CyberAgent (4751.T): Ready for the derby

Horse girls and a growing media business. What's not to love?

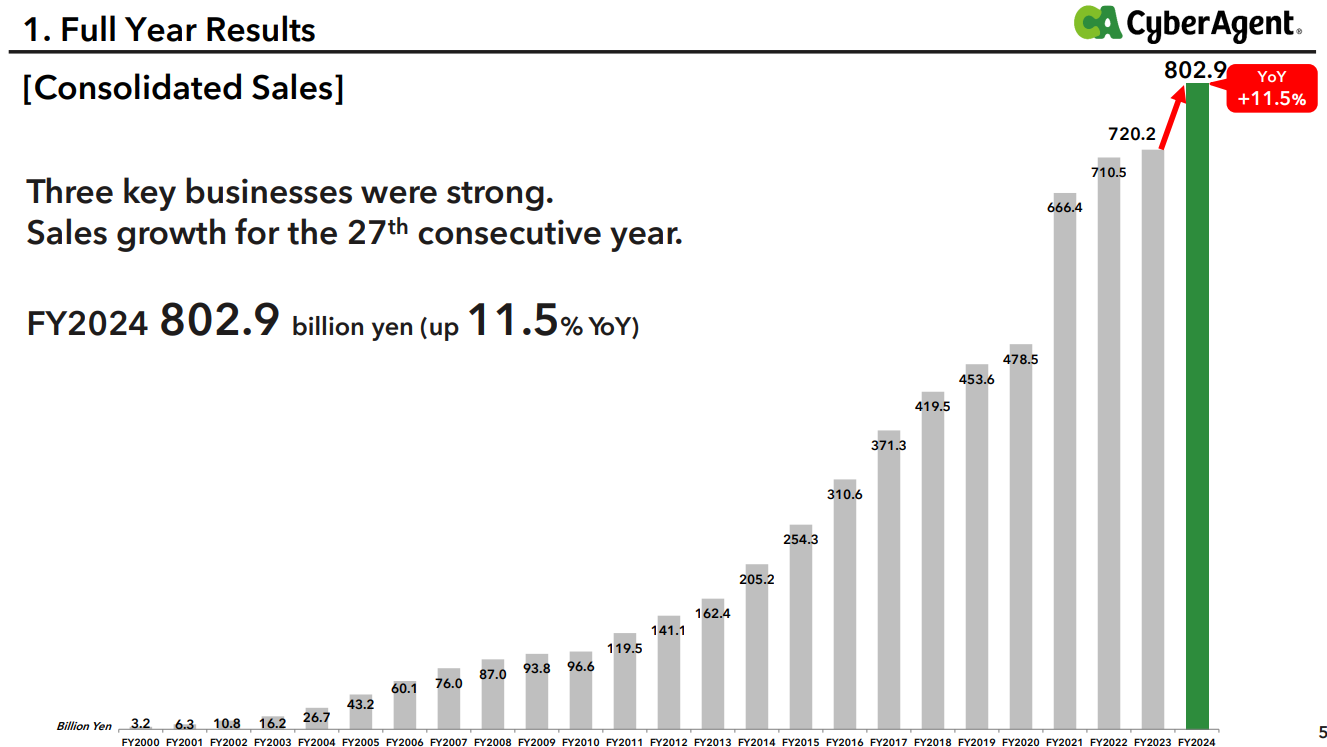

Two things can be true at once, and CyberAgent has been both an incredible stock and a terrible one. Returning 100x from 2003 is impressive. Returning 10x since its IPO is perhaps even more so, taking into account the IPO happened in March 2000 (the literal peak of the dotcom bubble). And then you would be largely flat if you bought from 2018. Operationally, there is little doubt that what CyberAgent has done, thanks to its internet advertisement agency business and then diversification into both gaming and media is impressive

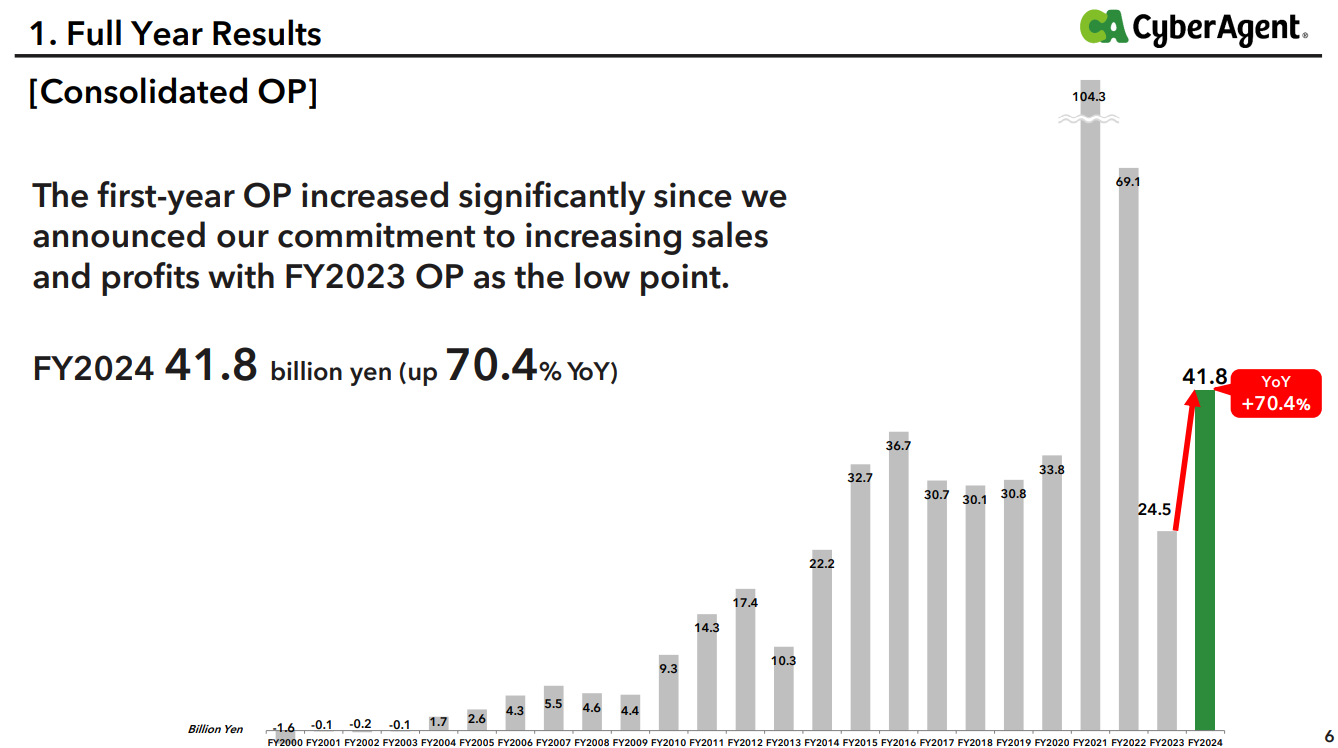

But first they got a bit stuck in terms of profit growth (2015-2020), and then they had a reactionary decline after the outsized success of Uma Musume in Japan (post 2022). I think it can be a good choice again, even if it trades at a crazy-for-Japan 40x TTM PE.

Why?

New (very successful) releases in the gaming segment, after a period of investment, start to pay off.

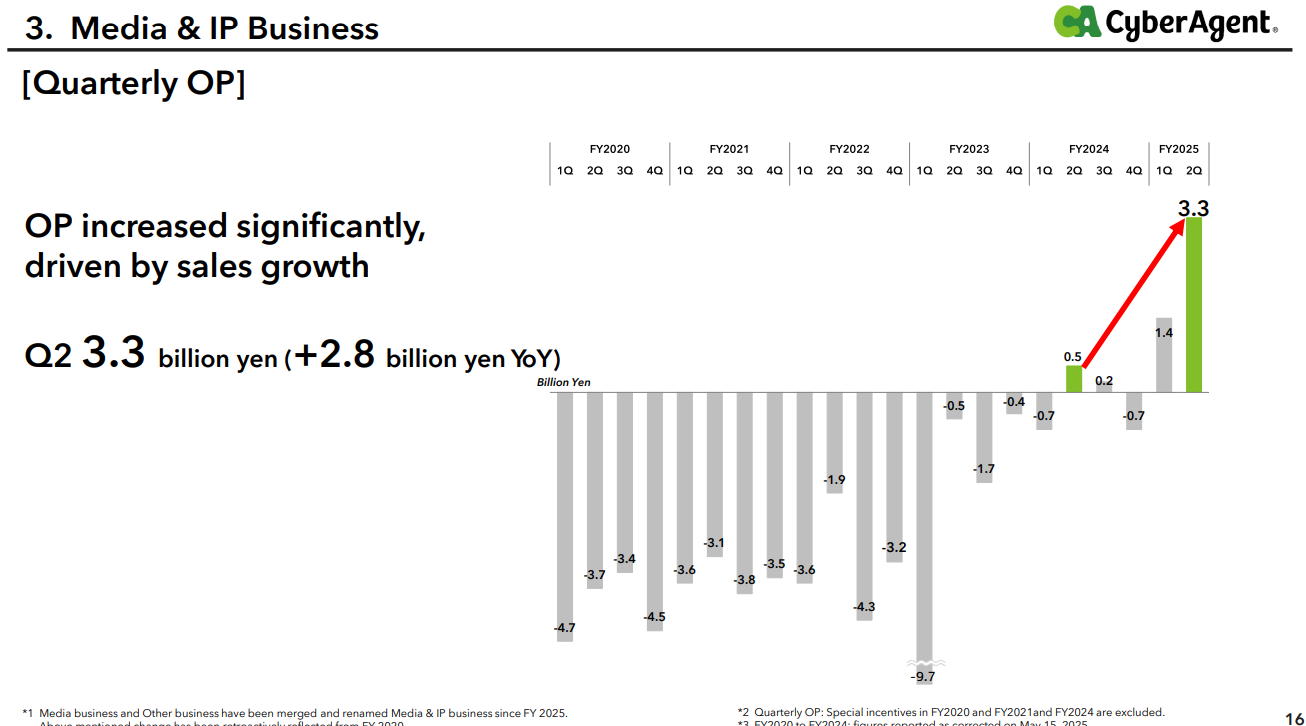

The media & IP segment is no longer a drag, being profitable in 4 of the last 5 quarters (and increasingly so).

So far, only the second reason has shown up in PNL, as the games have been released during Q31. Not all is good, though. The corporate structure has grown a lot, with the number of employees doubling since 2016 and even a relatively small accounting scandal. Let’s go through it.

Why has this sucked in the last few years?

CyberAgent started out focused on online advertising services (basically an agency), a business that it has maintained ever since. Contrary to many other companies in the area, however, they quickly started to diversify through a blog service (Ameba, 2004), starting their investments in media that would culminate starting Abema in 2015 along with TV Asahi. They also have other businesses like crowdfunding (Makuake, started in 2013), a venture capital arm, and even a football2 team in the J1 league3. But what really has shone for them so far is their games division. CyberAgent started in the mobile gaming business really soon, starting Sumzap in 2009 and Cygames in 20114, and it soon became their most important segment.

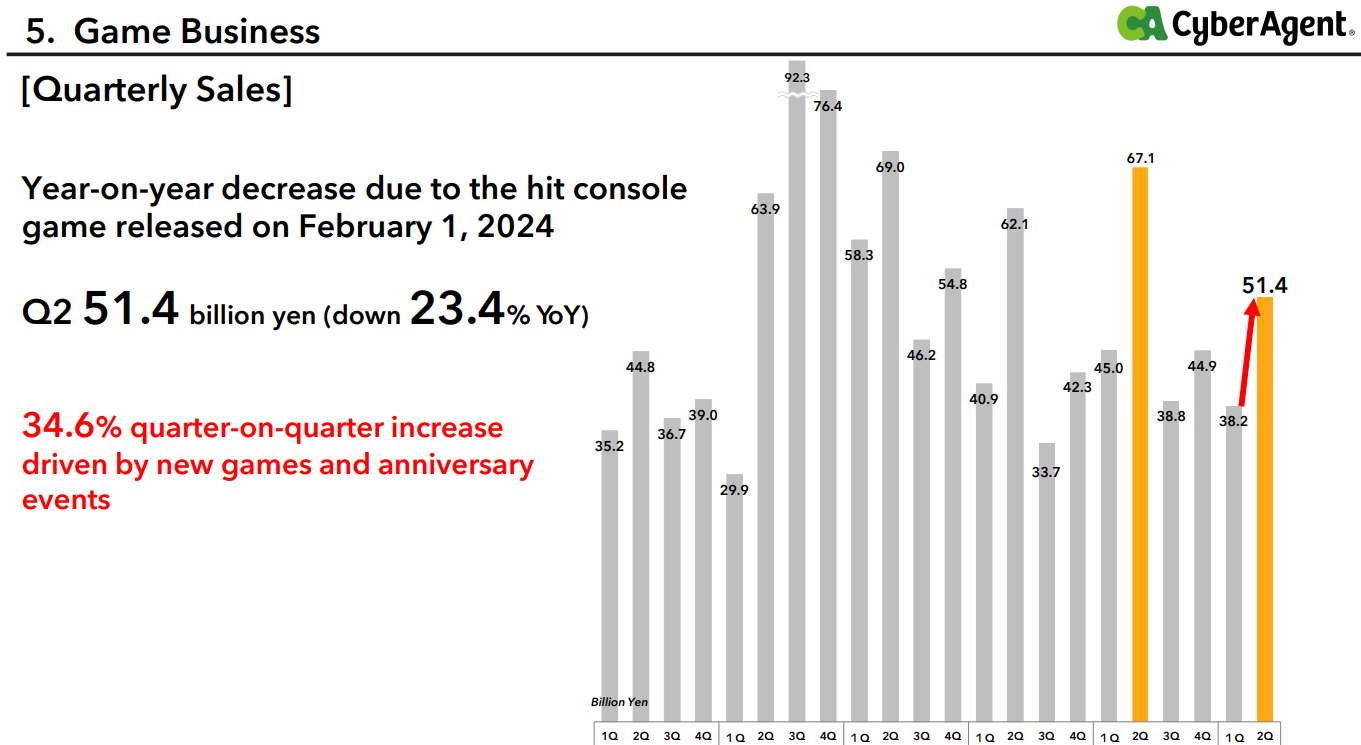

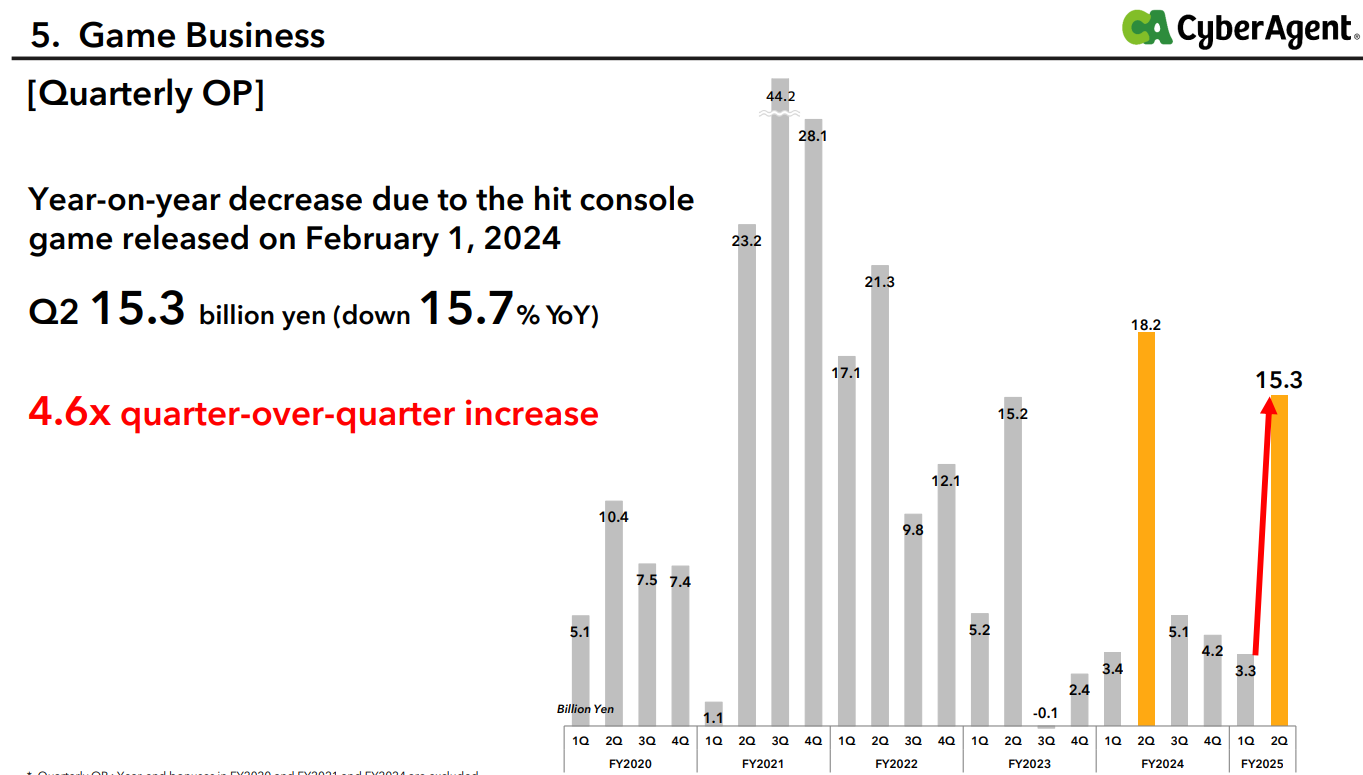

In 2021, they struck gold. They already had interesting franchises (Shadowverse, Granblue Fantasy), but the Uma Musume craze was on a completely different level. In 2021 revenue for the segment shot up 70%, and operating profit more than tripled. But operating leverage cuts both ways, and a 13% reactionary drop in revenues in the segment, plus some increase in costs, meant the segment profit dropped 37% in 2022, and then 60% in 2023, as costs kept increasing and revenues dropping a bit. In 2023 and 2024, while gaming revenues were well above 2020 in the gaming segment, operating profit was well below.

At the consolidated level, things were not much better. Since the start of Abema in 2015, CyberAgent has been investing heavily there. While losses were reduced between 2020 and 2023, they were still pretty significant. And the group’s most stable business was doing decently in terms of sales, but operating margins had dropped from around 8% in 2020 to around 4.5% in 2023, meaning that profits were slimmer.

What was happening under the hood was a wide investment in games and media that would take a while to pay off. It started to turn in 2024 thanks to a very successful console game release (Granblue Fantasy: Relink) and the growth of the media business, which got close to breaking even. The agency business seemed to also stabilize margins, with even a small increase in margins that seemed to signal that the worst had passed5. But that is nothing compared to what is happening on the games side in 2025. But let’s start talking about the advertisement and media businesses to get them out of the way.

Management

In the coming sections, you will see that I am a bit benevolent in some assumptions and the reason is that I trust that Susumu Fujita is fairly aligned and pretty good. Not only is he the founder of the business and the biggest shareholder (roughly 17%), but I think you will see he has proven that he does not care much about the profits of the period, but about increasing the value of the business over time.

I think that is clearly visible in the steps taken in both gaming and media business. The decision to invest in growth in both cases has depressed profits in a very relevant way, in media since 2016 and in games in 2022-24. In both cases, what we have is a heavy investment with a coherent strategy. In media, having a heavy free user base and being the gateway to betting-related content like sports, which puts them in a fantastic position should sports betting be legalised in Japan. In gaming, expanding the capacity of the group to be able to act both as a contractor and work on their own IPs with different types of games at the same time to increase the value and engagement for each IP.

Overall, I see a good direction for the company, and I don’t see them driven by short-term profit seeking to content shareholders.

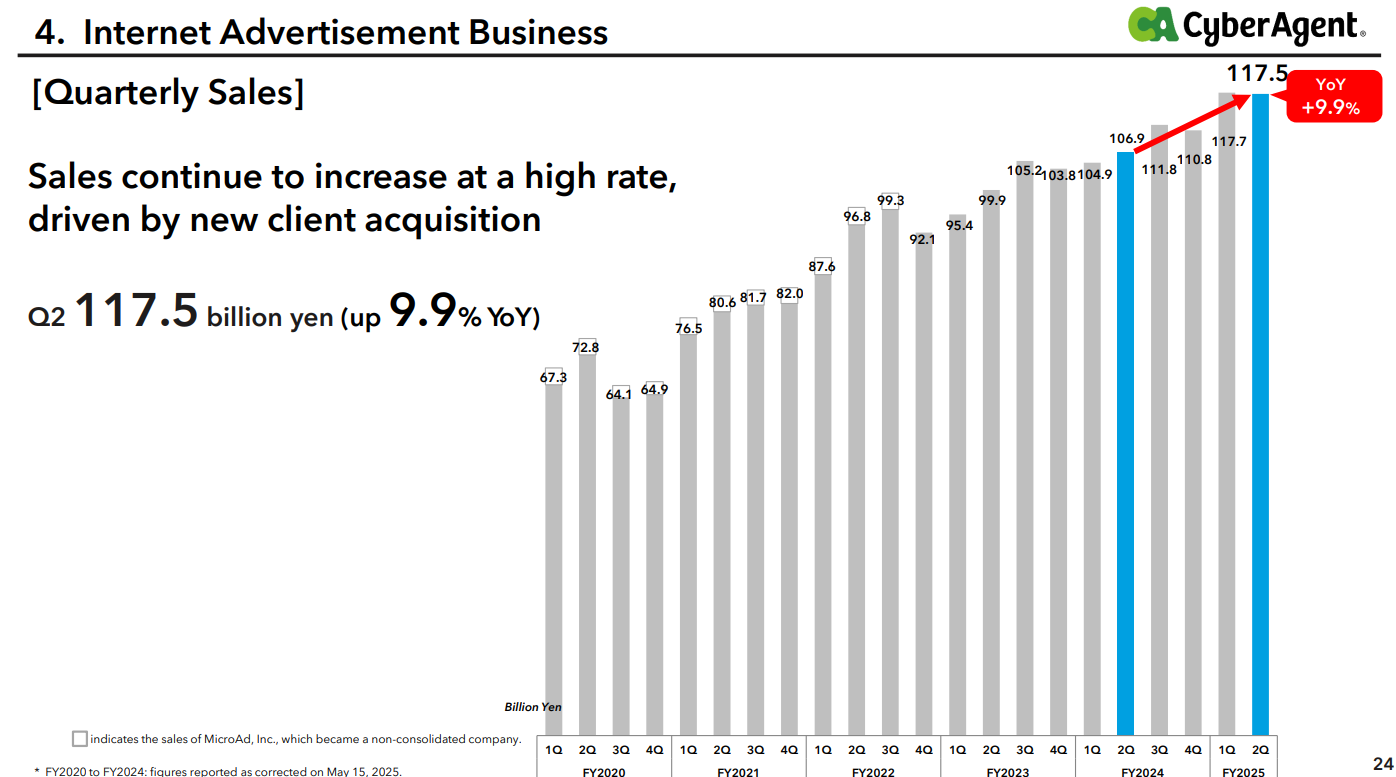

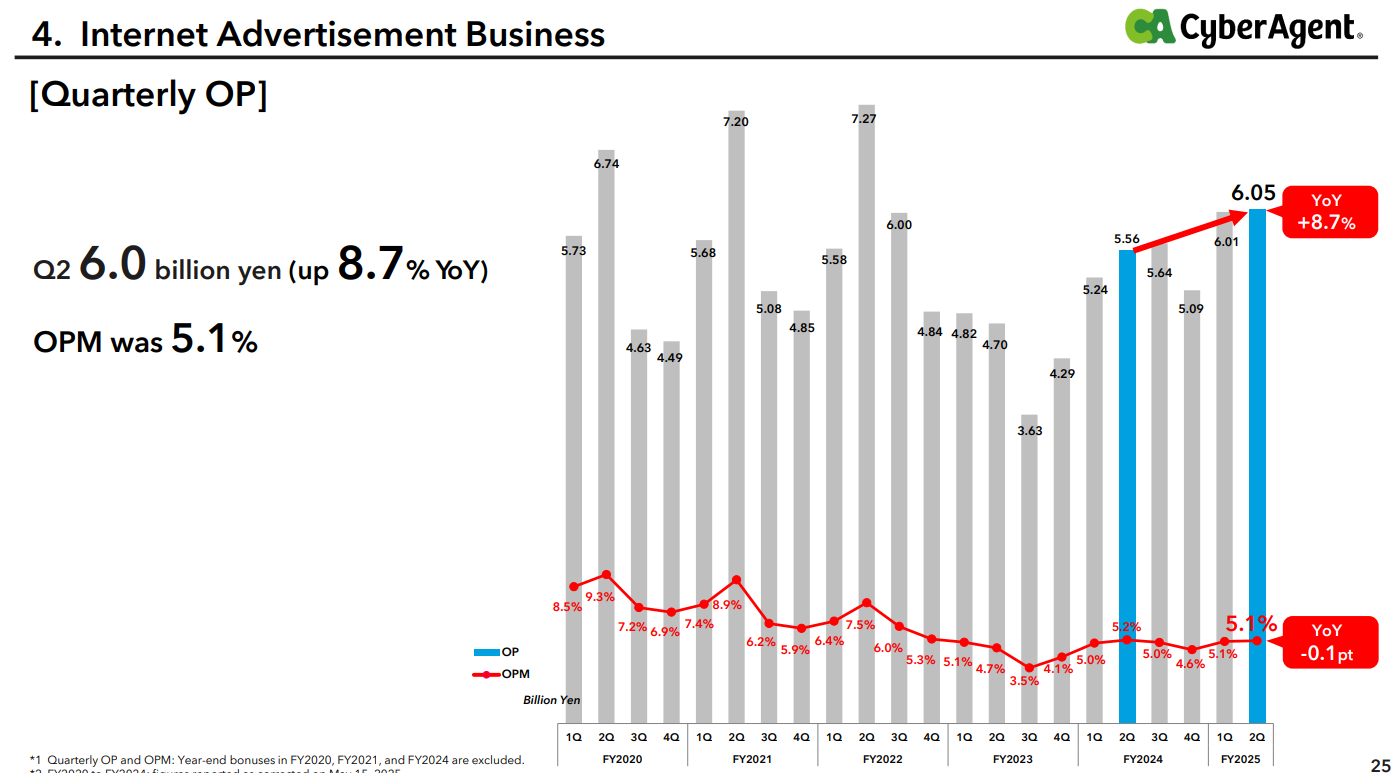

Internet advertisement business

CyberAgent’s online advertisement business has handled ever increasing volumes, but has not produced ever-increasing profits. Margins have been declining since the late 2010’s, but volume increases made up for it for a long time, with profits peaking in 2022. Since then, margins declined more sharply, going from around 8.5% to 5%, being even below 5 in 2023.

That is not surprising. The services they offer (inventory buying, optimization of performance marketing, an affiliate marketing network… ) have become heavily commoditized and, while their escale allows them to have some advantages, they also have a fairly big structure to take care off, making them probably less limber.

In the last few quarters the results have been slightly better, coinciding with CyberAgent showing some restraint on hiring in the area6 despite increasing volume. If that is just a temporary efficiency effort or signs of the abiity to handle more volume with less people remains to be seen.

All in all, I don’t expect this business to improve much. I do, however, expect it to continue generating profits. CyberAgent had about $3B in revenue in the segment last year, which means it is fairly large for a company in this business, and I expect the scale to help despite (or probably because) the commoditization. Last year’s operating profit was around JPY 20B7, and this year is going better (about 10% better).

This is also a major risk area, or so it seems of late. See, on March 26th, an investigation into the accounting practices for CyberOwl, a subsidiary dedicated to affiliate marketing, was announced… and a few weeks later (April 16th), the reports came in. The subsidiary had been inflating revenue and receivables, and doing it more and more every year. From a paltry 40 million JPY in 2020, the amount increased every year until it reached 1.75B JPY in 20248, a very relevant amount and almost 10% of the operating profits of the segment.

Obviously that has affected trust in the company, and it declined in value temporarily, and also provides a window into how hard-pressed the business has been, even in the last few quarters have been a bit calmer.

Personally, the fact that the fraud had to become so freaking large to be detected, and only popped up in relation to a potential M&A transaction where CyberOwl would have been the buyer is extremelly worrying. Then again, probably this will make them a lot more cautious in the future.

Media & IP

Or as it should be called, The Blender, because everything goes in there. Blogging, 20 mangakas living together in an apartment, anime production, crowdfunding, a dating app, and even the football team. In any case, and luckily, only a few parts are important and it is easier to explain.

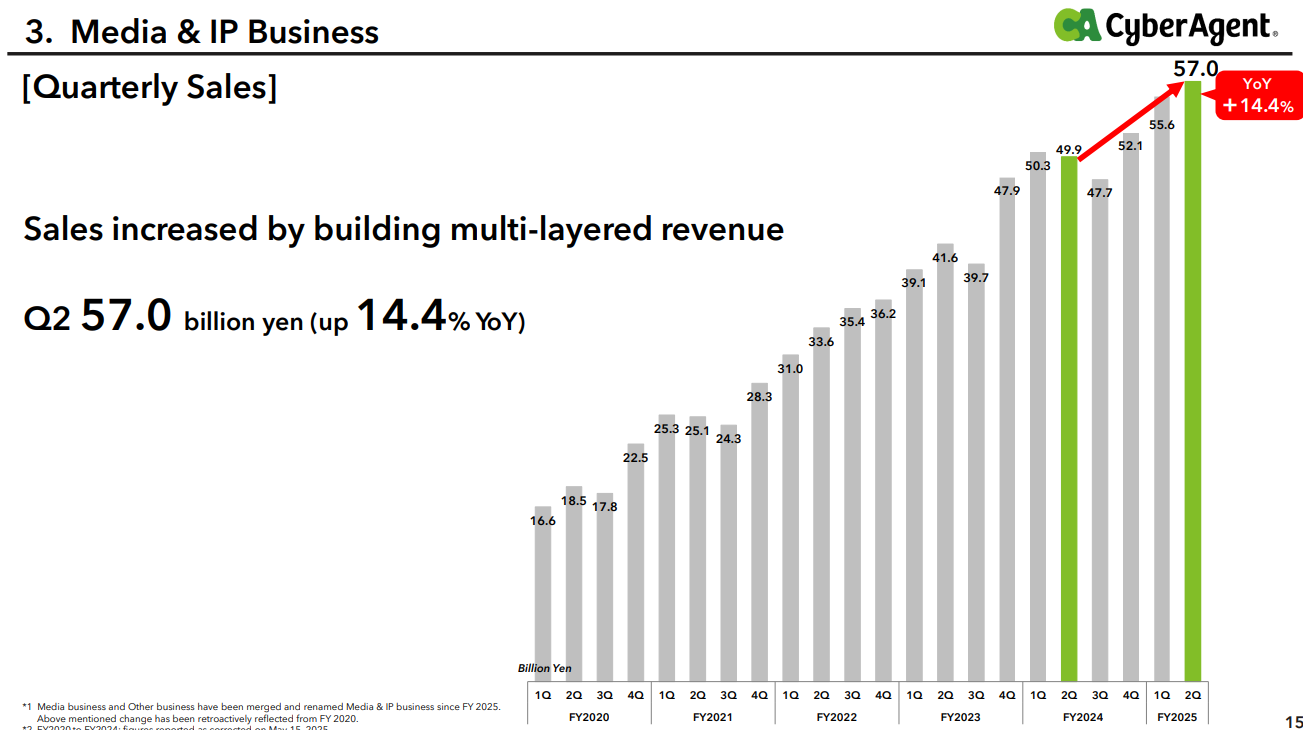

Back in 2016, CyberAgent and TV Asahi9 started a joint venture in streaming, mostly based on an ad-supported model. They have been gaining subscribers and revenue based in conversion to a premium subscription as well, and that is turning profitability as well. From JPY 23B in 2016, the media business grew to 170.8B in 2024, and seems to keep growing (around 12% YoY so far).

This is not only thanks to Abema, but also the result of the ramp-up in content investment in the last few years. Since 2018, CyberAgent has invested heavily into anime, including relatively sucessful IPs like Zombieland Saga or Oshi no ko10, aside from anime based on their properties, like Uma Musume11 and Granblue and in a smaller way, their online blog and webcomics services. But still, the biggest part of it is the increased monetization of the media services.

Margins are still incredibly slim, but growing, and it seems like the company has found significant operating leverage, being able to sustain a increased scale of operations without scaling it in proportion.

This is effectively one of the opportunities here. Abema is not the premier premium streaming platform in Japan, and is very very far from it. It is, in fact, small compared to Netflix and U-Next (about 4.3 million paying subscribers, being the biggest local one). They haven’t published paying subscriber figures for years (since 2020, when they had about 600k), but they have been publishing weekly users, and they oscillate between 20 and 30 million, 2-3 times what they did back in 2020, and sales have increased 4x. Part of it is better monetization of sports events, but well, I think ads and increased premium membership also play a role. A relevant part has also been played by Winticket, their sports betting12 subsidiary, which is promoted heavily in Abema (they have their own channel). It is interesting, but it looks like they are looking forward to sports betting being legalised in Japan as well. And it is normal. Winticket is probably the biggest platform for Keirin betting right now, and they already have the sports rights for many competitions, so they could, in theory, add other sports to the platform easily and promote them as well in Abema. My impression is that it will eventually happen given that… well, there is a lot of betting going on already and the government is not getting anything out of it but I don’t know of any upcoming effort on this regard13.

All this to say that sure, they are not the biggest paid streaming platform, but they can take share by nudging their very wide free user base there, or monetising it via ads or linked services, like sports betting, and they are doing it fairly well. Combined with a decent IP line-up, I think this segment will continue to improve results. It also has the potential to provide interesting IP for the gaming segment or create cross-media hits, like Uma Musume and, to a lesser extent, Shadowverse or Princess Connect.

Games

The games segment of CyberAgent is interesting, partly because it is a bit weird. Before Uma Musume, CyberAgent already had a very decent game business thanks to the Shadowverse, Granblue Fantasy and Princess Connect franchises and also exceptional work on some games made for other companies, like Project Sekai14 or, way before, The Idolmaster Cinderella Girls (so important for the later development of Uma Musume).

Typically, when a company like this hits gold, it starts exploiting the IP like crazy (think Angry Birds or Candy Crush) and usually development for third parties takes a back seat, if it proceeds at all. Not CyberAgent. In fact, they have pretty much dedicated Cygames to their own IPs while Sumzap and Applibot continued developing for third parties. And they have developed for everyone since 2020:

Bilibili/Toho15 - JJK Phantom Parade (2023)

SEGA - Project Sekai (2020)

Square Enix - FFVII - Ever crisis (2023) / NieR Re[in]carnation (2021)

Bandai Namco - SD Gundam G Eternal (released only a few months ago), Gakuen Idolmaster (released in May 2024, made by Qualiarts)

For SEGA and Bandai Namco, those are some of the best performers they have ever had. And this is only a selection, they have been releasing at least 2-3 games of third party IPs and published by other companies per year, while the roster for their own IP has been similar in terms of amount.

But not in terms of direction. What CyberAgent has done with their IPs under the Cygames brand is interesting, and it is a pity they only own 62% of the subsidiary16, even if they have complete control over it. And what they have been doing is expand their IPs reach.

For Granblue Fantasy, originally a gacha mobile game, they did 2 PC/Console games (Relink and Versus/ Versus Rising17), one a classical RPG and another a fighting game

For Uma Musume, aside from content from the main game, they did Party Dash for PC and consoles, mostly a party game that goes well in Switch18

This approach has resulted in a steady stream of revenue (JPY30-40B per quarter) from mobile long-running titles, where the decline in Umamusume and other games has been compensated by revenue from the games done for third parties, although with a much lower margin. That has been accompanied by the occasional non-live-service success (Granblue Fantasy: Relink in Q2 2024).

This year, I think that stream is more or less secure, thanks to the release of SD Gundam G Eternal, which has been very successful in Japan (generating JPY15B in sales according to game-i-daa since release, more than Umamusume and roughly the same as Gakuen Idolmaster, for comparison’s sake). But I think there are better things to come.

Why do I think things are about to change?

Behind the scenes, CyberAgent has continued working on live-service mobile iterations on their main IPs… and they have released two this year. Umamusume has finally gone global with a bang, and Shadowverse: Worlds Beyond is doing well in Japan. Let’s see how well that is.

In Japan, year to date, we see (using game-i-daa estimates) that Shadowverse: Worlds Beyond has generated JPY6B in the last 2 months (since release), and seems to be going decently well still. For comparison, that is almost 3 times as Umamusume’s Japanese version according to the same site in the same period, so it should mean a decent revenue bump.

Now, obviously those are only estimates. But they can tell us that the game is decently successful. But let’s check globally, with Sensor Tower estimates. Umamusume’s global version is estimated to have generated $22 million in the last month in mobile. And then we have Steam. According to Gamalytic’s estimates

Umamusume’s global version has generated around $30 million in sales since release (less than 2 months), and is still going strong19

Shadowverse’s Steam version has generated around $13 million, although in this case sales are clearly decreasing20

If we stick to the theory that SD Gundam is enough to get earnings and revenue to its preexisting baseline, compensating the decline of Umamusume JP and other games… well, this is a lot of additional revenue, and with good margins, as both of them are own IP and development. It is difficult to model what will happen, but I will be surprised if we don’t see game operating profits close to JPY20B in Q4 (July-September) with the sales we are seeing now. And that in turn would imply a massive company-wide revision given the current forecast.

Granted, it is difficult to defend the company is trading on this forecast, especially given the profit metrics are likely to be beaten in Q3, given the success of both releases’ initial days and the full quarter for SD Gundam. But I don’t think the full extent of these three releases is being taken into account, even if Cyberagent only owns 62% of Cygames (which develops Umamusume and Shadowverse).

There is an additional factor: Profit margins for Japanese revenue should keep improving. Umamusume, the biggest earner so far, was adapted to alternative payment methods only for part of the last reported quarter… and it seems the policy is to apply it as well to all new releases, so Shadowverse: Worlds Beyond should benefit.

Out of curiosity, DeNA should also benefit from this, as they own a sizable stake in Cygames (around 20% according to the latest annual report).

And the long term?

Both Shadowverse and Umamusume’s global release are mid-term boosts if things work out decently, and they should boost things for at least a couple of years. What will happen later, nobody really knows.

There are more games in the works in which I don’t have a lot of faith (Project Awakening has been delayed so many times already, and there is not much out about GAMM - although if you ask me I think the second will be more important, just based on vibes), but truth be told, the important part is mobile, and they tend to announce games without a lot of advance notice21. For me, the important part is the trend I see of consistently working in highly successful titles, wether they are in their own IP or others… and little by little expanding internationally.

They still have two of their main IPs (Granblue, Princess Connect) pending some revitalization work on mobile, aside from whatever new that they can release.

Summary

CyberAgent has a formerly unprofitable business turning around in media22 and new releases going better than expected in the mobile side. Both businesses have significant operating leverage, and I don’t think the price takes into account how big the effect of the new game releases is.

So… I am long CyberAgent now, let’s see how that goes. Let me know what you think!

Other news

Haven’t made a half-year post to discuss performance or picks, so let’s talk about a few things

I sold Creepy Jar a bit back, in May, at around 430. That’s a decent sell, almost 50% up from the price when I first discussed it. It has then continued to climb. Personally, I wouldn’t hold until release, but hey, presales are doing well.

I do currently hold a position in TV Asahi, started in late May, as I mentioned in April I would likely do if there were no further news (basically just wanted to make sure the market would take the extra liquidity before buying)

I do have positions in both Anycolor and Cover in the vtubing space, in case the discussion here was not clear. Both have been doing well, but I have to say I am amazed at the numbers Nijisanji (Anycolor) is doing in English after their prior problems. That, and that VShojo blowing up, should make things easier for both of them.

A few weeks after opening the tracker position in Mandarake, I mentioned here, I sold it after metrics deteriorated again at a small loss. Haven’t looked at the company since, because it seems likely that I will end up doing something dumb again.

Not a change, but I think tinyBuild is even more interesting nowadays after the release of The King is Watching. It is not a huge game, but it should help a bit with the cash flows until the release of Kingmakers in September. In my view, that relative success (minor one, has to be said) reduces the likelihood of an equity raise before the big release. Doesn’t eliminate it, of course, and it is still a high-risk position.

As you can see, my publication rhythm is slow right now, and I expect it to still be so for a while. Hopefully it can pick up in a few months, but right now, not a lot of time free to dedicate to this! But in any case, I am still open to discuss stocks in this area. If you have any interesting situation you want to discuss, don’t be shy and drop a message!

Q3 meaning April-June, in this case

Soccer for the US-afflicted among you

It is irrelevant for the business as a whole, but I find it funny that they bought the club in J2 in 2018, then it went on to be promoted to J1 in 2023, and finished third in 2024, which means they will probably compete in continental football in 2026 (Asian continental competition windows and its interaction with the J-league windows are interesting to say the least, as any Footbal Manager player will be a ble to tell you). 2025 was a bit less successful, with a 6th position, but only 6 points away from the winner. Definitely a top-tier side that should see plenty of continental football. Incidentally, prize/participation money for asian continental competitions seems to have tripled in the last few years, looking at the new competition regulations (elite, 2) and money in J1 league has also increased, with total club revenue going up going up roughly 50% since 2017 (see 2025), driven largely by ticket sales, merchandising and continental competition money. CyberAgent’s team, Machida, is a money sink. It has broken even every year since CyberAgent took over but that is only thanks to their overly large sponsorship income, of which CyberAgent shoulders a large part. Not very relevant to the group as a whole (CyberAgent probably sinks here less than 1B JPY a year if you consider the arms-length transaction price), but still interesting, so I wanted to leave it here for the football curious among you! I think over time it has the potential to be interesting if football in Asia keeps growing, propelled by the growth in both gulf leagues, Australia, Japan and Korea, but a very minor point!

The iPhone was released in 2007, and games in smartphones would take a bit to really take off. That said, the first few games of Sumzap were actually made for feature phones, not smartphones, using platforms like mobage. Other times.

Unfortunately, part of that recovery was fake. CyberOwl, an affiliate marketing subsidiary of CyberAgent, was faking its accounts inflating receivables. After correcting for that, margins did indeed recover slightly, but less than initially communicated. Still, the worst seems to have passed.

The maximum number of employees so far was reached in Q3 2024.

22.2B were reported initially but… well, keep reading.

Funnily enough, no corrections reported for Q1 2025, despite it being reported months before this came to light. Which tells me they knew a bit in advance and took their time to report it publicly. I don’t like that, obviously, especially since the internal timeline points to matters coming to a head only on February 10th and the report was published on January. Performative measures (30% temporary pay cut for the CEO and CFO, and all that) don’t make up for that.

Coincidentally, another one of my holdings. You can read about the investment case here.

They are also involved in Jujutsu Kaisen, via Sumzap, but the percentage seems tiny.

Funnily enough, due to mismatches in timing, Uma Musume’s manga and anime versions were the first things that went public with a very wide margin, with the manga starting publication in 2017, and the anime in 2018. Initially expected for 2018, the game wouldn’t see the light of the day until 2021.

For now, they mostly cover Keirin (a weird version of indoor cycling). They tended to disclose the volumes this business made every year, but they stopped mentioning it in 2024, except in the Q&A

There have been reports from time to time, but for now they are tightening anti-gambling laws

SEGA’s mobile F2P flagship until P5X was released in Japan

Toho is the main owner of the IP, Bilibili ended up being the publisher for some reason.

DeNA owns more than 20%, and Nintendo around 5%

Not developed internally

Also not internally developed, Arc system works sure gets a lot of work from them.

$5-6 milion a week. It has dropped to around #15 in the steam global top sellers after the last programmed event for now has finished… that’s still fantastic, but likely to net half as much as before or less. There will be other events, though!

Less than half a million a week according to the last estimates, but Shadowverse’s revenue is more lumpy.

Shadowverse: Worlds Beyond was announced in late 2023, the international version of Umamusume in 2024 and third-party IP work (like Gundam or Idolmaster) is sometimes not even announced in advance (as was the case with these last two apps)

In aggregate. I fully expect Abema to still be unprofitable and Winticket being the area driving the improvements, but this is not disclosed since 2024.

Hi,

Good to connect. I’m new to Substack after trading in my PPE and tools, and I now write about markets, risk, and the stories we tell ourselves to stay comfortable.

After the Close is less about prediction and more about process — discipline over drama, and thinking clearly when the screens go dark. The writing is partly a way for me to slow things down and stay honest, especially in a space that tends to reward noise.

If you ever have a moment to look through it, I’d genuinely appreciate any feedback on the process. Good or bad is fine. I can handle it.

Cheers, Andrew

Thanks! Something new to share about Games Workshow and its FY 2025 Annual Report?