Spinning trends for kids

If you don't know PAW Patrol, you don't have kids under 10. And that's not the only thing Spin Master does!

PAW Patrol is the star at Spin Master Corp, so obviously that is not how I got to know them. Maybe you remember CMON, the (maybe failing) miniature game maker. They have been launching comic-themed miniature games in the last few years, first Marvel, now DC. And those were launched together with Spin Master, because they hold the rights for this type of game.1

When I started looking into Spin Master, I was surprised to see a bunch of valuable IPs, not only licenses (Beyblade is there as well, and still making money). But then again, Mattel and Hasbro also have them, and they haven’t been particularly good investments. Spin is about half their size, so it is supposed to have a bit more runway if it keeps growing. They do have similar margin profiles, but TOY is significantly less leveraged. But that is not why I am looking into this.

Spin’s IP has been generated fairly recently. All of it was created in the last 30 years. And they keep trying to create more. This era is also markedly different from the Transformers animation times, where content was mainly an advertisement for the toys. Content can be pretty profitable on its own nowadays.

So I want to answer the following questions:

Where is Spin making most of its money? Is this a toy company? An IP company? A financial company in disguise?2

Is its IP factory still churning good ideas? Can we expect more IP from there, or just exploiting the ones they already have? How good have they been so far at this?

Betting the farm

When you start digging on Spin’s history, the first thing that comes up is how many times they essentially depended on one or two products working. And sure, that is normal with the earth buddies product (their first) or the devil sticks (branded devil sticks… can’t figure out how they succeeded with that3). But if you listen to one of the founders telling the story on How I built this, you will see Air Hogs and even Bakugan4 were close to that. The reason I mention this is that, like a lot of videogame studios, Spin Master has risk in its DNA and were created (not so long ago) on a series of really risky bets.

Now, a lot of those bets were successful, but Bakugan eventually was not. Or rather, it was so successful that its decline was close to bankrupting the company because the fixed costs were now bigger than could be absorbed.

In 2012-2013, Spin master essentially decided to drop Bakugan5 and refocus the range, and they had a few tough years… but by 2015 they were already above the peak of Bakugan-mania in terms of revenues, helped by PAW Patrol (launched in 2013). Since 2015, they have grown the business at a 13% CAGR.

There is an important question to answer though, and it is how much does Spin depend on PAW Patrol. The short answer is we don’t really know, but they are within the Preschool segment (roughly 44% of revenue in 2022), and shares it with other brands. We don’t know the percentage inside of the segment. It grew last year despite a decline in PAW Patrol sales, and I think it is safe to assume it is below 70% of the segment… but it is big. And there is also media revenue. The segment was only about 6% of revenue, but 22% of operating profits. And I would bet almost all of it comes from the same place.

So we also have to add a new question to the set above. Is PAW Patrol an evergreen IP? Some IPs (Anpanman, Barbie, Dragon Ball…) can drive revenue for many decades. Others, even if they are extremely popular at some point, don’t last as long (sure, Yu-Gi-Oh!, Beyblade, Power Rangers or Death Note still are around, but so, so far from their peak…). Because if it isn’t we would be running the risk of buying Spin in 2009 or 2010. Might play out long term anyway, but I would still like to avoid it! Let’s start.

Where is the money?

Spin Master makes money out of toys, sure, but also out of content directly through their entertainment division. While that has been the case for a while (after all, PAW Patrol has been around for a decade), entertainment was not considered as a segment until 2019. Part of the reason is that Spin Master does not make their content, for the most part

PAW Patrol is animated by Guru Studio (and Abby Hatcher as well)

Rubble & Crew by Jam Filled, as is Vida the Vet

Bakugan by TMS

And that's the case for pretty much all other productions. Spin Master pays for the production and they retain the rights though. This is not a situation where they license the IP for the studio to use. And the massive success they have with it is proven by its margins: 40% operating margin is the lowest I have seen in the last few years (as margins get lower when they release expensive content, like the movies in 2021 and this year), which is not that surprising as this segment includes brand licensing.

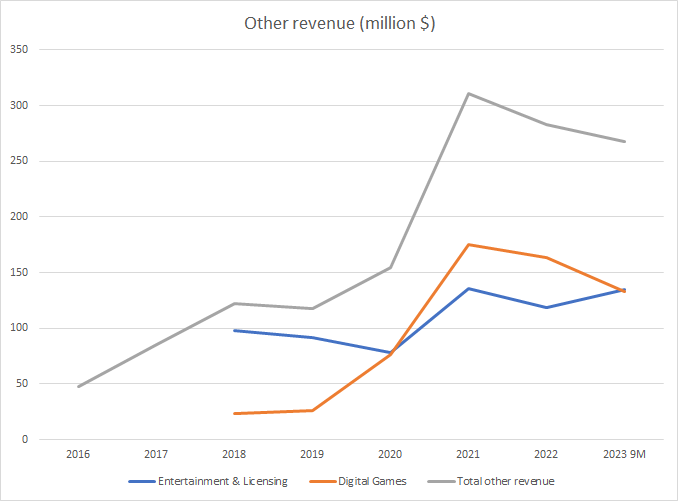

And, for now, the trend is positive. In 2016, other revenue, including both entertainment and digital games, was $48M. In 2022, both combined were $283M, of which $119M came from entertainment & licensing, and in 2023, $268M were recorded in the first few months.

So other revenue has increased almost sixfold, versus a more modest almost-two-fold increase in total revenue. Over the last few years, that has been driven mostly by exploiting the PAW Patrol with several seasons, 2 movies, and one spin-off… and it is still going strong (with 2 seasons amongst the 100 most watched in Netflix latest data dump), but that has not been the only thing Spin Master has attempted. Mighty Express, Abby Hatcher and a couple Bakugan reboots are only some of the productions. The ones were we have viewership figures in Netflix (Mighty Express and Bakugan) are not too encouraging, with all seasons buried fairly deep in the classification, so I suspect almost all the positives here come from PAW and they have not been able to catch lightning in a bottle again. Which sadly answers one of our prior questions in the negative.

Digital games are a different story though. One built on acquisitions and COVID. Back in 2016, Spin Master acquired Toca Boca and Sago Mini for about 31 million. I couldn't find a reference to their revenues at the time looking at the financial statements, but seeing that in 2018 the section was still generating only $23.6M in revenue, it seems a expensive acquisition… until you get to 2020. As with everything else digital, games revenue exploded in 2020 and 2021 and, while there was a modest pullback in 2022, 2023 seems posed for a new record. It seems a case of COVID expanding demand enough to improve long-term profitability, and I hope they can keep surfing that wave.

Their games seem to be oriented to very young kids, and they seem to be one of the strongest competitors there with the Toca family of apps.

Toys are a different thing, sadly. In that regard, Spin is very much in line with Hasbro or Mattel, and actually its total margins are not too dissimilar, hovering around 10% net profit margin in the last couple of years. And I don't think that will improve this year, as usually Q4 is weaker than Q3 for Spin, and it is displaying decent, but not particularly fantastic margins in the first 9 months.

Now, that is not the condemnation it might sound like. Both Mattel and Hasbro have alternated pretty decent years with terrifying losses. Spin Master has, so far, been able to avoid that (not a single loss year in the last 10), and has combined it with growing well while both giants are flat. And with decent cash conversion despite the working capital requirements, producing close to $1B of free cash flow in the last 3 years.

A good part of that growth has been PAW of course, but that cash has also been put to some use, instead of paying dividends. There isn't a year without at least a small one. They acquire the brand, bolt it into their channels, and profit.

This year they have gone a bit further, with a $1.1B acquisition: Melissa & Doug. It has been funded partly with Spin's own resources and partly with $500M of debt, and should add $500M in revenue… but at the margin usually obtained in toys, the price seems a bit difficult to justify. It seems like management is confident that they can also improve the distribution of this one.

So, to summarize, so far we have outstanding growth performance vs. peers, but mainly based in one franchise. There have been attempts to diversify through both M&A and new productions, and they have been somewhat successful, thanks to the digital games area and toy range, but the media arm hasn't been able to get a new success. They make about 60% of its money in the toy business, about 25% on entertainment, and about 15% on digital games, although it varies a lot by year, with media and digital growing faster than toys. On top of that, we have had sensible capital allocation so far, but there is a big risk of execution at this point.

Overview

In my opinion, Spin Master is compelling at this point, although not part of my portfolio at this point. It is compelling because they have proven good execution and, at $2.6B of market cap, they are decently cheap regarding the cash generated and the IPs they have.

But… they only really have one big evergreen IP. PAW Patrol is at its height right now. And while Spin has been looking for something else to complement it, they haven't found it so far. If we look at their productions, it is clear that they are looking to generate similar IPs (that is, toy-led IPs for a similar age range, or pre-teen in the case of Bakugan, but well, not much success there), so basically they are trying to be their own replacement as the dominant one in the range. That is, I think, smart, given the age-compression phenomenom6. Their range also seems to focus in that age (including their new acquisition), which to me shows pretty smart allocation.

My concern is that I haven't seen many ever-green pre-school IPs. They seem to rotate relatively fast. PAW Patrol is one of the more long-lived ones I remember already. Long-lived IPs tend to trap you in the teens or pre-teens, and then be somewhat acceptable consumption into the adult years (think fantasy or sci-fi stuff, videogames, animes…). There are some (Barbie, Polly Pocket…) that have been durable because parents also have brand recognition, and maybe PAW will get there. I don't know. It seems fragile to me right now.

But hey, if anyone has a different opinion, I would be glad to discuss it here, on X or Threads!

There are too many Marvel games around to count, but in the miniatures space the main one is Marvel Crisis Protocol, by Atomic Mass Games (yes, Asmodee in disguise, as always). Not sure how CMON and Spin Master got around that license, but Marvel United and the Zombicide version seem to compete directly. I have seen rights for miniatures in different scales go to different companies before (LoTR comes to mind)

Not an airline, so no I guess!

As a curiosity, Bakugan was done in partnership with SEGA Toys.

Temporarily. It is back now as part of the “wheels and action“ segment along Tech Deck, DC, Monster Jam, Air Hogs. The category did around $400M in sales in 2022, and $320M in the first nine months of 2023. It was relaunched in 2018, but it is interesting that the IPO documents already mentioned the decision to pull it was to preserve brand value for a future relaunch. You know who did the animated series for the re-launch? Yes, SEGA also owns an anime studio.

Well explained by HedgeFundGirl in her article about Mattel