Playway by the numbers

An overview on PlayWay's numbers and growth in the last few years, and the prospects in the coming ones

After I published my previous article on Playway, a friend (hi Paweł!) told me something like “You know, you are writing for geeks, we want to know the numbers, and that article has no numbers“. He has a point, so let’s try to get to the numbers behind the story.

There are a few elements I will be focusing on. First, cost discipline (since I think it is incredibly important). Second, the pace of games published & the evolution of the number of studios in the group. Last but not least, we will have a look into the overall evolution of the company.

Cost discipline

I think this is probably the most important data about PlayWay. They don’t do AAA, or AA, productions. Theirs is a numbers game. There will be some misses, and there will be some moderate successes, but it is unlikely we’ll see massive best sellers (say 10 million copies or more sold) here. The moderate successes they have (low millions of copies, or high hundreds of thousands) will be sustaining the company. And that means the many games that won’t reach that have to be profitable with less than 100k copies because the vast majority of them won’t reach that number.

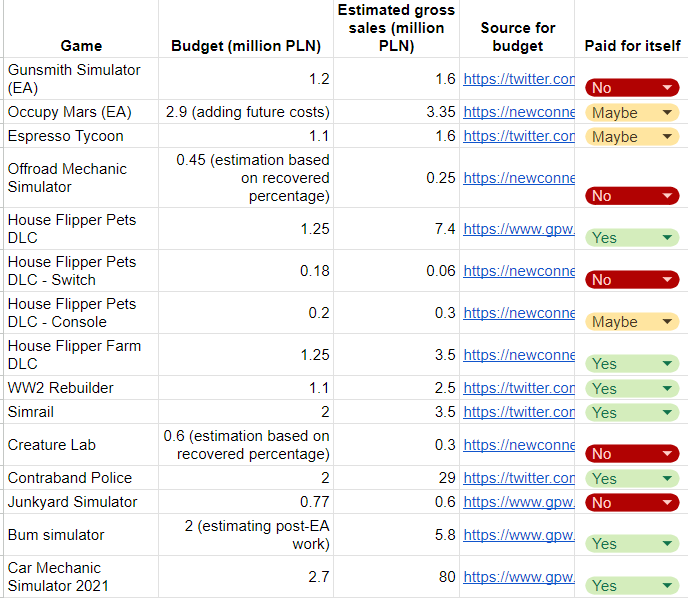

We have two ways to go about checking the cost discipline here. First, the companies of the PlayWay group tend to publish reports with both sales and costs for the game after a few days or a month (depending exactly on the company). They don’t do that for every game, but there are enough to have a nice picture. While the budget is linked to a company source, estimated sales are an approximation (based both on company-reported data and reviews-based estimations on SteamDB) and have to be taken with a huge grain of salt.

Once I took all the data I was able to find for relatively recent games, the average for the costs with this method is around 1 million PLN (or about 250,000 $), which seems to point to a really tight cost discipline.

Now, there is a different method of checking this, and it is going through the financial statements. It requires some assumptions, but nothing extremely hard. See, Playway counts the cost of development of the game as work-in-progress inventory until it is released. Then, it is moved to completed inventories and subtracted from the sales (or written-down, if the game doesn’t sell well).

Some developers might be tempted to forestall the write-downs or capitalise part of it as intangible assets, but I don’t think PlayWay is taking that approach. The intangible assets in the balance sheet, including goodwill, are around 3.5 million PLN. And in the inventory, the balance sheet amount corresponding to finished inventory was 6 million PLN in 2022 (and Q1 of 2023) and 2.4 million PLN in 2021, which amounts to less than 3% of annual sales in 2022 (and around 1% in 2021). So if they have been aggressive, it has not been by a lot.

Then we can divide the inventory costs for the year, plus the write-downs if any, and the remaining inventory at the end of the year (subtracting the finished inventory balance at the beginning of the year), by the number of games published each year. This is the part that requires a bit of work because figuring out the games published is not so straightforward. Of course, we have this list the CEO kindly published (although it doesn’t include some 2023 games, or some from CreativeForge), but we can’t use all the games. In the balance sheet, you will see that PlayWay has around 146 million PLN (in the Q1 report) of investments in companies accounted for through the equity method. In those cases, revenues and expenses don’t flow through the income statement, and that means we have to classify them first. I will also remove the ports, as that would move the average down quite a bit and you can’t really develop them without the main game. I will also remove games where the company in the PlayWay group was only acting as a publisher (as Movie Games did for Gas Station Simulator) to the best of my ability. You can check the game’s data here.

So in 2021, we have 20 fully consolidated games and 20 as well in 2022.

For 2021, we have 17.2 million PLN in inventory expenses, a finished inventory of 3.2 million PLN at the end of the year and of 0.7 million PLN at the beginning, and no writedowns, which gives us 19.7 of development expenses, so an average cost of 0.99 million PLN.

For 2022, we have 31.7 million PLN in inventory expenses, a finished inventory of 6.1 million PLN at the end of the year, and of 2.4 million PLN at the beginning, plus a 0.6 writedown, which gives us a total of 36 million PLN of development expenses in the games launched that year, so 1.8 million PLN per game.

While there is an important jump in costs between both years, both are roughly in line with good cost controls. Plus, 2022 saw a lot more ports to consoles or other environments (16) than 2021 (6). If we took those into account, it would be 0.76 for 2021 and 1 for 2022.

No matter the number we take, it indicates good cost controls with games coming out on average at far less than 1 million $. It does, however, make me think that the cost numbers shared in the reports are slightly off. Those numbers usually include marketing costs (around a third of it, from what I have seen), while the expenses calculated from the report should only include development costs. If you add around 50% to the averages, you should get a better idea of the average cost of releasing a game for PlayWay. That does not imply they are lying, actually. They usually specify that the costs shared are only the incurred ones until that point, and there are always patches, extra development to get things out of Early Access… stuff like that.

These numbers are just an approximation. For starters, I don’t have enough data to know with certainty which games are developed in-house (and hence go through the income statement in that way) and which are not. Even for external games, which I am not always counting, there could be amounts reflected there (from, say, paying a studio to develop a game, the advances…), depending on the agreement (it could be classified as a third-party service in the income statement instead of direct inventory cost). The same holds true for non-consolidated games published by consolidated companies (say Pyramid develops something, but Playway publishes it), which means that this number can be overestimating the development cost per game. That is intentional, better to overestimate the cost per game than underestimate it

Publishing rate & capabilities

As I explained in the previous piece, Playway didn’t publish that much until not so long ago, because they really didn’t have the money to invest. That is evident in this graph

There is a huge jump in 2021 (after the investment pace had picked up in 2019-2020), and despite the appearances 2022 is not really flat (remember, 16 platform ports vs. 6). Now, a lot of these games are not necessarily high value. It takes time for teams to learn both to work together and within the group (something the CEO is very aware of).

2023 looks like it is going to be a record year in launches. Right now we are only 5 launches away from 2021 and 2022, and there are 3 launches confirmed (Pool Cleaning Simulator, a DLC for The Tenants, and Thief Simulator 2) and a few more that are expected to be announced soon. PlayWay typically only announces the date really close to the actual release. Less than 1 month is not unusual except for staples like Thief Simulator. For example, for Espresso Tycoon the 7th of June release date was announced only 2 weeks before.

I also mentioned, in passing, the growth in the number of companies in the group. From what I have seen, that closely matches PlayWay’s capacity to develop and release new games. We can’t know the internal teams in the different companies of the group, but also I don’t think having many teams per company matches PlayWay’s modus operandi so far. Up until this point, what they have done is establish relatively small companies so they own part of it and the studio owns another part. There are other ways to achieve that, through profit share agreements (which is, I think what PlayWay has set up internally with Red Dot Games), so that might be the case and then we’ll be missing teams. But still, the general picture is interesting

The number of subsidiaries and associates (many of them studios) went up very fast in 2019, 2020, and 2021, that is, immediately after PlayWay struck gold with CMS 18 and House Flipper. That marks a period of search and set-up of many new teams. What we are seeing now is a phase of consolidation in that regard, with some areas being sold because they no longer fit the group (Simfabric, Movie Games), and others closing because it didn’t work out (RL9 comes to mind).

That does not mean they haven’t strengthened their internal capabilities as well. Salary expenses have gone up more than 3x since 2018, especially in 2022. 2023 seems to keep that trend in the first quarter. That makes me think PlayWay is changing tack a bit in the way they set up studios, and balancing out internal teams at PlayWay, Games Incubator, and other group companies rather than only applying this model (although I don’t think they'll leave it completely). This also indicates the strengthening of cross-group capabilities, like testing.

But again, the view is consistent with a large investment from 2019 onwards that is starting to mature now, which is what makes me so excited about the future of the company.

And the effect on the numbers?

Well, that’s the question, isn’t it? What has been the effect of all this in terms of revenue and profit? Basically, here I only care about revenue growth and EBIT

Revenue has increased constantly, although 2022 hit a bit of a slump, which seems to be picking up again in 2023 (at least in Q1). And margins have been quite alright! Let’s see the ones in 2023 when it finishes, but since they found some success in 2018 they have been able to keep margins at a very healthy level.

I use EBIT because honestly all their gains or losses from sales of subsidiaries or their change in valuation in the stock market are mostly noise. However, given their company structure, one thing we have to watch is the share of the profit that goes to non-controlling interests (that is, to the minority owners of consolidated companies). To approximate that we can add the average tax rate to the profits attributed to non-controlling interests and see what percentage of the EBIT they represent. This assumes that no part of the financial gains and losses go to the subsidiaries which is only broadly true. But well, I am a fan of spherical cows, and so I ended up using a blanket 15% of tax because it varies wildly yearly due to the effect of financial losses and wins (from 7 to 18%), and it still tells us what we need to know, directionally.

Overall, and except in 2020 (where there was participation in the financial gains by the subsidiaries, I’m afraid), the percentage has been more or less in the same range. I haven’t included Q1 in the comparison because this will fluctuate a lot per quarter… but it was 19% anyway, so not too far from the latest yearly numbers.

I think the most interesting part here is seeing what PlayWay’s growing capabilities have made it able to achieve. House Flipper and CMS18 were published in 2018, but in 2019 & 2020 they were still able to grow significantly (although 2020 was helped by COVID of course). And then there was strong growth in 2021 on the back of CMS21. But 2022 was a bit of a transition year, with no big releases. And yet, thanks to the good performance of the DLCs, the back catalog and some acceptable launches (Animal Shelter, Ship Graveyard…) they were still able to grow revenue a bit. A very small bit, because it was helped in no small measure by some PLN depreciation, and in EUR the growth is tiny (around 1%). But I would have expected a small slump. To me, this is an endorsement of their numbers-game strategy. Sure, bet strongly on the DLCs of proven properties. But keep the exploration going strong in the meantime.

And that is why I am very positive about PlayWay’s future. There are finally some big-ish releases in the near future (Thief 2, House Flipper 2, Infection Free Zone, the Builders of… series, hopefully, maybe Robin Hood: Sherwood Builders or Tribe), while the factory keeps producing more and more games to explore the terrain and see what is worth it to explore in more detail.

Hope you liked the article! I am sure I missed some games or others (impossible not to do when we are talking about a company that publishes so much), but I think this can give a good sense of where PlayWay is going, directionally. If you notice an error or have a different opinion, glad to discuss it in the comments, Twitter X, or through carrier pigeons!

I will be back next week with a new article, this time on a company I haven’t talked about before, and that seems a small mystery, maybe even a black hole…