tinyBuild: Two big releases on a tiny market cap

The Kingmakers publisher trades at about $30 million in the AIM, and could earn its market cap this year.

When I found about tinyBuild, I was surprised to learn that the publisher of the medieval Carmageddon that had gone viral a few months back was public. I was even more surprised to see they traded for less than $20 million, and I got a position almost immediately, because the organic publicity that game has gotten alone bodes well for it. Then I dug a bit deeper, and bought a bit more (and a bit more expensive). And then I thought for a while time about publishing this or not, for reasons that will soon become obvious. But first, let's bask in the glorious absurdity of the game

The opportunity

tinyBuild is not a success story, at least as of now. And it is unlikely to ever be for someone that bought the IPO, as it debuted at about 50 times the current share price and raising a fair bit of money and using it to go on a shopping spree of tiny studios. Of course, the strategy of flooding the market with content was obsolete by the time they started to execute it, so results have been less than stellar. They have also been spending like drunken sailors to keep the flood coming, publishing 141 games in 2024. So why on earth would I be interested in this company?

Because they trade for about $30 million and they have one game positioned in #19 (Kingmakers) and another in #57 (Streets of Rogue 2) in Steam's most wishlisted games, and they have no debt, thanks to a capital increase in early 20242. We'll go into numbers a bit more in detail later, but it is very likely, in my view, for tinyBuild to make more than its market cap in revenue with this two releases, and the expenses have already been incurred for the most part. There are also additional considerations (flurry of launches in H2'24 that should make expenses go down and revenue up a bit), but this is the main thing.

Why now?

Because there is a significant differential between what this games can sell and the market cap of the publisher. As I mentioned in the last article, publishers and developers tend to get valued on potential success ahead of the release, while revaluation after the release itself is less common. Since both releases

What is the size of the opportunity?

2-3x in a relatively short period (pre-release) would not surprise me. First, I think Kingmakers has the potential to go over 1-2 million copies with ease if it is any good, and far more if it is really good. Hoping for Palworld levels of success is too much, it has the same vibe that got it to go viral (as Carmageddon did ages ago). It basically subverts the careful time-traveler trope and puts you, guns akimbo, in the Middle Ages. That is why basically every relevant streamer has already talked about the game. If it is any good and doesn't become hugely repetitive in an hour, it will feature in so much streaming content that it won't need any marketing budget. We have already seen that with the trailers alone!

Streets of Rogue 2 is a different animal. It has a dedicated and very engaged following, and I think it can get, with time, to 1 million copies, like the original. But in the short term (1 year) and at a full price, I would only expect 300-400k if it does well. Considering a price of $20-25, that is still massive for a company of tinyBuild's current size.

In Kingmaker's case, the haul has to be split with the developers and we don't know the percentages. But I suspect it will be around 50% in Kingmakers (with recoup)3.

This is really risky, isn't it?

Yes. And that is why I was hesitant to write about it. But some write-ups and pitches are already making the rounds4, so I wanted to get my perspective out, regarding both the opportunity and the risks.

The first risk is obvious, it is illiquid and very thinly traded (a bit below $30k daily on average). Not only that, it trades in the ASX1 segment of AIM, in the SETSqx modality. What that means in practice is:

It is unavailable to trade in most brokers, including Interactive Brokers, as ASX1 is not widely available.

In the cases it is available (DeGiro, for example), it only trades electronically in 5 auctions a day. It also trades through market makers, so maybe you will get better access depending on who you trade with.

The second is… also obvious I think, because it is inherent to all videogame releases and happens even to the best studios. Kingmakers can flop, and this being an illiquid stock everyone will run for the exists and the drop will be really fast. In my view, the way to manage this one is through position sizing, which is why it is a small position for me despite its potential.

The third would only happen if the second does not materialise. Let's say Kingmakers is a success, and tinyBuild gets a ton of money, but doesn't rerate much because of the low liquidity and lack of access. Nichiporchik (CEO and owner of 58% of the company) can perfectly go back to piss all the capital available in pointless acquisitions and a flurry of low/mid tier games without being too conscious about cost. I think he has learned his lesson after the need to do a capital increase to keep the company going and expenses are certainly going down… but we'll see.

The analysis

Now that I have laid out the basics of the opportunity, it is time to go a bit deeper. Let's start with a very brief history, then the current situation (as in current numbers, balance sheet and releases) and then what I think the next releases can do.

A very brief history of tinyBuild

tinyBuild started as Nichiporchik's games company. After he had dropped out of high-school, thanks to being a professional Warcraft player5, he saw a flash game6 with potential and collaborated with the original developer to bring it to full publishing as No time to explain7. That took a long time due to problems with a Russian publisher, but it was finally out in Steam two years later8. It sold decently, and the tinyBuild team was a bit exhausted from dealing with all the problems of publishing that game but had some money now, so they started publishing other games.

Fast-forward to 2018-2019, they went through two rounds of funding, opened internal studios like HakJak9. The idea was to build an indie publisher that, through good relations with the developers and some internal studios, could do good games at relatively low budgets and get good profitability. It seemed to work in 2019, and emboldened by the COVID-19 boost, they did an IPO that left the company valued at more than $400 million in 2021 and used the money of both the funding rounds and what was raised in the IPO10 to go on a indie-studio buying spree… at inflated prices just at the top of the gaming content cycle.

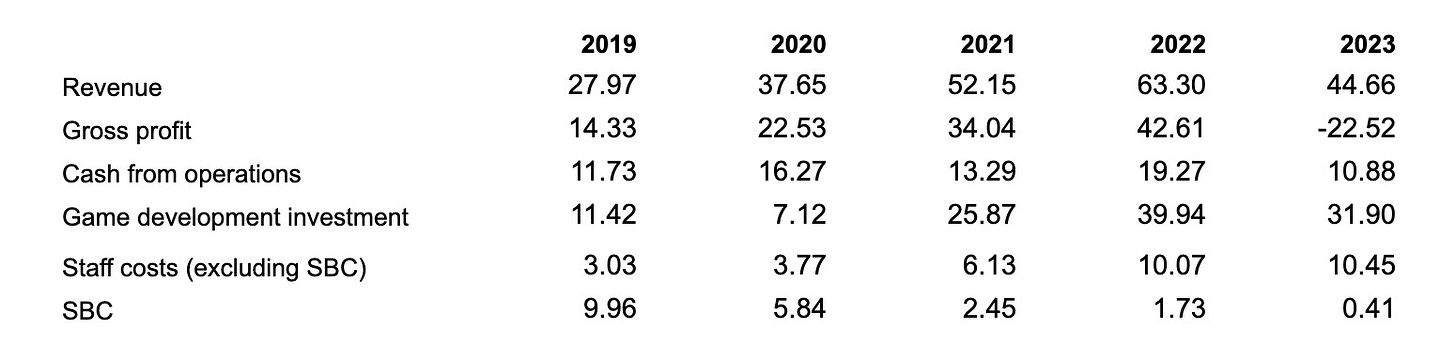

That left them with high fixed costs just as the videogame sector stopped growing (and even decreased a little into 2023-24). While net income grew to $11.5 million in 2022, that was only accounting-wise, as the company was spending a lot more on making more games than it was making, as you can share in the comparison between cash from operations and game development investment.

Staff cash-costs also increased a lot after the acquisitions, doing more than a 3x from 2019 to 2022. SBC went down after they went public, of course (mostly related with the lack of new rounds/IPOs making existing plans change valuation). While revenue increased thanks to the acquisitions and new releases, it failed to recover costs, and that is why the gross profit is negative in 2023 (a write-down of capitalised game costs).

In late 2023, with the company about to go under, tinyBuild embarked in a cost-cutting program, closing a good chunk of their internal studios, including Versus Evil (a publisher bought back in 202111) and HakJak (cancelling Pigeon Simulator while they were at it). Simultaneously, they were working on a capital raise of about $12 and doubling the share count. Most of it was subscribed by Nichiporchik himself with money from the IPO, bringing his ownership to 57.9%, but Atari12 (7.9%) and Netease (3.2%) also participated. And that is how we started 2024.

tinyBuild in 2024 and coming into 2025

H1 2024 was not that great for tinyBuild. It was kind of a new start, without some of the prior footprint, but they still had a lot of development going on and they still burned through too much cash. Almost $7 million, once you back out the sale of some IP assets

Now, that leaves them with 9 in the bank, and a hopefully reduced burn rate. As you can see, the capitalized development costs have decreased greatly in H1 versus the last 2, and administrative expenses also went down by almost 20%. That was, however, not enough to get to profitability. The structure is simply too big for the current revenues, and there is not a lot of runway left. At the pace seen above, one half, and then more capital raises would be needed.

H2 probably will bring a further reduction in costs though, and maybe even a small increase in revenues, if only because of the amount of releases rather than its success. Deadside and I am Future came out of early access, and other 2 DLCs and 7 games were published in H2. None of them had fantastic sales, but the combination of getting some revenue out of them and stopping the development costs13 should improve the cash flow, letting them get at least another H more worth of cash burn. Do I expect a cash-flow-positive H2? No. Just a reduced burn. 2 million of cash outflows in H1 are related to legal settlement, to that should also not be a factor anymore.

Fair warning though: they still have a lot of trade payables outstanding (money owed to external studios for development milestones and sales), about $6 million more than receivables. So if that were to unwind completely, they would be in trouble. But that is unlikely.

Revenues were also down (expected, due to the lack of relevant releases in H1, and H2 is also not stellar!), but as mentioned before, costs went down a bit too.

The summary of this is that tinyBuild has, I think, at least H1'25 to live without the need for further capital. And that is really, really important. Because their two most expected releases are supposed to happen in Q1, and they should bring more than enough money.

The next releases

tinyBuild actually has 3, not 2, releases with good potential. Sand sits at #47 in steam most-wishlisted as I write this, and it could be a success too. But it doesn't have a release date, so let's forget about it.

Streets of Rogue 2 sits at #57. The first one did around $8 million in sales14, which would mean about $5 million to tinyBuild in revenue if it were to repeat the performance. I don't think it can go beyond $10 million at best, and that would be overtime, with most of it in the first few months. Now, 5-6 million in incremental revenue would still be huge for a company that capitalizes less than $30 million, but not hugely transformative, just a really good year. They still have a solid back catalog that brings around $15 million each half.

Kingmakers is a different animal. First, it sits at #19, and second it is likely to be priced higher, in the $30-40 band rather than in the sub $20 one given the graphics and hype. How much can a game like that make? Let's look at recent releases that were either middling in this tier of fame or successful but not hugely so.

Planet Coaster 2 was way below that position, but released in Xbox as well. It had a botched release, but still has managed to sell more than 400k copies and generate around $15m in revenue for Frontier Developments in the first month (I guess around 20 to date).

House Flipper 2 had a similar position to Kingmakers in wishlists, but lower actual listings and no heavy marketing behind it (PlayWay being famously stingy). It has passed 600k copies in about a year, generating a similar revenue to Planet Coaster 2 so far but at a lower price point (slightly higher probably, we don't know exactly).

Granblue Fantasy: Relink was around the top #30, and managed to sell more than 1 million units generating $40+ million in revenue for CyberAgent in Steam alone, although the price point is premium in this case.

Persona 3: Reload managed to sell more than 600k copies in Steam alone (across all platforms it probably has crossed 2 million at this point) from around top #30 as well. Revenue estimates from steam alone are also around $40 million (again with the help of premium pricing)

These were not huge successes, but also not terrible flops. The thing is a middling but not terrible release has the potential to earn almost all the market cap in revenue. And I suspect Kingmakers can do better.

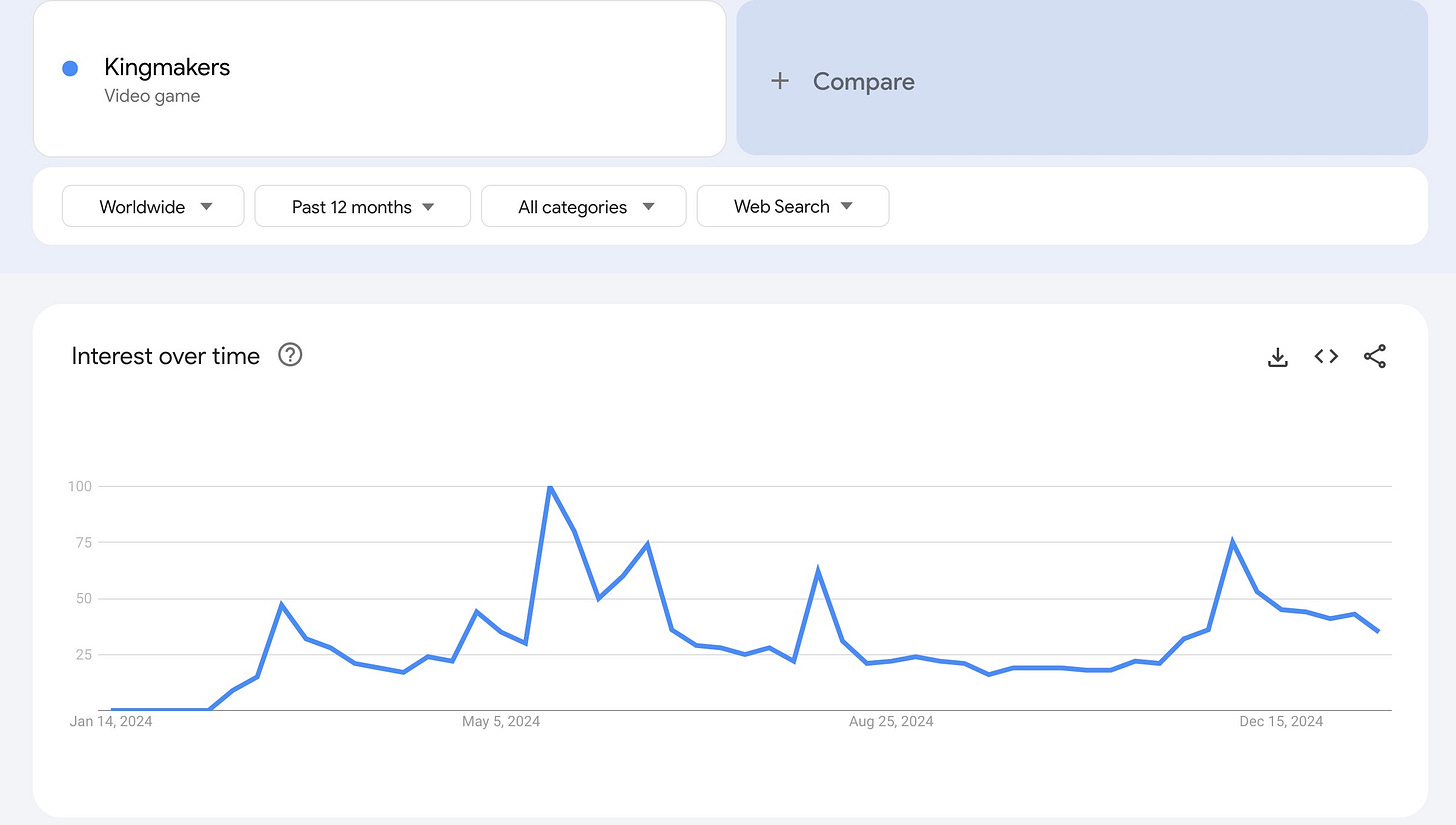

In terms of momentum, it is holding up really well. When it was announced the release was going to be in Q1'25, despite being an early access, it jumped from #21 in wishlists to #18 (with the new Elden Ring pushing it back one place later), and it surpassed 1 million wishlists a while back. Since then, it has held up nicely in two areas. One, Google trends

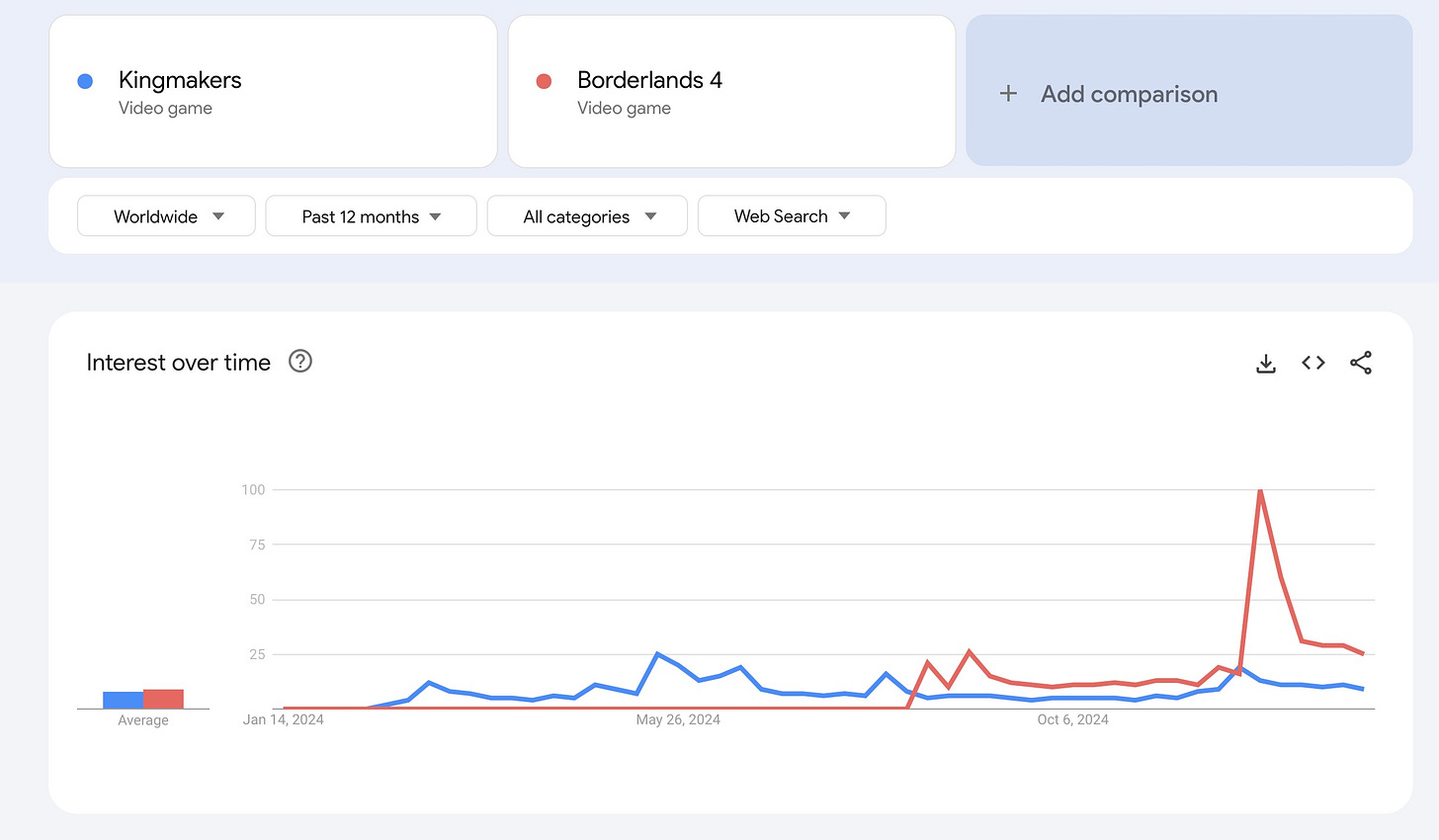

With interest holding up over time after the latest information was set. It is decent interest in terms of magnitude. This is how it holds up against Borderlands 4, a recently announced and much awaited sequel (Borderlands 3 sold about 18 million copies)

Sure, Borderlands 4 has more interest, but hell, might as well. To be fair, this comparisson has a bit of cherry picking on it, as we could compare with inzoi and it is a lot less flattering. But I think it gives an idea of the magnitude of interest. Not incredible and guaranteeing millions of copies. But fairly decent. It also gives an idea of the magnitude of the viral peak around the initial announcement, and that is important.

Another area where it is holding up is is new followers in steam. As of today, 8 of the 18 games that are above it in the Steam most-wishlisted classification are gaining new followers slower than Kingmakers, while only 3 of the next 31 (that is, top 50) are gaining them faster. Followers and wishlists correlate, although not perfectly, and are a pasable measure of existing new interest.

But the virality factor is the most important part here. Kingmakers is a game made to be viral and streamed. It is a bit of a meme in itself. So if the game does not completely suck this is going to be streamed non-stop. And that drives sales up a lot, and should supercharge the capacity of selling of the game.

Now, it could be that the game is insanely repetitive and you have exhausted it in a couple of hours (in terms of interesting situations), and then it will be a flop. But it has clear potential to sell 1 million copies or more if it turns out it is a good game.

And if that happens, tinyBuild is going to have a lot of money in their hands.

How to play this?

Videogame releases have a lot of uncertainty, but right now the risk/reward in tinyBuild's case is very skewed. Personally, I think what will happen is that tinyBuild will partially re-rate ahead of release, and if that happens, I will probably not go through the uncertainty of the release itself. What would be an adequate re-rating? I don't know. $60-80 million seems still cheap, but tinyBuild is so illiquid and difficult to access that maybe it would be fair at that range. Then again, Frontier trades at about 4 times their market cap with, in my view, worse prospects.

A potential bonus is that Streets of Rogue 2 might release before (in fact, I think it likely), and if it does well it can help a lot both in valuation and fundamental value.

If it doesn't rerate ahead of Kingmaker's release (which is in Early Access), I will decide holding or not depending on how it is holding up in terms of interest and response to new material as it is released. After all, they have other interesting releases, but releases are risky, and while I think they have learnt their lesson in capital allocation (and they have sold some IP and reduced their footprint), there is still a lot to prove. But we will cross that drawbridge when we get there.

Probably in a motorcycle, uzi in hand.

Disclaimer: I own shares in tinyBuild at the time of writing this, and this is not investment advice, just what I am doing at why. Do your own due dilligence, stocks this illiquid are risky at the best of times.

11 if you don't count Deadside, Slime 3K and I am future coming out of early access, aside from 3 DLCs for pre-existing games. 7 of them, plus 2 of the DLCs in H2.

Of which the CEO subscribed a bit part. Atari was also a big part of it.

Because Kingmakers seems a relevant effort and the studio making it doesn't have prior work to draw upon, as Road Redemption sold well, but not massively so, and that was ages ago. Streets of Rogue 2 is a bit different. The IP was acquired by tinyBuild a while back for $6.5 million. The developer retains a royalty on the revenues (at an undisclosed percentage) and is still the main developer, but it should be a small one (after all, tinyBuild owns the IP and pays the development!)

Eloy Fernández 's pitch is here, and I think Paco Lodeiro has referenced it as well somewhere (he runs Value Investing FM, a value investing podcast in Spanish and a host of other things - discord, courses…, so I haven't been able to find the mention, only references to it. Too much content to consume for me!). Name has also mentioned it recently

Warcraft III, not World of Warcraft. Didn't even know there were professionals of this!

Remember those browser-based games with animations? That's what I am talking about.

And the style of the whole company (logo and the like) comes from that game.

One of the first fruits of Steam Greenlight, Steam's self-publishing option (which was also a popularity contest!). It was replaced a few years ago.

Now closed.

A bit more than $40 million

For $31 million along with its QA arm, Red Cerberus, that lives on inside the group.

It truly is shitcos all the way down sometimes.

Internal studios are of course still there. But many of the games developed came from external studios and tinybuild was a publisher, and they won't be financing the games anymore.

And then the IP got acquired by tinyBuild by $6.5 million. Taking into account they were already the publishers and were getting a cut, it is one of the most overpriced acquisitions I've read about in the industry.

Welcome aboard! I've been writing about this company and attending the AGMs for the last 2 years 😉 You can find them over at firmreturns.com if you're interested.

Anyway, good article. Glad it's getting some coverage.

Hi,

Couple of things. You can purchase share via HL. It may not give you an automtic quote but I know people that have acquired them via the dealing desk.

Also Kingmakers now 17th on the Steam wish list

https://steamdb.info/stats/mostwished/

Interesting post. Thanks