A hitchhiker's guide to the Anime Galaxy

An investor's primer for Japan's most important export: aesthetics

The story so far: In the 1980s, some companies started importing Japanese cartoons into the West.

That made many parental advocacy groups very angry1 and was widely regarded as a bad move. It made some people very rich though.

I have been watching Japanese animation since I was little, and chances are you have as well2. I was born in 1990, but it doesn't matter if you are a bit older or younger. Anime already had a big international run in the 80s, thanks to Mazinger Z, Heidi, Lupin III, and Captain Tsubasa3 among others. For the TV stations and networks, it was cheap content and made for good numbers in kids’ slots. But economically that took a while to start really affecting the Japanese companies, which were really focused on their home market.

Part of the reason is that the English-speaking world didn't join the trend until the 90s, with Akira4, Dragon Ball, or Ghost in the Shell. Sure, there were some popular Japanese animations before5 but nothing on the scale the later fandom would have. And that scale has done nothing but grow in the last decades, especially in the last one, as this graph by Richardson Handjaja (of Animenomics fame) illustrates

You can find the original article here, and it is a treat.

That said, I think that graph understates the situation. A lot. First, because it includes only the animation industry itself, and I think adjacent companies are relevant, and second because it only takes into consideration Japanese companies, and the industry is more and more intertwined internationally. Solo Leveling is one of the most successful animes in the last few years. Tower of God was less successful, but also in a relatively high tier. While both were animated by Japanese studios, the source material is Korean. And no one will be able to convince me that the HoYoverse is not anime-adjacent.

But what does anime-adjacent even mean? How is this industry organized? Well, that is what I want to talk about. So grab your towel, and follow along!

But wait, is the industry interesting?

I am sure it won't have escaped your attention that the growth is not that high in the numbers provided in the above graph, that come from the Association of Japanese Animations (AJA). Doubling your market since 2014, give or take, and after a period of stalling, is not such a huge deal, even if it is understated there.

The growth in the industry comes from different sources, and the AJA breaks down the different segments. Let's see how they have fared in terms of growth (CAGR since 2014 and absolute numbers):

Streaming: 18.6%. From ¥59.5 billion to ¥250.1 billion

Overseas market: 20.3%. From ¥326.6 billion to ¥1722.2 billion

It is important to take into account that all overseas sources of revenue are lumped together, and this is revenue gathered by Japanese companies only.

Live entertainment: 14.8%. From ¥28.6 billion to ¥108.1 billion

Merchandise: 9.4%. From ¥312.3 billion to ¥700.8 billion

Gaming/Entertainment: 9.7%. From ¥144.3 billion to ¥337 billion

TV: -2.9%. From ¥128.3 billion to ¥97.3 billion

TV seems to have peaked in the early 2000s and has been declining since, although not in a linear way. It takes into account only domestic distribution. I suspect international TV distribution revenue has increased, as the deals before were… well, very low.

Movies/Film: 10.5%. From ¥27 billion (2014) to ¥68.1 billion (2023)

Video/DVD: -12.8%. From ¥98.2 billion (2014) to ¥36.2 billion (2023)

The Internet killed this one almost completely, except for collectors.

Music: -3.5%. From ¥36.7 billion (2014) to ¥26.7 billion (2023)

This captures mostly physical format sales. Part of it is now under streaming (all YouTube or similar sites, for example). Given the increase in Live entertainment, which includes live music performances -arguably the main events- I would say anime-related music is alive and well.

Let's look at domestic revenue first, and how the categories are growing.

Streaming is still not as mature a business in Japan as it is in the US, and that shows in the growth in the last few years (it was 51% in 2023 and has done 2.5x since 2020, not that I expect that to continue at that pace), and in particular anime was not the most monetized area there. It will reach a ceiling soon, probably, but it is already ahead of TV. Live events are a bit of a surprise to me. I knew they were growing, but not to that extent (domestically, a lot to do there internationally). Gaming/Entertainment includes many types of licensing, from videogames to Pachinko6, and given the decline in Pachinko, it is interesting that it keeps the pace domestically and Merchandising growing at the domestic level at that pace is encouraging, mostly because it has not declined post-covid, as many other markets have (hi videogames!).

But why is it growing so fast internationally7 and is it likely to continue? Well, I think so. Partly it is because of the increasing popularity of the genre, and I think that is continuing and will continue for a while. For example, Crunchyroll (an anime-focused streaming service that works mostly outside of Japan and belongs to Sony) announced it had passed 15 million paying subscribers in August, up from 13 in January. But that is, in my view, not the whole story.

‘80s and ‘90s kids who grew up with anime are now parents, and what used to be those weird Japanese cartoons that cause epileptic attacks and are too violent is part of their childhood. That makes taking share of wallet easier, and so far there has been no reaction against it from the new generations (maybe because while the cartoons were mainstream, being a fan of the genre wasn't, so they are not growing up seeing rooms full of old cartoon's merch - or maybe, like Nintendo, anime is universal enough in its variance that it won't cause that reaction, we'll see). Much like other fringe hobbies in those days (D&D, Warhammer), anime has the double trend of increased spending for kids from parents who don't regard it as quite as horrible and adults spending what they couldn't when they were young. I think that is a trend that still has some legs.

The different roles in the anime industry

If you look for public companies involved in anime you are only going to find a handful. Toei, IG Port, Nippon TV, and Kadokawa (mostly because of owning IPs, although they have studios as well), and maybe some lists will include Bandai Namco and Sony as well, although it is a small segment for both of them when measured directly (although they are relevant players in the ecosystem!). And I think that is wrong. The reason you would usually get such a short list is that people will default to thinking about who makes the anime itself, but that is not the only, or indeed the most profitable, function in this sector. In my view, we have 6 different actors, two of them being a bit debatable.

Anime studios: Never invest in a pure anime studio that just takes work for hire from production committees and does not have the money to be part of them. The competition is fierce, the money is tight and the barriers to entry are non-existent, as there is an endless supply of animators and would-be animators. Even Gainax (Evangelion, FLCL…) closed last year8. Investing in studios only makes sense when they are so well-established that they have the money to participate as producers and participate in the income stream from licensing and distribution. The role of the animation studios in the ecosystem is basically being paid (sometimes below cost) by the production committee to do the animation. If they have the resources, they sometimes are part of the committee themselves, but that is a relative rarity among small studios.

IP Owners: While there are relatively successful anime originals (Cowboy Bebop, Psycho-Pass…), it is far more common that anime is a derivative work from manga or light novels and, increasingly, from webtoons9, while series made directly to promote toys are, I think, a bit less common than they used to be10. That simplifies the process (in theory11) and brings an already existing fanbase. This role is typically filled by manga publishers, and they are usually in the production committee, on top of getting paid for the use of the IP itself (usually as a royalty, but deals may vary).

National anime distributors: Or as they are also known, Japanese TV companies. Streaming services also play more of a role of late nationally, with U-Netx, Docomo, and Abema all being primary distributors for some animes domestically. But for the most part, the TVs are either the primary distributor or participants, even if the streaming partner is a relevant one. Historically, that also meant they were a very relevant part of the production committee and that has led to some, like Nippon TV, entering into the business with both feet through M&A.

International anime distributors: Relevant for the ecosystem, not so much in terms of investing. International distribution is mediated thorugh large streaming platforms (mainly Netflix and Crunchyroll) or especialised distributors (GKIDS, pending Toho’s acquisition). Sony has significant rights, and has rolled-up some of the formerly relevant players into Crunchyroll (Funimantion and Manga entertainment come to mind). Of late, they have started to be producers as well, with some animes being created for these platforms.

Licensors: Companies using the IP for derivative products. They come in two flavors

Merchandising licensors (collectibles, figures, t-shirts… the works). The Bandai part of Bandai Namco is probably the biggest in the sector and juices the Dragon Ball and One Piece licenses to death. But far from the only one.

Additional content licensors: Videogames and adaptations into other media. Typically they license from the anime version rather than from the original IP holders12

Production committees: The actual owners of the anime. It is typically a group of companies, that usually includes the IP owner, sometimes the studio making it and usually at least one distribution partner, national or international. Some licensors can get involved as well (Bandai Namco does this from time to time). They pay the studios to make the anime, and are the ones that receive revenues from both distribution and licensors. One of the debatable actors, as they are joint ventures.

Companies making anime-adjacent products: Sure, that is not anime directly, and that is why I think it is debatable as well. But Nihon Falcom's revenue increase in the West follows a similar curve to that of anime, and there is no denying Sanrio is profiting handsomely from the expansion of kawai aesthetics. It is also no coincidence that v-tubers lean heavily on these aesthetics and tropes, and without anime (and K-pop) expanding the idol culture and tropes, it is doubtful they would have been able to expand outside Japan. Some Chinese and Korean gaming companies probably also fit in here, to the extent they use similar aesthetics and have been able to capitalize on prior work done by Japanese media. This includes:

Some Japanese videogame makers like Square Enix, CyberAgent (CyGames), or Nihon Falcom

Other related game makers in other countries (miHoYo, midgar studios)

Distributors specialized in related merchandise, like Mandarake or Buyee

Some toy and merchandise makers (Sanrio, arguably Kotobukiya in some of the lines, as well as some Takara Tomy lines)

V-tubers

Here you can see it summarized in a diagram:

Now that we know the industry a bit better, let’s dive into how you can invest in the different actors. But first, let's talk about some things to take into account when looking at anime as a business.

Some characteristics of the anime industry

The (right) tail wags the dog

Most manga and anime productions are not particularly profitable. Most probably aren’t profitable, or barely. But the business as a whole is incredibly so. Toei Animation owns many top-tier properties13, but 70% of their overseas revenue comes from Dragon Ball and One Piece. In IG Port’s case, the biggest 3 IPs last period (Kaiju n. 8, Attack on Titan, Haikyu) represented 57% of their copyright business revenue, and they are big properties… and yet, either one of Dragon Ball or One Piece alone would be several times bigger than the entire company.

So what you can expect here is relatively few productions driving profits for the whole industry, and it pays to bet on quality, either by selecting IPs that are already time-tested and have proven to be evergreen but are under-monetized or growing, or by betting on the taste of some company, expecting then to gain share leaning on an already existing fanbase. Take into account the volume is huge: there are about 300 animes listed in MyAnimeList as airing right now, and 540 listed as upcoming, and most of them will air, fail to get any interest and sink into obscurity. Hundreds of titles come up this year. Many of them will be profitable or break even, but not in a big way. A single-digit number will be really successful, and one or two will be mainstays, in the sense Ghost in the Shell or Sailor Moon are. Long-running successes like One Piece don't come up every year!

What I mean by that is that you don’t usually want to play the volume card here, even if there is some cost advantage. A player with hundreds and hundreds of titles can be a lot less valuable than a one with a few A-listers.

The growth is in monetization, not eyeballs

It is difficult to put a number on it, but international anime audiences have not grown at 20% per year for the last decade. Every kid already watched Pokemon in the late 90s, and while there is a significant segment of the adult population that now pays attention to it, minutes dedicated to anime are unlikely to have multiplied by more than 5. Money coming from overseas has, however. And in Japan merchandise has bloomed as well. Part of it is, however, internationally driven, as explained here:

The bottom line is that while there is some audience growth effect, the majority of the growth comes from other countries getting a bit closer in monetization of fans to Japan. Extreme monetization and dedication to hobbies have long been more common in Japan thanin other countries, outside of a few niches14. It has been an increasing trend in Western countries too, where things like adults buying merchandise and figures were extremely rare a couple of decades ago. So far, the trend shows no sign of stopping, and the increase in cross-border merchandise sales points to significant unmet demand, with fans buying directly from Japan.

But what this means is that we should look for companies that benefit from this either through royalties or direct sales, rather than companies that benefit from an increase in exposure only (namely distributors15). To be clear, there is growth in that area too, and anime IP being both more popular and appealing to a wider age range is important for paid media, like videogames. But my impression is that the increase in monetization is by far the biggest variable.

No longer exclusively Japanese

Many specialists would disagree with this, and it is false if we take a strict definition. But with the HoYoverse (China) being the most productive anime-like set of games around, and Solo Leveling and Tower of God performing well in the last few years (both Korean in origin, although the animes are Japanese), I think we can start to consider other sources of IP inside this trend16. Japanese tropes and communication are far more familiar to any other country, given that they were the trailblazers, but that is not an insurmountable advantage.

And now, Devil May Cry, a Japanese videogame franchise, has an animation series… financed by a US company (Netflix) and animated in South Korea as well.

Most title’s ownership is very widespread, and everyone wears different hats

This is a right-tail business and most titles fail. And that is the reason the Production committees exist. It is just a form of insurance, but it also severely limits the upside.

Take for example The Apothecary Diaries, one of the most popular titles in the last years. The anime rights are divided between Toho, Square Enix, Nippon TV, Shogakukan17, Dentsu and Imagica. Percentages are unclear, though it seems Toho takes a big share in this case. In Jujutsu Kaisen, at least MBS, Toho, Shueisha and sumzap (CyberAgent), and probably MAPPA18. In many cases, the participants in the production committee are not even public.

And this means that sure, no one will suffer a lot if the anime flops, but also the profits of the ones that work out in an outstanding way have to be shared, and that means that unless the company is very small or has a very big share of the committee a huge success might not be transformative for them. IG Port is a mixed example. Attack on Titan has left a lot of money for them and allowed further investment aside from tidy profits… but given the scale of their licensing revenues, it is clear they are not taking the biggest piece of the pie and what would have been fully transformative had they invested more is just a very nice contribution to the business19.

As for the different hats, almost everyone does. Bandai Namco might be an extreme case. They have their own studios, own some IPs that were created to sell toys (Gundam), participate in production committees and are a licensor both for merchandise and additional content. But it is rare to find a pure play in a single aspect, except for some merchandise makers and Toei Animation.

A look at the investable universe

Anime studios

If it is a pure anime studio… they are typically not very profitable, or at least not for long. Competition is fierce, and there is no limit to the number of people who want to work in the industry. Schedules and money are tight and profits are rare. So why would you want to invest in companies fitting this?

Well, because it wasn’t always like that. Up until the 90s the saturation of studios was not so excessive, and that allowed for profits. That, in turn, allowed some anime studios to participate meaningfully in the production committees of the animes they were making, and that has kept making money for them and allowed them to reinvest. Having some outsized successes where they were able to participate in the royalties has helped big time. They are also the only ones that are public20, so you won’t have to look too hard. Still, something to keep in mind if more become public.

So what you need to watch out when looking into anime studios is a strong set of existing properties and, if possible, a good cadence of new releases, wether they are refreshing old IP or creating new one. Or both! The examples I was able to find were:

IG Port: A company I have discussed in the past here, but where the valuation got high a bit quicker than I expected! They have made several well-known animes, and partially own the IPs of Attack on Titan, Spy x Family, Haykyuu, Ghost in the Shell and Psycho-Pass, among others. Probably the most active (of the public ones) in adding new IP to their portfolio with Spy x Family and Kaiju n. 8 being very recent incorporations.

Toei Animation: A classic. Tiger Mask or Cyborg 009 were well-known in the 60s and 70s, Mazinger-Z in the 80s. And nowadays they make tons of money from Dragon Ball, One Piece, Digimon, Slam Dunk, Precure, Sailor Moon… the sheer amount of productions based on well-known mangas they did in the 80s, 90s, and 00s still drives their revenue, even if it is thanks to new content for their franchises. They haven’t been able to add much to their roster in the last 20 years though, even if they have had some punctual success (Girls Band Cry, Id: Invaded) very, very far from the heights of their aging IPs. They are aging quite gracefully though. Honorary mention to Toei Company, which owns 40% of Toei Animation21.

Nippon Television Holdings: We should probably discuss it as a domestic distributor, but Nippon TV is a mix. Aside from their TV business, they own both Madhouse (Death Note, Frieren, One Punch Man, Parasite, Hunter x Hunter…) and a majority stake in Studio Ghibli22. As a distributor, they have been able to participate in many relevant production committees too (Apothecary Diaries, Nana, Claymore…). Anime represents about 50% of their current revenue growth and all their profit increase YTD, while distribution revenue (adds, TV-related events…) still represents a much bigger share of all revenue. So they are slowly but surely becoming more of an anime IP company.

TMS is also public through its parent, Sega Sammy. However the weight in the conglomerate is relatively small (less than 10% of revenue, although it has a better participation in profits), so it doesn’t make sense to describe it here (even if it is a growing segment for Sega Sammy).

The good thing about investing in the public studios is that they all have established IPs, and funding enough to go ahead investing in new properties or iterations of the same. As they have access to the IP, they do profit from the main drivers of revenue of the anime expansion mentioned above.

IP owners

The case for investing in IP owners is almost obvious. They have relatively low costs (producing manga is a lot cheaper than anime), and decent library of IP to draw upon. Most of them are, sadly, not public.

Essentially, the manga market is dominated by four editorials, two of which are actually part of the same group: Shueisha, Kodansha, Shogakukan and Kadokawa, with the first and third belonging to the same group. Three of them are private, and they also own almost all the really big IPs23. There are two relevant publishers that are public24, Kadokawa and Square Enix, but publishing is not their only business. In the case of Kadokawa, it is more relevant in proportion.

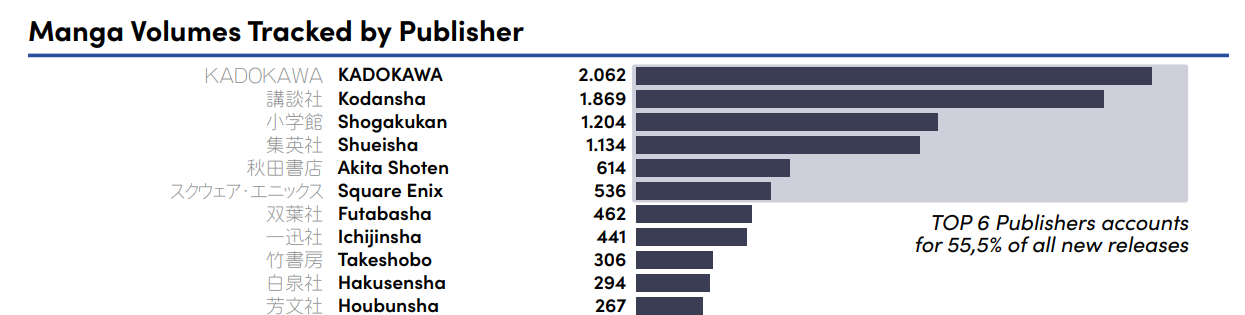

I covered Square Enix’s manga segment here. Kadokawa is bigger and has a much bigger library. They have been leaning into anime recently, with internal studios and the agreement with Sony, and have always invested as producers in adaptations of their material. However, I don’t particularly like Kadokawa, and I think the next two screenshots, from @Josu_ke’s amazing work on 2024’s manga market, explain well why

This only covers the physical market, so no digital sales counted here… but the reality of Kadokawa publishing a lot of not-very-popular works (publishes 4 times as many volumes as Square Enix and sells less than 50% more) is visible. That does not mean they don’t have interesting IP, they do (Sword Art Online, Konosuba, Bungo, Made in Abyss, Delicious in Dungeon… we could put Your Name here as well25), but in a business that leans heavily on the right tail, I don’t want to bet on the volume player, and the fact that they have the number of publications as a KPI is not something I like as an investor. They are also the parent company of FromSoftware (Dark Souls, Elden Ring), so not saying the stock is not interesting. But they have lower margins than their competitors for a reason.

There is a third IP provider that hails from South Korea and trades in the US: Webtoon entertainment. Their finances are not great, and they lost almost $145 million last year, with relatively lackluster revenue growth (5%). They went public last June and have lost more than 60% of the value since, while it still trades at close to $1B (and an EV of 1.5B). It is the parent company of several webtoons, and also Wattpad, and they have high revenues. They also emit SBC like crazy, and are owned mainly by Naver Corp and Softbank, with only 13% or so being free float. They have some mildly interesting IPs (Tower of God is the main one that comes to mind), but I find it expensive for what they do. Most of their revenue comes from paid content in their webtoon and ebook platforms, and at their scale and with their terms that is a low-margin business26. The theory was that being able to leverage that IP into royalties would yield great results, but so far that is not happening, and their latest investment has been an anime studio (Project no. 9) without any great hits on their back.

National distributors

It is usually said that very few public companies are related to anime, but some are a bit more hidden than others. And I am talking about Japanese television networks and their holding companies.

In this case, we are generally talking about companies with a deteriorating business (linear TV) and then some forays in streaming or providing content for streaming platforms. Japan being Japan, it is not uncommon for them to also dabble in other lines of business (hotels, events, real state… the works). In general, and in regards to anime, there are things that can make you wary. The main one is that viewership, and especially local viewership, is not the driving factor in growth for the category, especially on linear TV.

But there are two things that can make them interesting in terms of anime. First, they are part of many production committees, as they usually are part investors of many productions that are or were aired in their channels, and in case they landed good IPs, that can help a bit, although they don’t usually report how big that stream of revenue is.

And then you have the cross-shareholdings. Depending on the case, they can be a very significant part of the market cap, thanks to the practice of getting shares in businesses with whom business alliances were made. It is not uncommon for them to have shares in companies like both Toeis, IG Port, Kotobukiya, Toho…27.

The main ones28 are:

Fuji Media Holdings (4676): It has re-rated quite a bit thanks to a sex scandal29, but they have decent rights (including some piece of the action in Dragon Ball, albeit small). Animation and merchandise revenue is tiny for them at the moment, but it has been increasing over time. And they have sizable stakes in both Toeis, Toho, and, truth be told, many other companies, amounting to about a third of their market cap, although their cash generation has been reinvested in a big way in real state, so make sure to check that part!

TV Asahi (9409): Apparently a much smaller company than Fuji (roughly half the profits and revenues), the combination of its low valuation (260B yen), cash on hand (70B) and cross-shareholdings (more than 240B yen) make it interesting. The main holdings are again the two Toeis, Recruit Holdings and KDDI. Sadly, they haven’t taken measures to reduce it, but there is a lot of value here waiting to be surfaced.

Tokyo Broadcasting System - TBS (9401): They have stakes in both Toei Company and Toho, but tiny compared to the market cap. They haven’t participated in a lot of well-known animes as producers, so there is not that much coming from rights30. Not particularly interesting from the POV of anime, as they seem to produce a lot of fodder to fill slots in their programming, mostly. The ads side of the business is still doing fine however, and they have been able to keep costs in check, so they are doing well in general.

TV Tokyo (9413) is the odd one in this list, in that it really leans heavily into animne, with about 20% of their revenue coming from anime rights, and growing. They have been investing in successful franchises (Naruto, Spy x Family…), and they have made it a top priority in 2024. They also have valuable legacy IP (Captain Tsubasa). I am a bit skeptical, because costs are increasing even on the TV side, but interesting to watch. They do own a small cross-shareholdings portfolio as well, but is small versus the market capitalization and they have already been reducing it.

That aside, we also have Toho (9602) which is a different kind of distributor, more focused on films and also the owners of Godzilla!. The thing is… they are leaning heavily into anime of late. The acquisition of GKIDS to try to dominate distribution in the US, especially to cinemas, is part of it. The acquisition was not particularly steep for Toho, at $140 million31. But Toho has also been working hard at investing in successful productions. Spy x Family, Haikyuu, The Apothecary Diaries, My Hero Academia or Jujutsu Kaisen32 are some of their main titles nowadays, and they have put it at thee center of their new strategy. And that is paying out, with the production and licensing segment being now about 25% of their revenue and a bit more of their operating profit versus 12 and 10% in 201933. Thanks to the massive investment in the area they are making, Toho is pivoting from being a distributor and participating as a producer to being a full IP owner (including production studios with major hits). A pity that it is also saddled with a cinema chain34.

Merchandising licensors

This is probably the category with the fastest growth, judging by what I see overall. Not only is it still growing domestically as we saw in the numbers above, but it seems to do the same externally. Take Bandai Namco (7832) for example. Their Toys and Hobby line went from 222B yen in revenue in 2018 to 509B yen in 2024, and FY25’s first 9 months still show 19% growth. This far outpaces the local growth according to AJA, and that is a situation we find across publicly traded companies.

Square Enix’s (9684) merchandise division has doubled since 2021, multiplied by 2.5 since 2019.

Kotobukiya (7809) has doubled sales since 2019, although their max was in FY23. It is a pure-play, but has been losing ground of late and its margins are not as big as its product (essentially highly priced figures) might imply. They sell collector’s items at a great premium to manufacturing costs, but between royalties and lack of volume, they don’t get that much out of it.

Furyu’s (6238) MD segment has multiplied by 2.6 since 2020, but they face pressure because of the decline of their other business (and the lack of relevant IP and a distribution advantage makes their margins slim, together with the focus in the gacha prize category. They are gaining share though!)

Bushiroad’s (7803) TCG unit has roughly tripled since FY20, while the pure merchandise one is roughly flat until FY24 (though FY25 is seeing it double). TCG is much bigger for the company though!35

Takara Tomy’s (7867) T-Arts division, dedicated to gacha prizes and similar collectibles, has been slower, tripling sales from 2008 to 202436 and growing at double digits in the current financial year. The rate of growth is more consistent with AJA’s, but accelerating.

Granted, those numbers do not only include anime-related sales (Square Enix sells figures for Final Fantasy and NieR, FuRyu sells v-tuber plushies, Kotobukiya has their own IP for some lines…), but all is adjacent and should line-up, roughly. And that doesn’t even take into account merchandise made by companies outside of Japan.

That said, other than for Square Enix and Bandai Namco, profit margins in this area are slim, and what both have in common is their own IP37. Even in the cases where the IP is not their own, Bandai Namco has a dominant position in terms of distribution, and is so connected to other anime companies through production committees and existing deals that they can keep acceptable margins38

While pachinko companies also do machines based on anime licenses, and it is part of what drives gamblers to those particular machines, I hesitate to include them here because I don’t think it is the main selling point of the machines, while here the IP is the point.

Additional content licensors

Many games and videogames have been licensed, but it is rare these days that the majority of the business depends on that, rather than being a game developer that takes all types of licenses and original IP. Bandai Namco makes a lot of anime-based games (Dragon Ball, Bleach39, Naruto…), Sega Sammy also does a few (Demon Slayer).

But I don’t see any as a primary play here, except maybe Akatsuki (3932) due to their dependence on Dragon Ball mobile games. You can read a detailed pitch on them on AltayCap’s blog (it has done fairly well since!), but I think it is more accidental than a deliberate choice.

Anime-adjacent & others

I think the popularization of anime is helping others gain ground, mostly overseas, so I think it is worth it to spend a second looking for companies that don’t fit the prior categories, but are related. I am sure I will miss some!

In the merchandise area we find:

Sanrio (8136): Everybody knows the Hello Kitty company and their incredible run (which I have missed, to be honest!). They sell kawaii. Might not be licensed from any anime (though they did their own for a bit), but the rise of anime surely helps!

Happinet (7867): A distributor focusing on video games (software and hardware), toys (managing part of Bandai Namco’s distribution) and video and music. They have grown really well, and started to invest in IP (they appear in several production committees from 2018 onwards). The growth has come from taking share on the toy/hobby and videogame distribution market and an outstanding management of their amusement centers. Their video and music business has not been that good, partly because the anime investments have, so far, not panned out.

Mandarake (2652): I wrote about them a while back. I am no longer so bullish on them, after seeing them failing to profit from both the tourism boom and growing demand outside Japan, and I no longer have a position40

Then we have CyberAgent (4751). They are a curious company. They have a media segment that includes a controlling stake in Abema41, and that has been their main drag in the last few years, as it was deeply unprofitable. As Abema grows in scale both in the ad-supported version and the paid one, that situation is starting to turn. But there are many streamers in Japan (Hulu, Amazon and Netflix, of course, but also U-Next). So in part they are a national distributor, and they do intervene in some productions as such. But they also have an online ad agency business, and most important of all, a videogames business where Umamusume Pretty Derby, Shadowverse, and Granblue Fantasy are the biggest IPs, all greatly influenced by the tropes and aesthetics of different types of anime. Umamusume (a mobile game) is going global soon, after many years as a Japan exclusive, so let’s see how that goes!

And of course, we have my favorites: v-tuber companies. Anycolor is currently more focused in Japan, but Cover Corp derives a lot of its revenue and growth from outside the country, and it would be unthinkable for that to happen without anime’s prior success. I already talked enough about them here, so I won’t bore you further

Some video game companies could be included as well, but I have already covered some in the past. JRPG-heavy companies like Nihon Falcom, Square Enix or even Sega Sammy (Atlus, RGG) would fit the bill42, but I have discussed all of them in prior articles already!

Research tools

Well, we have gone over what the growth in the sector looks like, some of its characteristics, and at least some of the public companies that are related to it.

I think now is the time to talk about how to research an anime company, or at least some of the things I look at.

The first thing to check is how popular is their IP really, and who is involved in the production. And for that, we have MyAnimeList and Anime News Network.

What I usually do is I use MyAnimeList to check for popularity, although you have to take into account that it tells you more about overseas popularity than Japanese one, and it doesn't reflect well the popularity of shows aimed at children. The number of members and average rating can help you understand the ballpark in which you are moving, although it is far from precise. You want to see at least a few hundred thousand for a mainstay IP.

The second is to check the fan base. Now, after a while in this area you get a feeling for who watches what and the type of fandom they have, but still, Reddit is a fantastic tool for overseas fandom. For any given popular anime, you will find a subreddit and be able to gauge, more or less, if you are dealing with a predominantly female or male community and also the age it reaches. As examples you have Solo leveling (power fantasy aimed at teen guys), Frieren (theoretically aimed at the same group, but with an audience with a bit more age and genre range43), or Fruits Basket (target demo being teen girls). This is important because women tend to spend more on merchandise, although there is a fair bit on additional content spending - that is, games- going on on the male side. So you want to know the demo it is hitting, and then go to the next step!

The third step is to check how well monetized it is. You can go to Buyee, Bandai… and check what you get in those stores. It is good to see all types of figures, but if you see really premium ones (say $300+, though it is an arbitrary line), you are likely to have a very hooked fan base, whether it is very extensive or not. It is also important to check if there are ranges of gacha prizes made for the series, as those are important for both revenue and exposure. I would also check Steam, especially for Shonen, as that can be a relevant part of royalty revenue (although far from merchandise).

Of course, it only pays to do this for the biggest properties in a company. Toei has made hundreds of things, don't go checking each one!44

And talking about Buyee, at least until they are acquired45, Beenos, their parent company, publishes interesting data from time to time, hope they continue!

But there are two real treasure troves of information out there too. The first is a newsletter as well, and a must if you want to follow anime as an industry. You might already have an inkling because I have cited him a couple of times in this article alone, but I am talking about Animenomics, by Richardson Handjaja. If there are relevant news or trends about the industry, you will get them in the newsletter, well distilled and with sources.

And another is actually about the manga industry, and focused on the physical market. While he uses data that is publicly available (mostly, though not only, from Oricon), the infographics and summaries @Josu_ke makes are fantastic. Not only the annual review I linked earlier but also weekly and monthly summaries on sales that you can find in his Twitter/X profile.

Conclusion

Anime has been growing in popularity internationally for many years now. The 80s marked the first exposure to it in many countries, and it hasn't really stopped capturing the imagination of people. It has in fact increased its reach, and now encompasses several generations… and that means it is easier to get share of wallet now than it was a few years back.

Now, the US is a big part of this growth, and tariffs might hurt it in the short term, as a big part of the merchandise is currently manufactured in China, but I don't think that will change the trend meaningfully over time, even if there is a bump. Large companies, like Bandai, already split their manufacturing in several countries even if China plays a major role, which might help dampen the impact, but many others rely only on Chinese manufacturers46.

Personally, I think what is important is to find companies that either own strong and relatively under-monetised IP, or that are able to consistently produce high-quality content that is slowly improving their catalog. Easier said than done! But still, as Toei Animation's increase in earnings shows (4x since 2016), and increase in royalties from Dragon Ball (2025 will probably be a new record, given it is already very close to 2024 with 1 quarter left) proves.

I will try to review some of those companies in the coming months, hope you will join me!

Much like Mortal Kombat or D&D, Anime had its moments causing moral panics. From the Urotsukidoji (no, that is not for kids) thing in the UK to Brazilian evangelical preachers talking about Pokemon spreading Satanism to all the cuts and censorship in virtually every country, partly caused by misclassifying all animation as just for kids, partly by cultural differences.

And the reason I was riffing off Douglas Adams in the intro is because this is meant for tourists. You don't have to like my sense of humor, I promise the data is better.

Surprisingly little success in the UK, understandably so in the US (it is about football, after all). But it was a huge success for decades in Spain (as Oliver y Benji) LatAm (as Supercampeones) and a good chunk of continental Europe and the Middle East.

Akira was relatively successful here too, but it was much less of an AHA moment, at least in Spain.

Speed Racer, for example. Transformers is an interesting case of USA-Japan cooperation too with massive success.

Funnily enough, in the official English version of the 2023 report, AJA translates that epigraph as “The Pachinko and the like". That is not an accident, the revenue Pachinko machines generate for anime properties is fantastic. Probably on par with videogames, or above, domestically.

I was going to originally title this Anime is eating the world due to that growth, but a16z already paraphrased their cofounder. For a puff piece for AI companions with which I disagree vehemently.

This week another small one closed, and more will follow, as they always do. In fact, Animenomics reported we had a 15-year-high in the number of anime studio bankrupcies.

Especially Korean ones. What is the difference between webtoons and manga published directly online? Usually webtoons are adapted to mobile better, I guess.

Beyblade, Bakugan.

Sure, the story is already written, but in some cases the anime adaptation catches up with original material and filler ensues. Also, adapting stuff can be more complicated than just taking the prior material

In the same way that products licensed more form the Game of Thrones TV series than from ASOIF books. That way they can use the better known likenesses.

Sailor Moon, Digimon, Saint Seiya, Pretty Cure, Fist of the North Star… and they also animated Interstella555, for the Daft Punk fans among you!

Ahem… Warhammer.

Although Happinet is a very interesting company, and has grown well as a distributor. You can find exceptional players in every niche.

Of course, fans will say that manga, manhwa and manhua are not the same thing. And it is true each has their own quirks, but also they influence each other a lot and share much in terms of aesthetics, and most importantly, they compete for the attention of the same set of people outside the three countries.

This series in particular is weird, in that it has light novels and two different manga adaptations, so the rights are a bit all over the place.

Appears in some lists, but not others, but MAL tends to leave out the animation studio of the lists.

IG Port has fully financed some productions, but none have been outstanding sucesses on that level. Many relevant companies eventually try that to get out of being just an anime studio or to try to jump to the next level. MAPPA did it recently with Chainsaw Man, and here you can read one of their former executives explaining it. “I think it’s quite difficult to break free from hand-to-mouth operations with such a setup“, he says. Indeed.

For the most part. DLE is also there.

And also Super Sentai (the show where the Power Rangers fights came from!) and Kamen Rider.

You have seen the drawing style of that studio all over the place thanks to the latest image generation model of OpenAI too!

Attack on Titan, Naruto, Dragon Ball, One Piece, Demon Slayer, Jujutsu Kaisen, Bleach, Death Note… all are in those three. Of all the animes that really made an impact outside of Japan that I can think of, only FMA is elsewhere, in Square Enix - and it is not that evergreen by nature. Many really good IPs are outside (Delicious in Dungeon, Made in Abyss, Apothecary Diaries…), but nothing on that level… in Japan.

Akita Shoten, Futabasha or Ichijinsha are also private.

Ghibli aside, films are usually far less relevant in terms of generating recurring revenue (unless they are IP activation plays, like One Piece / Slam Dunk / Digimon films that Toei makes regularly). That’s why except for really exceptional cases like Your Name, I won’t mention them a lot despite being successful.

Puzzlingly so, my instinct would be that with that level of revenue they should be able to extract a profit. I am seemingly wrong.

Recruit holdings also shows up in several, surprisingly (at least to me)

Excluding Nippon Television. They also have interesting shareholdings in Toei, IG Port and Recruit, making up about a third of their market cap, and are unwinding part of them.

As opposed to their privately-owned affiliate MBS, which has had unbelievable taste.

It is pending closing, so exchange rates fluctuation are in play of course.

Also Kaiju n.8. They work really closely with IG Port.

As of FY24, revenue did a bit more than double, profit for the segment has multiplied by 3. The percentages are for FY25 and in particular for the results of the first 9 months, which will be a new record, with revenue and profit growing quite handsomely and likely to surprise to the upside, given DAN DA DAN release timing.

Their cross-shareholdings are also not particularly big, so no relevant value to unlock there.

Bushiroad’s TCG unit would probably be worth more as a stand-alone business than the whole company is right now, having so many subscale businesses is really hurting them. Related, I am not too sure if Bushiroad’s TCG are additional content or merch… but IMHO they usually are bought as collectibles, not to play.

Takara Tommy call the financial year ending in March 2024 FY23, contravening the conventions almost all other companies use. I have used the usual convention, so when I am saying 2024 there is FY23 for Takara Tomy, and ends in March 2024.

And also Square Enix reports royalties in that segment, altering the margins.

And improving. They were lower a few years ago (7%), but in the last full financial year op margin for the segment is 15%

Sad to see Rebirth of Souls disappoint though!

Briefly reopened it after seeing their new online store help sales pick up in December… only to go back to earth a bit in January and go flat in February. So after the report for February, I sold.

TV Asahi, our favourite business hoarder, has the rest.

Not Capcom though. I don’t think anyone classifies Monster Hunter in JRPGs, despite being Japanese.

The demo is largely defined by what publication picked up the manga, not by the fanbase they actually have. One Piece or Naruto might be shonen, but it has a far more diverse fan base than, say, Solo Leveling. The Apothecary Diaries might be classified as targeted at men, but it has a sizable female following too… that is why it is important to check beyond the classification.

957 according to MyAnimeList, though only 287 are TV content and some are separated season by season.

So do most European and US companies. Asmodee and their American subsidiaries (FFG, for example), Steve Jackson Games, Deca (owners of WizKids), CMON, Hasbro… the hobby area is going to have major problems in the US. Even Games Workshop makes part of their range (scenery, dice, print material) there.

This was a great article, I really appreciate the breadth here. As I am a huge fan of anime and manga it feels great to try and invest in quality companies making it. Your blog helps me a lot in that regard.

Learning the different components of anime economics production, studio, distributor, etc is something I would really like to know more about.

I would especially love to hear more about your opinion on Toho. There potential vertical integration, the acquisition of Science SARU which is now creating one of the hottest anime of the year. Do you really think their movie theatre chain weighs that heavily against them?

Bleach fans. UNITE !

Sorry for the late read, thanks so much for the detailed write up. Much appreciated. I still believe BLEACH has potential for being monetarized...

Also, i could see a world where Overlord becomes popular.