TV Asahi (9409): profitable TV station below the value of their holdings

And how the price might catch up to the book value

In my recent deep dive into the anime industry, I dedicated one of the sections to talk about national anime distributors, that is, TVs, and TV Asahi was one of the companies mentioned there. I think it deserves a more detailed article because, let’s face it, it is ridiculously cheap. That said, in the truest tradition of Japanese value stocks, it is difficult to say when that cheapness will turn into returns. But I think there are several potential ways this can play out, either through better capital allocation or results improvement. But let’s talk about those assets first.

Assets: Cash, land, cross-holdings, and affiliates

TV Asahi is one of those companies that publishes all1 its reports in English as well, which means we can read their balance sheet!

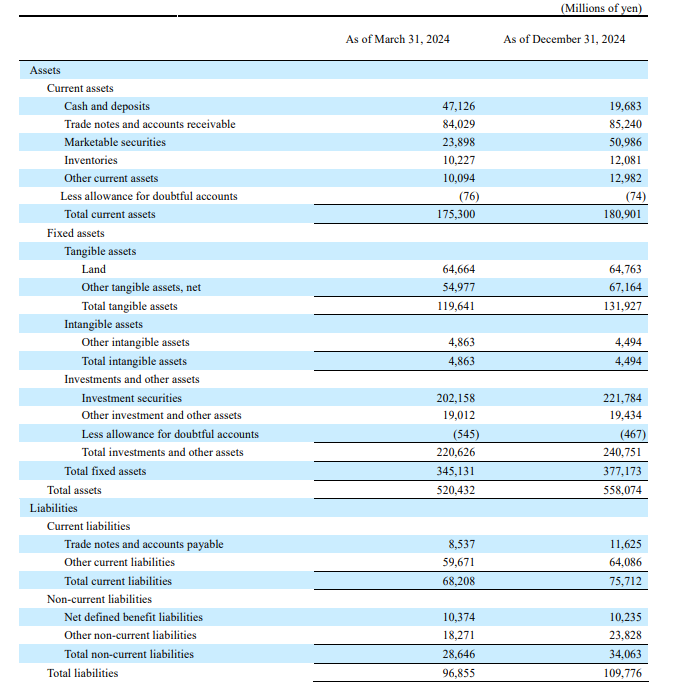

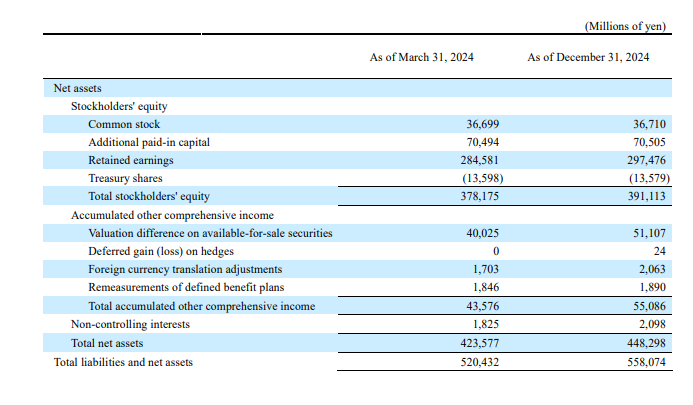

They have a book value (446B yen, excluding non-controlling interests) well above their current market cap (268B yen). But not all the assets are liquid, and we would be wise to exercise some caution.

In my view, we can take cash, receivables,2 and marketable securities (mostly short-term fixed income) at face value. Let’s forget about inventories and other current assets for now. With that alone, we get 155B, which leaves us with 58B once we subtract all liabilities.

Let’s move on to the fixed assets. The tangible assets are, for the most part, offices and studios, with the “other tangible assets“ epigraph referring to equipment and works done in those buildings and land to the value of the land as such. The majority of the buildings are in central Tokyo, with over half the total value in Minato Ward. Taken together, the average price is about 2 million yen per sqm, which is well below average prices for land3 in that area. So let’s take the land at the value in the balance sheet and forget about the buildings themselves, equipment, and so on. That would be another 64B.

But the interesting part is actually in investments, which include:

10B yen in bonds held to maturity, not much to talk about here!

A good chunk of value is in quoted stocks. That was 68.5B yen in March 20244, but let’s review the main holdings (overall, there is a slight increase, but they have also sold about 4B in securities in Q4 and not revealed which ones, to my knowledge, so I think we can use 70B as an approximation):

4.6 million shares of Recruit Holdings (6098.T): 34B at today’s price, 30.9 in March.

10.2 million shares of KDDI Corporation (9433.T): 26B at today’s price, 23 back in March

3.4 million shares of 2433.T (3.6B now, 4.8 before)

0.8 million shares of 4234.T (2.4B now, 3.4 before)

3.9 million shares of 9405.T (2.7B now, 2.5 before)

1.1 million shares of 9412.T (1.2B now, 1.2 before)

Their holdings in Kotobukiya - 7809.T are not included in those (about 1.8B at the current valuation)

And then there are the companies that they consolidate through the equity method. There are 17 of those, mostly several local TV stations that are not publicly listed5. But there are 3 areas that are of interest:

20% of Toei Animation and 19.6% of Toei Company. Since they are treated as equity-method affiliates, the stakes are not valued at market value. The value of those stakes is 142B yen for Toei Animation and 64B yen for Toei Company, for a total of 206B yen6.

AbemaTV (37%) & AbemaNews (50%), both part of the Abema service jointly established with CyberAgent. Abema is an online streaming platform with a mixed ad-driven and subscription model that has been inching toward profitability thanks to growth. You can read more about them on CyberAgent’s material.

Telasa (50%), a typical SVOD established jointly with KDDI which is having trouble achieving scale7. If it was not being fed content by Asahi (which needs it anyway for the TV), it probably would have folded already.

Participations in unlisted companies for almost 60B yen in the balance sheet (including, if I understand correctly, the unquoted affiliates mentioned above).

Of all this, I think Abema and Telasa are interesting to take into account to discuss the business, but not as assets. And the participations in unlisted companies is probably worth something, but who knows how much. But I think we can consider their roughly 278B yen in stock holdings as an asset for our calculation of the value TV Asahi holds, as well as the 10B in bonds8.

That would leave us with 410B yen after paying down all liabilities, and that is only counting relatively easily liquidated stuff. TV Asahi trades for 268B yen. Are they burning money in their day-to-day business?

The intangibles

You won’t find it in the report, but TV Asahi also has interesting rights, especially in terms of Anime. While unfamiliar for most American audiences9, pretty much everyone else would have heard about Doraemon, with Asahi being one of the main rights holders, and Shin-chan (ditto). Asahi not only acts as the main distributor, but also owns the anime studio that made both animations10 and is one of the main producers. They have also acted as producers in other anime (like Sailor Moon) and have participated in more recent productions, with Blue Lock being the most successful one.

Both Doraemon and Shin-chan have been successful for decades, and TV Asahi makes almost annual films for both11, aside from regular TV episodes (both have ongoing series), and are the most valuable properties in this sense.

TV Asahi: The business

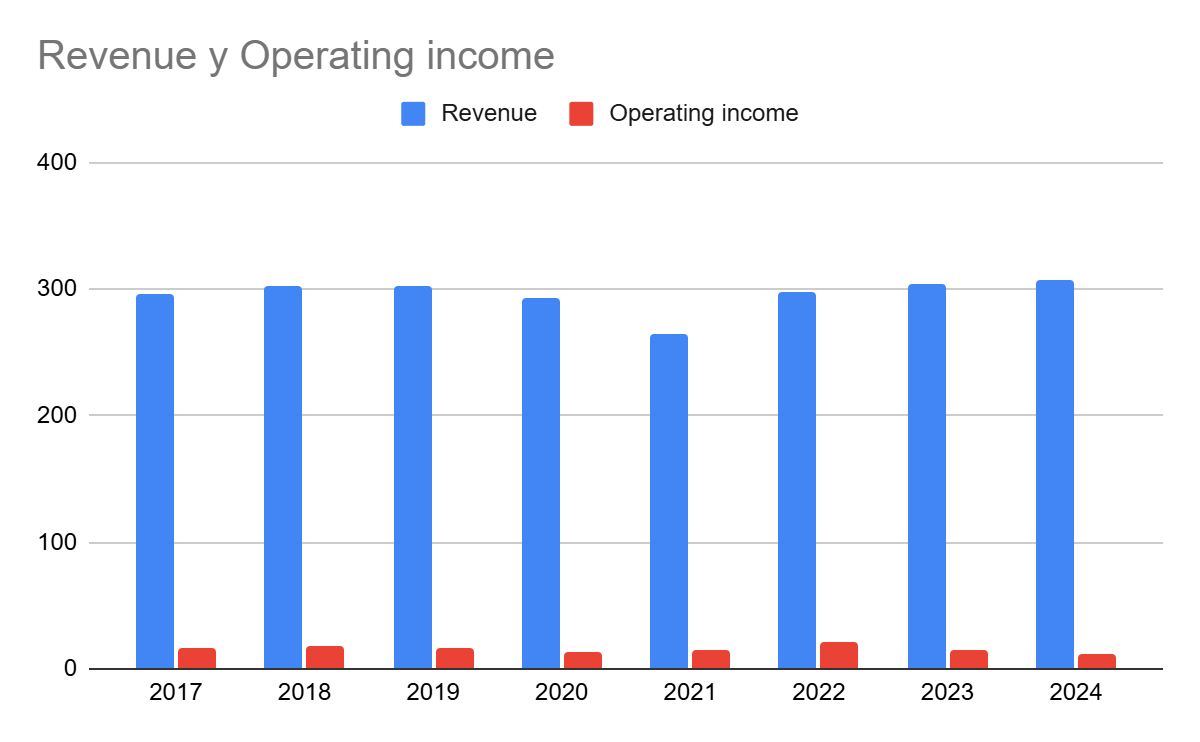

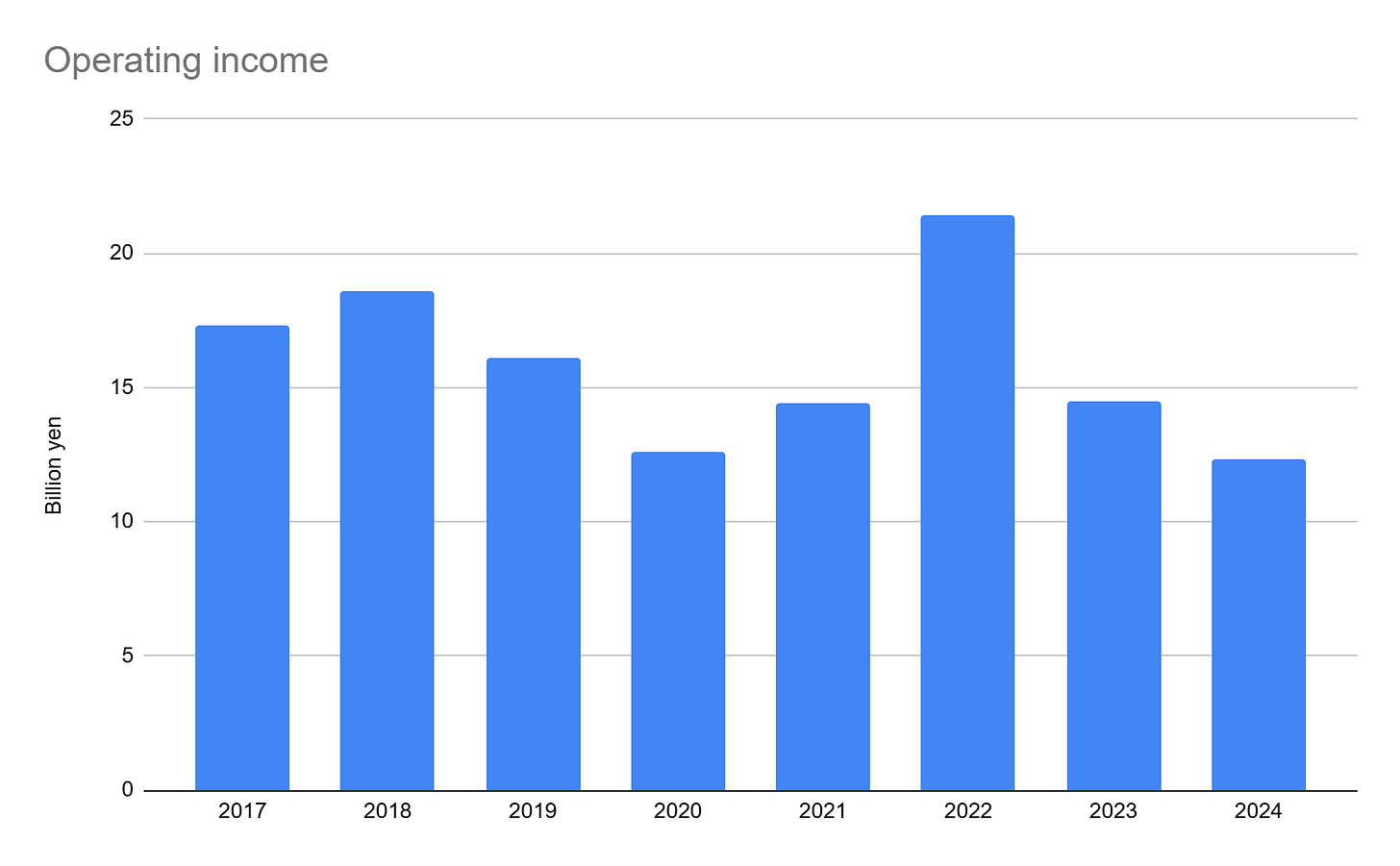

Surprisingly enough for that market cap, TV Asahi is doing just fine, although it is a declining business in many aspects, as is all linear TV. Their operating income in the last few years has generally trended down, although the best year was FY202212 (with a post-COVID recovery in many areas, and cost-cutting measures from ‘21 still in place), and 2025 seems poised to be a relatively good year, with all segments growing, and will probably beat 2023.

And what are those segments?:

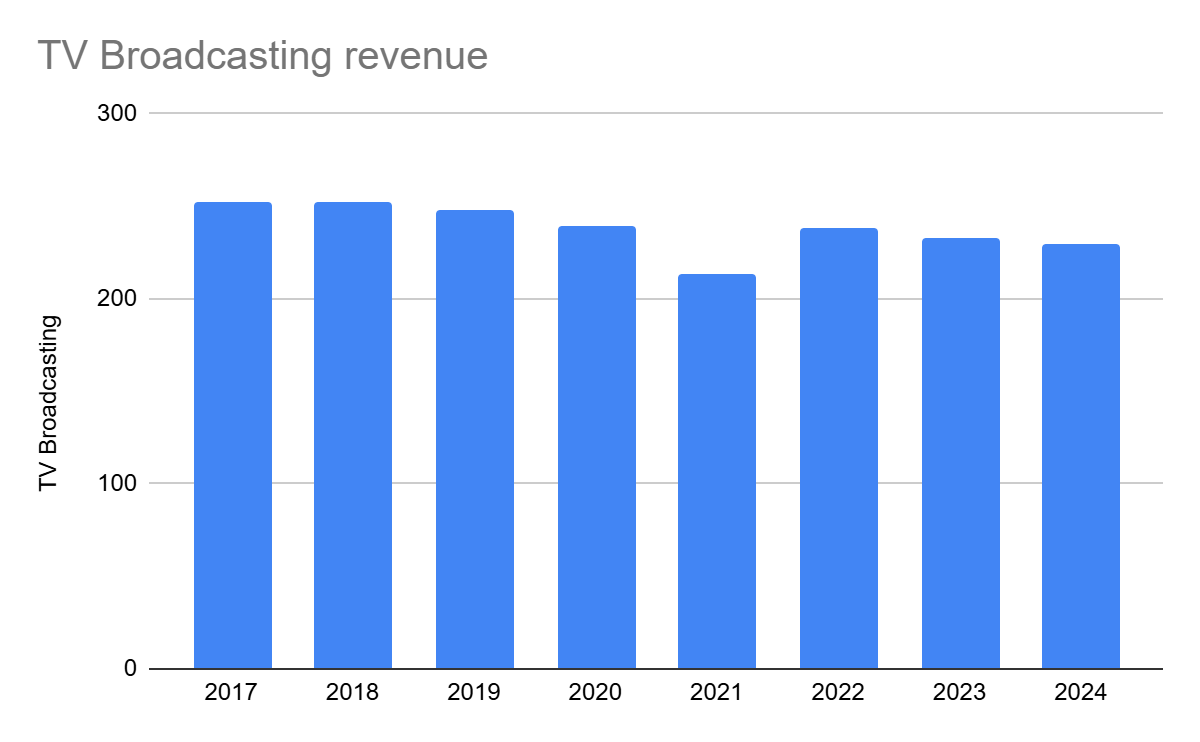

TV broadcast, including most licensed content broadcast. Includes ads in open channels13, their paid channel business, sales of content and other streams of income (like royalties and the like, where the income from merchandise from anime would fall, for example). Of all those streams, only “other“ is growing; the rest are either flat or going down (especially ads, the biggest source of revenue). It is the bulk of both the revenue and the expense. Despite revenue declining, they have managed to keep it profitable every year (even in 2021, when there was a sharp YoY decline. It has recovered slightly post-COVID, but below 2020 levels, and it is unlikely to ever reach them again.

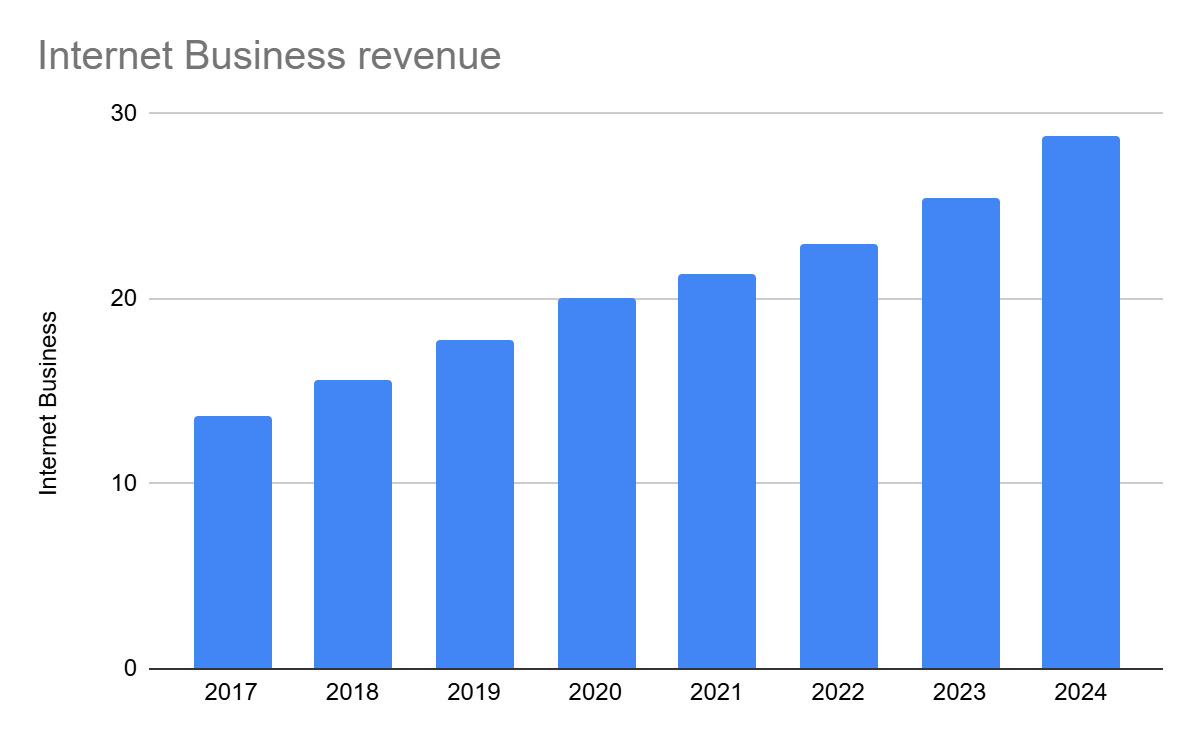

Internet business: Sales of content over the internet, and royalties for streaming of original Asahi programming. It doesn’t include, however, Telasa and Abema revenue, as they are equity method affiliates. It does include what they pay for TV Asahi content, though. Asahi also has its own online distribution (Douga). It has grown relatively well, but there is no COVID explosion here. While it is growing well, it has not compensated for the drop in TV so far.

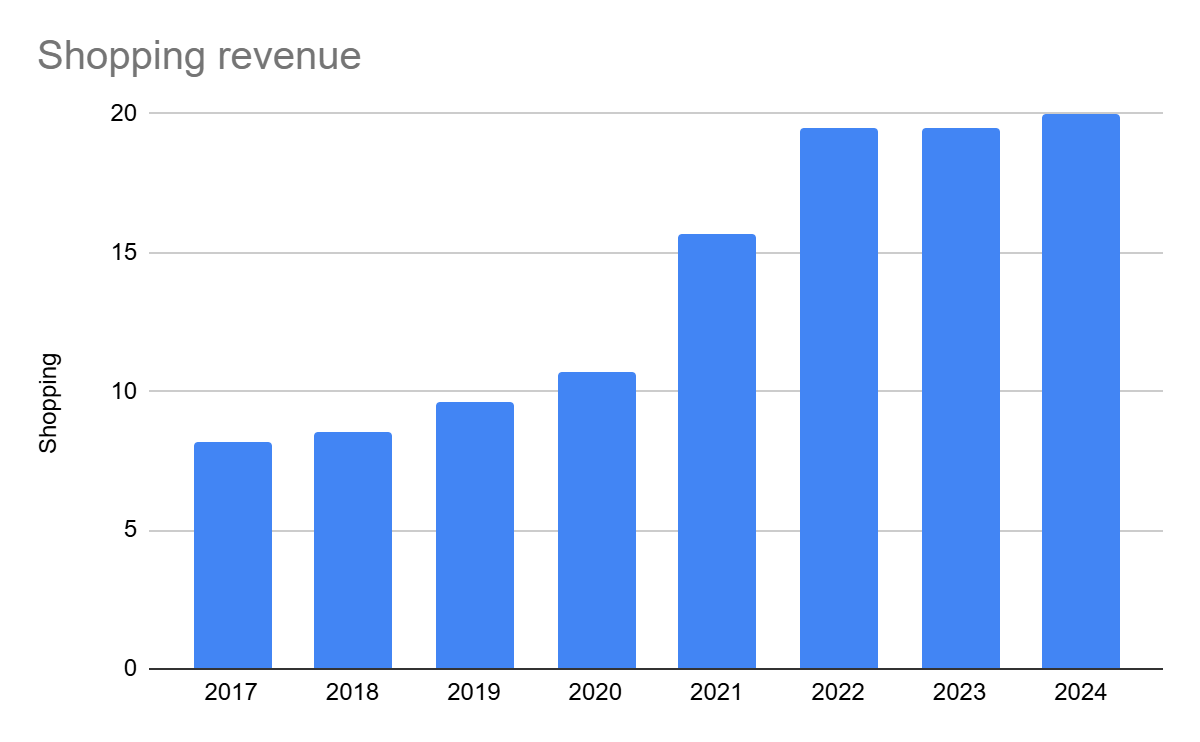

Shopping: TV Asahi has a thriving teleshopping business, which seems directly mostly directed at the older audience. Not great margins (surprisingly low in 2023/24, close to 10% before that), but growing in relevance, but very small compared to TV, and seems to have stalled post-COVID

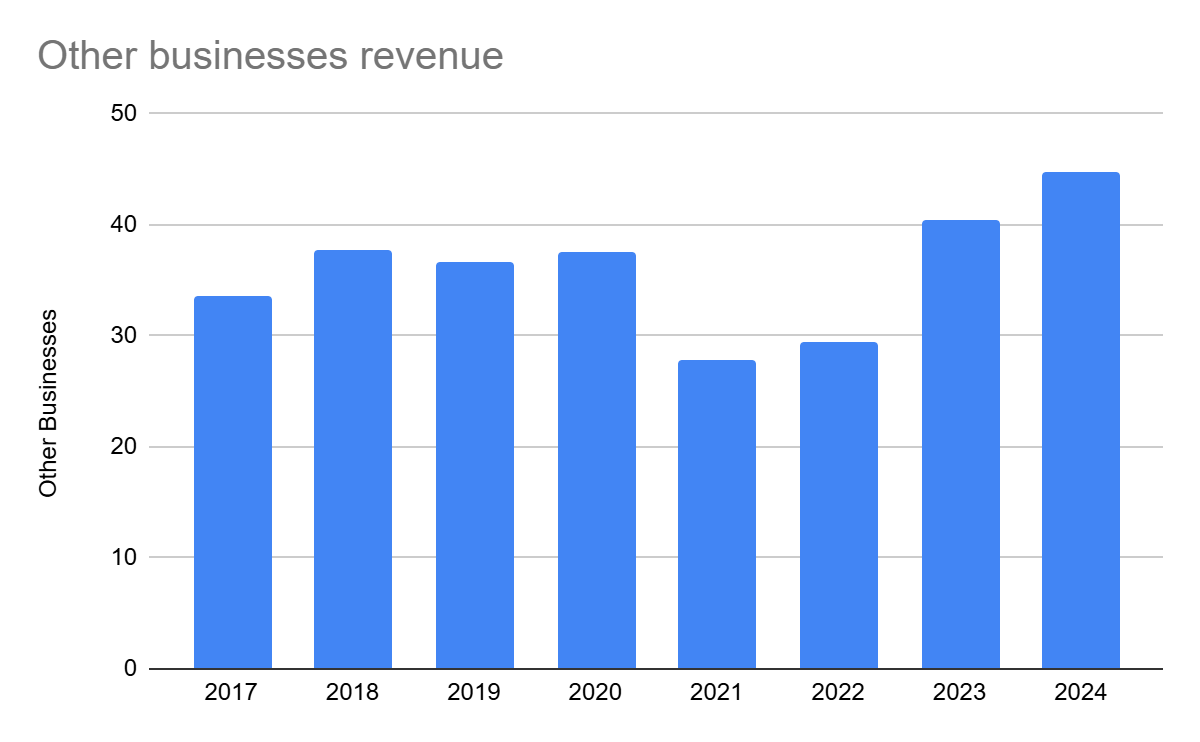

Other business: Music publishing, events, equipment lease, DVDs and Films (mainly Doraemon and Crayon Shin-chan). Music has recovered to pre-COVID levels after a drop, and events keep growing. DVDs have better and worse years, but streaming has largely killed the business, equipment lease is somewhat stable, and films are a hit-driven business14. All that together adds up to 73% of other businesses as of 2024. I have no idea what makes up the rest!

In general, and without considering income from affiliates and dividends, they have been generating a decent operating income, with the worst year (2024) amounting to 12.3 billion in operating revenue (or roughly 9B net to shareholders after tax). 2025 seems like it is going to be the best year since 2021, with operating income 41% ahead of 2024 in the first 9 months of the fiscal year.

As you can see, it is not a great business, but it does generate cash. And that is the cash they have been using to reward shareholders. Not even all of it, actually.

Capital allocation

TV Asahi has been paying about 5B yen a year in dividends, and they have made the occasional repurchase as well (2B in 16, 3B in 21, 2B announced last week). That said, they have been investing very heavily in the last couple of years, so you won’t see free cash flow there. But it is an investment, and one that I think will pan out.

They have also been selling part of their cross-shareholdings in the last few years, and used that along with the funds generated by the company to invest in more real estate and shareholder returns

That said, that percentage of net assets shown is… well, a bit tricky, because it does not take into account the shares in Toei Animation and Toei Company as strategic shareholdings. But they have stated as an objective keeping it below 20% of net assets.

They seem to be happy to go lower, though, and this year they are selling a record amount of about 8B, according to one of their releases. Only part of it happened through December (5B), so more sales are expected in Q1.

All this to say that I think they will work to reduce the cross-shareholdings, but very, very slowly, and without including the Toei stakes in the short term.

Investments

Have you ever thought it strange that most capital allocation sections focus mostly on shareholder returns, and not in investing in the business? I typically do that because most of the businesses I talk about are relatively capital-light, accounting-wise (meaning a good chunk of their expenses are in potential growth), and even then, I have complained on occasion15. But in this case, there is something tangible to talk about.

Events

Enter Tokyo Dream Park

Essentially, this is a huge building with several spaces, a concert hall, areas for events, theaters… essentially, TV Asahi is looking to capitalise on the trend for increased event spending, and they want to both organise their own and have a huge center were others want to hold live events.

The location is relatively close to the 20-meter-high Unicorn Gundam and Diver City16, and TV Asahi has invested a lot of money on it. I haven’t seen it detailed anywhere, but I suspect it is going to be close to 50b yen17, the total amount earmarked for strategic investments in the last management plan18, although they have gotten stakes in Kotobukiya and BookLive as additional investments. Some spaces are already open for reservations, and part of it will be opened in the coming months, with a full opening in 2026. This should propel event revenue going forward, and TV Asahi can populate a good chunk of the event calendar (profitably) if they don’t have enough external demand, given that they have both a good range of IP and a music label.

Anime

TV Asahi was a very relevant investor in anime properties in the early days, and aside from Crayon Shin-chan and Doraemon, they acted as producers for Sailor Moon, Slam Dunk, and some of the Gundam series. But they failed to get their hands on much of note from the early 00s onwards19, other than exploits of their existing IP.

In the last decade, they have had some hits, like Yuri!!! on Ice and Blue Lock20, and have ramped up both in number and apparent quality (they have just announced a joint project with Science SARU21, of Dan da dan fame). Aside from that, they have entered into an alliance with both BookLive and Kotobukiya22. BookLive is an online bookstore that doubles as an online manga publisher23, and Kotobukiya is an anime figures company. The idea is to leverage TV Asahi’s distribution to strengthen the IP of BookLive and Kotobukiya24, and at the same time use Kotobukiya’s expertise to profit more from the merchandise.

Overall, although it is not first-rate, I think their already existing IP and a solid distribution base, as they already have (with Abema and Telasa doing the streaming part).

Why would this re-rate?

So far, we have seen that TV Asahi has a decent, but not great, business and a huge collection of assets that more than justify its current price. So, when will this re-rate, if it does at all? Well, there are several options:

Buybacks and dividends: As I have mentioned, Asahi has been selling small parts of its holdings, and used the resulting cash both for investments and returns. They haven’t typically held huge amounts of cash, and they have chosen stock investments well, historically. One potential catalyst is the acceleration of the sale of cross-shareholdings and using those funds for shareholder returns. I don’t think it is likely to happen fast, but they have been reducing the number of shares outstanding in general, and pricing is fairly attractive now, both to sell some of their holdings and to buy back shares.

Results improvement: Several avenues for that:

The streaming platforms are improving their results, and they have been masking for years the share of earnings in affiliates that TV Asahi really has. All those TVs are profitable, but billions in losses from ABEMA and Telasa have been pulling down the total. ABEMA has been improving markedly and is close to profitability, which would improve how the results look (and the value of their stake, of course).

Event revenue and profits increasing markedly thanks to Tokyo Dream Park.

The investments in anime in the last few years seem to be having some effect, even if they are in a relatively early stage.

None of them are a sure thing, and you have to weigh it against the possibility of years of losses in the TV Broadcasting business if they don’t cut costs as the business slows down. But I think it is unlikely, given their history. If they were going to keep their level of expenses at the level of their past, we would already be seeing relevant losses, but they have been adjusting little by little, and I expect them to continue doing so.

Last but not least, there is a bit of an overhang at the moment. Two of the main shareholders announced they were going to sell up to 9 million shares of the company, roughly 9% of the company’s shares25, and the transaction will take place this week. To offset that, TV Asahi has approved a 3B yen repurchase starting in May, which can absorb, at current prices, a bit more than 1.1 million shares… which means there is going to be a lot more availability of shares than it used to. A similar situation happened with Toei Animation last year, when Bandai Namco sold its stake, and shares were tumbling for a couple of months before finding a new equilibrium. The same might happen here, which is why I don’t own shares yet!

Conclusion

TV Asahi is asset-rich and has a decent business on top of it, with several avenues for improvement in the next few years. It is not a guaranteed slam-dunk, but I think it can have a good place in a basket of cheap companies, even if it is only as a way to own Toei at a discount. While currently there is some overhang that might cause the price to tumble in the short run, I will probably open a position in the near future, if I see the price accepting the new supply.

As always, do your own research, and please let me know the results!

Not quite. They publish their results and their decks, but not the annual securities report (equivalent of the 10K) where the stock holdings are detailed, along with the consolidation treatment of several subsidiaries and affiliates. More on that later.

They have had a really good record of collecting, and the tiny allowance for doubtful accounts you see (less than 0.1%) there is pretty consistent with the historical number, without major write-downs that I can see. You can always apply a haircut if you think that makes sense!

You can check both official surveys (4 of the 5 highest price properties listed are within walking distance of the main office) and Sotheby’s listings in the area. Both point at about double the current value in books or more.

Quarterly results don’t disclose how it changes, but investment securities epigraph is 20B higher. That includes about 5B in earnings from equity affiliates, so about 15 should be stocks revaluation as of December. But of course the market has not been that great since then!

9, to be precise. Others include Bushiroad’s subsidiary New Japan Pro-Wrestling (22.7% of it), Ray (a live-events company) and BookLive an ebook store focused on manga that we will discuss more later.

If you look at the 2024 annual reports of both Toeis, remeber to take into account that both did a 5:1 stock split after the report date.

In some market share reports, you will see it as having a bit more share than Abema. But those reports refer to the SVOD market. Abema’s bread and butter is the more than 20 million regular users of their free ad-supported content, not the about 2 million users they have in the premium tier. Telasa, meanwhile, has almost the same number of premium subscribers and no free-tier.

There are other securities, 14B of which seem to be close to cash (other securities with maturities within a year), a 1B investment in a LLP, and I am not 100% sure if all the unlisted stocks are included in that number. The disclosures are a bit messy.

While aired in most of Europe during the 90s, Doraemon didn’t make it into US screens until 2014.

Shin-Ei, purchased in 2010

Toho is in charge of distribution for those. Doraemon is the top-grossing film franchise in Japan, with 137B yen in tickets sold, and Shin-chan is in number 13, with almost 47B yen

As with many Japanese companies, FY is April to March.

Both in their channel and in the programs retransmitted in stations affiliated with their network. Asahi owns one of the main networks.

Although COVID aside, they have been doing alright.

Yes, I still think Games Workshop underinvests in production lines and should take more risk regarding inventory write-downs.

It is in Ariake and not Odaiba, but just crossing one of the bridges that separates the two.

Judging by the amount of increase in land value in the balance (21B since 2020, all in place by 2023, when construction started), the 11B yen in WIP construction in FY24’s estatements and the increase in other tangible assets in the last results (13B). Not all of the first and last elements will be for this, but there will be some additional expenses and current total is already likely above 40B.

In theory, only half of it was supposed to be for this investment. But by the time they said that, the land was already acquired, so maybe it was not included.

Tenjho Tenge or Loveless had a bit of a following, but were far from mainstream success.

And some minor ones like A Couple of Cuckoos or Sing "Yesterday" for Me. Despite really good reviews, Medalist has so far failed to get a good level of acclaim.

A Witch’s Life in Mongol. They have also worked with 8bit (Blue Lock) and their own studio, Shin-ei, has branched out into some isekais and shojo, and not only Doraemon/Crayon Shin-Chan exploitation, although part of that work is being released in other TVs.

Alliance in this case meaning they own 21% of booklive and consider it an equity method affiliate, and 15% of Kotobukiya. They spent a little bit more than 2 billion yen in the Kotobukiya stake, and the investment in BookLive has not been disclosed (but I think it was a similar order of magnitude, looking at the cash flow statements for the period).

So far, their properties have been adapted only a few times, without major success. But how can a publisher that releases Boys Love manga under the cigarrillo brand fail?

Kotobukiya has a couple of figure lines with their own IP, so to speak. Asahi is already preparing an Arcanadea anime, butr not much is known yet. Hopefully it will have better reception than the Frame Arms Girl anime. Then again, that one was made by A-CAT, of TBATE infamy

101.6 million shares outstanding

Thanks for the write, its quite detailed. Good Job.

I take it that Asahi is protected from foreign investment under the Broadcasting Act https://www.lexology.com/library/detail.aspx?g=6461c2e0-e510-4125-8287-9b76df7abdce

Do you see it as a hurdle for a possible rerate?