see anyone paying that multiple for Asmodee in the public market though!

Cities: Skylines still has more concurrent users.

All of them seem below 100k copies at the moment. Paradox Arc releases have also been lackluster with Nexus 5x (formerly Stellaris Nexus) being the most relevant one… below 50k units.

Which I think is going to flop anyway.

Imperator: Rome is also experimenting a surprising rise in popularity, but I think far from enough for Paradox to give it proper support.

Well, Victoria skipped a generation.

Paradox had 33-35% net income margins when it went public, now it is at 20% despite multiplying revenue by 4.

For Japan. It is at about 20x ex-cash for a company that has 8x earnings since 2015. With fantastic cash conversion and no dilution.

Funny they have done a serious version of Dragon Ball Abridged, though!

Not disclosed, but last year's was disclosed as $77 million, and they cite 7% growth.

Very slowly in the case of mobile. Monopoly Go! still hits #1 in monetization in the US most days according to Sensor Tower, the only difference is that now it has more days when it is #2 or #3. It is also less profitable than the additional revenue from BG3, as the ongoing spend in marketing is pretty big. You can check how big in this piece by Stephen Totilo, for example.

They are still Final Fantasy games. XVI sold about 5 million copies so far, and Rebirth more than 2 so far.

DQX expansion pack was actually released in the last few days of FY24, but still.

SEGA has been able to grow their JRPGs while competing with them, right?

Thank you, mate. We’ll see how Embracer ends up in the end. If we all always had the same opinion, the market would always be efficient, haha