Results Medley: The War in the Pacific (Toei, Bandai Namco, Kadokawa, Sega Sammy, Square Enix)

Part two of the results overview, focused on Japanese companies

Result season is on us! This time, the focus is on the results of Japanese anime and videogame companies. And as with their western counterparts, for the most part the results have not been too kind (IG Port aside, but I already talked about them1). The reasons are not the same though. So let's go one by one.

Toei Animation (& Co)

A few weeks ago, I talked about the big valuation gap between Toei Animation and Toei Company (with Toey Co being valued below the value of its stake in Animation), and my wish to find a way to bet on it narrowing. Well, I didn't find a way, but the gap did narrow down very, very slightly2, with Toei Company going up 2.5% to Animation's 0.5%. I still think it is too wide, but let's go over what has happened with the companies.

First, Animation has presented absolutely fantastic results. The fact that revenues are only 7% down despite the fact that the comparables included One Piece: Red and The First Slam Dunk is impressive. But as you all know, operating leverage cuts both ways, so that means operating income is down 16% compared to 2023Q3 and 18.5% for the first 9 months of the financial year3. That said, sales and profit are still down significantly, and the stock is still richly valued, despite the slight drop.

If you go line by line, there are some other interesting signs:

Film: Expected to be down due to the release schedule, and is down 10% in revenues and more than 40% in operating income. Expected, and entirely due to comparables, nothing to see here. BUT it is important to mention that the all-important overseas film line (essentially revenues from runs & re-runs all over the world) still goes very strong, with a 6% increase despite the comparables.

Licensing is also down, although not as much. This case is a bit surprising, with domestic licensing going up, and overseas going down. Mostly related with the fall of revenue from Dragon Ball's videogames, I think, but interesting nonetheless.

Sales of goods are up a lot on the back of Slam Dunk's film toys, although it was a tiny segment since COVID

Why do I talk so much about overseas sales in film and licensing? Well, because Toei Animation has been a story of monetizing the popularity of its anime overseas in the last few years both through better film monetization and through licensing, but mostly licensing, while domestic licensing was stable, with its ups and downs.

This is the first year in a long time where in all three quarters we see international licensing down. Now, it is a 7% drop after multiplying by 3 since 2017, and still the second best year in Toei's long history in that regard. But maybe the easy money on licensing is made, and the tailwind

The animation part is, however, under-monetized internationally4, and they seem to be improving a bit on that. Which is good news, but not enough to offset stalling in licensing (about half the revenue and two-thirds of the profits), or even a decrease if it were to happen.

As for Toei Company, sales are flat both YTD and in the quarter. The film sub-segment suffers a lot (as expected, and for the same reasons as we saw before, animation is consolidated as a controlled entity and there was a similar dynamic with releases), but the rest more or less make up for it. Since margins in other businesses are a bit worse, profit attributable to shareholders is 23% down. But the good part is that every other business (cinema chain, hotels, events and interior renovation5).

Don’t get me wrong, I still think the discount is a bit too wide. Toei Co.’s stake in the animation business is still worth more than its current market cap. But… why is the discount narrowing down now, if the results were somewhat worse for Toei Co?

The most important thing for Toei Animation’s market cap has to do with Bandai Namco, really. One of the reasons Toei Animation is so richly valued is the lack of available float. Of course, that is cited many times as a reason for a low valuation, but if the price is going up and the company is well known, as is the case, it can quickly turn the other way. The thing is that roughly 80% of the shares of Toei Animation are in the hands of other Japanese companies. About 38% is Toei, but the rest is spread between TV Asahi (19.6%), Bandai Namco (10.8%), Fuji Media (8%), Sony and Fuji TV (a paltry 2% each). Bandai Namco just announced that they are going to sell most of their stake6. That comes as a response to Toei’s request and will put the company in compliance with the new listing rules, which require at least 25% float to list in the standard segment of the TSE. It will also increase the supply of Toei Animation’s shares by roughly 40%.

Maybe other companies in the cross-shareholding list will follow, so Toei Animation can comply with the Prime segment listing requirements. But well, at a minimum we know that they are trying to get some cross-shareholders to divest, and that supply will increase… and that explains the valuation shift. It also improves Toei Co.’s position as a main shareholder a bit, avoiding the need for them to sell7.

Bandai Namco

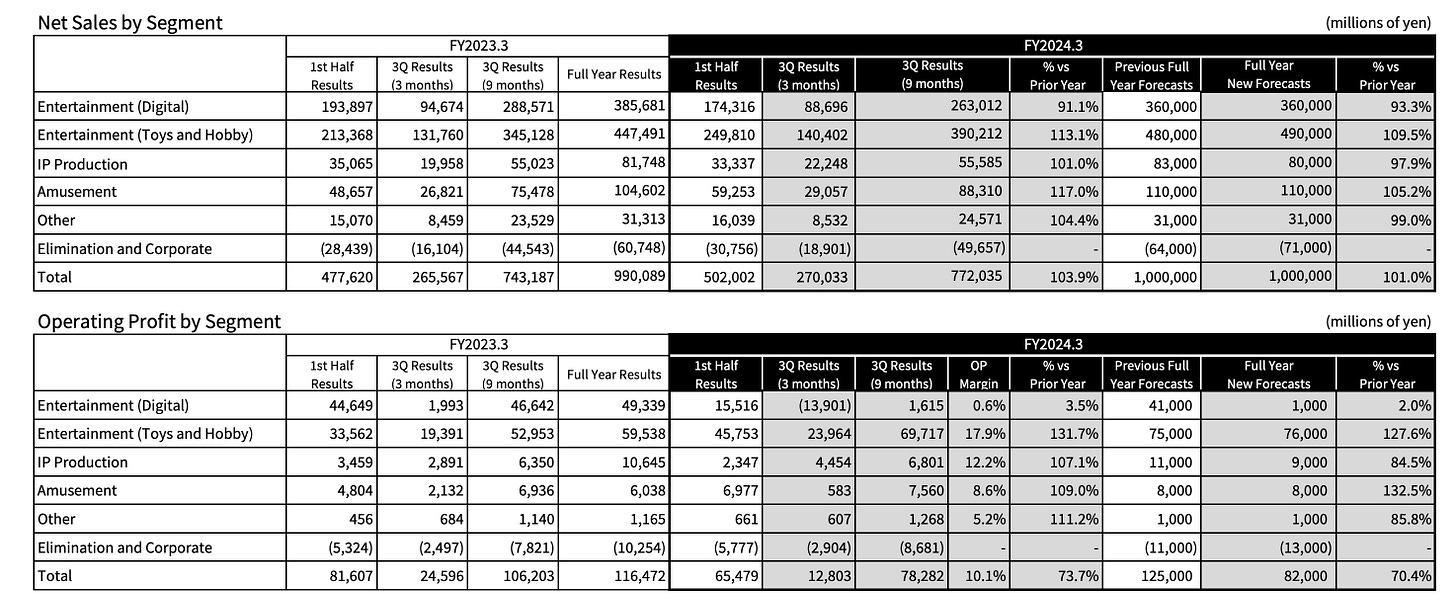

Aside from the big cash infusion (about ¥54B, or about 2.5% of the conglomerate’s market cap) from Toei’s sale, Bandai Namco doesn’t have that much to boast about. And the reason is, as in many other cases, the videogame market. Now, as you can see, full year sales remain on target, vs the previous forecast. So what happened to the videogame division profitability?

The answer is, mostly, write-downs. That does not mean they don't have a real effect… but a write-down of that size is pretty concentrated. Bandai Namco has mentioned the cancellation of 5 titles to justify that write-down, plus bad performance of Blue Protocol in its Japanese release (the western one still pending). Some write-downs are still pending, but already included in the guidance. The full impact of this write-downs seems to be ¥30-40B (haven't seen it disclosed yet anywhere yet), which is pretty significant (Bandai Namco's game development expenses in 2023 amounted to ¥76B, according to their annual report). In terms of number of launches it is not that much, as Bandai Namco is launching 50 titles this year.

As with their Western counterparts, the physical hobby market is going better. With significant improvements vs. last year in the toy/collector market thanks mainly to the strength of One Piece's IP (with a 50% increase). More important is the margin improvement, with operating margins hovering around 17% both for the last 3 and last 9 months, while last year it was around 15%. The division will sell around $3B this year, which proves how strong the anime collectors market has become. There is a fair bit of toys in there, but the increase in margin points to an increase in collectibles. Not only that, but the increase in sales seems sustainable, and they are up about 70% since 2021 (assuming predictions hold)

IP production segment comes without great surprises, as does the amusement (read arcades) one. Although I am surprised at the increase in profitability of the last one!

All in all, the business is solid and healthy, videogames aside. In videogames, the story seems pretty general (pandemic led to over growth of the studios and greenlighting of dubious value propositions, and that has hampered profitability). Let's see what companies recover.

Kadokawa: a year in purgatory

Elden Ring was released at the end of February 2022. While the initial sales were booked in FY22 for Kadokawa, a good part of it was booked in FY23. And that means videogames section revenues and profits are going to be way smaller. They are actually better than expected, thanks to the performance of Armoured Core VI8. But that only means they are going to be half of last year’s profits, instead of a third. That’s not that much of a problem, coming from those comparables9. The video and anime segment is also doing really well, doubling results. The rest of the business (publication aside) are essentially flat when you put them together.

Sadly, the publication business has also hit problems this year. The US has a slight hangover from too much manga in the last few years and, while sales continue to be relatively strong, the channel was a bit flooded… which has meant returns, and lower profitability for Kadokawa. Publication being the biggest business for Kadokawa, that has meant the inevitable profit warning.

International publication sales are still strong, and growing in Asia. They are trying to sell more in Europe as well10 and the internationalization still looks promising, despite the USA hiccups this year and the ebook sales drop. They just bought the creators of Octopath Traveler, and it seems like From Software is looking into becoming a publisher outside of Japan as well. An Elden Ring DLC is coming up in June. And the anime business is doing well.

Now, Kadokawa is not cheap given its profits. At about 30xFCF, it is beyond my usual range. But it is also a story of margin expansion thanks both to growth and better segments gaining relevance. And that growth comes in good part through internationalization and a licensing business from the published material. That has played out correctly before. I don’t particularly like it at this point, because I see better options, but it has its merits.

Sega Sammy: Profit warning and good sales

Not so long ago, I shared a write-up on Sega Sammy here, arguing that the stock was too cheap for its current operations, while also mentioning their launches in October-December had been lackluster (Football Manager 24 aside). Well, apparently that had not been incorporated in the guidance issued in December, and the lack of performance of those new releases caused a profit warning.

Gaming

The profit warning affected the entertainment contents business, and inside it, the sales of new games, with a 12.5% decrease vs. the prior forecast (roughly ¥8B). This comes mostly from Endless Dungeon, Total War: Pharaoh, Persona 5 Tactica and Sonic Superstars not performing particularly well. FM24 has always been a niche game, and can't really cover all four of them underperforming. Like a Dragon Gaiden sold well, but it was always supposed to be a minor offshoot. All four titles failed compared to the expectations SEGA had11.

Now, let's put this in perspective. With all that failure, this is the second-best Q in SEGA's full game sales in recent history in the bought games segment. Once you take into account the full gaming segment, it is actually the best, with ¥70B of revenue. Profitability is way worse, mostly related to the almost ¥10B additional write-downs incorporated in the guidance12. Those write-downs are justified (the games affected are selling way below the thresholds they would need to recover costs), but let's remember the cash outlay has already happened.

The silver lining is the performance of titles released in Q1. Like a Dragon: Infinite Wealth and Persona 3: Reload sold over a million copies fairly quickly (and continue to sell well), and Unicorn Overlord seems to have a decent amount of hype built in. The future line-up, with the nostalgia-charged line-up (Jet Set Radio, Crazy Taxy, etc. - although when they will be released is unclear), the return to content-heavy DLCs in TW:W3 (Thrones of Decay is coming up in April) and a mainline Sonic game coming along with the third movie (Sonic x Shadow Generations), along with a couple Sonic games for mobile titles (one from Rovio, that I don't expect this year), a new Altus franchise (Metaphor: ReFantazio) and Shin Megami Tensei V: Vengeance13

All in all, I don't think the gaming side thesis is weaker as of now. There is only one source of concern, and it is in their Q&A session, with management insisting that all the problems come from the European side. Well, see, 2 out of the 5 big games14 underperforming come from the Japanese studios, and F2P games are suffering a 15% decline YoY after the Phantasy Star Online 2 update didn't rekindle interest and their revenue forecast has been reduced twice, from ¥64B to ¥52.7B… and those are entirely Japan-based. I hope they don't make the same mistakes that happened in SEGA's golden age regarding SEGA of America.

Regarding their Q4 forecasted results… well, it seems achievable to me, but might be wrong:

New title sales might seem a tad optimistic, with ¥28B of predicted sales for the quarter (which would be a record). But they just released 2 games at AAA prices that passed a million copies in their first week, and Unicorn Overlord still is in the period. Plus sales from previously released titles in the year. It is achievable.

Repeat sales are expected to come in at ¥5.3B for the Q. Which would be the worst Q in the last couple of years and the second-worst since COVID. Given repeat sales have been particularly strong this year, it might be a bit conservative. Q4 is usually weak for repeat sales, though, so maybe not that much.

F2P, Rovio and other guidance implies basically the same trends we have seen in the year continue (other ex-Rovio grows slightly, Rovio and F2P continue decreasing for now, at a similar pace

Sammy

The results on the Sammy area are really good. And the profit warning upgrades them… very conservatively and potentially with a bit of sandbagging. Let me explain.

FY 2024 has been fantastic for the gambling business due to the sales of 2 machines in the pachislot (read slot machine) modality (one released last year, and one this same fiscal year). But they have also been relatively solid, with another successful pachinko machine, probably the best performing one released in years, in Q1. Sales of models decay pretty quickly, so obviously they expect a far lower Q4, as the big hits were slowing down. Hence the forecast of ¥16B in sales in Q4 (about 60% of Q3's sales).

Now, I don't think this forecast was completed the day it was released. Only 4 days before, Sammy released two new machines, one pachislot and one pachinko. According to P-World estimates (and here I have to thank @subset_member for sending me that website!) both of them are sitting currently in second position in their categories and seem to be performing decently well in all metrics. They also have a new pachinko machine pending to be released in early March, and the numbers are encouraging (it is the release in that week with the biggest number of planned installations).

With that context… I think that the revenue predictions are very, very, conservative.

Not to mention that the business is supposed to make losses because of inventory write-downs in Q4. The inventory write-downs might still happen, but with the way those releases are looking, maybe the effect will be a bit less devastating for the PNL account.

Resort, Anime, Amusement Machines, Toys…

The rest of the conglomerate put together is 23% of the revenue and about none of the profit, even if we attribute to Sammy and the gaming area all the corporate structure. That is a long way to say that I don't that much about it. But some short notes:

The amusement machines division now is put together with Toys within SEGA Fave, instead of being set within the videogame division. It makes a lot more sense. I don't think it is a prelude to a sale, but oh, boy, do I hope it eventually happens.

TMS seems to be doing well, but given the numbers are mixed in with the toy ones, it is difficult to tell. The only part of this set I hope they don't get rid of.

On the resort business, it seems like Paradise SegaSammy will finally contribute positively, while Phoenix will not contribute in one direction or the other due to reduced expenses.

All in all, yes, not a brilliant quarter and the concentrated write-downs make it look worse than it is. But I don't think it hurts the overall thesis at all!

Square Enix

The Final Fantasy company maintained a very strong guidance for Q4, despite the relatively lackluster first 9 months. They have maintained their level of revenue so far, but on the back of the publishing, merchandising, and amusement businesses, which have worse margins than video games, resulting in a 6.4% drop to date. But they expect to make about ¥20B of operating profit in Q4 (versus 35 the rest of the year). Optimistic? Maybe! But FFVII: Rebirth is going to be released today, and I would be very surprised if it does not sell well.

Foamstars, however, failed to make the impact that was hoped for, and Helldivers 2 quickly knocked it down after a promising start. I suspect they won't run the servers for many years.

Interestingly, they seem to stick to their mostly PlayStation-oriented strategy, despite the lack of availability of PS5 for a while and the fact that multiplatform (or even PC alone) seems to do better in general15.

Since the equity has gone up about 50% in preparation for the release, I am not sure there is a huge opportunity here, unless FFVII: Rebirth does Spider-Man 2 numbers, and that is a tough bet. Don't get me wrong, the equity is not terribly expensive. I just don't see as many catalysts in their release schedule (other than the one mentioned), and I am a bit disappointed with the strategy re: platforms.

Their publication arm is doing fantastically well, but it is not big or profitable enough to compensate if the gaming one does not perform as well, and the amusement center one, while profitable and on the rise16, is far from profitable enough for it as well. Together with merchandising, they make up about 50% of the videogame segment YTD. And that is in a good year for all other segments, and a bad one for the gaming one, and before the biggest release in the financial year.

And that is all I am going to cover today! There are other interesting Japanese companies that have presented results, of course (CyberAgent, for starters!), but the issue is long enough already. If you have seen interesting results in other companies or want to discuss these ones, the comments are open!

And The Old World is still out of stock, as it was when I wrote that piece. Even in the US nowadays.

Although it widened initially, and Astutex gave me a bit of lip about it. Great account though, and superb following of IG Port!

Although for the rest of the year most of the difference comes from Saint Seiya write-downs. Not that they are undeserved, but the rest of the business was working really well.

You don't need to be a genius to think that if the revenue split in film is 40% Japan and 60% RoW the overseas publishers are taking a nice cut. We are talking about Dragon Ball and One Piece here, which are global phenomena, not Jujutsu Kaisen. But international used to be below 50% (until 2019, in fact!) and is slowly but surely increasing share.

No, not a joke. They have a business that does home and cinema renovations. ¥6B in revenue, but only 0.2 in profit

They did go through with the sale yesterday, but in all honesty I didn't want to rewrite that part. Supply won't hit the market until March, and the sale was carried at a significant discount (about 11%), so if Toei Animation does not drop the buyers will have an incentive to sell. Hell, I would probably sell too if I was sitting in $30 million of immediate profits. The whole sale was ¥48B without taking into account the green shoe, which at this time will almost certainly be exercised, unless the share price drops quite a bit in the next few days.

Although the cross-shareholding mess continues. Toei Co. owns 17% of TV Asahi, that owns, in turn, 20% of Animation and 17% of Toei Co.

Also mentioned by Bandai Namco as performing well. About 3 million units, if the leaks are true… and it tracks given the data from steamdb.

And keeping an almost 30% operating margin in the business as well!

Although why they chose to open in Germany before France is anyone

Sonic Superstars is an offshoot of the main series really, and not one of the main games. Why Sega hoped it would sell as well as Sonic Frontiers is beyond comprehension. The rest of them

The increase in ad spending is huge, but is related to the consolidation of Rovio for the most part.

Which was just added to Steam a couple of days ago as a pre-order for June, and is 55th in the global top sellers as I write. Not bad.

CoH3 still counts as new because it was released this fiscal year, but 4 out of the 5 flops were released in a very short span of time.

It seems like the choice SEGA made with Atlus and Ryu Ga Gotoku is being vindicated.

The fact that Bandai and Square Enix are growing their amusement business, and Sega Sammy has a profitable one as well (even if they don't operate centers anymore) is mind-blowing and proof that Japan is a different planet in some aspects.