Plug-in idols

Celebrities have always been magnets for money. Some companies are now creating their own virtual ones, and Cover Corp is one of them.

Fictional icons are nothing new, but at the same time we have very real celebrities attracting the interest of the general public. They inhabit the talk shows and gossip columns, set or expand trends, and many people are obsessed with them.

The difference between fictional characters and these celebrities was, I think, their responsiveness to their fanbase and the world in general. A fictional character is in a story, a game, an anime… whatever. But there is little responsiveness outside of that narrow area, and no real presence. We can feel closer to real-world celebrities, watching or reading their interviews, listening to the music they release or their new shows… and that makes for stronger relationships with them. Virtual celebrities are… something in between. And v-tubers are probably closer and more reactive than typical celebrities. And there, I think, lies there strength. But let's review a bit the history of virtual idols.

Virtual precursors

Of late we have seen the rise of virtual bands and idols. While we can see some very early cases (Alvin and the Chipmunks), maybe the closest precursors of the current trend are Gorillaz and Hatsune Miku. Gorillaz is a virtual band with fictional characters formed by Blur's singer and an artist that then had many different touring ensembles (and ways to present on stage). Both their aesthetics and sound clicked well with the times in the 00's, and had significant financial success. They were still heavily tied to a few real people and focused only on music so while their media and merchandise presence was strong it also faded relatively quickly. Hatsune Miku is a very different animal.

While also tied to music, Crypton Vocaloid characters are a lot more versatile. Vocaloid is just a software for synthetic singing coming from some pre-stablished patterns. While the software was owned by Yamaha, they licensed it for distribution to Crypton, and Crypton added a few characters to promote it… and the rest is history. While the other characters have not had nearly as much fame, Hatsune Miku has starred in lots of videogames, merchandise… anything that does not require a personality (by design). The scale is difficult to understand without numbers. Project Sekai: Colourful stage alone brings around $10m a month in revenue, according to Sensor Tower estimates1, and while that is probably the main revenue source in games, we can't forget the PlayStation ones, or the tons of money in merchandise.

But even with Miku all that was attempted was to have a mascot for the rhythm games and products, and some songs. What we are going to talk about here is a bit different. We are going to talk about V-tubers, and in particular, about Cover Corp, the talent agency behind some of the most successful ones.

Cover Corp by the numbers

Before talking about what Cover Corp does exactly, let's have a look at their growth and current valuation (as of June 24th 2024):

Current Market cap: ¥96B

Current Enterprise Value: ¥87B

LTM PE: 23x

Last year revenue growth: 47.5% (74% 3-year CAGR)

Last year EPS increase: 65% (44.5% 3-year CAGR)

So yes, it is a bit pricey, but with this growth, it is arguably still cheap. That said, cash conversion last year was not great, with operating cash flow at roughly the same level as the previous one. But in FY23 WC variations were really positive for cash (netting almost ¥2B) and in FY24 they were negative (¥0.3B). Adjusting for that, it would be more than a 60% increase. FCF was pretty muted (¥1B in FY24) because they have been investing relatively heavily in both physical goods and intangibles. Still producing cash while investing for growth at this rate though.

So we see a business that is growing insanely fast, and that in the last two years has found relevant operating leverage, with earnings going 3.3x higher and revenue only 2.2x. Growth also barely decelerated last year, going from 49.7% in FY23 to 47.5% in FY24. Q4 FY24 was the slowest, at 43% growth YoY.

Their announced forecast is slower than that, sadly.

Only 20% revenue growth and 22% profit growth. For FY23 they initially guided 30% revenue growth, and for FY24 they guided 30%, then corrected to 39% in February and ended up beating it pretty handily in March. Depends on the company, but setting lowball guidance for the year is pretty typical in Japanese companies, at least in this space.

That said, they have already released their Q1 results and they are… not great. Especially disappointing is the relative lack of growth of merchandise income2. I think it is just a quarter that went sideways, but we'll have to keep close watch on it. Anyway, their streaming revenue (closest proxy of the revenue they could generate at full monetization, in my view) keeps growing well, while the corporate structure scales up to operate internationally in a bigger way.

What is a V-tuber?

So what is a V-tuber, and why are they generating that much money for a few Japanese3 companies? V-tubers are simply streamers that do their job behind a virtual avatar (animated and with expressions through mocap, and also with their voice modified in many cases). Hololive (the brand Cover Corp operates under) can be understood as a talent agency, similar to idol agencies in Japan and South Korea. They select talents, make groups with them, cross-promote them and commercialize the IP.

The streamers do live sessions, mostly gaming but also just running Q&A sessions or just sessions presenting new outfits for the avatars. The relationship with their fans is, in that regard, similar to the one other streamers have and as such it is a localised relationship (though not necessarily local). In some senses they are a bit more versatile than standard streamers. As the avatar is, in most cases, an anime-like character, animated content or music videos can be easier to produce, as is introduction in other audiovisual content (from anime series to videogames). As an example, Gawr Gura4 is one of the better known V-tubers in Hololive. This is what music video content looks like:

While live videos done with mocap look quite different both when it is mostly 2D based like this one (in which she showcases a Hatsune Miku game, funnily enough!)

Or a 3D one5

Each of the V-tubers has their own style (ones are snarkier, others are sweeter… a character for each preference!) and so have their own public… but there is also significant overlap, and that means cross-promotion works. V-tubers are, I think, far more responsive to their fans. Over time, it is common to have some changes in the persona driven by the inside jokes of the chat and lore of the avatar, generated in events and in streaming sessions. As such, the fandom of a v-tuber, while not usually massive, tends to be pretty loyal.

But… who watches this?

I know, I know. It is easy to get a bit weirded out by the concept of virtual anime girls on stream. Truth be told, it is not only anime girls, there are anime boys as well! Both Nijisanji (Anycolor) and Hololive have male V-Tubers, but Nijisanji seems to dominate in the male Vtuber space, while Hololive does the same in the female space.

In Japan, there seems to be space for Vtubers of both genders to be fairly successful, and Nijisanji has managed to get fairly good numbers focusing on male ones.

Outside of Japan, the market is mostly dominated by female streamers and I suspect there are more male fans, although demographics are difficult to come by. In general, male V-tubers have had a harder time in the west, and the main vtubers, even those of other origins (say Ironmouse) are anime girls.

I would say that we have several distinct markets really

Japan: The craddle of the phenomenon. It skews younger, although in the male fandom there is a significant section above 30 (not in the female one though!). Far more widespread than in other countries, and also merchandise purchases of anime-adjacent content are more normalised.

China: Really relevant for the initial vtubers, like Kizuna, and at the start of Hololive as well. I haven't found a demographic breakdown, but given the popular streamers, I guess it is also skewed to female vtubers. The main characteristic of this market is the difficulty to operate in it, which made Hololive abandon it in 2020, prioritizing the west, after a controversy regarding Taiwan6. It is still a sizable market where VirtualReal, a joint venture between Anycolor and Bilibili, is the main agency.

Asia (ex-Japan and China): Mainly S. Korea, Indonesia and Thailand. Haven't found a demo breakdown, but seems similar to Japan, although at a much lower level of purchasing power (S. Korea aside).

West: Content is mainly in English, although Cover is starting to produce content in other languages (namely German). Cover is the main agency operating here, and the public is more skewed toward males and seems to skew younger than in Japan.

So we have mainly young people, anime-subculture adjacent with a strong fanbase in Asia and a growing one in the west.

Why do people watch vtubers

Much like normal streamers, people watch them for entertainment and the content they create with game streaming, commentary programs and similar stuff, and that varies a lot by streamer. But while that is the starting point for the viewer, vtubers offer a different experience in terms of aesthetics and interaction.

In terms of aesthetics, including the behaviour, it is anime-adjacent, and depending on the v-tuber they index more to some anime tropes or others (In the case of Gawr Gura we see her go more toward a silly but cute character, others like Houshou Marine index more on the saucy side), and the English branches are usually less blatant with it. It is typical for a vtuber to adopt a persona that closely resembles some stereotypical characters in anime, which attracts viewers familiar and comfortable with those tropes. This is part of their strength (as most streamers do not offer content with those codes), but also a big barrier to entry, as they can be extremely cringey for people not very comfortable with that language. This effectively means their success will probably be related with the extension of anime-coded content7.

In terms of interaction, obviously you have the more common interactions in-stream, their charisma and the parasocial relations that form. While that is true for other streamers (and in many cases, celebrities) to an extent, it is probably more common in this area (you can check this video on it8). That aside, there is another relevant part of the equation here, which is the co-creation of the character. V-tubers avatars lore and behaviour typically evolves over time, based on the things that happen in the streams and interactions with the chat or other v-tubers, usually accentuating the characteristics that are deemed the most iconic for the character9. Some fans witness and participate of that evolution, and feel part owners of the success and evolution of the character in what the Chinese are deeming parakin relationships. For the smaller percentage of the fanbase that feels that way, retention is higher and obviously spend as well.

As you can expect, this correlates a bit with the darker aspects of idol culture and it has led to problems on occasion (when both male or female vtubers were rumored to have sentimental relationships and faced backlash for it), although the para-romantic relationship is not necessarily the main parasocial one for most fandoms in the v-tuber space, and the EN branches are typically less idol-like.

Can we expect the audience to grow?

Purchasing Cover here means underwriting a growth business, and one of the factors is the number of people in the general v-tuber audience (Cover capturing that growth is a different story!)

Streaming as such is relatively mature at this point, as are edited videos on YouTube. Sure, there is still growth, but we have seen streaming figures transition to the mainstream and vice-versa, and content produced without the backing on major networks or streaming services is a steady part of the content diet of most of us in audio (podcasts), video (YouTube) or written (Substack, and many others) form. Why would V-tubing still be a growth niche within that area?

First, I think the expansion of anime aesthetics outside of Japan is here to stay, which makes it less cringeworthy, so I think they will slowly get more accessible to the mainstream, while I very much doubt the part of the public which is into this now will merge back into the mainstream.

Second… I think the use of online avatars for content creation is going to get more popular, as it allows more freedom to the creator when it is clear and understood they are interpreting a persona. More freedom to the creator should mean that the frequency of them hitting the right spot could be higher, but also that more creators will experiment with avatars as they get cheaper and easier to use. Then the agencies can pick and choose and launch the ones that do well, as this is effectively a distribution issue, as we will see later. That should drive the increase in content quality and cause audience growth. This, though, is just elucubration on my part.

So overall, yes, I think we should see the audience grow (although as everything else on the internet, COVID pulled growth forward quite a bit). That said, some minor agencies have closed recently, and Anycolor streaming revenue is seeing a pullback (IMHO of their own doing), so something to watch closely.

Why an agency?

Being a V-tuber has very low barriers to entry, as being a streamer (or any kind of content creator really). So V-tubers will pop up everywhere unsupported and some will make it, and the market is saturated at this point, meaning making room for a new v-tuber is hard, much harder than it was 4-5 years ago.

The agencies already have an audience, or rather two. First you have the people that is cued in to the agency in particular because they like their style (one could say Yagoo, Cover Corp's CEO, has his own fans). Second, you have the audience of the already existing V-tubers, that you can use to cross-promote the new ones. That allows a V-tuber channel to get economically viable pretty fast. For example, Cover had 4 debuts 4 months ago, the ones of Hololive Justice. The 4 V-tubers now have 1.4m subscribers in Youtube (combined). That would make it a top 30 brand on its own according to vstats’ rank (6 of them belong to Cover and 2 to Anycolor). Very few v-tubers achieve those numbers ever, much less in 4 months. Basically, in a saturated market whomever controls the distribution has the advantage, and the big agencies do. It does not mean an independent can't get there, but it is an uphill battle. In other content-creation areas it is far more difficult to become a middleman but here there is a common thread for all the fans regardless of the exact content they want to consume, the aesthetics, which gives the agencies the ability to be curators with staying power.

That aside, having an agency allows for easier access to merch production, possibilities to participate in events and of releasing higher production value music videos or other avenues to use the IP (brand advertisement, anime, videogames…)

The downside, for the creators, is that the agencies own the IP of the character a retain a substantial part of the revenue generated. Cover is one of the most generous ones, and only 15% of revenues went to pay the talents, with a gross profit (inclusive of other costs) of slightly above 50%. But 15% of a lot is more than 50% of almost nothing!

The business model of the v-tuber industry

Vtubers in general have 4 sources of revenue, although most of them do not exploit all of them. First, there is content revenue. Fans send gifts in whatever form the platform uses (superchats in YouTube, for example). Additionally there can be branded content on stream (for example, some companies paying for their games to be played on stream) and, of course, we have ad revenues and music royalties. It is also the base for everything else, and an indicator of well things are going in terms of fan acquisition.

Then we have merchandising. Plushies, figures, pillows… you name it. As with idols or anime characters, anything can wear the face of your favorite V-tuber.

We could have grouped the above into IP and licensing, but it is too relevant for that. Let's leave IP and licensing for other areas, like videogames and licensing of skins for other games or content (as opposed to content produced by the vtubers and their company).

Last but not least, events, like IRL concerts, are a surprisingly relevant for large productions

I want to go in detail on how Cover manages each area, but first there is an important aside.

Who owns the IP and what can they do with it?

In the case of V-tubers that work with an agency like Cover, the IP belongs to the agency, but that doesn't mean they can do anything they like with the characters. Not necessarily because the contract says so (nobody knows what the contract of each V-tuber says exactly, of course), but because the backlash would be bad for the company as a whole.

What does this means in practice?

Replacing a performer (many times called voice actor/actress or VA) is unlikely. You can check what the rumours of that happening did to Kizuna AI, back then the most popular V-tuber, even if that is technically allowed under the contract. The actual identities and/or alt accounts of many of the most popular V-tubers are known in many cases (even if everyone acts like that is not the case) so pushing out and replacing one of the VAs would be counterproductive. After all, the parasocial relationship is not only with the avatar.

Other uses of the IP typically get the performer a royalty. This has centered around merchandising and voice packs10, which is fairly easy to compute as each vtuber has their own products. It is unknown to me how this is managed for less clear situations, like games in which all vtubers of the company appear. So far, other uses of the IP have also ceased when the vtuber graduated (changed jobs, as we say in the real world). While the company might theoretically have the ability to keep at it, it doesn't make a lot of sense for merchandise (which the fans buy to support their idol… who no longer would be there).

So while the IP belongs to the company, it would be hard to use it without the vtuber participating or agreeing to it. AI presents a series of interesting case. Would the vtubers agree to have bots trained with their voice and typical answers to offer custom conversation to fans that paid for it? Would that work with the fanbase? I don't know. It is not something that has been done so far by the big ones, at least to my knowledge. What I don't expect to see is agents trained on the VA's performances to replace the VA's on stream, as I have heard some people in the investment community pitch. Mostly because I don't see an agency that does that surviving the backlash. For now, while other options for IP use can be attractive, I am not considering the cheap bot replacement thesis or the potential to increase the offering with custom agents.

Content, the basis of it all

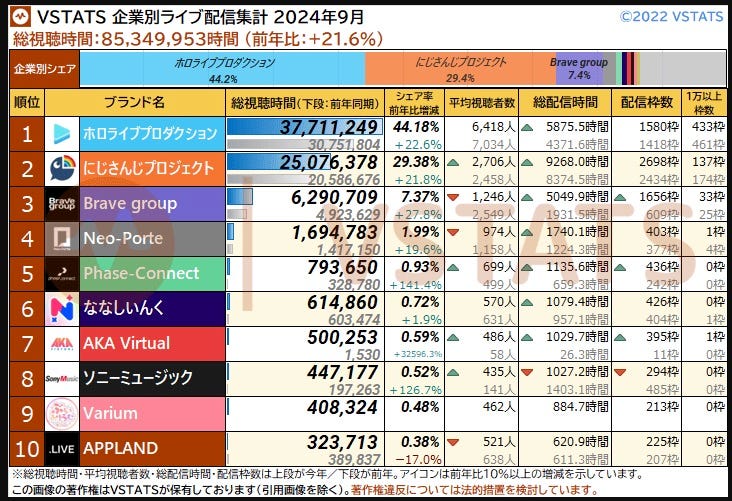

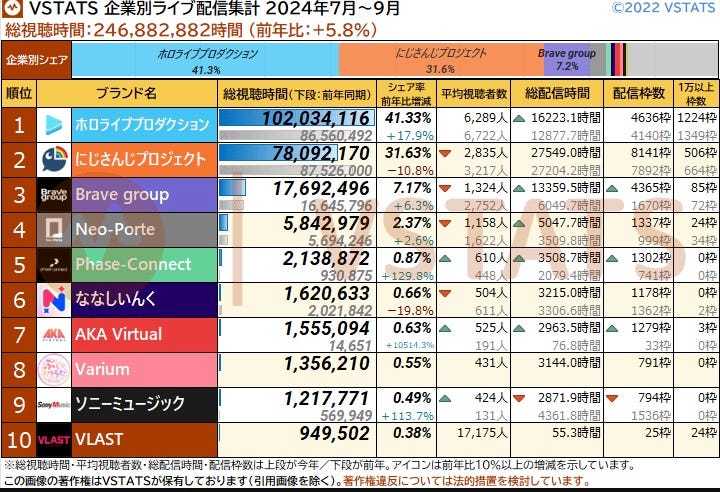

The main metric to track how each agency is doing in terms of relationship with the fans is how much their streams are consumed and, at least in YouTube, Hololive reigns supreme, with 37.7 million hours streamed in September, according to Vstats

And in Q3 as well

In Twitch, the VShojo v-tubers dominate and Hololive does not really have a meaningful presence. But Twitch is way less relevant than YouTube in this segment11.

Total growth in hours in prior quarters was stronger, around 20% in both Q1 and Q2, and I suspect we will get back to that once the effects of Nijisanji nuking itself calm down a bit. Still, the category as a whole is growing even with that, and maybe more than in 2023 (total annual growth of 12.7%)12

Cover became the most-watched company only in 2023, with Anycolor being the dominant one until then. This year they have been solidifying that lead and taking share. While Hololive already had the most popular vtubers, Nijisanji made up for that in numbers, with about twice as many streamers. They still have around twice as many, but it is not enough to catch up to Hololive anymore. In this regard, the strategy of Cover is pretty clear: relatively few debuts, grouped in generations and well supported.

At the same time, they do try to keep a stable roster. Only 3 or 413 vtubers have left the agency since the start, although there have been a few more cases of dismissals14 bringing the total to 1315. Contrast that with more than 60 leaving Anycolor. When there are debuts, they are typically grouped in thematic generations of 4 or 5 members, with one of them (ReGLOSS) acting pretty much as an idol group as an experiment.

In terms of geographies, Cover is currently making content in Japanese, English and Indonesian, and a bit of Korean, although that one only as part of Hololive JP, while the others have official branches. They used to have a Chinese branch, but it was closed after an incident involving Taiwan. Nijisanji has a similar geographic footprint, except they have an official KR group, and then they have a joint venture (VirtualReal) operating in China. It seems like Cover is starting to do some content for China again, with some recent streams in Bilibili by some members of the JP and IN branches, but there is no official branch or announcement there. Personally, I hope they reopen there eventually, although I get why they decided to close given the harassment their vtubers were being subjected to. If they do, that might cause a bit of backlash in the current fanbase.

Streaming aside, Cover also has been focusing on the music and music video side of things of late. In the last few months, Cover vtubers have released some fairly successful music videos, and also have created music for several anime productions. The idea with this content is not only to make money directly, but to promote the vtubers outside the small vtubing bubble, little by little appealing to a wider fanbase. And they have been successful with this of late. BIBBIDIBA, released in march, is marching its way toward 100 million views in YouTube

As a result of the strategy of few but well-taken-care of talents with low rotation, accompanied by premium content, Cover has long surpassed Anycolor in streaming and content revenue, almost doubling them in the last quarter, and they are still growing both in revenue and viewership. As

explained in his piece on Cover, the advantage should compound over time, as the best talent is likely to want to go to Cover rather than Anycolor due to the better terms… with a caveat. VShojo is smaller and American, but well known to provide more freedom and a better share to their talents, and while they have a smaller roster, it is led by Ironmouse (one of the most popular english speaking V-tubers) and Kson (who used to be a relatively important VA for hololive under another persona), so Cover needs to take care to avoid being surpassed in the future as they did to Anycolor. Aside from that risk, the only bad spot is their absence in China, but that would expose them to backlash elsewhere.Merchandising

If Cover lags anywhere, it is in its merchandising strategy, and they are aware of it. Historically, Cover has focused on event-related made-to-order merch only. By event-related I don't mean only concerts and similar stuff, but also vtuber's anniversaries. They are slowly increasing the range of merchandise available, and when it is available (and where, because they used to have nothing available in 3rd party online stores or retail). Over time, the ratio of anniversary goods should go down as the standard goods increase.

The increase in availability and sales of cover merchandise has been disappointingly slow. That said, some efforts are starting to get results, and we have examples of collaborations with Round 1 (which you might know about thanks to

). But merchandising commercialization needs to improve at a better rate. I suspect this is slower for Cover because they are in-housing the planning and design functions for a good part of the merch, rather than just licensing out, to capture more value in the long run, but this is just based on some scattered comments, not something solid.The shift from made-to-order event-related merchandise to standard one is important. First, it moves the price point lower. Second, performer remuneration for this one is lower (because they don't have to promote it specifically16)

There is an additional impediment, which is the fandom composition. Nijisanji fans are majority female, while Hololive ones are majority male, as we saw before17. As Altay mentioned in his article as well, there might be higher propensity among the female fans to get merchandise, so Cover might have a lower ceiling. Unless they are able to get good male vtubers (which so far the haven't been able to get right), they might have a comparative disadvantage to Anycolor here.

In general, I think it is something to watch. Their evolution is encouraging, but a bit to slow for my liking. The evolution of advances in the last few quarters points to an increase in distribution, and we should start seeing the results in the revenue mix.

Events

IRL events like concerts are a relevant (27% of FY2024 total revenue) but volatile line in Cover's revenue. Depending on the quarter, it can be huge or minimal. Still, it is an interesting way to get additional revenue from the most hardcore fans.

Cover has been probably the most successful vtuber agency in this regard, doing almost 3 times the revenue Anycolor did in the last year. Cover is run in a much closer way to traditional idol agencies in this sense, and they manage it well. The latest sets of live shows in the US have been a success in terms of attendance (although there were some practical hiccups). The good thing is that it is going well, the bad thing is that it probably scales much less than other areas in terms of the attention required from the performers and cost of opportunity of other stuff. Conversely, merchandise or IP licensing don't require that.

That said, I suspect these events won't be the biggest moneymaker for Cover, but I think the events are good to galvanise the fans anyway.

IP and licensing

Despite being only about 15% of total revenues in FY 2024, and despite thinking the Holoearth project is doomed to fail, I think in this area is where Cover is doing a much, much better job than anyone else in the sector. But let's talk about Holoearth for a moment to get it out of the way. Cover is investing about about 3-4 billion yen18 in their own metaverse alternative, a sort of Second Life reborn. It is not a tremendous amount of money, and it has some pull because they can use the streamers as a hook. But there are so many alternatives (Roblox or Eve come to mind, in very different sides of the spectrum) that I have a hard time seeing it succeed. Since it is relatively low cost, it might get to break-even thanks to the presence of hardcore fans… but again, not too optimistic on this. Hopefully management won't be to headstrong if it fails.

With that out of the way, let's talk about what is really interesting here, which is exploiting the vtuber avatars for two things:

Advertise products

3rd party content

Why do I think Cover is doing such a fantastic job, if Anycolor actually derives more revenue than they do from this activity, almost 40% more last year? Well, because Cover is being far more strategic about the 3rd party content, and I think that can lead, in the long run, to better advertising partnerships, while Anycolor has gone full Krusty the clown here (and I don't mean this in a bad way! If you think this is a fad, Anycolor is the company that is doing things correctly from that POV).

From the point of view of advertising partnerships, Cover is doing more of them over time, mostly in Japan and Indonesia, although some US ones pop up from time to time. For example, they have announced partnerships for different vtubers with AmiAmi and with McDonalds in September, both for Japan.

But what I really like is their approach to 3rd party content.

Engagement with video-game developers to make licensed games, not only skins for existing games.

Holo Indie created as a brand to be able to release fan-created indie games with the vtubers. 10 games already released (4 of them free), all in the last 10 months, and 2 more announced. They are not making tons of money, but Hololive does not put much investment here, they basically release fan-made content and get a bit of money out of it. Taking into account at least one of the games seems to be around 100k copies (HoloParade), maybe there is something to it. More importantly, helps to induce the fans to generate more related content, even their way of life, keeping them in the ecosystem.

Pretty generous derivative work guidelines, which again encourage fans to clip and create things based on hololive content (without even hindering monetization)

There is also the potential to create anime, but so far I don't know about anything firm regarding that (and, after the Kizuna AI anime, not super optimistic), other than the web anime Cover publishes.

In general, it is clear that Cover right now is focusing on achieving as much expansion of their brand as they can, and they do it by estimulating third party content to the best of their ability, with generous derivative work guidelines and supporting the release of fan-made games. The reason I am so excited about this is that we have proof that other virtual avatars had the ability to become massive successes based in aesthetics and little else, remember what the numbers in Vocaloid's case!

Cover's cost problem: Capital allocation

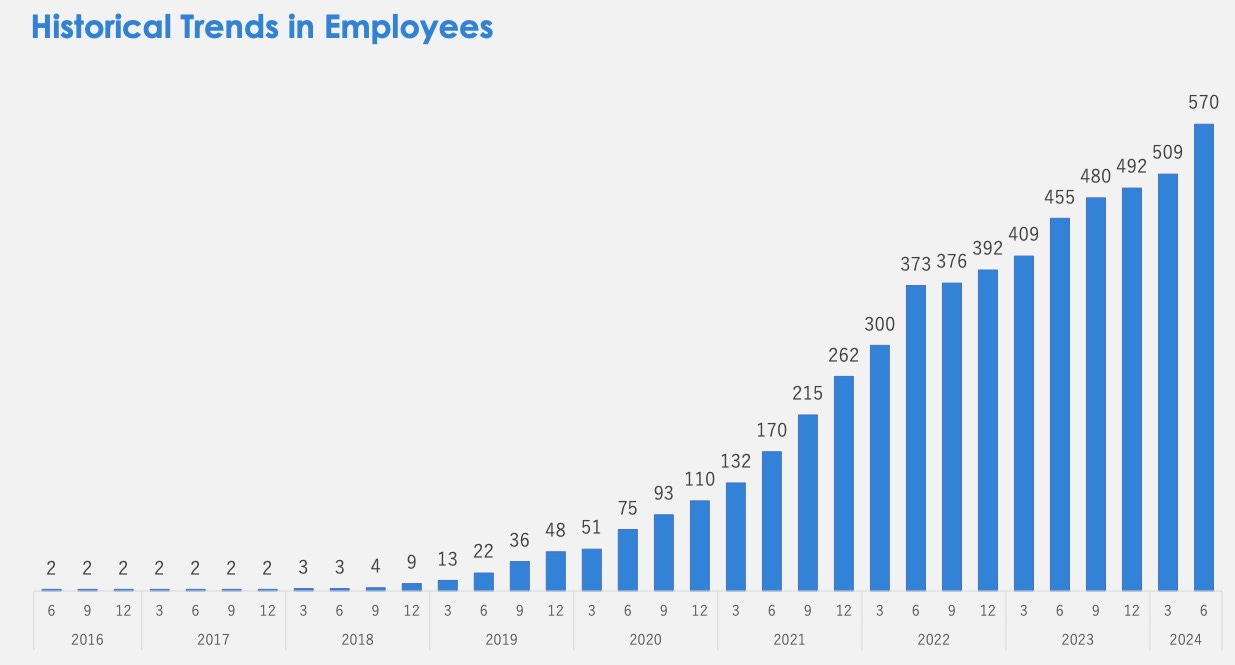

Cover is doing a lot of things internally, on top of talent management. Design and planning for merchandising, Second Life Holoearth development, some talent support for models (although other parts are subcontracted19) and recording, events… and that means a lot of costs. And that affects economics. While their gross margin is around 50%, depending on the quarter and the proportions of different revenue types, they do have a cost issue, mostly because they keep adding more functions.

Currently I think that what they are doing makes sense, Holoearth aside, and will benefit them in the long term. They are already outcompeting Anycolor, which was bigger than them only a couple of years ago, thanks to the care with which they have treated the English content expansion. But the cost trend is something to watch because while their tendency to make every function an internal one allows for more control, it also greatly affects profitability. Currently Anycolor has around a 30% operating margin, while in 2024 Cover had 18%… and that is overstated since the Holoearth investment won't start flowing through the PnL until the tail end of the current financial year. Essentially, Cover is reinvesting a high proportion of the cash flow generated in expanding and not pushing monetization hard, while Anycolor is keeping expenses to a minimum and pushing monetization as hard as they can and outsorcing as much as they can as well. Hence why with similar revenues and twice as many vtubers, Anycolor needs 120 employees less.

That does not mean Cover does not generate cash, though. They do. Last year they generated approximately 1 billion yen in FCF, despite the Holoearth investment. But currently they are not returning any of that cash, and keep about 8 billion in net cash. By way of contrast, Anycolor generated about 6 billion yen, and used 2.5 of them to repurchase stock, with a further 7.5 billion of repurchases during this summer. However, their revenue declined in the last quarter mostly due to the Nijisanji EN branch debacle. I bring up Anycolor's numbers as they are a good comparison that tells us just how much Cover is investing. And it is a lot.

Conclusion

I think the vtuber industry is here to stay, because it has generated a solid social niche with its own gossip, areas and memes. I also think that the way it is set-up enables for better generation of secondary uses of the IP, like animation and videogames20, that should ensure long-term royalties.

Inside the industry, I think agencies have a better chance at capturing the market because they have been able to insert themselves as curators and can guarantee the best talents bigger reach from the get-go. The fact that they own the IP of the avatars makes it more difficult for the best performers to leave and strike out on their own or in other agencies, but it is not impossible as Kyrio Coco/Kson's case demonstrates, so it is important to try to keep good relationships with them.

That last part is why I think Cover is a superior investment in the industry to Anycolor, despite the lower profitability at the moment. While in Japan Nijisanji has been able to keep their audience so far, they have blown up all their international operations, which I think present a much bigger opportunity in the long run, especially the US and other countries in Asia.

Cover has also been willing to invest in internal tech. I think vtuber avatars present some interesting opportunities for third party (games) content, and also for customized interaction down the road. Given the characteristics of the fan base, I am not sure that will work out, but I think Cover will try if they see an opportunity, while I don't think Anycolor has the capabilities or interest in building them.

That said, the investment case rests in vtubers not being a fad, but having staying power for more years. If they are a fad (anyone remembers frozen yogurt?), then Anycolor is the correct way to play it. Lower costs and a extracting mentality that will probably return the market cap in the next few years… if Hololive or others don't manage to challenge their dominance in the very profitable male v-tuber industry in Japan.

For me, Cover's case is more compelling, and at the current price very attractive, as I think they can increase revenues at a high rate and get significant operating leverage. While I am invested in the company, as you can see there are potential pitfalls, and I would encourage anyone to do their own research before jumping into it!

Last month estimate taking into consideration Japan and RoW, Android and iOS together.

Yes, it grew 40% YoY, and yes, that is not much given the relative monetization. Anycolor's streaming revenue is only 16% of their total sales, while for Cover we are talking of more than 30%. Merchandise revenue should be growing faster (although I am happy with that 20% growth in streaming revenue, as opposed to Anycolor's shitshow)

Anycolor is also listed and on this space, is slightly bigger, more profitable, has a lower valuation, and repurchases shares. But I still think Cover is a better bet!

Story time! I came to know what v-tubers were by looking up Games Workshop on Twitter back in 2020. Games Workshop's ticker in the London Stock Exchange is GAW, so I sometimes manually checked for posts on #GAW in Twitter search. And it kept autocompleting it to #gawrgura. At some point, I just had to check!

Legend of the Galactic Heroes reference included. Anime-adjacent indeed!

A v-tuber showed their audience stats, and YouTube displayed Taiwan as a separate place. Cue the drama.

Several videogames qualify here as well.

I find Rima Evenstar to be one of the best source of content explaining the v-tuber world, and found her useful in understanding it a bit better, including dynamics or what happened to this or this other famous v-tuber. It is, essentially, a v-tuber celebrities channel of sorts, but a pretty respectful one. She has been at it for about a year and her typical video hovers over, or surpasses, 100k views, with the most successful ones going over 500k. Funny how you can probably make a living talking about v-tubers now.

Equal parts fan-service and Flanderization

Literally packs of recorded audio snippets, typically around a theme.

Only 3 vtubers go above 1 million hours watched in Twitch according to streamcharts, 12 did that in September in YouTube according to vstats.

This statistics only take YouTube into account, I don't have the equivalent for Twitch, but again it is a much smaller portion of the viewership in this segment.

Depending on how you count one of the cases, the new affiliate.

Yozora Mel due to leaks, plus part of the Hololive CN vtubers when the agency there closed.

Five of those are in Holostars, the male vtuber brand, which hasn't worked that well, which partly explains it.

At least in Japan, which is where that survey comes from, but I suspect it translates.

2 through March

Not always acting in good faith with their contractors, which has earned them a slap in the wrist from the Japan Fair Trade Commission. I don't think this affects the investment case, but it is a pretty bad look.

Standard streamers have tried in the past with somewhat mixed results.

Thanks for the mention! Thanks to you and Altaycap, I might need to watch that vtuber anime for marker research purposes