IG Port Q3 update, PlayWay releases, Ragnarok's return to China and Games Workshop latest scandal

And some interesting activity in CMON plus ICv2 recently presented insights

It has been a while since my last news recap article, and since then many things have happened for the companies we have covered here in one way or the other, with relevant game releases, some industry trends consolidating, and of course, some result reports. Let’s start with that last one!

IG Port’s Q3

There is a lot to unpack in IG Port’s latest set of results. But first things first: new guidance and it is up:

What that table means is that revenue forecasts are up 11%, operating income 26%, ordinary income 13.7% and profit attributable to shareholders only 6% (which, to be fair, is almost 40% from last year!). It is strange to see the huge difference between the operating profit increase and the actual profit, but there are reasons for it.

Now, in terms of actual results, net income was ¥0.8B up 20% versus last year in the same period, while revenue is slightly down (2%), thanks to the change in composition towards the copyright segment we talked about in the initial analysis of the company. A big chunk of that increase comes from 200 million of the compensation for the change in the publisher of The Ancient Magus’ Bride, also discussed in that article. The rest of it comes from the recording of part of the profits from Spy x Family Code: White. While that was expected for next quarter (and that is still the case for Haykiuu!), they were recorded ahead of the original schedule (because the performance was much better than expected, covering the costs in record time). The important part is not when they are recorded, but that both films are going way above expectations, which is the main reason for the upgrade in earnings.

Now, with both films doing so well, we have the reason for the operating profit forecast going up 26% but, why do the overall earnings jump so little? Well, because it comes with relevant provisions that put the result of the anime-production segment at -¥0.4B, down from -¥0.1B, due to the overall increase in costs and tight budgets. As I discussed in the prior piece, being a pure animation company is not profitable, and it is good that IG Port finds itself in a place where it can turn into more of a copyright one, and quite diversified at that.

To be honest, I expect IG Port to outperform their latest forecast. Both films are doing well overseas, and they just released Kaiju no. 8 to good ratings and comments. But far more important is that their line-up for FY25 (Suicide Squad anime, Kaiju no. 8 episodes… ) doesn’t give signs of faltering. New animations from Mag Garden publications1 and other series2

The pricing of the equity is not as steep as it might seem. At ¥25B of market cap and with about ¥7B in net cash3 it is a bit below 17 times forward earnings ex-cash if the predictions hold. Given that IG Port is guiding 40% increase vs their best result so far, I think it is going to beat even that, and that the setup for next years is also strong… well, I like it, what can I say? The reaction to the results was, however, a steep drop (11% down). I don't get it, but then IG Port has had sharp moves both up and down before.

Also, there is going to be a 4-fold split because… well, because it is a fad in the Japanese market. Toei Animation, Toei Company, and Mandarake have done theirs already, to mention some.

PlayWay releases

Or release, maybe. PlayWay has published 14 games and 4 DLCs in 2024 to date4, but for the most part they have not been very successful. Profitable… some of them5. But Robin Hood: Sherwood Builders and Builders of Greece failed to live up to expectations, as did YAFT despite how low they were.

But Infection Free Zone had a pretty good release, and has already returned almost 3 times the investment in the game in the first 72h. It was the most expensive game released during the year6 at PLN 3.4 million, and it keeps selling well. Ratings are not that good, and although they are working to try to patch them, it is a pity PlayWay keeps having these issues in new releases.

Overall, I think these has been a rough patch for PlayWay, with many games not going particularly well in the new releases front, but the back-catalog is doing well. House Flipper 2 is selling pretty well and is already wildly profitable7, but I think more was expected of it from investors. In all honesty, I think in that game the money is in the long run, with DLCs reactivating the main game, as happened with the first one so I am not worried. Contraband Police is getting close to its first 1 million copies, which is pretty insane for a game in that budget range8. But the ramp-up in revenue has not gone as well as I expected, at least until IFZ.

Still, of the 5 big opportunities mentioned in my latest PlayWay review, 3 have been released, and 2 (HF2, IFZ) have gone well. There have been no wildcards, however, and one relevant flop9. On the bright side, there is a new entry in the potential big launches category: Crime Scene Cleaner is more or less at Holstin's level of wishlists and followers as I write this.

At this point in 2023 PlayWay had released a huge success (CP), but also a few smaller ones (Into the flames, Simrail, WW2 rebuilder). This year, we only have IFZ, with Beer Factory and Anonymous Hacker Simulator following far in the distance. Hope the trend improves. That said, in terms of numbers, PlayWay has a market cap around $500M. It is not a demanding valuation for their back-catalog or their release schedule, I think!

Ragnarok returns to China and America

Ragnarok Origin was released in both NA and Latam (in a joint way), and has found some success, particularly in Brazil and Mexico, where it still is among the top 50 monetization apps day after day both in iPhone and iPad, and close to that in Android10. It was also released in China less than a month ago, and it still ranks within the top 30 apps (grossing) in both iPad and iPhone. Pretty decent for Gravity, especially if they can follow up with Ragnarok X in China.

If you look at the charts in China you might see another familiar game pop up in the top places there. Persona 5: The Phantom X was just released, in beta, in China. New releases will be coming up this month. Might be the missing piece for Sega Sammy. We'll see!

Games Workshop latest scandal

Apparently there are female Custodes now, Custodes being the only . Regardless of that tweet, that is pretty new, and in fact Games Workshop didn't let Black Library authors add female custodians before11. And part of the fanbase12 is pretty upset about it, with claims about Games Workshop going woke.

Personally, I think this does more good than harm. In my (admittedly biased) experience, the inveterate complainers are also the ones that spend less on miniatures, and usually competitive players or collectors don't care that much about a couple of fluff retcons. But I know anything remotely close to wokeness is a very sensitive topic in the US, so go figure. In other news, the Custodes battle force, open for preorders on saturday, is out of stock everywhere13.

This is not the first time a section within the Warhammer community swears off the hobby. There was another online scandal in '21 because of this letter, there were also complaints about the kids' books, and then, of course, The End Times and the Squats. So far, I can't say things have gone badly for them. And inserting female Custodes is more lore-friendly than female Space Marines, and probably a halfway decent compromise. Or not, who knows. Another thing we'll have to monitor. I just hope Henry Cavil is not one of the angry guys!14

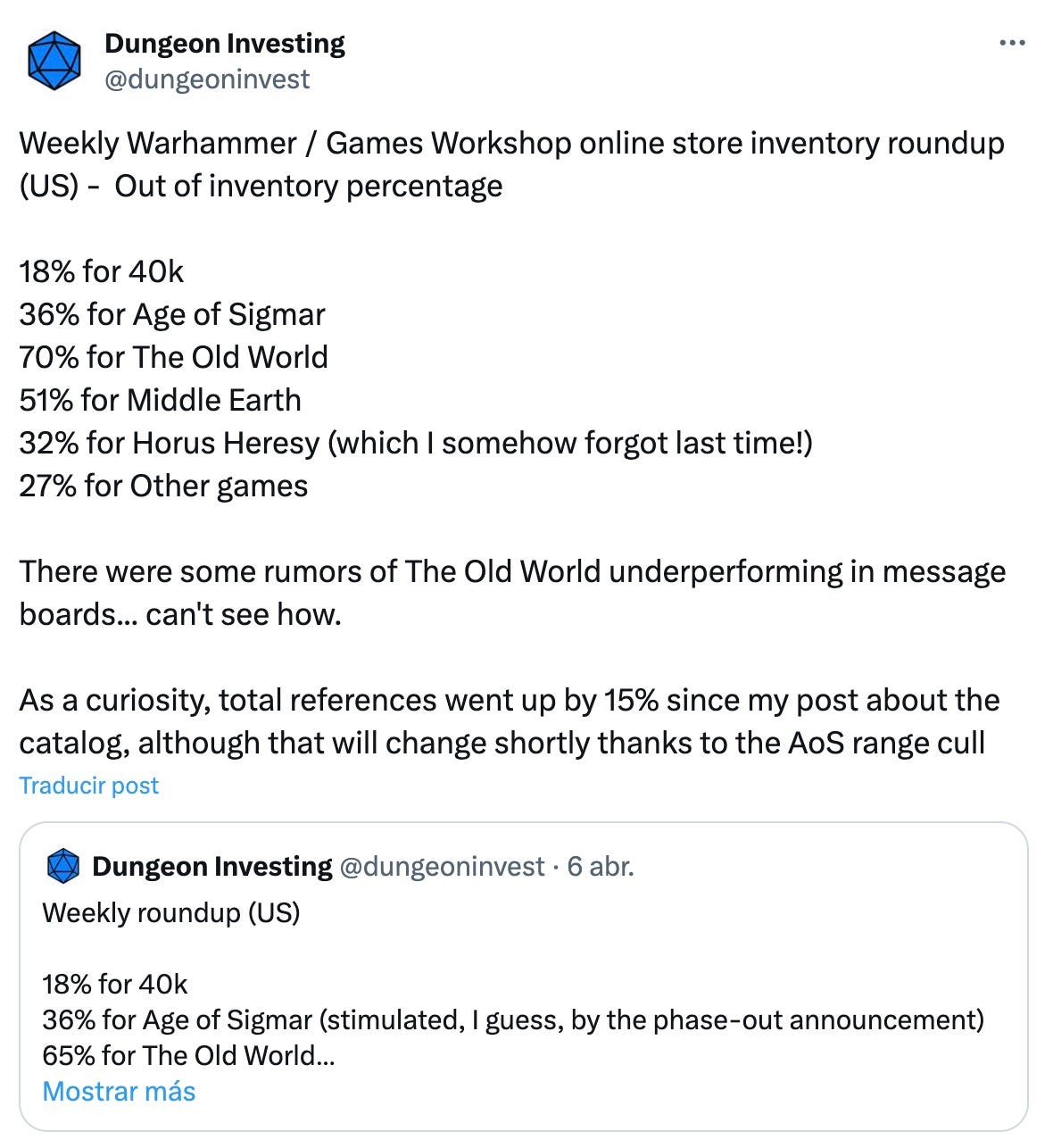

In other news, I have been following Games Workshop's inventory in the USA online store for a while now.

A few relevant things after a month of this exercise:

Total references are still going up. 15% since my article about Games Workshop's range increase.

40k has seen stable levels of references out of stock, between 18% and 20%.

The Old World range is almost continuously out of stock, and that includes not only the resin and metal range, but the Bretonnia and Khemri starter sets, not so the Orcs & Goblins one (way cheaper, but doesn't include the rulebook).

Age of Sigmar sees more and more references go out of stock with time. I guess part of it is because the ones that are being culled are not being restocked.

Because in an effort to keep their range at a rational level, Games Workshop is deprecating a big chunk of the AoS range.

CMON: Capital raise, change in platforms, change in shareholder agreements

CMON is seeing many, many changes of late. Not a bad thing, because the company was not doing well. They presented their annual results recently, and the news are not great. Oh, sure, the net debt is down slightly, but that seems to be related, mostly, to the sale of a building. Once that is out of the picture, it is actually up, and for a firm for which interest expense is almost as high as their profits, that is a problem.

The thing is there have been some changes in the works that I suspect might make this company interesting again (that, or they are just in their death throes). First, they changed from Kickstarter to work exclusively with Gamefound. Since in the Gamefound pond they are the biggest fish, I guess that means preferential treatment, and either a waive or a significant reduction of that 5% fee. Since that fee for CMON is about twice their annual profit, it is fairly relevant for them.

Then, it was announced that the main shareholders (David Doust and Ng Chern Ann) decided to invalidate their shareholders agreement, and that a VC that had a significant stake in the company had been selling since January (they have a much reduced stake now). And last but not least, a capital increase for almost 20% of the company, which will give CMON a bit of oxygen ($1.2M or whereabouts, doesn't seem much, but it is a lot).

Now, this can be just another million for them to piss. It can also be an inflection point in the company, with Ng Chern Ann taking the reins fully and optimising the operations of the company… which with $45M in revenue of a product with good margins should be making quite a bit of money. I will follow it with interest. So far, in its first trading session after the announcement, it jumped 26%.

One thing that will make it more difficult is the current situation of the tabletop market, as presented by ICv2 in their latest white paper.

As you can see, the hobby board games channel seems to be in decay (those numbers are not adjusted for inflation). Now, ICv2 typically only measures the hobby channel, but they also mentioned more problems to raise funds in Kickstarter and similar platforms, something that tracks with what I have seen anecdotally. That is a bit of an issue for CMON.15

Other news & articles

Continuous Compounding - Alan published a very interesting article on SK Japan a while back. IMHO, it has a lot of merit!

Animenomics explains the state of the anime industry. TL;DR, the situation is better than it used to be, but it is still a difficult, risky and low pay profession, in yet another example of why high demand in something doesn't mean making a lot of money out of it if the supply is unrestricted

In Steam releases, No rest of the wicked is out this week… and the next goes the long-awaited Manor Lords, in what should be one of the biggest releases of the year, if it converts its huge wishlist (being the most wishlisted game in the platform as of now!). Odd position for an indie game, I really hope it breaks all records!

Talking about wishlist conversion, The GameDiscoverCo newsletter dedicated a post to exactly that topic. The conclusion? Conversion has gotten a bit worse on average, but there are more extreme outliers16.

Sega Sammy keeps doing well in the Pachinko / Pachislot front with its latest release, aside from the Persona 5: The Phantom X release.

Shoutout corner

As you know, when I do one of these mixed issues I like to add a reference to webs or people that make my life investigating these things easier. In this case, I think ICv2 deserves the spot, since I have used their data in this and previous articles. It is the place to be if you want to read about the hobby market in the US, and comics as well!

Dalilah wilts no more, Night of the living cat, Sengoku Youko

Shinkalion has not started as well as Kaiju no. 8. My Deer Friend Nokotan seems a bit stronger at this point, but let's see when it debuts. Great Pretender: Razbliuto has done worse than previous issues, but pretty decently, and Kimi ni Todoke seems to have some expectation as well. New Legend of the Galactic Heroes and Ascendancy of a Bookworm content is also expected.

About ¥7.25B, up from ¥7B at the beginning of the year, if you consider 0.8*receivables + cash - pending royalties - debt - payables. It is not much, but there are several productions ongoing where they have money tied up, and the intangibles related have gone up ¥0.7B, it is remarkable they have continued to generate cash, actually!

If I am counting correctly. Playway is not easy to track, with the amount of entities in the group!

Pretty sure about Beer Factory and Anonymous Hacker Simulator at the very least. DLCs for Ship Graveyard 2 have also done well.

Closely followed by Robin Hood: Sherwood Builders with 2.5 million, which I think is unlikely to recover its cost. Probably PlayWay will lose about 1 million PLN there.

About 3x, give or take.

About $500k initially, although I am sure the latest patches and modes have added to that amount somewhat. Let's say $750k. Given it has generated almost $15M in sales (8-10 net to the developer and PlayWay), it is still a pretty remarkable success… that still sells a few thousand copies every week.

And after BoG's performance, I suspect Builders of Egypt might be another.

Within the range in Brazil, a bit lower in Mexico

Because they only had male miniatures, so you can bet female miniatures are coming.

At least part of the American fanbase.

Except in Australia.

It is the army he happens to paint and play.

And not only for CMON. Asmodee will probably suffer a bit too, although they are less dependent of the hobby channel, and also have both collectibles and non-collectible miniatures, although board games are by far their biggest seller.

Plus, Simon was kind enough to mention my prior article there, because the Pachinko ranking site caught his eye!

Thanks for the shoutout Dungeon Investing! Watched episode 1 of Kaiju No.8 yesterday, looks interesting!

Just to clarify, my previous write-up on SK Japan is free: https://open.substack.com/pub/continuouscompounding/p/sk-japan-7608-ultra-quick-pitch?r=28rmoq&utm_campaign=post&utm_medium=web

My newest write-up on SKJ is behind a paywall, but will be released to free subs later this week.