Betting on Release

How do the biggest videogame launches affect their company's stock

I have come across several great investors on the internet. Unsurprisingly, not all of them follow the same tenets I am wired to follow. I am a value investor at heart, and I can't avoid it. That does not necessarily mean I will go for low price-to-book companies, but it does mean I rely on discounted cash flows or similar methods, even if they are simplistic, back-of-the-envelope "models" at times. Over time, I have come to realize that growth investors or speculative ones can get absolutely fantastic returns, and have ended up copying some of their tactics.

What I am going to talk about today is something I have seen in several places, most prominently from TenchInvest (@10_ch_10 on X), and it plays a lot on human psychology.

But first, let's talk about one of the relative successes and surprises of 2024: Space Marine 2. Or rather, about Pullup Entertainment, the parent company of Focus Entertainment, the game publisher.

A tale of two games

Or rather, two stocks. This is the performance of Pullup Entertainment in the last few months. Keep in mind Space Marine 2 was released in early September.

The stock roughly doubled from the lows in May to the release date of Space Marine 2, with most of that run-up happening in August and early September. Despite being a huge success, the stock roughly remained flat after that. It even gave some opportunities, despite a very decent earnings release.

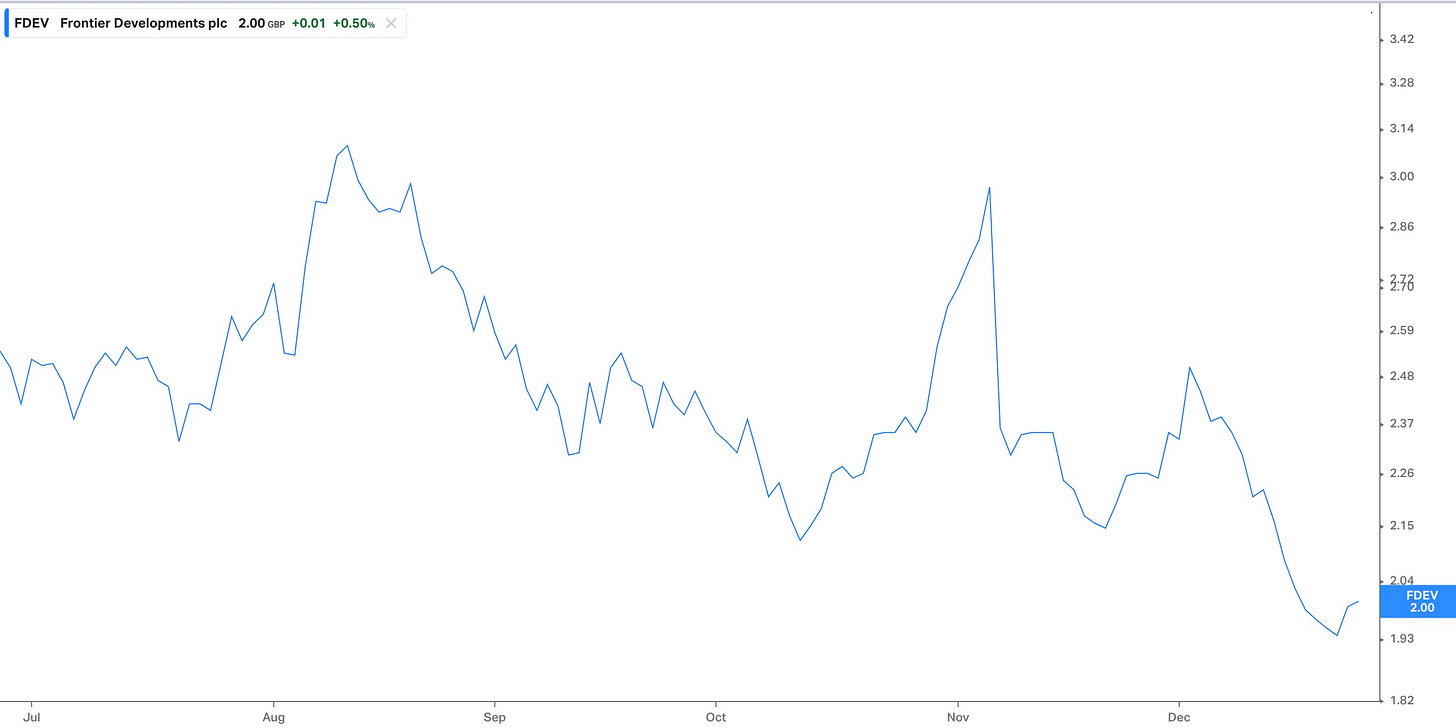

Conversely, this is Frontier Development (FDEV) chart over the last few months.

Planet Coaster 2, their most expected game, was released on November 6th. In the month or so before release, the price ran up quite a bit, only to fall back to earth fairly quickly on a release that was... not great.

Now, both situations were far from equal, but they had something in common. The releases were key for both companies, with the potential to improve their finances in a great way. What happened in both cases was also similar: the stock ran up to the expected value in case the release was successful.

In the case of Frontier, then the stock reacted to a botched release (justifiably). In the case of Pullup, arguably the stock underreacted to the success of the release, even if it was wildly successful1.

Is it possible that overreacting to an important release is a feature of how videogame companies trade? Or, rather than overreacting, a big part of the upside gets priced in before release, and then getting returns after release is really hard.

The evidence

To see if that makes sense, I compiled some information for releases that were very relevant to their respective companies. There is some judgement involved (What is a failed release? What were the expectations?). And I also added another column to mark it as a clear case or not. In this case, a clear case is a game that was relevant for the company economically in a way that success could return a large percentage of the market cap in profits, or change the path of profits for the company. I included several unclear cases because highly hyped games can move large stocks even if their success is less determinant. The results are, as expected, mixed, at least when taken naively.

First, the idea of applying that intuition in a quantitative way goes out of the window really fast. Out of the 17 cases, only 10 have a positive return in the month prior. Among the “clear cases", 6 out of 11 have negative returns, and the 3-month picture is even worse.

But let's go through the “clear" cases one by one.

Cities Skylines 2 released after a weird year for Paradox. Until August, the stock climbed 46% based on expectations of new releases, the successful release of AoW4, and well received DLCs for the main games. A promising H1 report was released at the end of July, propelling the stock further. Then it became apparent that the new releases, mainly The Lamplighters League, were not gathering traction, and the release bombed in September, causing a relevant write-down. It was hard to propel the stock further. And then, the failure of the release took a long time to be digested (stock was falling for many months). But that is probably due to hopes of salvaging the game with additional content and patches, which wouldn't be a first for the publisher. Lesson to take here: wider context matters.

Elden Ring and its DLC were key for Kadokawa (and less key for Bandai Namco, but also relevant), and FromSoftware's Dark Souls series was well known already, and it was announced in 2019, and the release date was announced in June 2021. From June 2019 to the release date, Kadokawa had a 290% return. Part of it was a good run of results, but let's not forget Kadokawa was trading at around 40 times earnings at the time. My personal impression is that the expectation for the release was baked in well before. A similar thing is happening with Take-Two since January '23. Despite results being not great, everybody is just waiting for GTA62, and the stock has gone up about 80%. Lesson to take here: For really, really big releases, as in worldwide events, the run can take longer and finish earlier.

Cyberpunk 2077 is a similar case, with the stock peaking a few months before release (and with a spike in price just before it happened). At that peak CD Projekt was trading at about $10B, or about 200 times their Witcher 3-derived earnings at the time, running almost 200% since the 2018 E3 trailer.

Frostpunk 2 is another case that can happen: Delays. It was scheduled to be released by the end of July, but then at the end of June it was pushed back 2 months. Until the announcement of the delay, the stock was doing well (10% one-month return, 22% three-months return), then it went more or less flat until the release itself (which was not terrible, just not as good as expectations were). Silent Hill 2 is a mix also of delays and the price of Bloober reflecting expectations from the date it was announced onwards, rather than just before release.

House Flipper 2 is… just a weird case. There was relative hype for the game, and it would have been good for PlayWay. But the prior quarter had been relatively bad for the company and it was pushing down the price. It was also expected to contribute more over time than in a big bump.

Why did it work for Dragon's Dogma 2 and Granblue Fantasy despite them not being so relevant for them? In the case of Dragon's Dogma, I think it was a big game that was not taken into account that much before getting close to release. In the case of Granblue, I think it was just confounders, as it matched with CyberAgent media division going better.

My general conclusion is this can work but:

Check carefully if is already reflected in the price. If expectations are already up there, even if there are a few months pending for release, it is dangerous to get long at that point. Better wait until the release. Really succesful releases take their time to be baked in the price, I think (and we have examples like Phantom Liberty to prove it!)

If a really hypeable game is announced, it can be feeding the price for years (TTWO, CD Projekt, Kadokawa to a lesser extent).

Bad releases are penalised fairly quickly in most cases, and returns after a good release are not necessarily that good. 8 out of 11 clear cases went down after a release. Don't think this can be used to systematically short on release, but maintaining a videogame company up until the release date of a flagship game can be dangerous!

Some potential cases now

Capcom has a shot at having a decent case going on right now. Monster Hunter Wilds is selling really well so far, and it doesn't release until late February. Personally, I am not here because I think it is mostly baked-in already, and also as big as it can get, Monster Hunter Wilds would have to be a Elden-Ring level success to really be huge for Capcom (which trades at about $11.5B right now). It could be (Monster Hunter Rise was pretty close), but I don't see the risk/reward skewed enough.

Nintendo is another, until the Switch 2 announcement is out. And I think it is a big reason for its performance this year. Here, the potential of a blue sky scenario is not fully baked in, because the potential is Nintendo dominating almost as much as in Japan in RoW. Personally I am not that sure about that scenario, and I don't have a position (I like other stuff better), but I would be careful about the reception of the announcement, at the level it trades.

Nihon Falcom is interesting in this regard, but the release is in autumn 25 (I am talking about the global release of the remake of their most popular game to date, and with GungHo as a publisher). Personally, I think this one can be transformational for the company and is not reflected in the price, and I do have a position, but a long time left.

Krafton, the company behind PUBG, is releasing Inzoi, a Sims competitor in February, and it has a decent following. It is not a PUBG level release, of course. The company trades at about $10B, and adding a successful release on that area to their portfolio could bring a decent amount of value, as it is very recurrent thanks to content packs. And it is not particularly expensive either. I have no position, as it is difficult to own South Korean companies without ADRs, but if anyone knows of a broker available in Europe that offers them, open to suggestions!

Embracer is releasing Kingdom Come: Deliverance II in February. The original one sold 8 million copies (as of this year, but frontloaded, as usual). It has a decent following and promotional content is starting to pick-up. It is not the main reason (spin-offs incoming and the easybrain sale are more important), but I don't think it is fully priced-in.

CD Projekt Red after the Witcher 4 trailer is a good candidate. They have a solid revenue base with Cyberpunk, and Witcher 4 has a lot of expectation. Personally, I think it is already valued for growth so I wouldn't make it a full position. But I am tempted to take a small one based on this framework alone.

And there is another case of a small cap with not one, but two upcoming releases that can affect it in a big way. But that is one I want to explain in more detail, so you will have to wait for one week!

Thanks to that release alone, Pullup made €22 million in net profit in last half, which included only the results up to September, and FCF was around €40 million after correcting for working capital changes (namely liquidation of balance in Steam), and the game has continued to sell very well. They even have approved a repurchase program for up to 10% of the outstanding shares. And trades at €170 million as I write this.

And Civ6, and Borderlands 4, yes.

Thanks for that research! Do you have good sources for getting release data at scale?

I have not looked into it for a while, and it seemed quite manual/not scaling to get that for every company, even more so on mobile given how many smaller games get pushed... so I always wondered if it was worth the effort. and focused on the post-release data instead.

It could be interesting to couple pre-release date with sentiment-analysis, for example, or generally how much traffic/noise is generated around that game as well. There must be tools out there for that.

Very interesting. However i have one notpick. You have to take into account how "the market" in generally acted and how much of that game studios stock performance was merely beta as opposed to alpha. It that makes sense.