Results Medley: The Western Front (Embracer, Paradox, Hasbro, Gravity, Applovin)

Lots of companies in the games space have presented results recently. Most of them have fared... poorly. Let's have a look at how bad it is!

But before getting into the details, a small self-promotion bit! Graham Rhodes, from Longriver, was kind enough to have me over to chat about Games Workshop, its future, its challenges, and its dammed-long ERP change project. I do say ‘so to speak’ and ‘and so on’ way too many times, but I think there still were some interesting tidbits. Let me know if you like it!

And now, on to the results. This has not been a kind season for videogame companies. I suspect Matthew Ball is partly to blame (not on the results, but on the market's general willingness to throw the baby out with the bathwater). The physical market seems to have done slightly better (although we still don’t know Games Workshop’s results). And then, there is the pick & shovels mobile play. Today we will go through the results of Western companies, and the next bit will be on the results of their Eastern counterparts (too many otherwise). Gravity is, obviously, a South Korean company with a Japanese parent, but they trade on Nasdaq, and that is enough of an excuse for me.

Embracer disappoints (again)

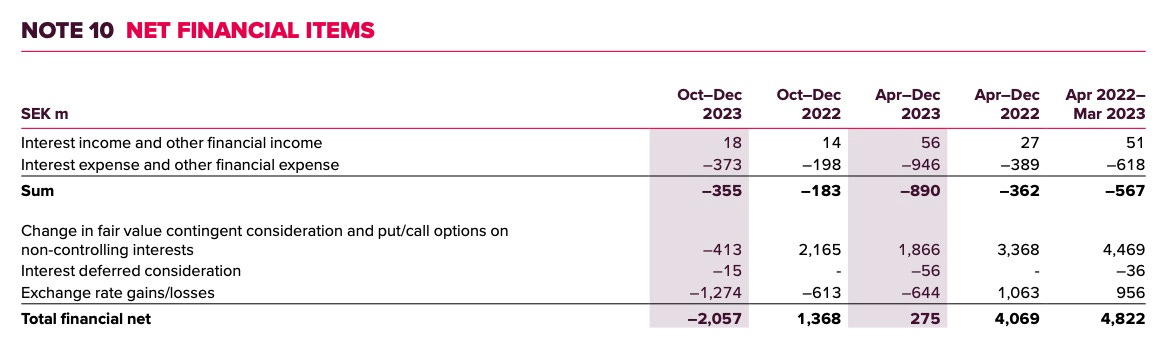

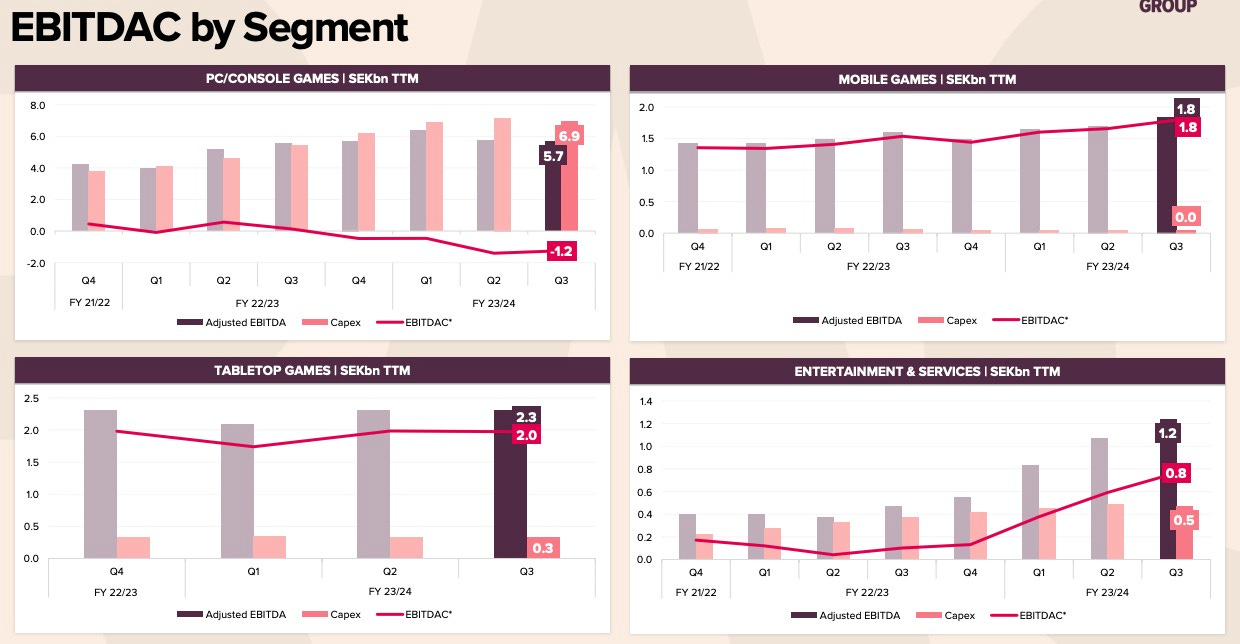

The problem with Embracer is not that they sell little. They have been doing fairly OK on that front this year (13% growth in PC/Console sales and 1% in mobile, both YTD). Their problem is they have SEK 23B in net debt. And yes, that is down from 28B a year ago1 , but that is mostly due to a 2B equity raise, and about 3B of reduction of value in the contingent considerations… due to Embracer’s share price dropping. Their official net debt has been pretty much stable in the last twelve months, and they had targeted reducing it by 8B. Not a good look.

Not all is bad news! Both mobile and PC/Console are outperforming the market in sales, managing to increase YTD. Asmodee is also growing sales! Or… are they? Without acquisitions, mobile is down 10%, PC/Console 9% and Asmodee only grows 1% (the physical market is doing better, as I mentioned!). And Embracer can’t do more acquisitions, even if it is still paying for the prior ones.

Headline earnings are confusing because of the financial situation and how it is being tackled. There are almost 7B of non-cash items there YTD that are related to Embracer’s restructuring (or, to say it in a different way, canceling games Embracer had invested a similar amount on). Some of them are related to games published this year, and most of them are related to games canceled this year, that might hurt Embracer’s pipeline in the future, but save cash now.

But it has not been enough yet. Their FCF has been roughly break-even this year, but that is before considering the 2B in contingent payments for prior acquisitions. Even their OCF is not much once you adjust for videogame production costs2: about 600 million SEK. Interest costs were 890 million YTD, and 355 in the last quarter (up from 236 in Q1). And that has only been possible thanks to Asmodee’s resiliency and improvements in inventory management, which makes me think the gaming side is not doing great. Only a fantastic set of releases in the next few Qs can help the company manage its asset sale process. Their line-up for Q4 was not particularly promising (Tomb Raider I-III remaster, Deep Rock Galactic: Survivor, Alone in the Dark…3 ), although Deep Rock Galactic's spin-off is doing remarkably well4. Homeworld 3 and Space Marine 2 look far better, but both have been delayed. Alone in the Dark is the only title there that might help turn the tide.5

Even if they outperform and sell well, I think Embracer is submerged in a negative spiral. They recently closed Eidos Montreal and canceled a Deus Ex game with it. Saints Row’s studio Volition was an earlier victim. It is hard to believe this doesn’t have a deep impact in Embracer’s capacity to exploit their IP. And they will have to sell some, because otherwise, their growing debt costs will eventually catch up with their dwindling pile of cash6.

Now, that does not necessarily mean Embarcer’s equity is worth nothing. But videogame IP is not a static asset, and buyers are going to offer as little as they can. They need a 2-3 million copy success to get a bit of a breather and be able to sell at a good price.

The bull case

I feel obliged to include here something many Embracer bulls will mention (and that I don't agree with), which is essentially summed up in this graph:

Essentially, according to the company (and let's not forget it says adjusted all over the place), only the PC/console segment consumes cash, and that should improve as investments diminish relative to revenue, which should go up with a better release schedule (Homeworld 3, Space Marine 2…). And even if they don't, the other segments can carry the company. In summary, there are several bullish points:

The company did generate cash in Q3, which is true! around 350 million! But it came mostly from 900 in inventory reduction. This is a Q where Asmodee always reduces inventory, and that increases cash generation, which is offset in other quarters. The last 9 months picture is still not great, with a 100 million burn.

This is at most a liquidity issue, and Embracer has assets worth more than its EV. I personally agree, but I also think it is less true every day, but I see why others might disagree. You see, I think Embracer is doing cuts mostly trying to win time until they have a hit or two, big enough to give them time to negotiate with some strength the sale of assets. That means that I think Embracer's driver for cuts is not the long term value of the games or studios they are closing, but how much liquidity they preserve. If you disagree and think they are making those cuts based mostly on long-term value, you will think it is not deteriorating as fast7.

That said, that is, for me, the key. I think Embracer has the potential to earn more than enough money to pay down their debt through sales of assets and actual income generated from their franchises. So if they get good results in a couple of big games in the next 6 months, I might be a buyer. More breathing room probably means a higher price for the assets they sell, and that the cuts can be made with a long-term framework in mind.

Otherwise, not worth the risk for me.

Paradox: margin troubles and record cash flow!

Paradox managed to increase their sales YoY, largely thanks to their long-awaited Cities Skylines 2 release. Their operating margin also dropped from 45 to 25% in the whole year, and 12% in the last quarter. That means that, despite revenues being 34% higher than last year, Paradox's profits are slightly lower than last year (which, to be fair, was a record year!).

That is mostly because of one disappointing release. The Lamplighters league didn't sell well. That was already well known. What is surprising (although there was some disclosure in Q3's report already) is its cost. About 330M8 SEK, or more than $30M. Or, in what will probably become my favorite unit for spending, more than 60 PlayWay games. It sold about 20k copies in Steam, and doesn't seem to have sold much more in console. A harebrained scheme indeed. Without the about 300M SEK in losses this has caused, we would be talking about a fantastic quarter and another record year, and the margins would look as good as usual. But bad decisions exist!

Cities: Skylines 2 has done better, selling about a million copies despite mixed reviews. It is not a bad result, and it seems very profitable already9. But… Cities Skylines was a huge success for Paradox not only because it has sold 12 million copies over the years, but because they were able to sell DLCs to the existing player base. While it sold well, ratings are not that good, and the game averages about half the users the previous edition still has, which casts some doubts about how well that strategy will go this time.

As a reminder, Paradox's business model does not hinge on frequent releases, but on long-lived games with DLCs released twice a year or so. They have 5 properties that allow them to do that (Hearts of Iron, Crusader Kings, Europa Universalis, Stellaris, Cities: Skylines). They have tried to add to that several times, but the last successful attempt was Stellaris, while Imperator failed, and maybe Victoria 310. So far, they have never failed in their update cycle. Sure, Crusader Kings 3 has not quite caught up yet with its previous iteration, but its release saw the active CK2 player base migrate there almost completely. The same happened, eons ago, with HoI4 and EUIV. The number of active players for all 3 of these sequels is still going up, actually11. Cities: Skylines 2's CCU is now on par with that of Victoria 3, and well below that of the original game. That doesn't bode well, but if the next couple of DLCs are good, they can eventually migrate the player base and maybe sell as much as the original one. Or that is the hope.

That is the important question for Paradox. Will they be able to have a successful update cycle for Cities: Skylines 2? If they do, Paradox is probably going to do even better as a business12. And it is a fantastic business, generating about SEK 700M FCF from 2.6B in sales (doubling last year's, thanks to a better release schedule). They also have about 1.3B in net cash. They do, however, sell for 21B. Very steep price, even if it is for an excellent business!

Hasbro

Hasbro generated a fairly decent $500M in FCF in the last year. But between impairments, film business sales, and lack of topline growth, it is hard to see in there. It doesn't necessarily mean it is going well either.

We are talking about a company that is a bit sprawling and unfocused. Their $5B in sales are spread in 3 main segments:

Toys make up about 60% of it. Well, they call it consumer products. It is at best an acceptable business (10% operating margin in 2021) and at worst a terrible one (-2.2% this year). It has mixed good and bad things in there. For what is worth, the 20% decrease in revenues this year seems intentional, and driven by SKU cuts to increase profitability in the following years. Further decreases in revenue are expected, but there should be some margin improvements.

Entertainment makes up about 13% of it, and will make up far less going forward, after the sale of eOne for about a tenth13 of what it cost back in 2019 (talk about bad capital allocation).

Wizards of the Coast and Digital Gaming makes up the rest, and is the good segment of the company. 35% margin and 10% growth, largely driven by the release of Baldur's Gate 3, with the tabletop segment essentially flat YoY (quite an achievement, after more than 40% growth in 2021, and 12% in 2022).

Hasbro is a company with some fantastic properties (D&D, Magic, Monopoly, Transformers…) but terrible capital allocation in the last few years. They haven't been able to adapt to the new toy and tabletop game market. Spin Master is probably king of the toy market now, with their well-directed focus on preschool. Asmodee is king in tabletop boxed games because they have been able to focus on the very profitable and segmented specialized market. Hasbro has not been able to adapt yet. They are trying now with a massive efficiency program. But they are still a toys and games company at heart, and that is part of the problem.

Wizards of the Coast was bought many years ago, in 1999, for a steep price at the time ($325M). More than worth it though. They generated more than $500M in operating profit this year on $1.5B of revenue and are one of the biggest companies in the specialized hobby channel. Bigger than Games Workshop, bigger than Asmodee. Only Bandai Namco is a bigger player14 I think (and there is a lot of toy revenue mixed in there). If it was spinned-off, it would probably be worth far more than the $7B Hasbro is valued at right now (well, $10B EV). But Hasbro insists on trying to be a mainstream company instead of playing to their WotC niche.

A recent example is the D&D movie. Nothing against it, I thoroughly enjoyed it! But D&D is not that kind of property. It doesn't have characters you readily identify with and that are well-known, because the universe was not set up for that, at least not as a whole. You could do a Drizzt series. You could do a Baldur's Gate movie, maybe. Or Dragonlance. But a D&D movie playing only on the setting and the tropes of roleplay is maybe not the way to go for a full-budget Hollywood movie, and it is a move that I can only try to understand as Hasbro scrambling for global relevance versus Mattel, and using the media-as-toy-promo approach. It had to be D&D because that is the brand they sell in stores.

The day they understand they don't compete with Mattel but with Toei, Bandai, and Games Workshop… then this company becomes investable. But for that, I would have to see them act as a global geekery behemoth with some toy assets. I am not seeing that yet, so I am not invested.

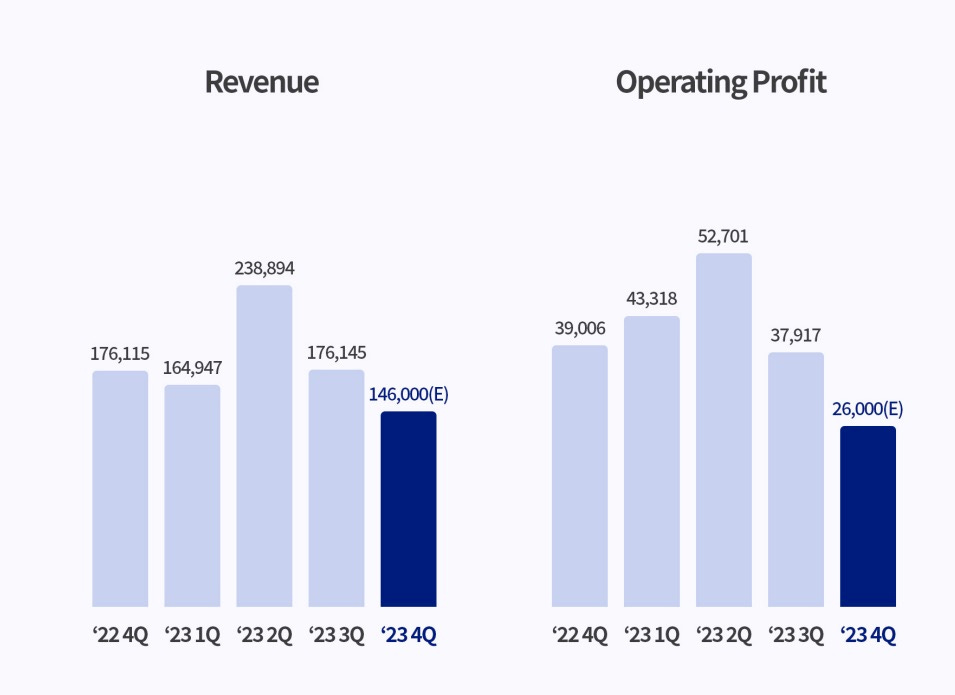

Gravity: the clock is still ticking for GungHo

Revenue & profit were down, as expected for the Q, although a bit more than I expected. Until the releases in America (Q1) and China (Q2, although it was expected in Q1 initially) of Ragnarok Origins, a decline was expected, as the launch frenzy winds down in prior countries.

Despite the steep decline, both revenue and profit are still above the amounts pre-Origin launch (Q4 '22). I think the expansion into America (both Latam and a US re-launch) and China will help offset that and we will see some growth in H1 versus H2, although H1 '23 is difficult to surpass. Both launches show a good number of pre-registrations15

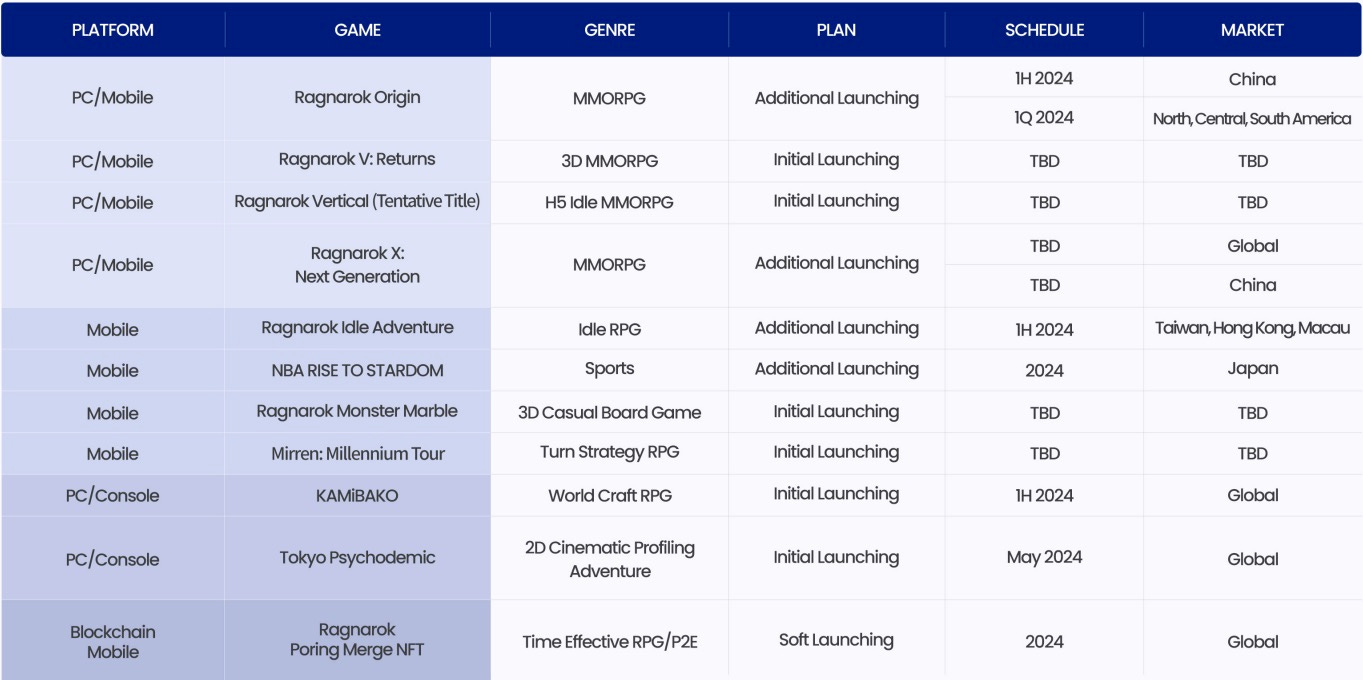

They are also increasing the amount of non-RO experiments they are trying. This is their release schedule, including the China delay:

All of this is interesting, but largely irrelevant for shareholders. Their liquid assets are up again and they now boast ₩461B in liquid assets. Probably it is a bit less in net terms (say 430B), and they are still not using them, other than vague allusions to growth or acquisitions. And shareholder's returns on Gravity depend on one of two things: Either Gravity enters another of its fadish cycles (which usually happens every 1-2 years), or they start doing something with their cash hoard (other than sitting on it).

What can help change that? Well, GungHo's poor results. Gravity's parent reported a close to 20% revenue increase and flat operating profit, but a 14% decrease in profit attributable to shareholders. Once you strip away Gravity, their sales went down 19%, and operating profit was down about 23%. All their cash & equivalents growth also goes away once you deconsolidate Gravity (in fact, it goes down a little, ¥3B, if I am counting correctly). They still have committed to about ¥7B between share repurchases and dividends, which implies another ¥3B of burn if results are stable, less if they improve, or way more if they decrease (as they have for the last three years, where Gravity's growth has kept the consolidated results flat). They still have ¥60-70B in the parent's balance sheet, so that doesn't mean they have an urgent need of funds but the longer they take to act, the bigger the problem of getting access to Gravity's cash it will be, especially if they keep depleting their own funds.

They might still pass on the opportunity to fully consolidate it, or on the possibility of giving a special dividend, or on purchasing other shareholder's stake with Gravity's money. It is just a more enticing choice for them every quarter that passes.

AppLovin: The mobile massacre winner

As we have seen (and will keep seeing, probably, I think) the mobile market has become a bloodbath16. Revenues are going down for many players, and profitability is going down too. The market has become huge in the last few years, but 2022 didn't show the expected growth, and 2023 has actually seen some contraction… just when all the majors had prepared many mobile teams to assault that market, or made purchases to that effect17.

The winner is, of course, the pick & shovels play. AppLovin essentially provides marketing and analytics tools for mobile apps (no, not only games). With profit margins narrowing down while a bigger slice of the companies’ teams are dedicated to mobile, trying to make sure each release is a commercial success is more important than ever, and also gets a bigger share of the expenses. Or in other words, marketing is more important in a mature market.

AppLovin reported 16% revenue increase for the full year, which might not seem like much, except it is accelerating. Q3 was 21% and Q4 was 35%. They are also displaying significant operating leverage, with operating costs actually going down for the year. After a 300% run in the last 12 months, the stock is still not particularly expensive, especially considering their cash conversion is fantastic (between 700-1000 million, depending on how strict you want to be with share settlements and the like). And all that cash was used to reduce the share count significantly (not at current prices, they stopped buying in the 30s)

Not much else to say here. Accelerating top line, operating leverage, great cash conversion, top notch allocation, $23B EV.

I am aware that does not match the official net debt numbers. But as proven by the fact that they have shelled out SEK 2B in the quarter for this concept, contingent considerations for acquisitions and considerations owed to employees for the same reason are debt. It was just another way to finance the acquisition spree.

Sorry, no one is going to be able to convince me that the cost of making the inventory they sell should be considered in the investing section of cash flows. You can’t run a videogame company without spending money making games. And that is why I like PlayWay’s accounting so much more!

And also We are Football 2024, supposedly a competitor for Football Manager 2024. Currently, it sits at 345 followers on Steam, and its recently released demo peaked at about 60 players. It is not even listed in the wishlist ranking. Yikes. But, to be fair, Alone in the Dark looks promisiong.

Not that it will be a turning point. This is a small-ish game, selling at about 9$. It would have to sell several million copies to be really relevant for the group as a whole. Still, a very nice surprise!

Deep Rock Galactic is too cheap, Expeditions, Outcast, and South Park: Snow Day are not performing well in pre-orders, Tomb Raider I-III remastered is selling alright for a 90s game remaster, but that means below 100k copies in PC, maybe 3 times that overall, being optimistic.

They have about 3B in cash, their interest cost run-rate is 1.4 and likely to grow, and they have 4B in current liabilities between financial debt and deferred/contingent considerations. Either they generate 7-8B in actual cash next year, or they need refinancing or asset sales. The less they generate or the more they burn, the more expensive the refinancing, the cheaper the sale. The less they try to burn, the less they generate by hurting their capacity to create. Leverage works very well until it lands you here.

Mobile profitability is up massively while user acquisition costs are down a lot. Revenue is down organically. CAC is much lower than last year. Probably the only company that shows this in the sector. Does it look like cutting investment to show profitability? Oh, I am sure am I imagining things. Are this kind of numbers sustainable? Usually, no. There have been changes in the games line-up, so maybe it is just that Embracer is doing it fantastically.

The report says it is a bit less. It also says some extra development costs postrelease were expensed directly aside from that, but doesn't specify how much.

Although the agreement with Colossal order seems to include a relevant revenue share, and it seems like the capitalised development costs were not that high (unless they are using the linear method this time, which would become apparent in the next financial year)

Well, that case is a bit more complex. Victoria II was a niche game in a niche category, with a very solid fan base that had been requesting a new release for many years. The player base did migrate to Victoria 3, and the game as such sold alright, but reviews were not great and I have the impression it fell short of expectations both for Paradox and the players. At the same time, users seem to be increasing bit by bit, and it has about half the sales and CCU of CK3. Those numbers should be able to support a stream of DLCs. It has gotten 2 so far (Queen of the South and Voice of the People) with an upcoming third on its way. Maybe the jury is still out on this one.

Subjected to peaks and valleys, of course. CK3 has not surpassed the release CCU peak, but 3 months after release it had fewer players than now. If it follows the same pattern as HoI4 and EUIV, we will see CCU max peaks in a couple of years. EUIV had its CCU peak 7 years after release and has a stable player base even now after more than a decade. HoI4 is still growing and marked a new peak 4 months ago, more than 7 years after its release.

They also have the Vampire game in the works, and a The Sims competitor (although I don't have much faith in that one)… Paradox is still trying to expand, if a bit more prudently than a couple of years ago.

Well, yes, the music business was sold a while back already. Maybe they got about a fifth of the purchase price putting everything together. Still not great.

An apples-to-apples comparison would take many adjustments, but what i am considering is Bandai Namco's toys and hobby segment in isolation vs. Wizards, as it is the closest comparison. Maybe we should subtract the digital part of Wizards or add back a bit to Bandai Namco. But the result is still the same, Bandai Namco rules the world still!

At the time of writing this, 8 million in the Americas launch and 7.7 in the China one. I take those numbers with a pinch of salt though.

Haven't talked about them here because there are plenty of people covering them, but Take Two's mobile segment also lost revenue (It shows an increase for the full year, but that is because Zynga's acquisition was closed in May 2022, so the YoY comparison still has some non-Zynga months). The same holds true for EA, with a 3% decrease.

With Zynga's $13B acquisition being the posterchild, but EA and SEGA have also made smaller relevant acquisitions. And Tencent gobbled up anything it could.

Thank you for this earnings update bonanza!