Nihon Falcom (3723.T): Nostalgia & Switch

An update for Falcom looking into 2025. Plus Games Workshop and IG Port results!

It has been almost a month, but I promised a Nihon Falcom update in the 2024 review and here it is! And we will be talking about death, taxes,1 and changes in publishers. But first, a short re-cap. I pitched Falcom as a small position last May. The summary? A budget-conscious developer with increasing revenues coming from abroad, especially the West, and a ton of cash that gives some optionality in case they decide to do something with it and trading at slightly above 10 times profits, with almost all the market cap in cash.

Cheap J-RPG Makers: Nihon Falcom (3723) & NIS (3851)

JRPGs were an inseparable companion of many of us. Wether it was playing Legend of Zelda or Golden Sun in the Nintendo portable consoles, or the Final Fantasy or Tales series when we were at home, we spent countless hours on it. Hell, even Pokemon is one of this games. With all those examples in mind, is easy to understand the attractive of this genre, …

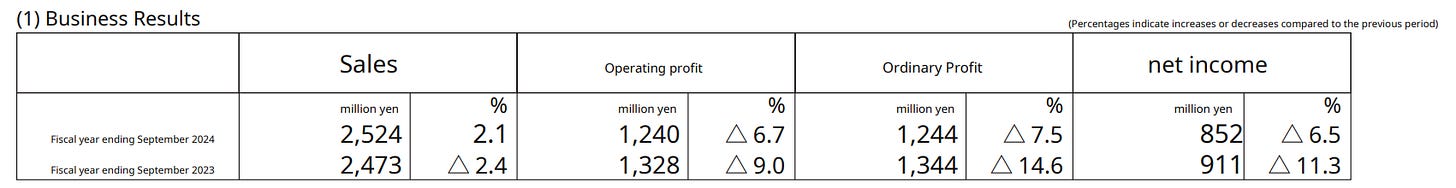

Since then, the stock has barely moved (up about 6%) and the results have been slightly lower than last year, although with slightly higher revenue

So why do I believe it is a better opportunity right now? Well, we will start with an obituary, follow up with a surprise announcement by Nintendo, and follow with their line-up for the year, shall we?

Nihon Falcom: Ends & beginnings

On December 15th Masayuki Kato, Falcom's founder, died. While he had left the company in the hands of current CEO (and Falcom enthusiast) Toshihiro Kondo2 back in 2007, he was still the chairman, and owned, through a combination of personal holdings and control of a society, 61.5%3 of Nihon Falcom. Kato was one of the key figures in the development of the early Japanese videogame industry, controversial as he was4.

While the implications on a day-to-day basis shouldn't be that relevant5, the implications in terms of capital allocation and also possibilities for a sale are very different now. Suddenly, the majority of the company is not under a single, very reluctant to transact, person. Capital allocation decisions might also change. With 75% of the market cap in cash and at a low valuation, both things can be catalysts for a revaluation, and I have to admit that is part of the reason why I have increased my position. But it is far from the only one.

Popularity in the West

One of the points I made in the original article was that Falcom was gaining traction in the West, especially thanks to NISA publishing most of their catalog, a big chunk of it previously inaccessible. That has reflected only partially in their revenues, and I think that is about to change starting in FY25 but especially in FY26.

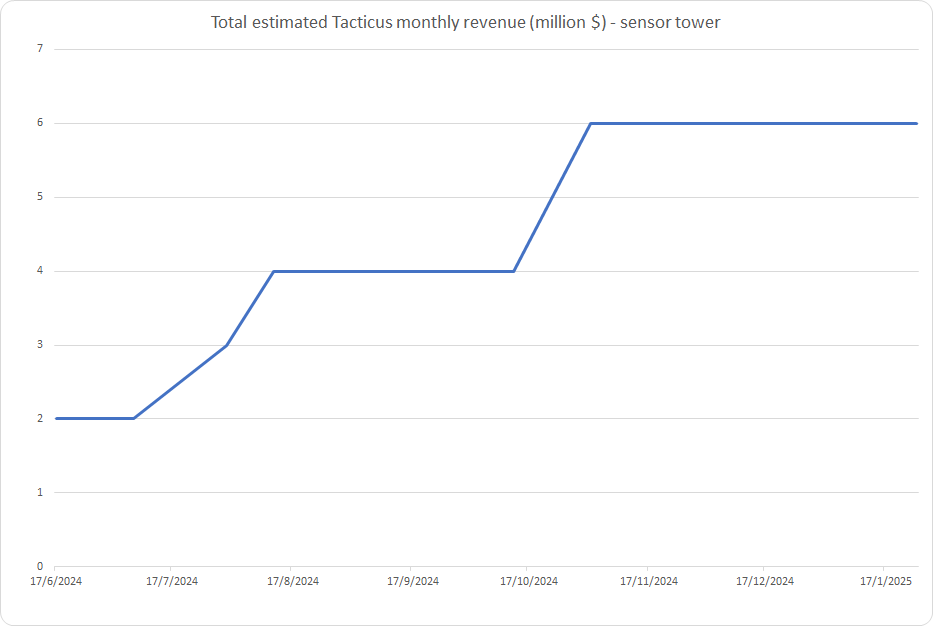

Now, in terms of the popularity of Falcom games outside of Japan, especially Trails, I think there are two statistics worth keeping in mind. First, revenue coming out of North America and Europe has grown at a 33% CAGR since 2018. Granted, COVID helped, but 2023 held up, and 2024 saw a 19% increase.

That is with gaming spending roughly flat in general, sure. But more importantly, with Falcom's revenues in Japan roughly flat in the last few years, and down since 2020's COVID-assisted peak. That's because Falcom's releases of late haven't been huge successes, with the Trails series losing a bit of steam there. The lack of global releases (with delayed releases both in the West and in the rest of Asia) has also hindered the momentum of the new games. That means that the revenue growth in the West comes from more general availability and back catalog, not from new hit releases, and is supported by another anecdote. In September 2022, it was reported that the whole series had passed 7 million copies sold. In January 2024, it was 7.5 million. In August, 8 million (revealed in their interim results). In September, 8.5 million.

The reasons that acceleration, especially in 2024, didn't translate in a bigger increase in revenue were

These are mostly sales outside of back catalog, probably with discounts in most of them.

Mostly outside of Japan (or on platforms inside Japan where the development is not carried out by Falcom, which only covers PlayStation and Switch), where Falcom gets a smaller percentage because they don't carry out either the ports to most platforms or the localization of the game.

There was still a decent increase in revenue coming from the West. But not commensurate with the increase in copies sold. I think that the arrival of Ys X Nordics (released in the West right after closing the accounts for the year) and Trails through Daybreak II next month will help. But I think the most important change will happen later in the year, and will be reflected both in 2025 and 2026's profits.

Remake, global release and new publisher

Back in August, Nintendo surprised a lot of Falcom fans by revealing a remake of Trails in the Sky I for Switch (including the CEO of Falcom, according to Nintendo Life6) at one of their Nintendo Direct. Now, Falcom getting the spotlight from Nintendo in that way is already uncommon, as, despite the long history of the company, it is not a huge seller, so that was great publicity. Trails in the Sky was the most popular subseries of the Trails series too, so having a remake of that makes sense, updating it to new hardware (coming, as it did, 20 years ago).

Then, in December, something more was revealed. The remake is going to come to PlayStation and PC too, and going to come in the form of a global release with GungHo7 as a publisher in the West, and released with localization to German, French, and English right out of the gate. So we are getting a first-time global release, better published and ported, of the most popular entry in a series that was already gaining popularity.

And it is also not the only thing in Falcom's backlog. Falcom has been pushing only one game per year as a rule. Sure, there were ports and localizations being released at the same time8, but no more than one game from the company. In 2025, Falcom is releasing at least the Trails in the Sky remake, plus an enhanced version of Ys X: Nordics, called Ys X: Proud Nordics9, and a PS5 and a Switch port (neither revealed yet) that are happening in-house10.

So the summary is that I expect stronger sales (and profits) thanks to them taking advantage of their increasing popularity to release a lot of ports, an enhanced edition, and a long-awaited (and finally well-published) game. Along with the more open possibilities for M&A and/or capital allocation, seems like a good set of potential catalysts, although none is certain.

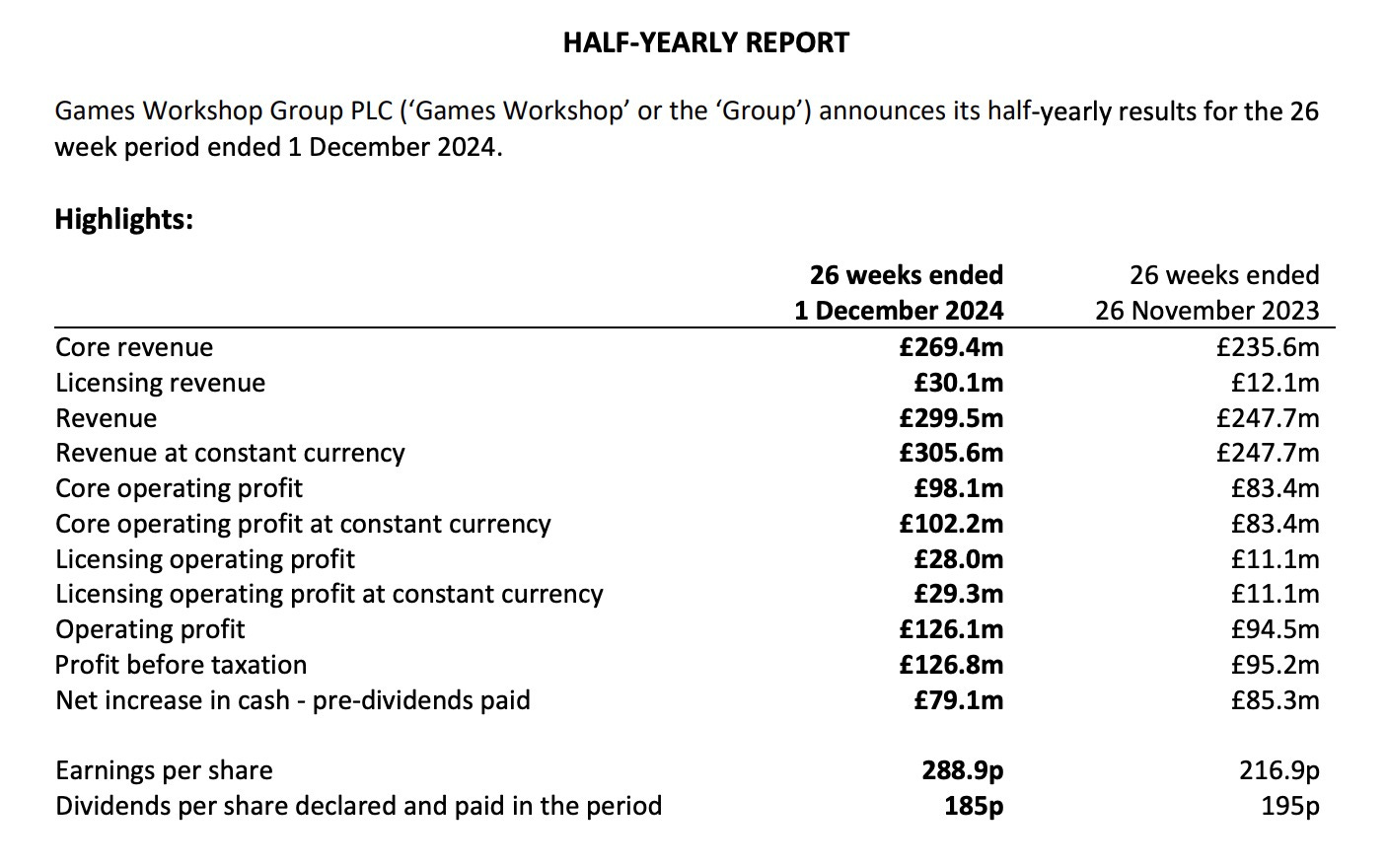

Games Workshop's best half (so far)

I talk often about Games Workshop, but I haven't talked about H1 results yet. There is often not much to talk about in them, because the level of revenue and profitability is known (approx) in advance, as they release a trading update with the figures a bit more than a month before, and they don't disclose that much in terms of operations. That's not the case this year, though. First, the results were clearly excellent, thanks in good measure to the royalties from Space Marine 2

But the increase in miniatures (aka core) revenue is not insignificant. I suspect it came mostly in Q2 and partly on the back of Space Marine 2, the Secret Level episode dedicated to it, and the confirmation of a live-action series for Amazon with Henry Cavill involved (all things we have previously discussed here, though the confirmation itself only briefly in the 2024 review). More importantly, we have an unusual tidbit, because Games Workshop's C-suite is not prone to talk about current performance

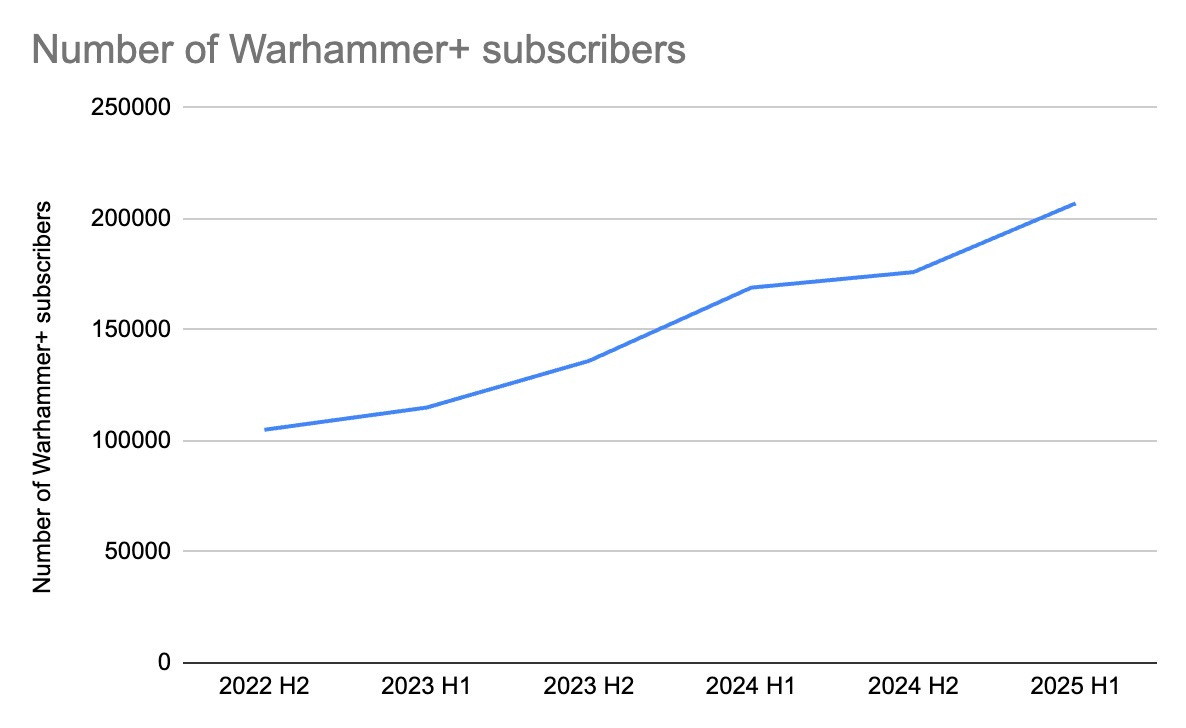

So the first month of the period is going well already, and doing so despite not many releases. January is a bit different in that regard, but we'll go into that later. There is also an additional sign of reignited engagement, which is the re-acceleration of Warhammer+ subscriber growth. As a reminder, this is a very limited streaming service (that also offers some exclusive miniatures and access to the apps for playing)

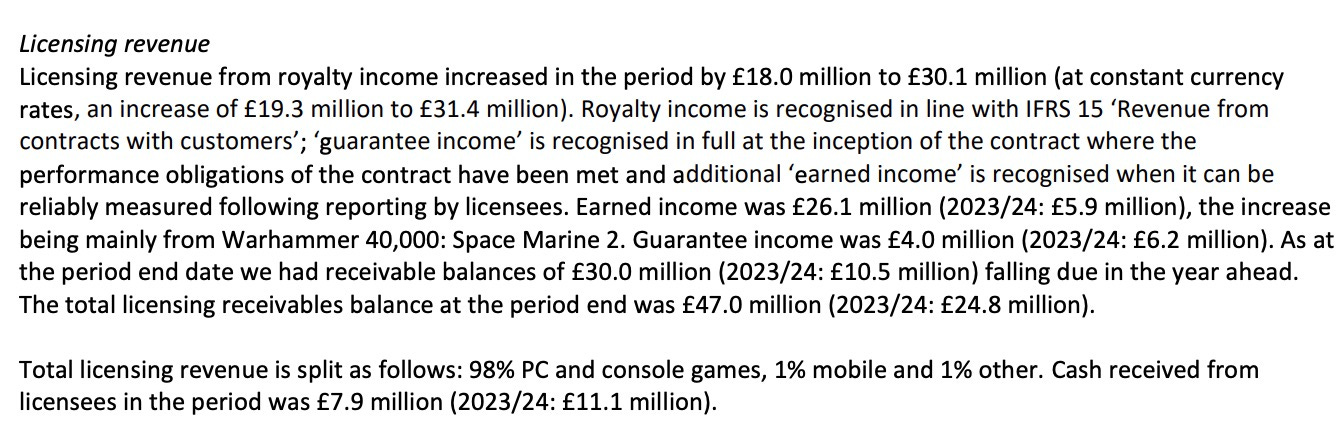

The most interesting tidbit for me is this, however

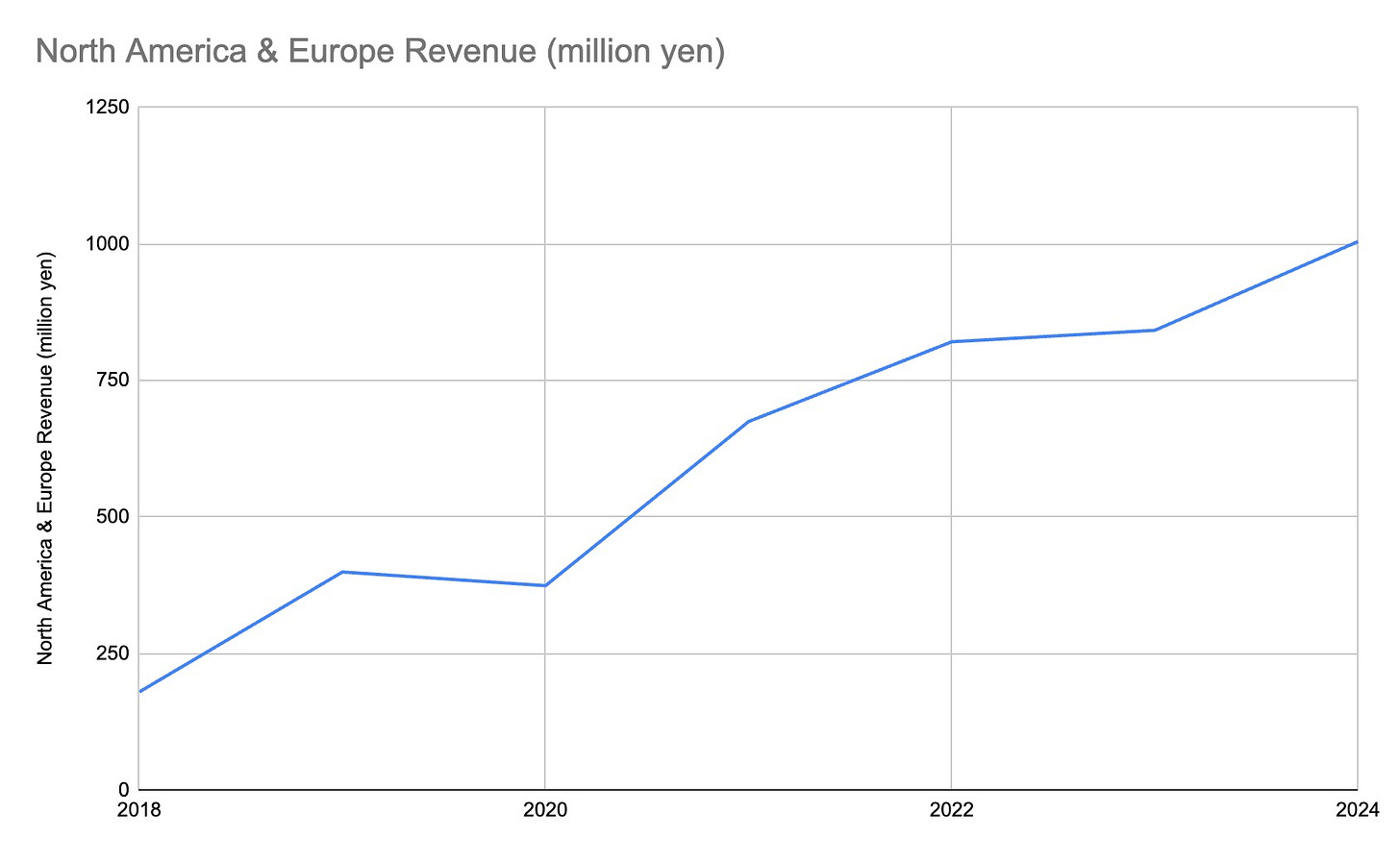

1% coming from mobile? Last year they made more than 4.6 million, with almost 4 in H1. And now they are reporting 0.3 for this half? I get that those 4 million could very well have been an advance for a future game, but Tacticus is doing really well, according to Sensor Tower. So what is going on here?

My suspicion, and it is only a suspicion, is that MTG11 has bee investing heavily in growing the user base (taking advantage of the SM2 push), and that royalties in this deal are calculated after CAC to allow for better investment. But as I said, only a guess. Sadly, the rest of the mobile games, like Warpforge, are not having a similar success.

Also extremely low is the share coming form other areas (Joy toy figures and the like) which usually is more than a million a half as well, and they are reporting 0.3 too. Other than a potential typo, I have no explanation.

Ok, so we know that they had an extremely successful half, and the first month of the next one is going decently in terms of miniature sales. We also know there is a suspicious slump in mobile royalties revenue (that I suspect but have no proof that is due to growth investment). What do we know about the future?

Future royalties and stock situation

The first thing we have to take into consideration is how well games sales are doing and… well, they are doing well. Total War: Warhammer III released the latest DLC in December. It did not have the outstanding performance Thrones of Decay had, but it did perform decently, well above the dismal levels of Shadows of Change back in 2023. Aside from that, Darktide has been selling really well since early December, thanks to content updates, with its best CCU count in a while.

Both things should help keep royalties high. But Space Marine 2 is probably the most important bit here. Despite having a CCU count way below Total War in Steam, it consistently ranks well in the sales charts, and let's not forget it is a multiplatform game. In any case, it only fell from the top 50 best sellers for a few days in early January, never going too far from that, and it is typically around top 30-50, currently with a 25% discount. I expect it to drop close to top 100 when the discount ends, but still, fantastic run so far. What all this means is that this is still easily doing more than 10 million in sales a month12 across platforms and the guarantee was blown through. Royalty revenues in H2 are going to be just fine. I think lower than H1, because it is difficult to reach the SM2 release revenue levels, but with a less steep decline than expected13.

Equally important is the situation with miniature sales. And the company said that December was going well (up 12% from last year), but what has happened since? Well, the release train has started going on in earnest. And they are going well, by and large. The main releases have been:

Orruk (Orks) new battletome and spearhead in AoS: Not sold out.

Empire of Man for The Old World: Main items sold out in Europe, and only some references (and not the main ones) sold out in the US.

Krieg/Astra Militarum in 40k: Main items sold out almost everywhere14

Aeldari in 40k (released yesterday, as I write this): Mixed. Only Fuegan and the Collector's edition codex are sold out everywhere15, and then some aspect warriors on each geography. Vehicles are just re-releases, so they are not expected to sell out. Those are fantastic results for something that is not an army box, by the (web)way.

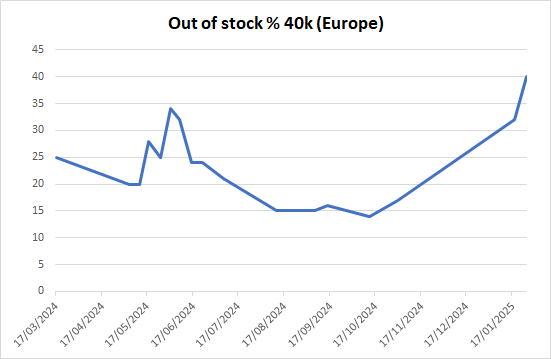

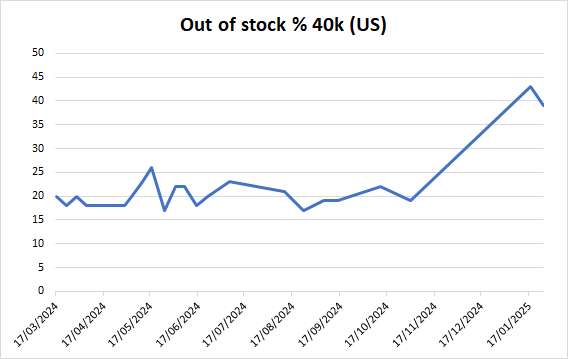

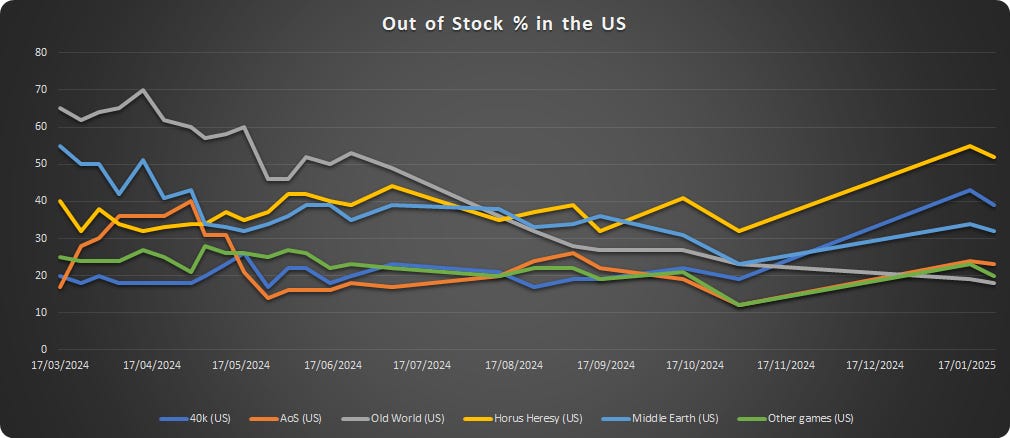

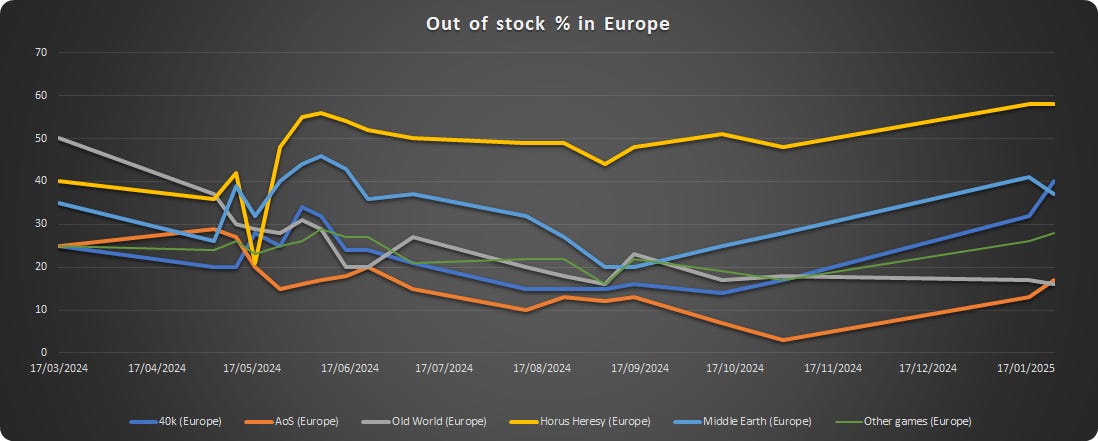

I think that is pretty good for the first few releases of the year. But there is another metric that gives us an idea of what increased popularity is doing to Games Workshop's logistics. Out-of-stock for the 40k range is at an all-time high, and Horus Heresy as well. AoS has also increased, although far less. The measurements are so high for 40k that when I initially saw it last week I thought it could be a temporary problem in their warehouses. But I have been getting the same consistently for a week.

As you can see, the increase in out-of-stock for 40k after November is just out of this world, and a record measure in all geographies. Hope they are busy increasing production, or at least allocating it better! Let's see the rest of the lines

It is visually less impressive, because Horus Heresy has always had crazy levels of out-of-stock in Europe, and The Old World was very short on stock at the beginning of its run. But still, you can see what is happening in 40k and Horus Heresy in the last few months.

What can I say, this bodes well if they can improve the supply situation.

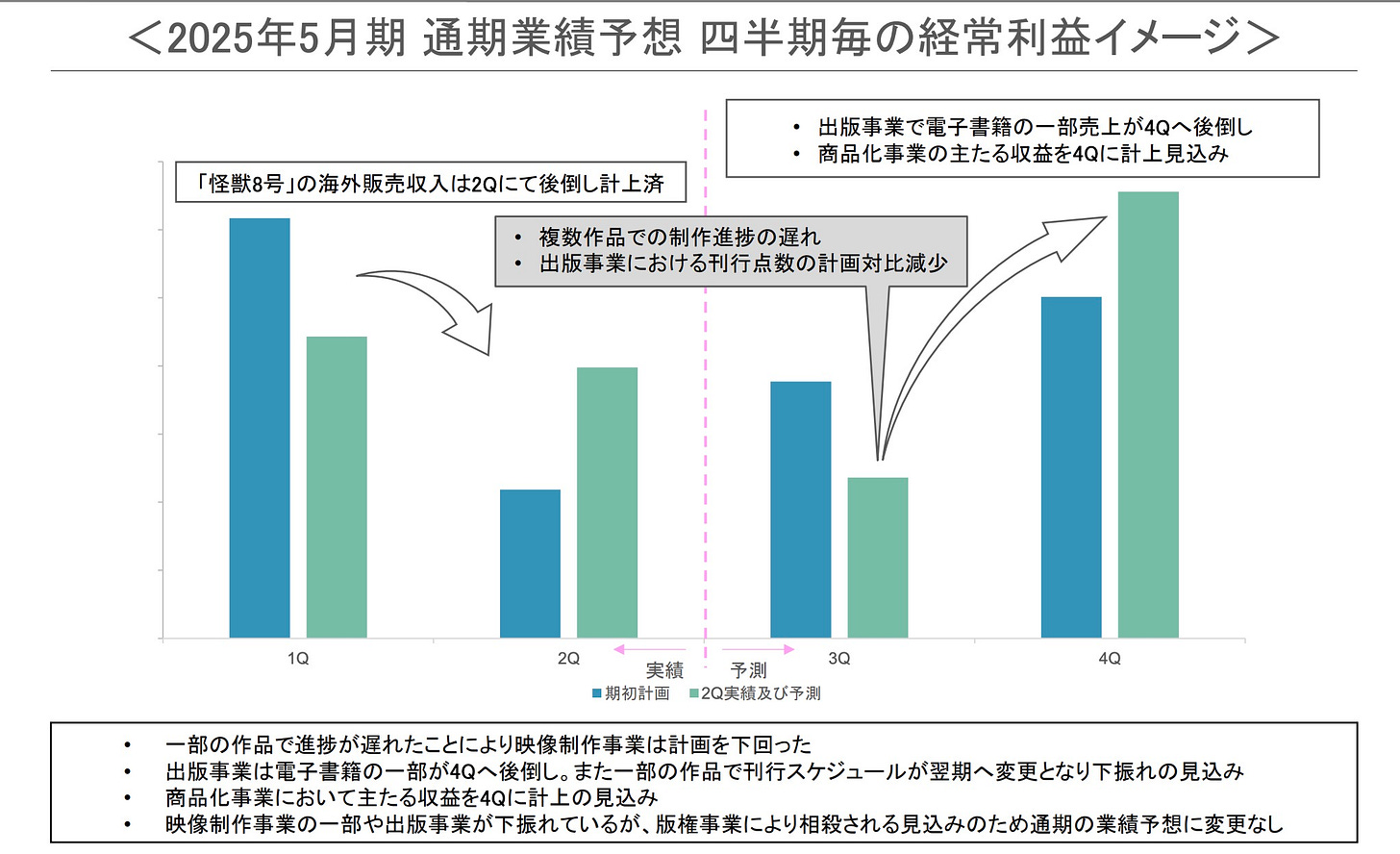

IG Port delivers on Q2

Last time I commented in depth about IG Port here was about how their Q1 results were a bit disappointing, but it should only be a timing difference. Well, they did deliver as promised, but a similar situation will impact Q3-Q4, with Q3 being lower than expected, and Q4 being higher.

The half, as such, has been strange at first sight, with a large increase in revenue (almost 50%) and operating profit (almost 40%), but a much lower increase in profit before taxes (because of investment gains on their portfolio in FY24) and a decrease in net profit

The increase in net profit is because of a situation we already touched upon last time: Taxes and the structure of the group. Because of the way the group is set up, with WIT being a somewhat independent company with non-controlling interests, the losses incurred in the animation business can't be offset by the earnings obtained elsewhere. The result? An effective tax rate of 48%

Of course, that wouldn't be a problem if the animation studios earned money by themselves, but currently, they don't. I hope IG Port sorts out the pricing of the studios to production committees. I get they use cheap prices there to get in on the action, but this has group-wide consequences for tax.

That said, as the copyright (read production committees) derived business grows versus the animation one (and in particular WIT, because as far as I know this does not apply to Production IG) this should be less of an issue, and anyway it is not a situation that should hold for long (or WIT will eventually close or be fully absorbed, and then the losses could be offset).

Keep in mind when evaluating their price that the net income is depressed because of this. It is starting to get interesting again for me, although not quite there yet.

And that is all for now! I am working in the long-mentioned guide of the anime sector, but that will still take some time. In the meantime, happy to talk about any company in the area. Reach out in the chat (where we were recently discussing Remedy) or by mail (and thanks to those of you who did, always nice to get in touch and learn!)

Well, the taxes bit is about IG Port.

Enthusiast is selling it short. The company hired him because he created the biggest fan site for the games of the company back in 1998, and they needed someone who knew how to maintain servers. Then started playtesting and writing for the games because he knew them so well. And now he is the CEO. The ascended fanboy trope personified, really.

Underpaying employees, not including contributions in credits… he even had a couple of big waves of people leaving. If you want to know a bit more, this article explains quite a few things, while this spreadsheet has a full history of the music of Falcom.

Shouldn't, but who knows. Kato was said to still be involved in the day-to-day in some capacity, even after leaving any formal role that implied that. We all have met founders like that :)

Which… would be weird.

Gravity's majority owner gets most of their revenue through mobile games. Not an AAA publisher by a long shot, but many times bigger and with more resources than either NISA or XSEED, prior publishers in the west, or Cloud Leopard, prior publisher in the east outside of Japan. It is not bigger than Koei Tecmo, but they only managed ports outside the platforms favored by Falcom in Japan. Once you start to look into their publishing history, you understand why their release schedule is a bit of a mess. Oh, the Embracer group apparently will handle the physical release in Europe, and also the collectors edition.

Although it has accelerated. In January we had Ys Memoir: Oath in Felgana for Switch (Marvelous) and Kai no Kiseki released for PC in Asia (Clouded Leopard), and in the coming months we'll get Trails through Daybreak II in the West (NISA), Ys: Memories of Celcetta for Switch (XSEED) and Ys vs Trails in the Sky (refint/games) will also be released this year.

A practice I like to call being Atlused. Because almost every single Atlus game does this. Persona 5 has Royal, Persona 4 has Golden, SMTV has Vengeance… you get the drill.

Both could be Celcetta, published by XSEED, it is not clear if the PS5 title is that one too, Switch is almost certainly the case.

And talking about MTG, here you have an excellent piece about the group by Justin Yau in Naavik with the Plarium acquisition as an excuse for reviewing the whole company. It's not exceedingly optimistic, but interesting to see how these conglomerates get formed.

Not revenue, sales. Remember, VAT and platform tax take almost half of that away.

Edison, which publishes sell-side research on GAW paid for by the company, estimates 4.9 million in royalty revenues in H2 vs. 30.1 in H1. That would be the worst licensing half since 2018, and is, to put it plainly, a stupid estimate. I would be surprised if it is not 3 times that.

Except Australia, somehow they still have stock there.

Except, you guessed it, Australia, where everything is in stock. I suspect that they overestimated the stock of everything needed there thanks to some problems last year.

A bit late to the party, but thanks for the write up. The (web)way crackled me up.

With the Ys coming out this month and Remake coming out in less than two months, any sense of how things are shaking out now?

The Sky FC Remake looks great, and the promo videos seem to have racked up a pretty decent amount of views on YouTube. I feel like it wouldn't be a shock if it does 1.5-3x the amount a new release like Daybreak does as this is a game that all audiences can play as opposed to the increasingly niche new releases that require playing 10+ games before. On the other hand, correct me if I'm wrong, but Ys might be disappointing and not a full release potential for sales since it isn't going to be a brand new game.

Nonetheless, this seems like a pretty interesting opportunity before the Sky FC remake launches, and with how clean the balance sheet and cheap the multiple is, it feels like there is very little downside with the stock. 3x EV / FCF means 3 years and you'll make back all your investment in just cash flow generation. The R/R seems quite good here, but these types of opportunities usually have something else keeping it cheap. What do you think could go wrong here?