Sega Sammy: results & perspectives update

A much needed Sega Sammy (6460.T) update after a bad earnings release

I have been following Sega Sammy since the inception of this substack and I think it is time to go over how things have gone, especially given the recent Q3 results release, starting from what the original analysis stated. I highly encourage you to read it before if you haven't, as otherwise the context will be missing!

A bad release, but not a bad future

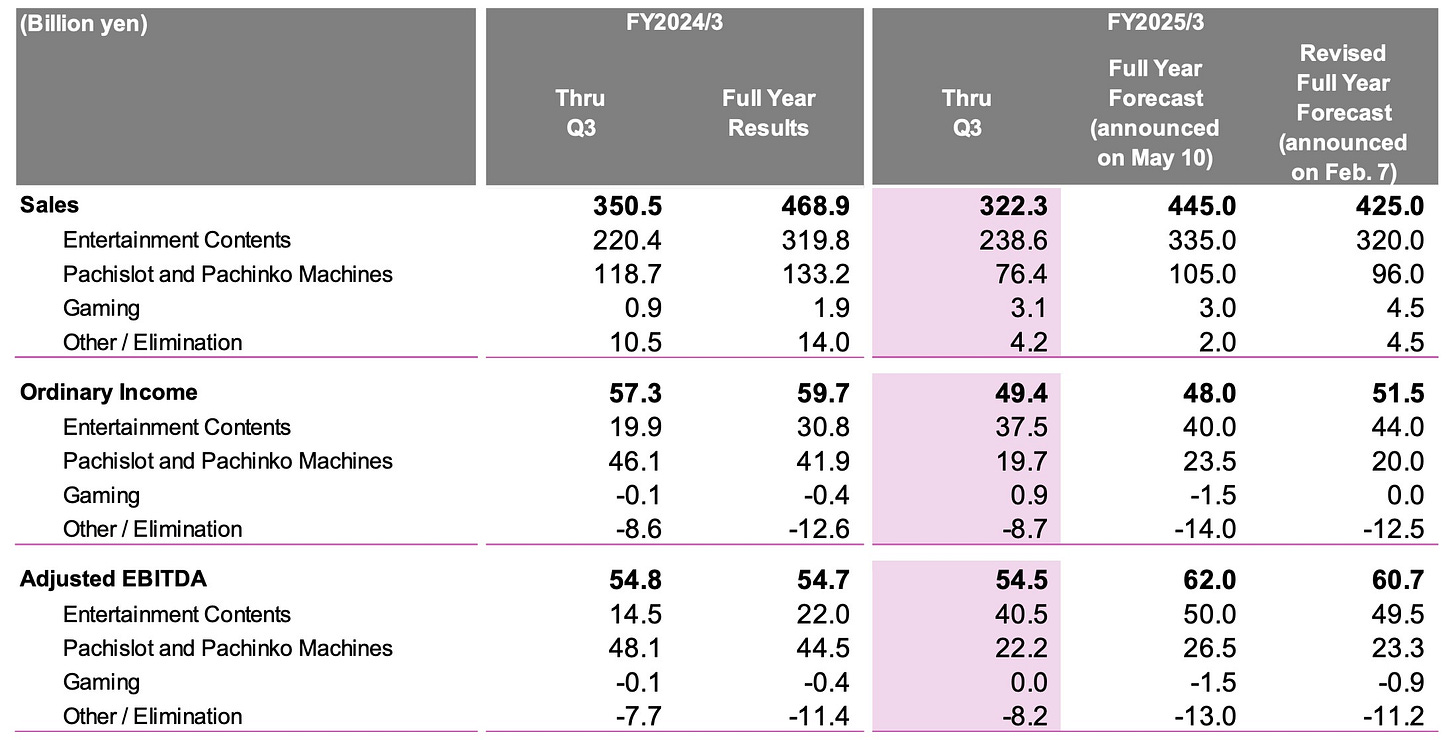

There is no way around it, Q3 earnings release was not good and the revised forecast is bad too. Despite that, I am moderately optimistic about the company. First, let's look at the overall release and the forecast

A downgrade of revenue by 20B yen (about 130 million USD) is not great, especially when it is across the board, with both Pachinko and Entertainment Contents (anime + videogames + toys) going down. Profitability, however, suffers a lot less. It will go a bit worse than expected in the Pachinko segment, but better in EC. Let's review the segments in more detail.

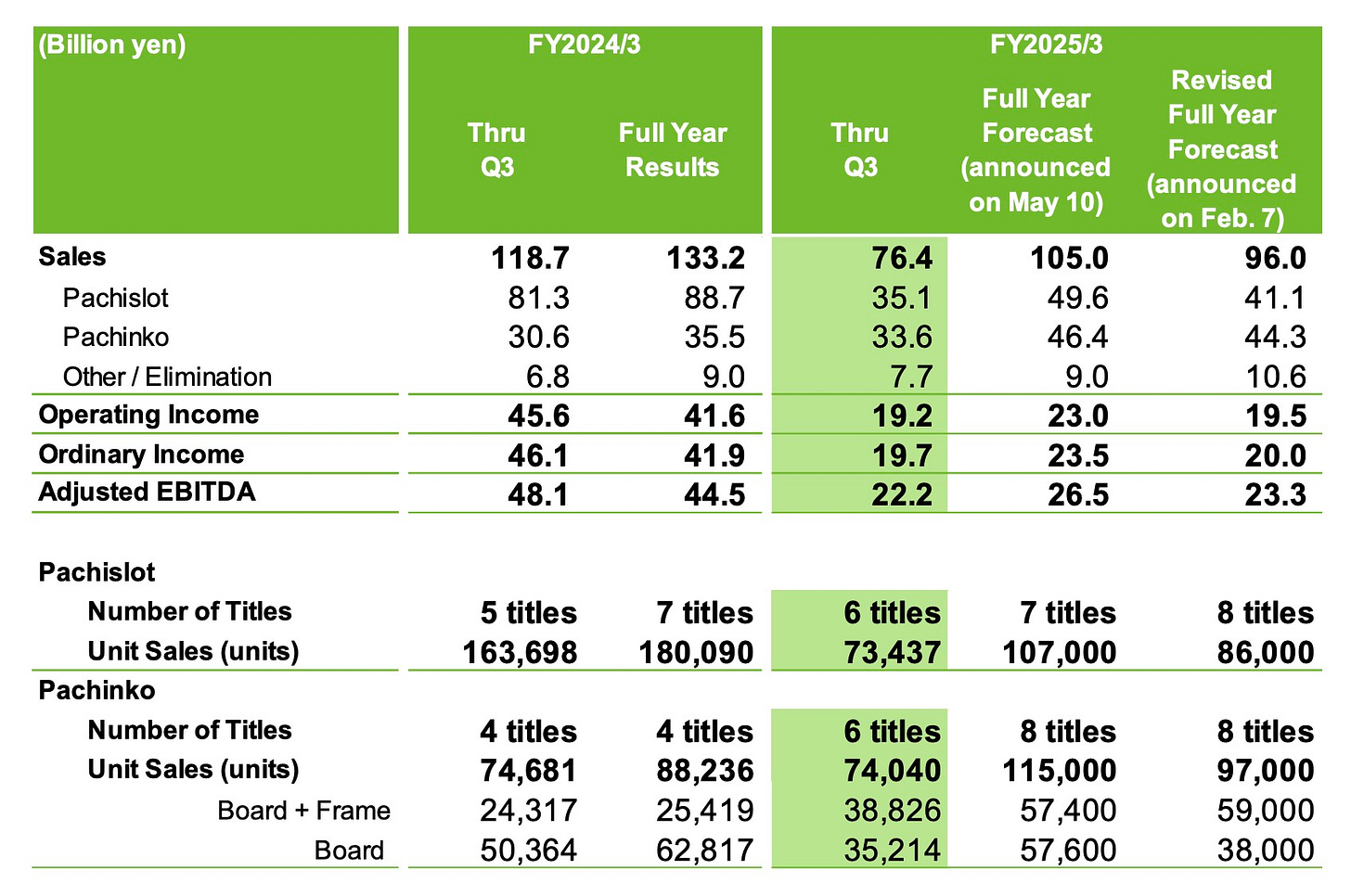

FY24 was a fantastic financial year for Sammy thanks to Fist of the North Star pachislot's success. In the last year, they failed to find similar success and sales are back to FY23 levels. Which is a bit disappointing. I had expected a bit more from their releases this year (basically that they would have been able to hold to the initial forecast (which already took into account a reactionary drop.

It will still provide very decent profits, but calls into question the durability of the business if they can't keep maintaining the share gained last year. Little else to mention on the domestic front of Pachinko and Pachislot. Hopefully they can keep at least these levels in the coming years, while the industry slowly disappears.

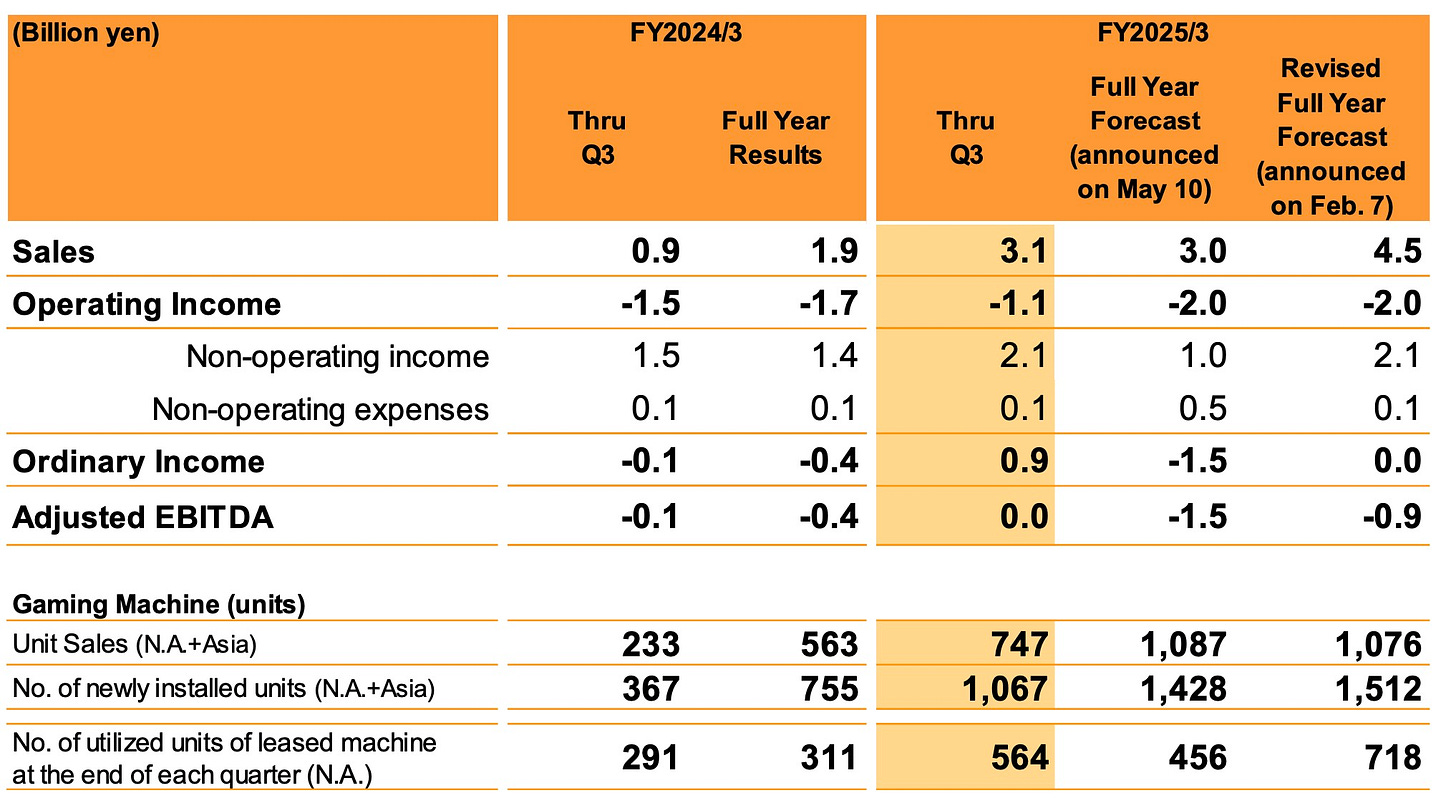

The only bright note in this segment is the gaming segment (that is, slot machines) which is still tiny but growing at a good pace. Q4 sales are expected to be the best ones yet, and accelerating. But it is still a subscale business that loses money (that non-operating income comes from the participation in a resort in South Korea). That said, losses in Q3 were minimal (0.1 billion yen), so seems profitability is improving with increased sales.

In entertainment contents things are a bit muddier, because of the different dynamics that we have mixed there

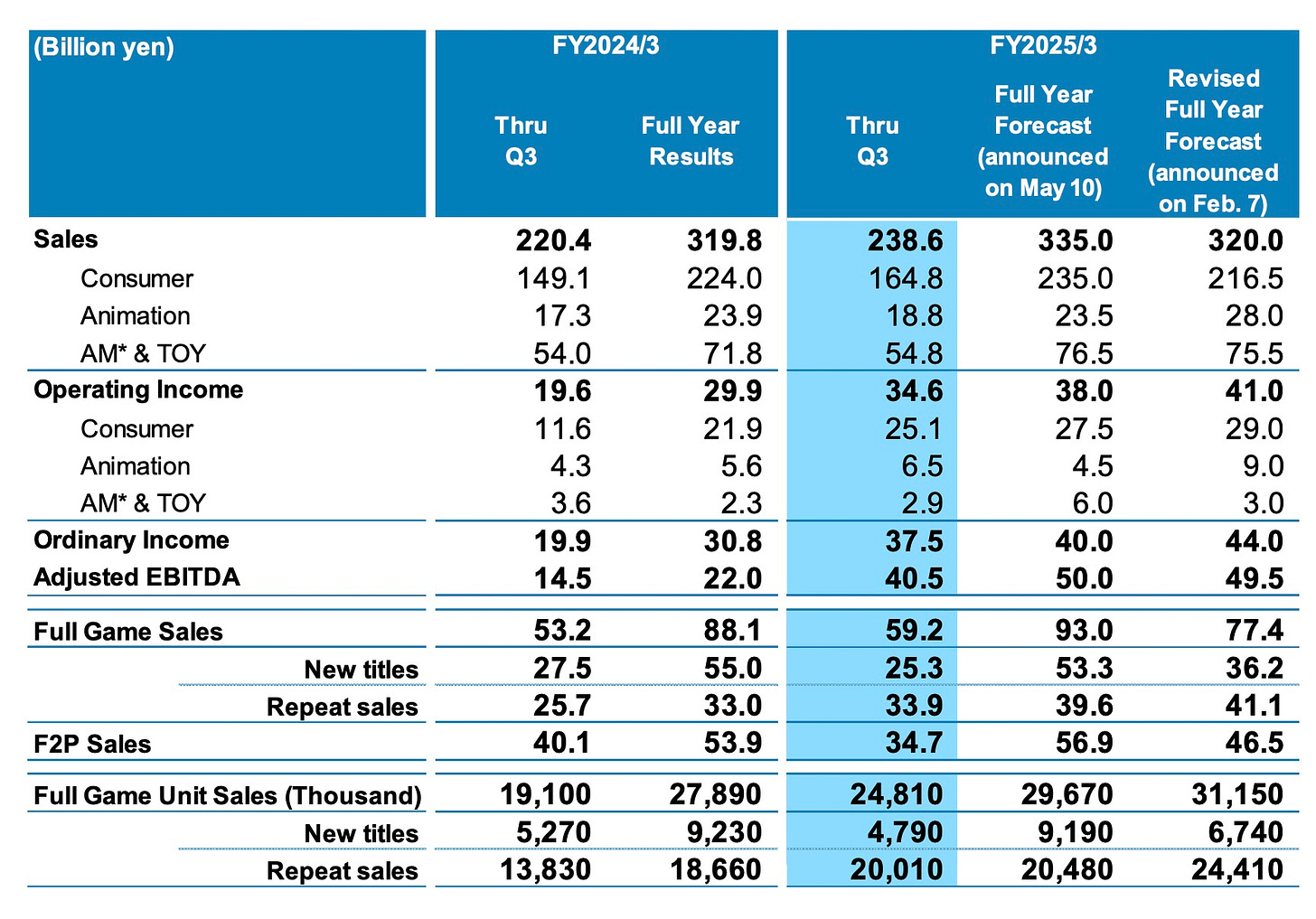

Animation is doing fantastically well, and doubling its forecasted operating profits to almost $60 million thanks partly to the Sonic film contribution1, but also to Baki, Blue Box2 and the release of Sakamoto Days in Q4.

Amusement machines and toys are not doing great compared to forecasts, but still doing far better than last year, both in revenue and profit. Still a segment I hope they eventually divest or reform very deeply.

Consumer (aka videogames) is where the fun is at. They are generating more revenue than last year at this date, but not by much, and last year there were two very big releases (Infinite Wealth and Persona 3 Reload), while this year the calendar is less packed3. Let’s dive into the causes of underperformance:

F2P is underperforming greatly, losing about 15% of sales YoY and going to miss initial predictions by more than 20% (at a 10.4B yen miss). This alone explains most of the 15B yen gap. Decline was expected (all other games, including Project Sekai, are already old), but management was guiding higher because of expected releases… that did not happen. Let’s look at them:

Sonic Rumble seems to be stuck in eternal pre-release, and despite more than decent reviews and good use in some countries it generates no revenue because the operations are not run in that direction. At the same time, the pre-registration campaign is unable to arrive to 600k pre-registrations… probably because it does not even explain well what is a pre-registration or what counts in Steam… I mean, it is a bit of a disaster. Release date remains undisclosed, and it is available in half the globe meanwhile, but without much marketing or operations. I truly don’t understand what they are doing with this game, and would love to interview whomever is in charge, because there has to be a reason for something so bizarre.

Persona 5: The Phantom X was supposed to come to Japan during this fiscal year, where it should be operated by Sega directly, and that has not happened. I suspect the performance in Taiwan and South Korea not being great has helped, but they have announced no cancellation (it is in the release schedule, just without a date).

Metaphor: ReFantazio sold well in PC, and that drove me, and I think many other people, to think sales were better in console than they have been. Given that all put together is about 1.5 million units4, that does not seem to be the case. Seems to be both outperforming P3R in PC, and underperforming in console. Not a financial failure, but seems like Sega expected more, given the slash in sales forecasts for new games… together with the next item.

Football Manager 25 cancellation was announced along with the earnings5. This series has been selling about 1-1.5 million copies a year, plus Xbox/Apple/Netflix revenue. So it is a big hit to earnings, especially since some costs have been written down. The mismanagement of this game’s release deserves a case study, and is probably the worst I have seen, other than outright scams.

It was expected for early November, and preorders were opened.

A bit later, the release date was given as the 26th of November, which already irked some people.

10 days later, the release date was pushed back to March, with no specific date

Then last week, on Sega’s results presentation, the cancellation was announced (with preorders still open on Steam)

In the case of FM25, I think they got to a release-able-ish state very late, and decided to cancel to avoid the reputational hit. I think this is a mistake and they are going to get it twice, because the first iteration of a new CM/FM engine has always been a bit of a mess (player feedback is relevant, as is to see how they actually use the features added). Now they have already had the hit of missing a release with multiple delays, and FM26 will get the hit of being the first of a new series. Sales were going to be pitiful and reviews bad anyway, at this point. Just with they had gotten on with it at a reduced price and called it a day. Probably I am missing some reasons why that was not a good idea.

This has been partially offset by the back-catalog performing really well, thanks especially to the Persona and Total War series, with Sonic actually having lower unit sales than prior years despite the successful Sonic x Shadow Generations release. After Sonic 3 was released, Sonic back-catalog titles went up in sales in late December and January, so probably that will improve a bit in Q1. Also, the other category has been performing really well, despite including Rovio (which is performing way below forecasts). Licensing revenue must have skyrocketed to cover for it and actually deliver an increase in revenue.

In terms of the new forecast, I have no opinion on Pachinko, it really has been a mediocre year. On consumer, I don’t think they are lowballed on the videogames side. They are forecasting $340 million in revenue in Q4, with $50 million coming from back-catalog, about $80 from F2P, $140 from other (Rovio and licensing, mostly) and $70 million from new games. The mix will probably be different (I suspect F2P will be a bit short again, and back-catalog a bit better), but I don’t think we will see massive surprises on revenue, unless LAD: Pirate Yakuza in Hawaii outperforms by a lot6.

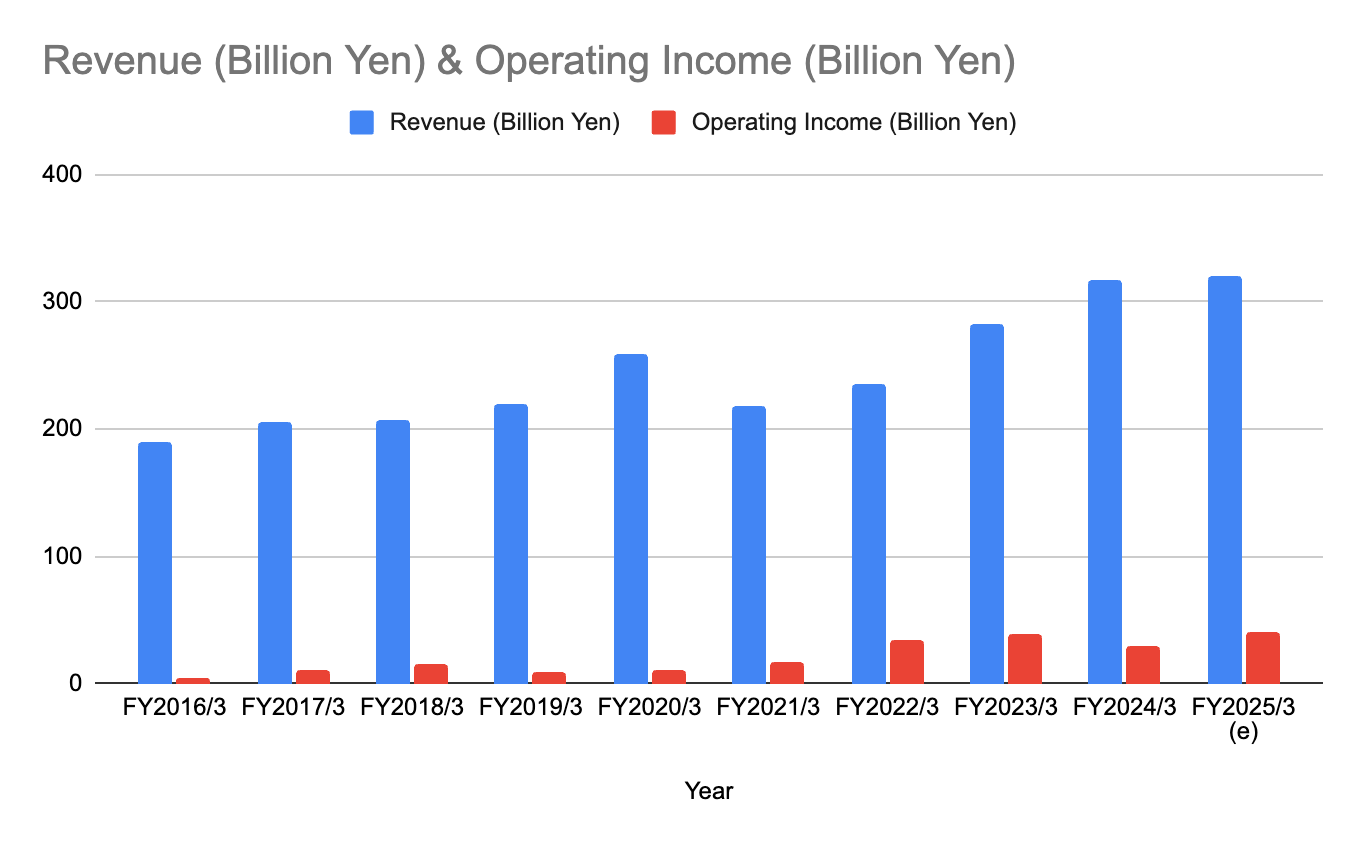

Why am I still optimistic regarding Sega? Well, despite all these things failing (and it has been an anomalously bad year in that regard), this is on track to be the best year for the Entertainment Contents segment in more than a decade7.

Where does this leave Sega Sammy?

The company is still relatively cheap, in my view, although less than it used to be. At about 640B yen this is about 13x EBIT (expected at 53.5B) or 17x expected earnings, you are paying for the current performance of the company, but not for the optionality it has.

What optionality? Well, this is the evolution of the entertainment contents segment since FY20168, with FY25 being a record year in both revenue and profit if estimates hold (and when they are this close, they have tended to estimate lower if anything, though maybe not this time!)

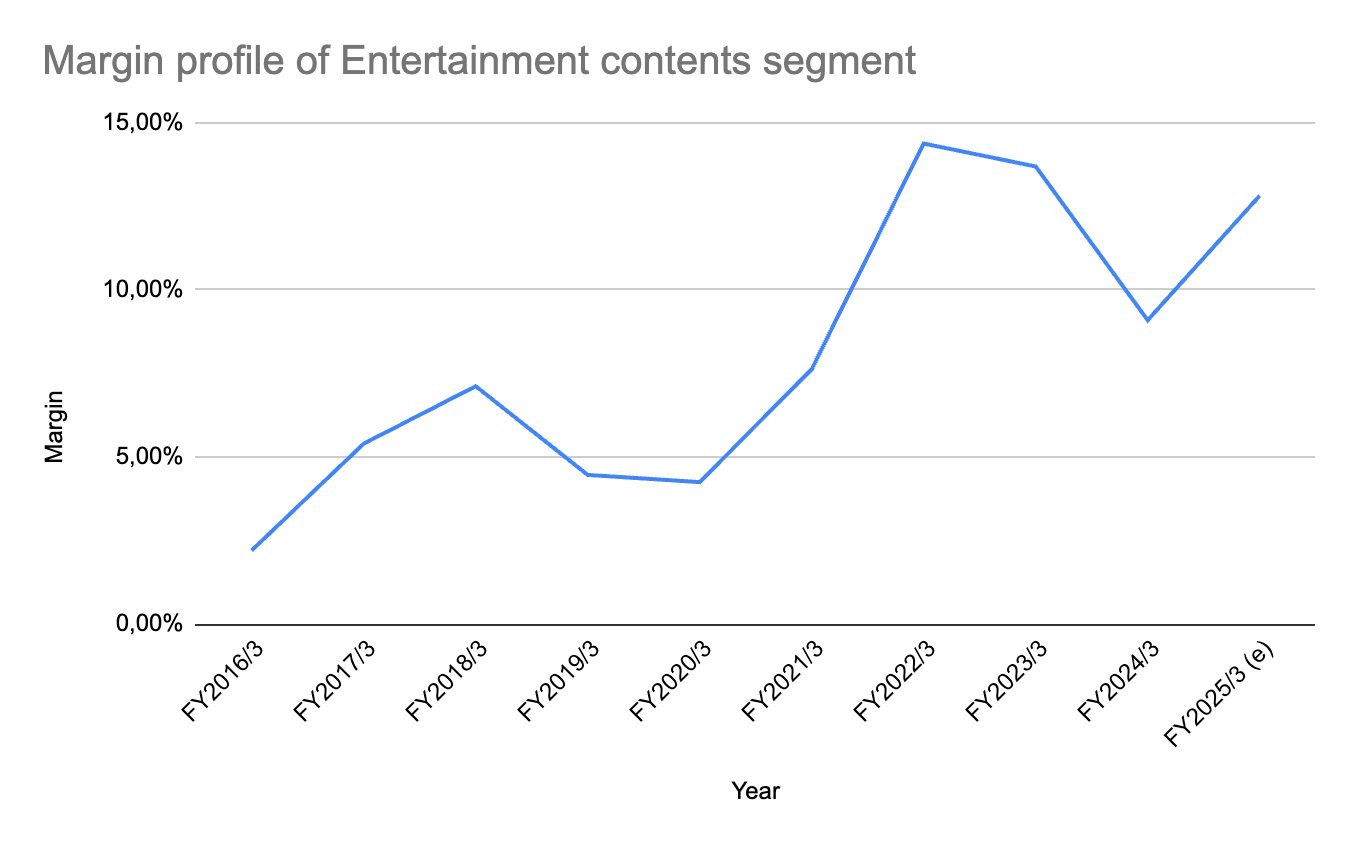

And the changes in margin profile.

As you can see, the segment has been doing well overall, and the COVID margin improvement has mostly held in two very difficult years for the videogame industry. And that has happened despite several high profile mistakes. It is a pity, because this should have been a banner year for Sega, and it would have been with FM25 not cancelled and Sonic Rumble well rolled out.

But the situation is still the same, and arguably a better long term set-up than last year. Sonic IP revival is proceeding well, with Sonic 3 making a $470 million box office haul and becoming the second best selling videogame movie9, Atlus is generating fantastic JRPGs and RGG is creating excellent games10 as well, and Creative Assembly has recovered quite a bit of the goodwill (and part of the sales) thanks to Pharaoh Dinasties and the last two DLCs for TW:W3. We have a number of interesting releases to look forward here in the coming years, namely the continuations of Persona and LAD, Sonic games (racing has been announced, and we should get a new mainline announcement during the year, I think), Alien Isolation 211 and all the IP revivals.

Amplitude and Relic are now out of the family though. I completely understand the decision on Relic, despite the fact it was a studio with a really deep history in RTS. Amplitude… not so much. I think they had a lot of potential to challenge in 4x games, and just needed a bit better direction. But alas, they will have to find that on their own12 13.

There are additional good signs. Sonic 3 revenue allocation aside, TMS has been doing well in animation, and has slowly transitioned to participate in the production committees as well. Blue Box is a good (and successful) example of that. And as of Q3 has already surpassed the prior combined record operating profit of Animation and Toys put together, forget about Animation alone.

On Sammy’s side, for me Pachinko is still a melting ice cube and slot machines an open question (though one progressing well). But the Japanese integrated resorts that will open in the coming years will be a boon to Sammy, as well as other equipment providers, and that should help a bit (though I suspect there are better ways to play it).

And in terms of capital allocation, the share count keeps going down, although more slowly. I don’t love the M&A (Rovio, GAN, Stakelogic), but at least there is some plan behind it.

Sega clearly does not know how to do F2P mobile, and they are proving it again with Sonic Rumble. I just hope they just let Rovio play with the Japanese IP instead.

And that is all on my side for Sega Sammy’s results. I still have a position (although a slightly smaller one after the run, have to keep the portfolio a bit balanced!), and I think it has good odds, but it is not as incredibly undervalued as it was a year back.

A quick round of portfolio updates

I have made some changes recently in the positions I have mentioned in the past, so might as well get tell you all!

I sold both Embracer and Asmodee. Embracer was at around 180 when I mentioned it here14 and I sold at around 26015 (adding up Asmodee and Embracer). Not a bad profit for a few months, and I don’t trust management in the long run, let’s see how clear are Asmodee’s now that it is a bit more independent.

I took a small position in Mandarake again. Ready to be burned a second time, I guess! Will be following the results and monthly sales data with interest to see if the reversal I suspect is confirmed… because there is a reason behind it. See… in December, Mandarake opened a store in Mercari, which is basically like any brand having a store front in Amazon. And in December sales went from essentially flat YoY the prior two months to 16% up. Why do I think there is a causal relationship, and that it can be really important for Mandarake? Well, because they had failed to increase their online sales since the pandemic, and their online store gives GeoCities vibes. And Mercari is already a hub for both foreign and Japanese collectors. For now, seems like the online store keeps selling well, based on number of reviews, let’s see how much is cannibalization and how much is additional.

If you are interested in Cover Corp… it reports Q3 results in a few hours! I will be hosting a space in X/Twitter16 to go over them as they are published. Given that it starts right when they are supposed to go out and I have never hosted a space before, it will probably be a disaster. But I think the results will be good. Come and have a laugh if you are awake!

Yes, it is allocated to animation instead as to non-operating income as it used to be, they changed the policy after the last film.

As part of the production committee.

LAD: Pirate Yakuza in Hawaii is not tracking nearly as well as Infinite Wealth (as expected), and Two Point Museum is also not tracking as a huge success.

Sega Sammy sold 3.77 million copies of new games in Q3. Almost 2 million come from Sonic x Shadow, and a bit comes from SMTV:V and others

Well, there was a notice in SI’s site a bit before, I think. But a matter of not much time.

Over the top enough that I would love to see it succeed, but honestly I have many doubts it will attract many people beyond the hardcore LAD fanbase, being a spin-off and not a main title. I would be very surprised if it reaches a million copies in the first few weeks.

Forex played a part in that. Otherwise it would have been the second best in sales, but still the best in operating profit.

I cut it there because it was a bother to include prior years because of a change in segment denomination, but the prior 4 years the company was earning a lot less money than the Pachinko/Pachislot segment alone every single year, so you get the picture.

After Mario’s movie. It is the console wars again, but as a farce, given the distance nowadays.

They are JRPGs as well. I guess. Since LAD7 (Yakuza: Like a Dragon), I think that series has its own

A cult survival horror classic made by Creative Assembly 10 years ago that sold over 2 million copies back in the day. The sequel was confirmed in October.

With Hooded Horse as a publisher. Those mfs don't miss.

In both cases, divestment terms were not made public… but I think they were more or less given away to lose the costs. The market was not exactly hot for games studios (just look at the crappy sales Embracer made), so it was that or keep them. They should have kept Amplitude IMHO.

Wether you take my original purchase date in November or when I explained it well, in December, doesn’t matter, it was essentially flat between dates.

Someone more skilled at catching the tops would have done a quite a bit better in the last few days. Ah well.

If you know any alternative platforms for something like this, please share them with me!

thanks for sharing,